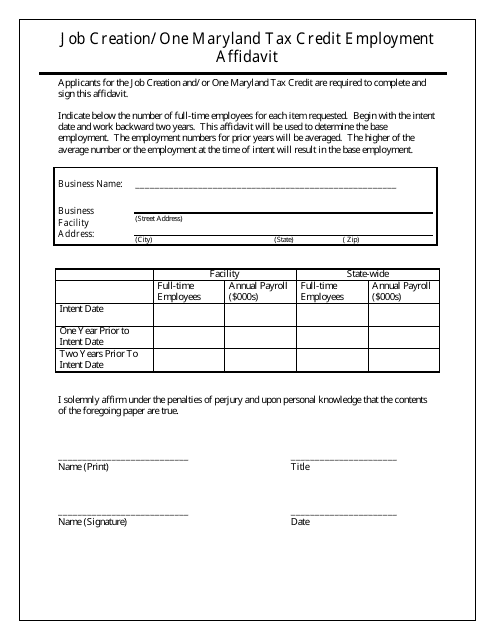

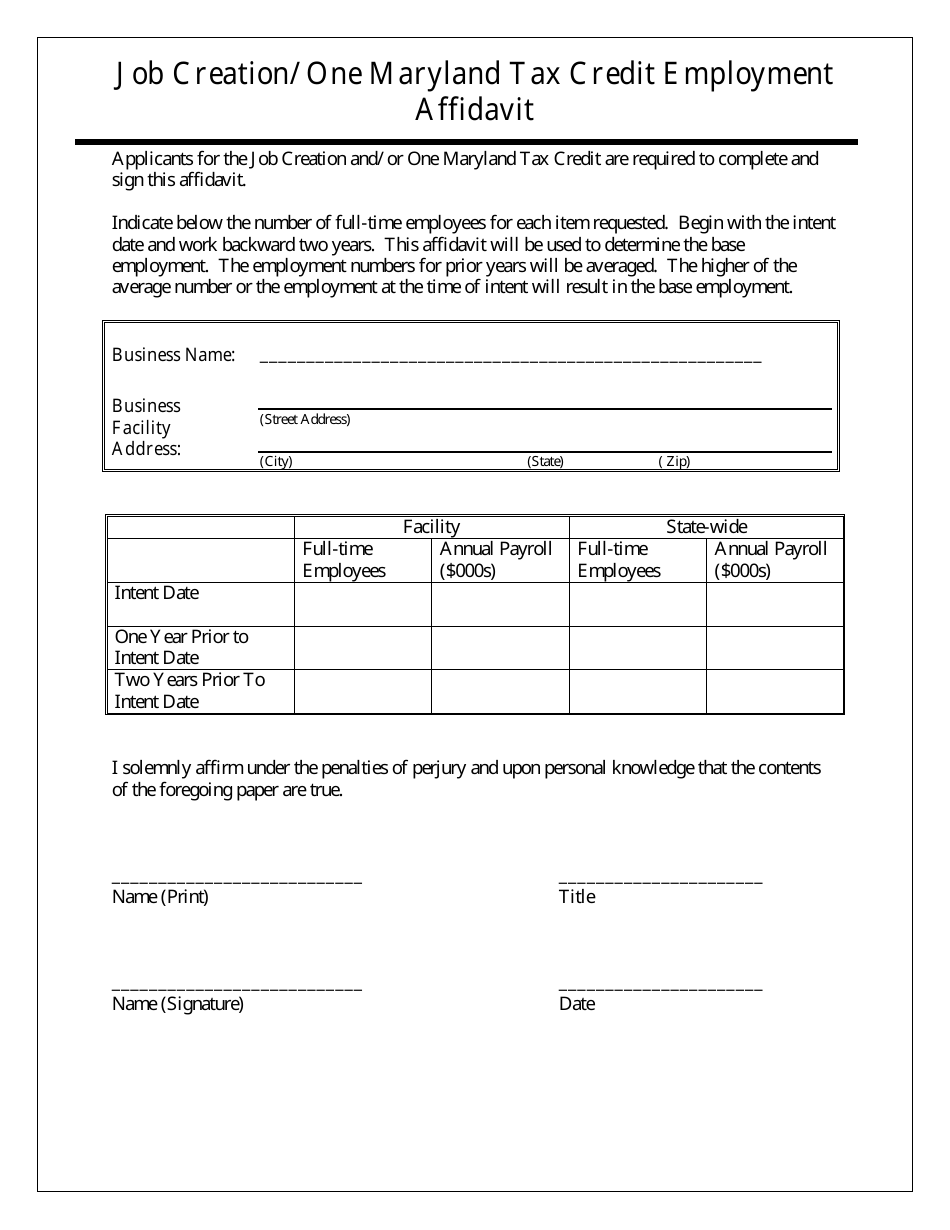

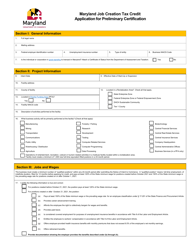

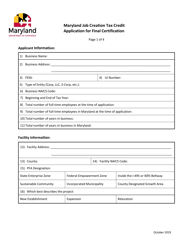

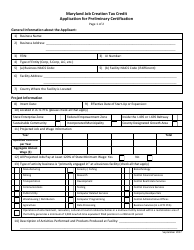

Job Creation / One Maryland Tax Credit Employment Affidavit - Maryland

Job Creation/ One Maryland Tax Credit Employment Affidavit is a legal document that was released by the Maryland Department of Commerce - a government authority operating within Maryland.

FAQ

Q: What is the One Maryland Tax Credit?

A: The One Maryland Tax Credit is a program aimed at encouraging job creation in Maryland.

Q: What is the purpose of the One Maryland Tax Credit Employment Affidavit?

A: The One Maryland Tax Credit Employment Affidavit is a form used to verify that an employer has created and filled a qualified position eligible for the tax credit.

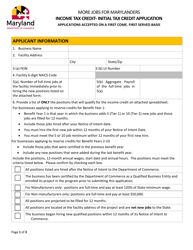

Q: Who is eligible for the One Maryland Tax Credit?

A: Employers who create and fill a qualified position that meets the specific criteria set by the program are eligible for the One Maryland Tax Credit.

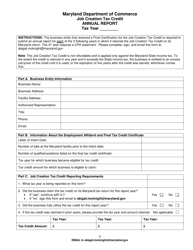

Q: How much is the tax credit?

A: The amount of the tax credit can vary depending on the number of qualified positions created and the wages paid to the employees in those positions.

Q: How can an employer apply for the One Maryland Tax Credit?

A: Employers can apply for the One Maryland Tax Credit by submitting the completed employment affidavit and supporting documentation to the Maryland Department of Commerce.

Q: What supporting documentation is required for the One Maryland Tax Credit application?

A: Supporting documentation may include payroll records, proof of job creation, and other relevant documents that demonstrate eligibility for the tax credit.

Q: Is there a deadline to apply for the One Maryland Tax Credit?

A: Yes, there is a deadline for application submission, which is typically specified by the Maryland Department of Commerce. It is important to submit the application before the stated deadline.

Q: How long does the One Maryland Tax Credit last?

A: The One Maryland Tax Credit can be claimed for up to 10 years, as long as the employer continues to meet the program's requirements.

Q: Can the tax credit be carried forward if it cannot be fully used in a single year?

A: Yes, unused tax credits can be carried forward for up to 5 years to offset future tax liabilities.

Q: Are there any limitations or restrictions to the One Maryland Tax Credit?

A: Yes, there are limitations and restrictions on the One Maryland Tax Credit, such as the number of credits available in a given year and the specific eligibility criteria that must be met.

Form Details:

- The latest edition currently provided by the Maryland Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.