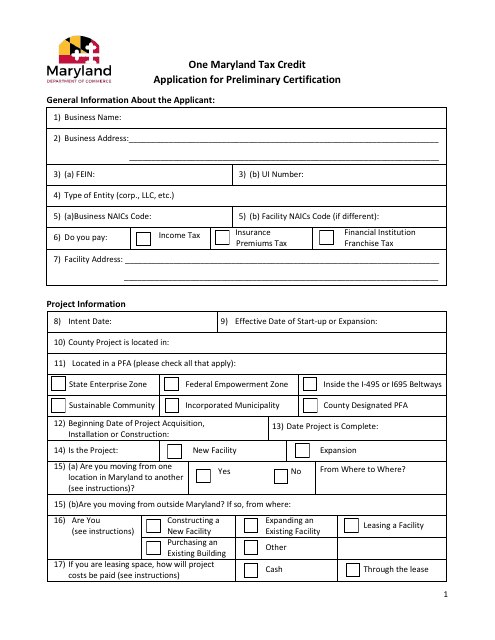

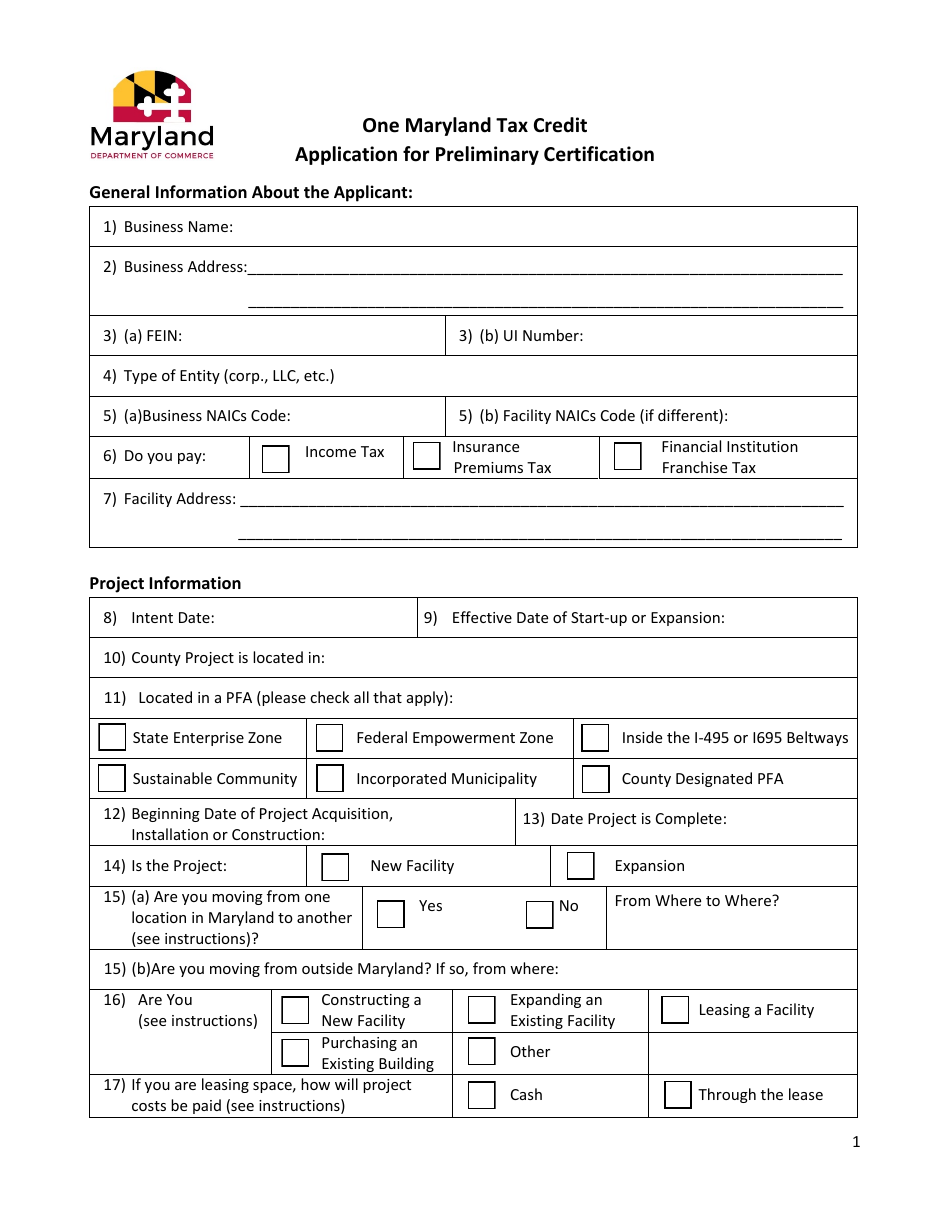

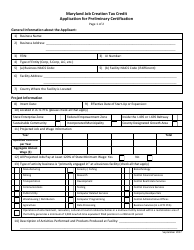

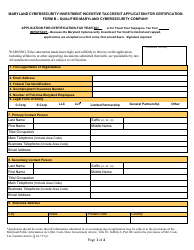

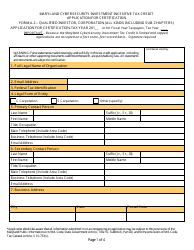

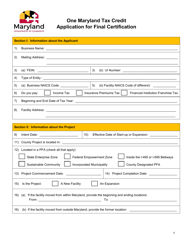

Application for Preliminary Certification - One Maryland Tax Credit - Maryland

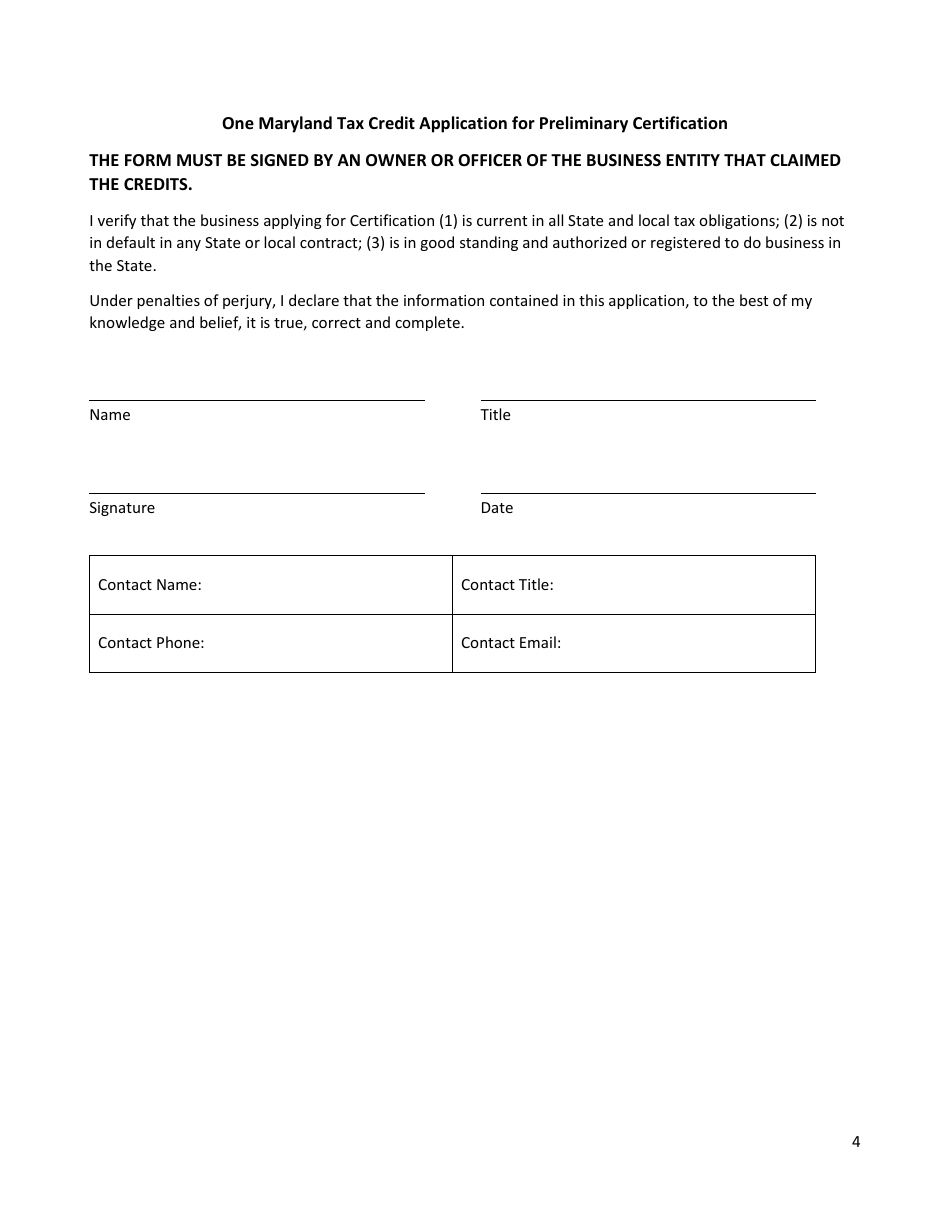

Application for Preliminary Certification - One Maryland Tax Credit is a legal document that was released by the Maryland Department of Commerce - a government authority operating within Maryland.

FAQ

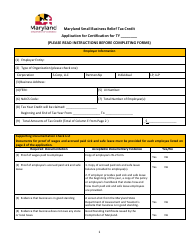

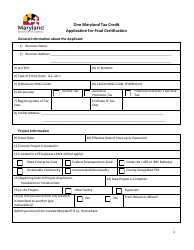

Q: What is the One Maryland Tax Credit?

A: The One Maryland Tax Credit is a program that provides tax incentives to businesses that locate or expand in designated areas in Maryland.

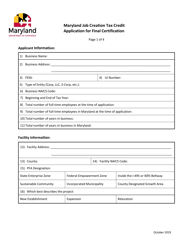

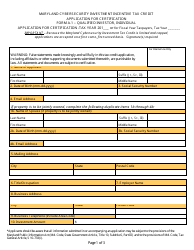

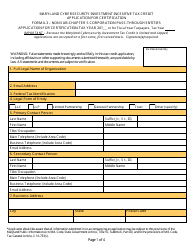

Q: Who is eligible for the One Maryland Tax Credit?

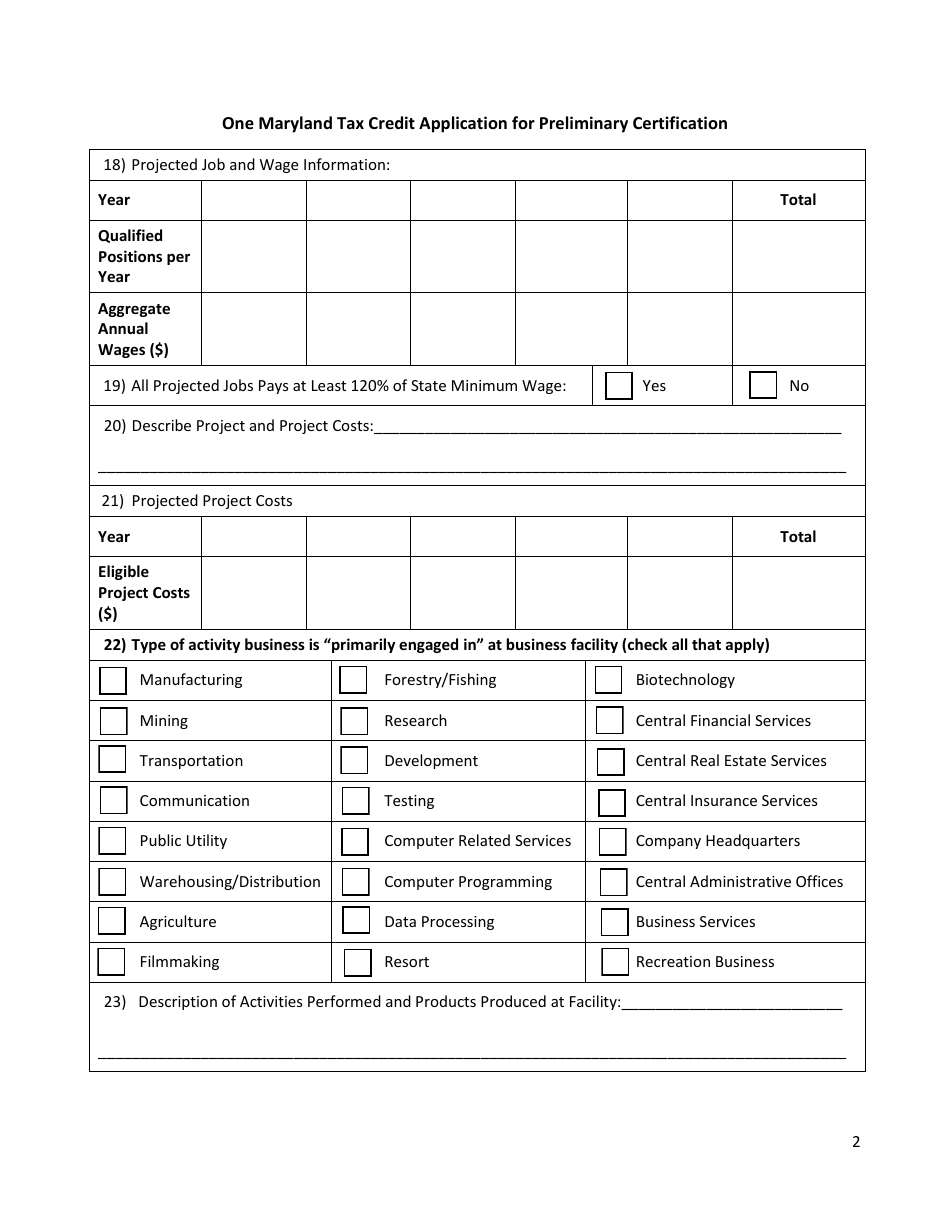

A: Eligible businesses include manufacturers, research and development companies, and businesses engaged in specified industries.

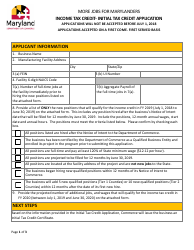

Q: What are the benefits of the One Maryland Tax Credit?

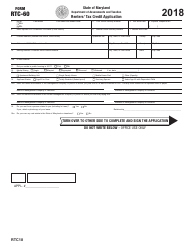

A: The program offers state income tax credits based on the number of new, direct, full-time jobs created by the business, as well as property and income tax credits.

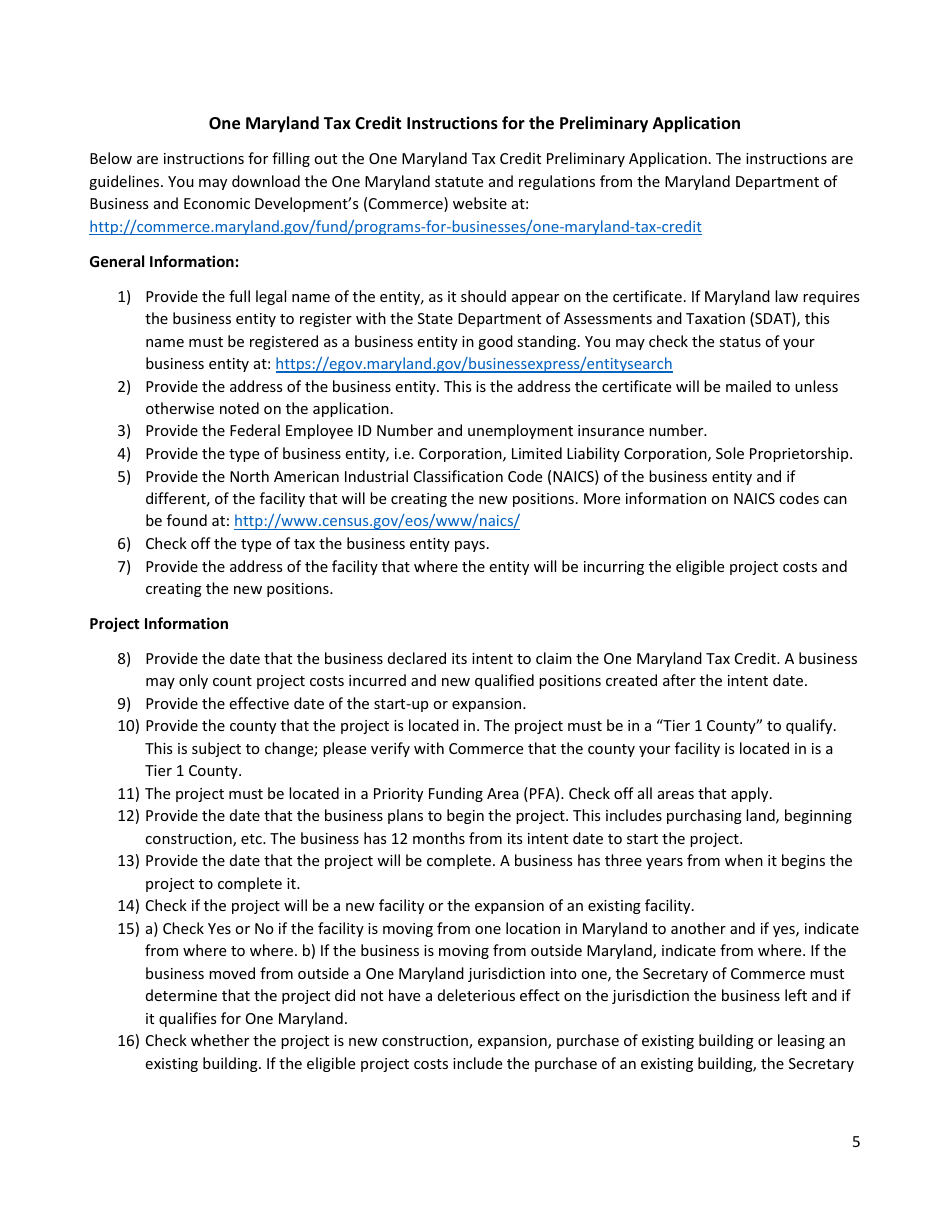

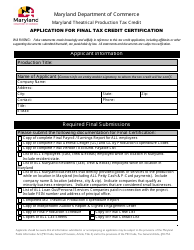

Q: How do I apply for the One Maryland Tax Credit?

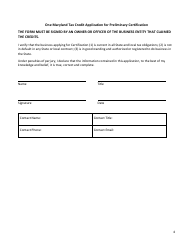

A: To apply for the One Maryland Tax Credit, businesses must submit an application for preliminary certification to the Maryland Department of Commerce.

Q: What is the purpose of the preliminary certification?

A: The preliminary certification is an initial step in the application process to determine if a business is eligible for the One Maryland Tax Credit.

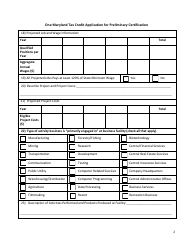

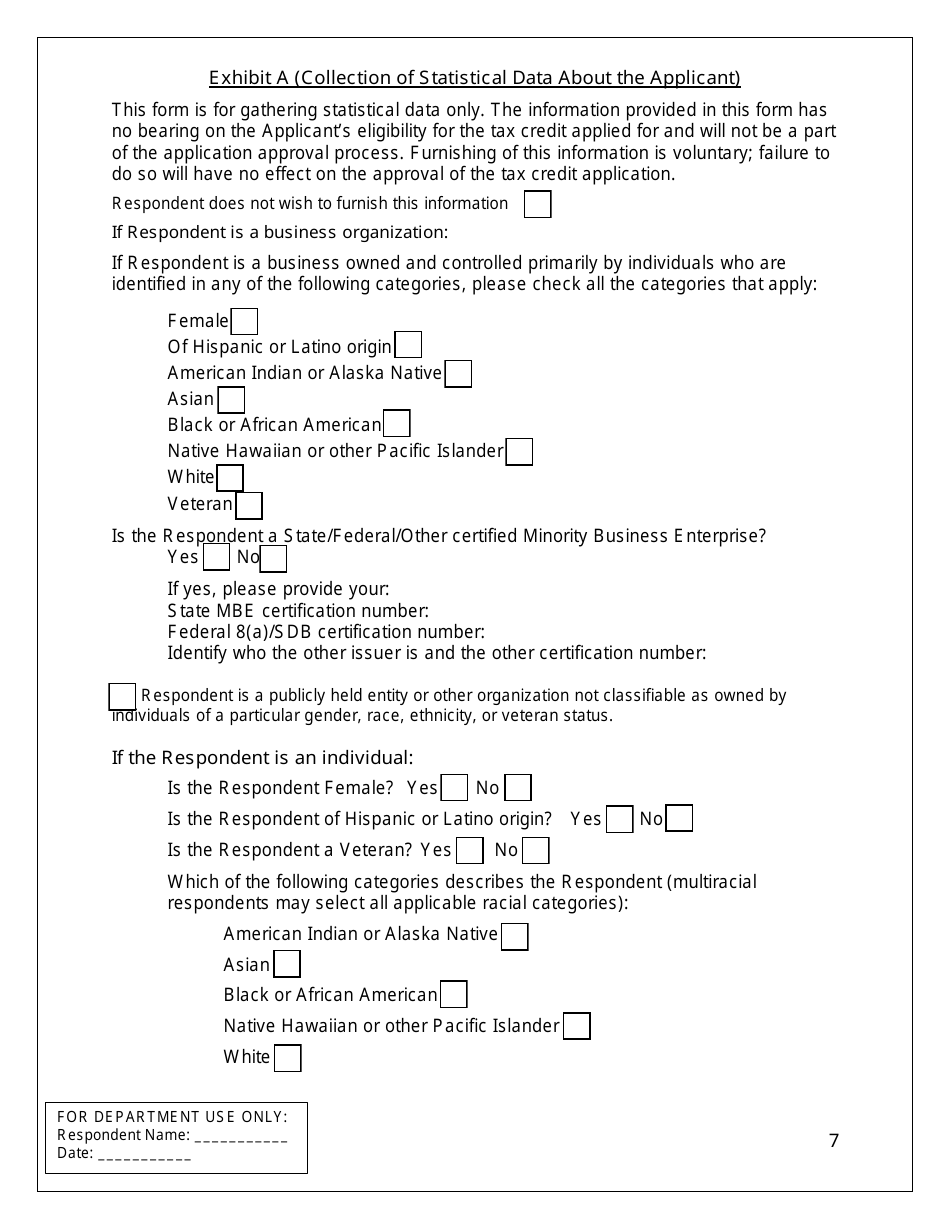

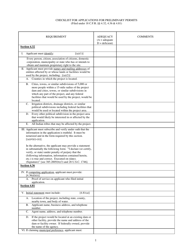

Q: What documents are required for the preliminary certification application?

A: The application must include information such as business identification, job creation plans, and financial projections.

Q: Is there a deadline to apply for the One Maryland Tax Credit?

A: Yes, there are specific deadlines to submit the preliminary certification application, which vary depending on the type of project.

Q: Are there any restrictions or conditions for receiving the One Maryland Tax Credit?

A: Yes, businesses must meet certain requirements, including creating a minimum number of jobs and making significant capital investments in Maryland.

Form Details:

- The latest edition currently provided by the Maryland Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.