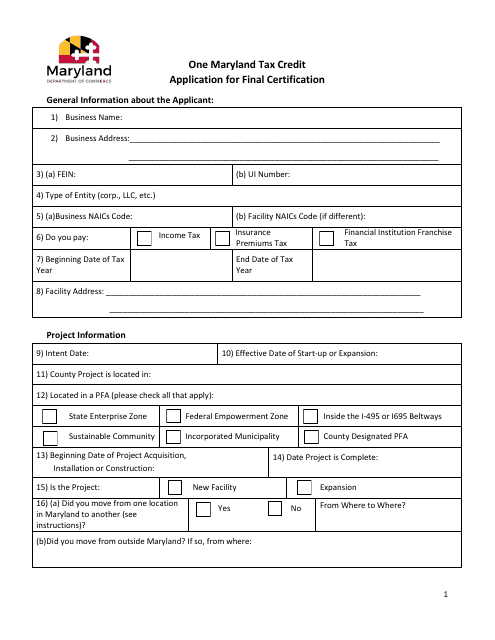

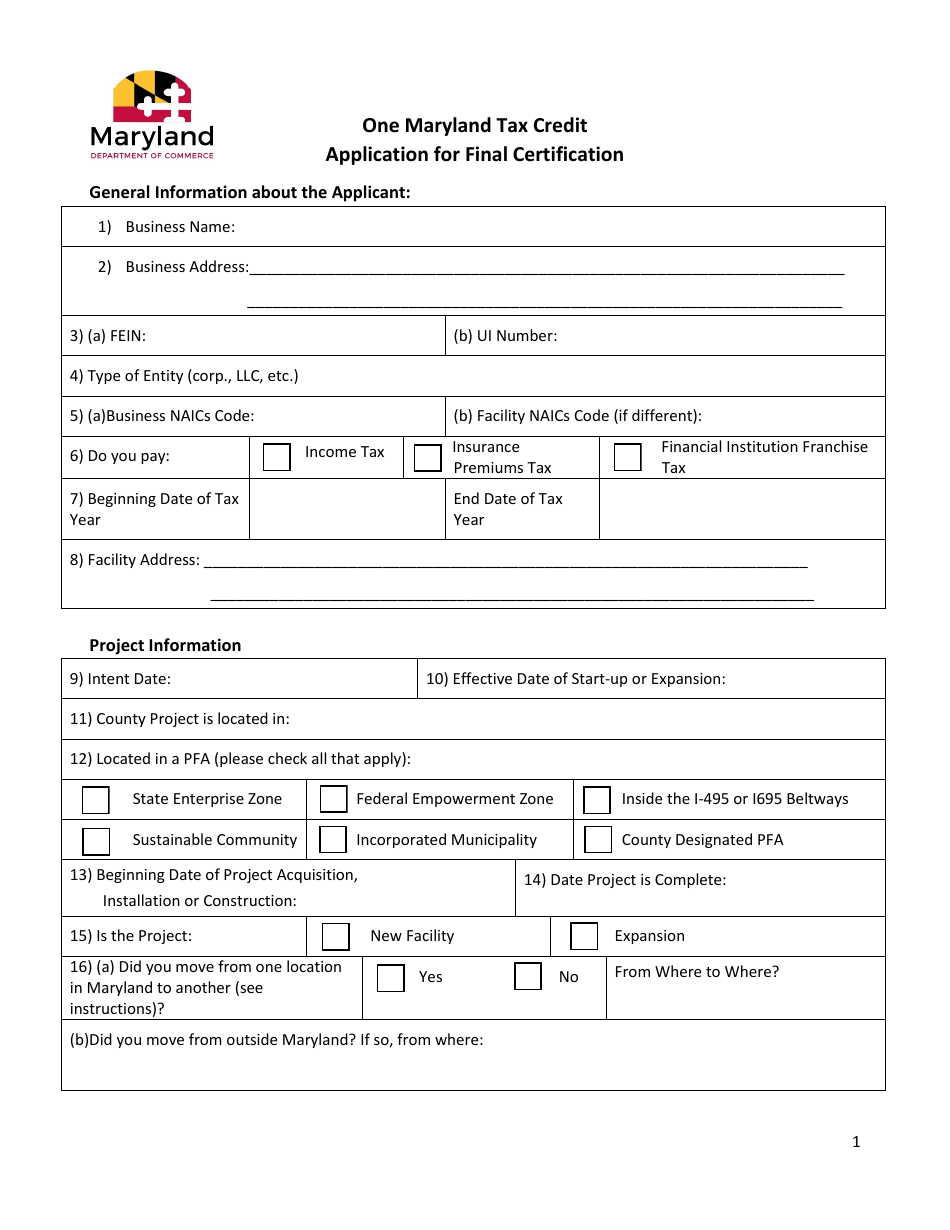

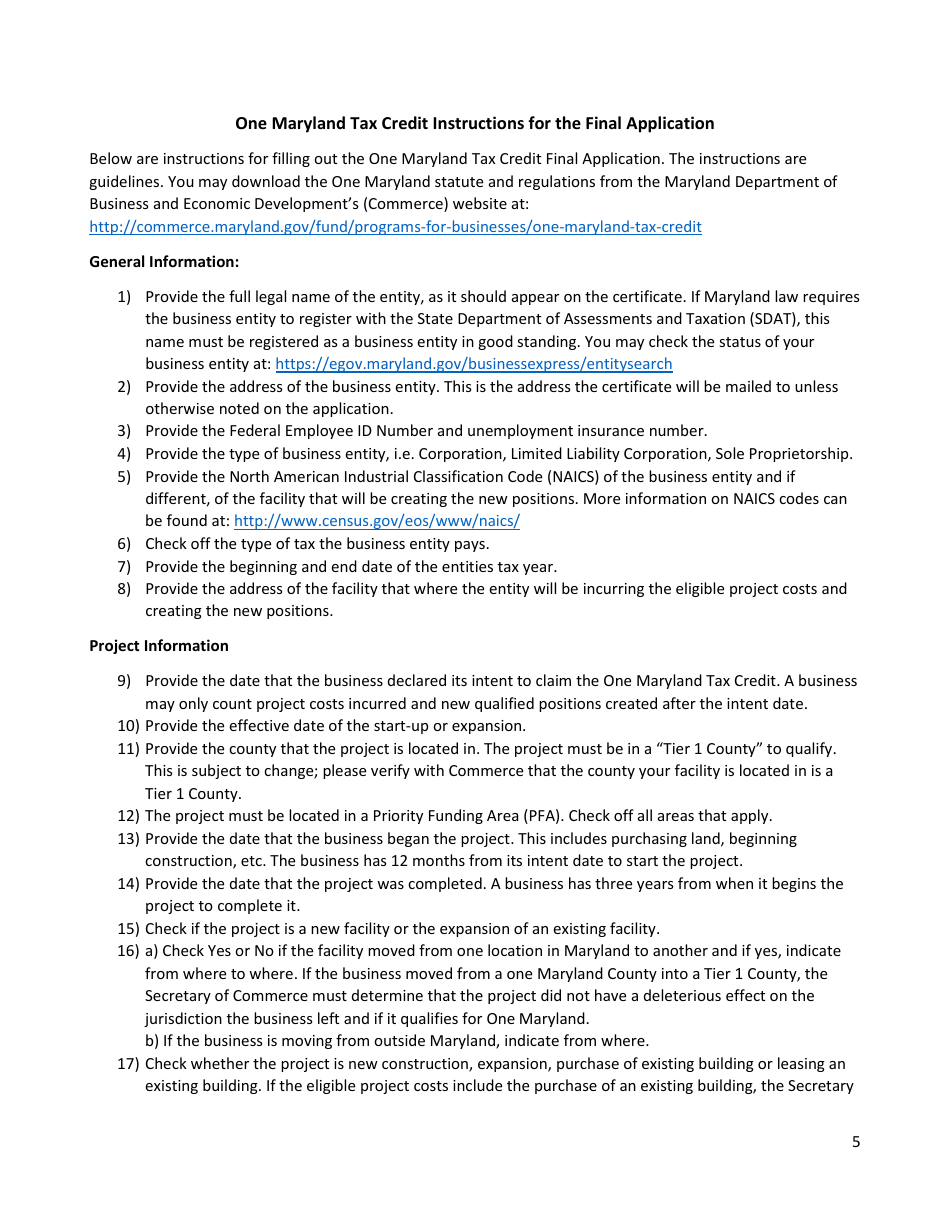

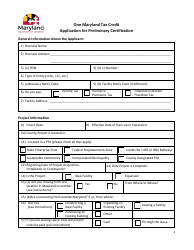

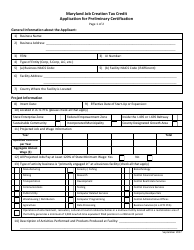

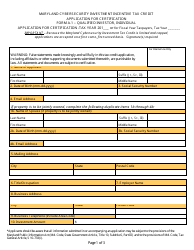

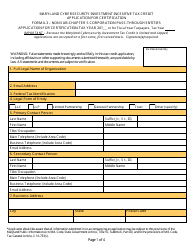

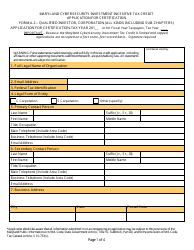

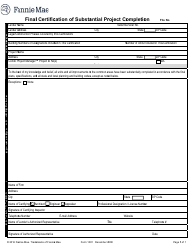

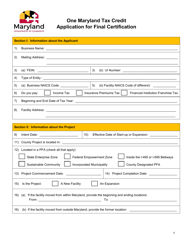

Application for Final Certification - One Maryland Tax Credit - Maryland

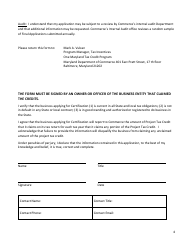

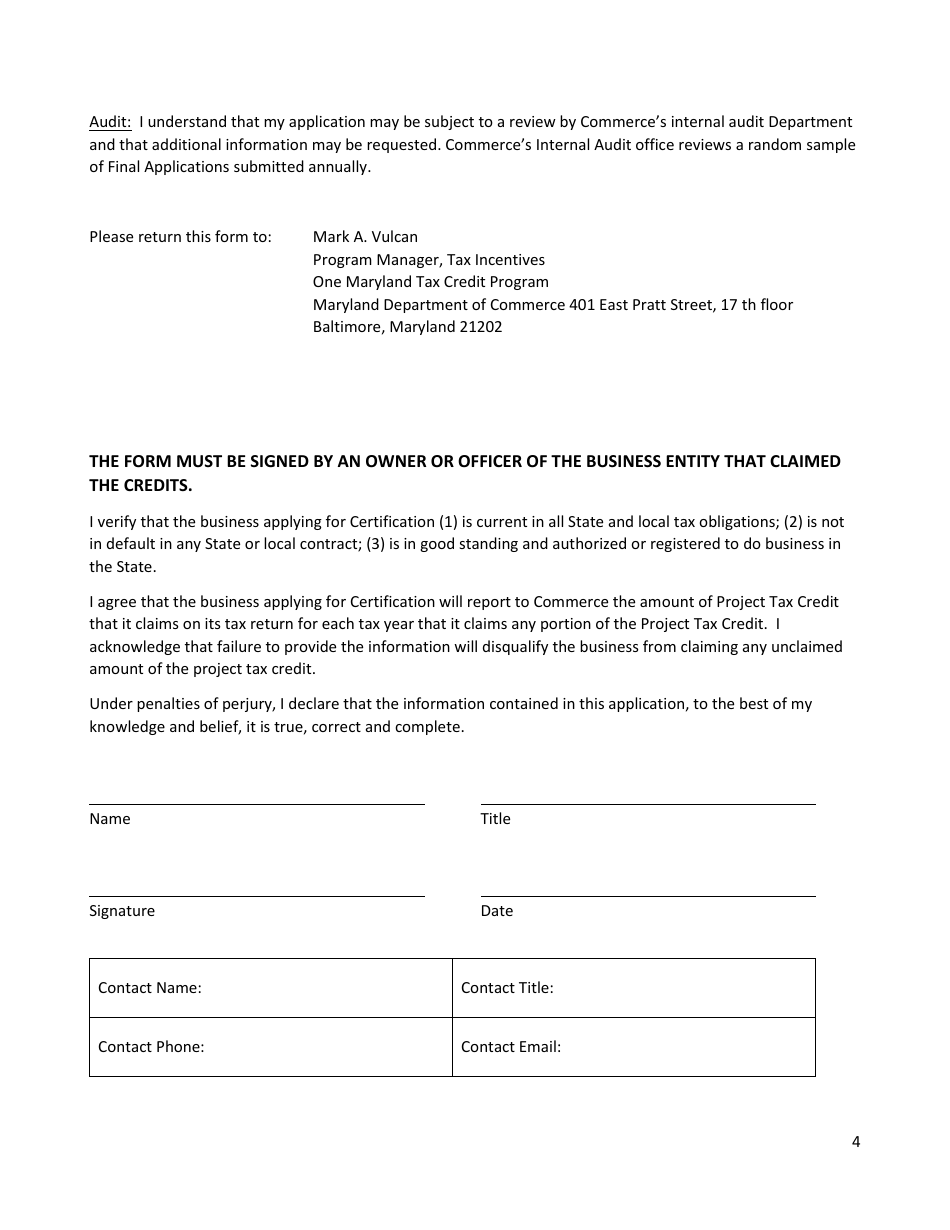

Application for Final Certification - One Maryland Tax Credit is a legal document that was released by the Maryland Department of Commerce - a government authority operating within Maryland.

FAQ

Q: What is the One Maryland Tax Credit?

A: The One Maryland Tax Credit is a tax incentive program in Maryland.

Q: Who is eligible for the One Maryland Tax Credit?

A: Businesses located in certain economically distressed areas are eligible for the One Maryland Tax Credit.

Q: What are the benefits of the One Maryland Tax Credit?

A: The One Maryland Tax Credit provides businesses with a tax credit against their state income tax liability.

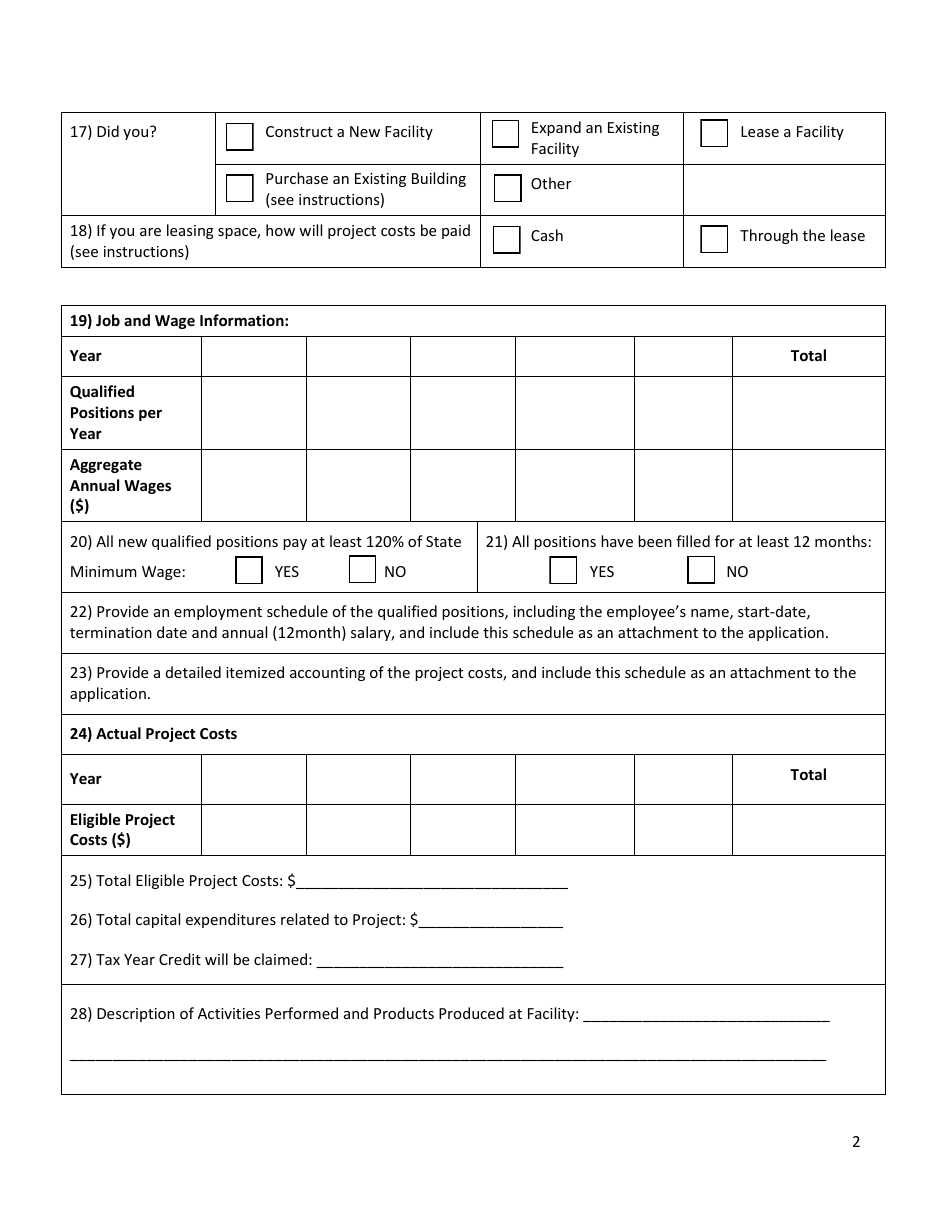

Q: How can businesses apply for the One Maryland Tax Credit?

A: Businesses can apply for the One Maryland Tax Credit by completing and submitting an application form.

Q: Is there a deadline to apply for the One Maryland Tax Credit?

A: Yes, there is a deadline to apply for the One Maryland Tax Credit. The specific deadline can be found on the application form.

Q: Are there any other requirements to qualify for the One Maryland Tax Credit?

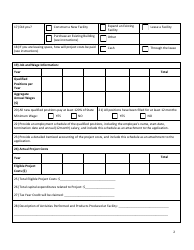

A: Yes, businesses must meet certain job creation and investment requirements to qualify for the One Maryland Tax Credit.

Q: Is the One Maryland Tax Credit available in all parts of Maryland?

A: No, the One Maryland Tax Credit is only available in certain economically distressed areas.

Form Details:

- The latest edition currently provided by the Maryland Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.