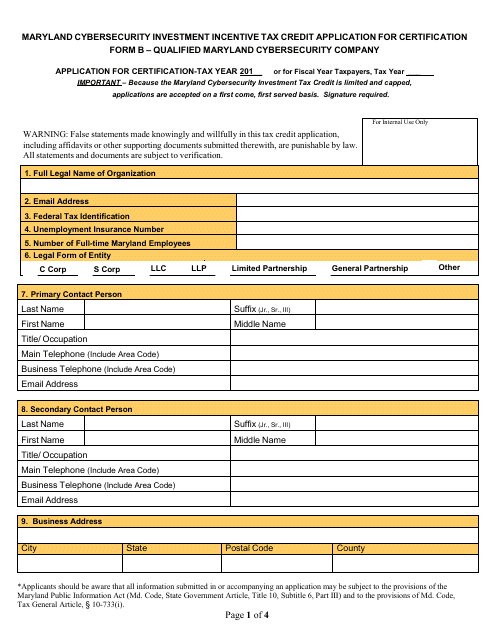

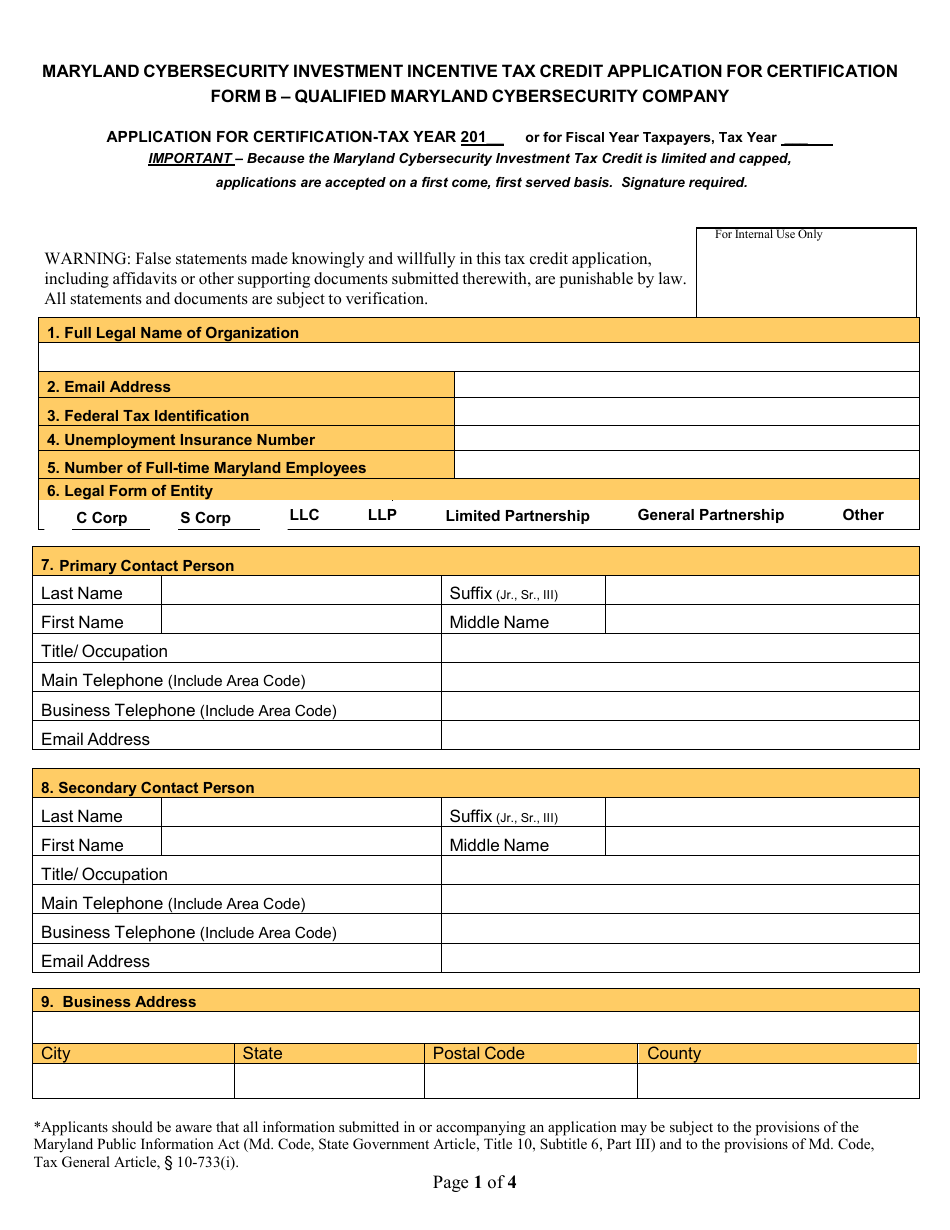

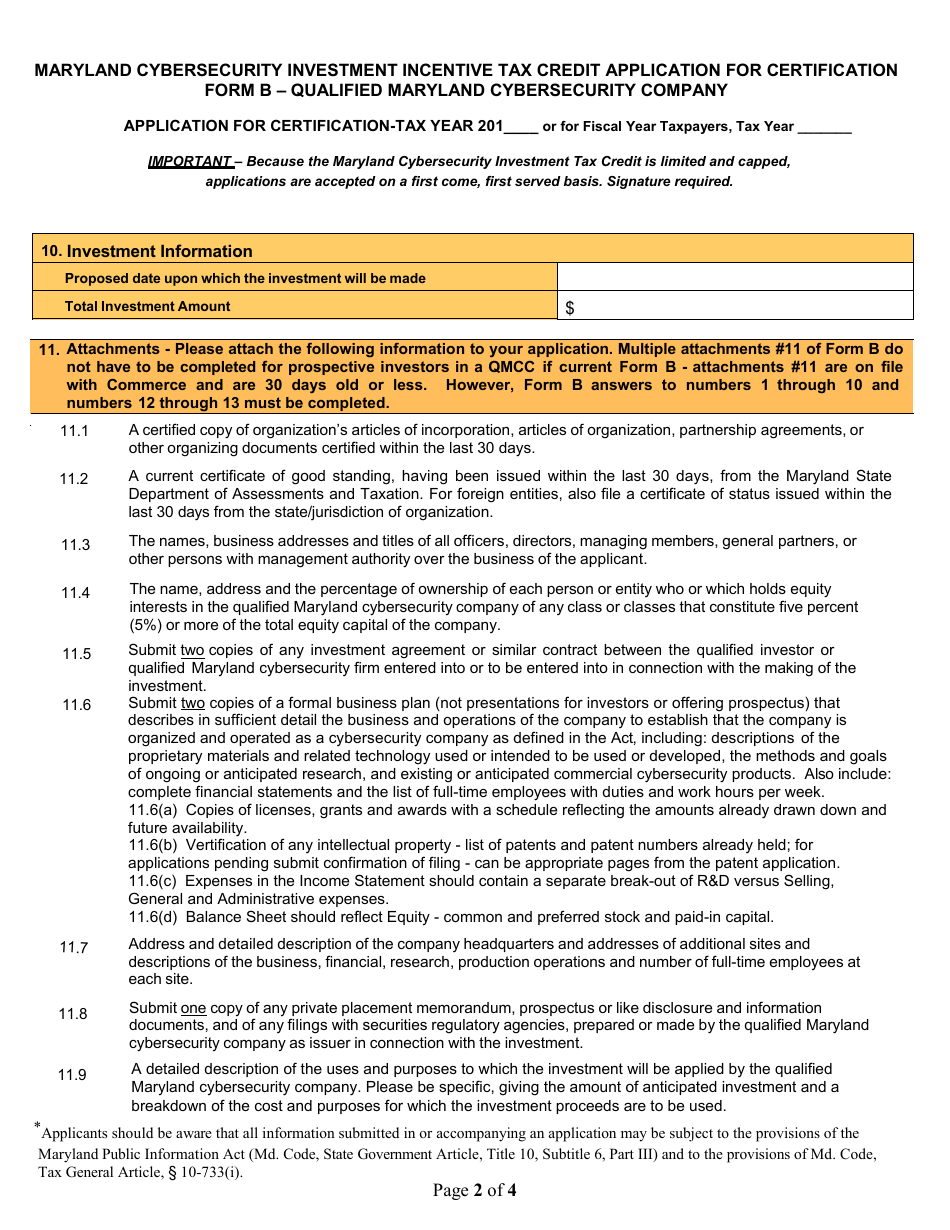

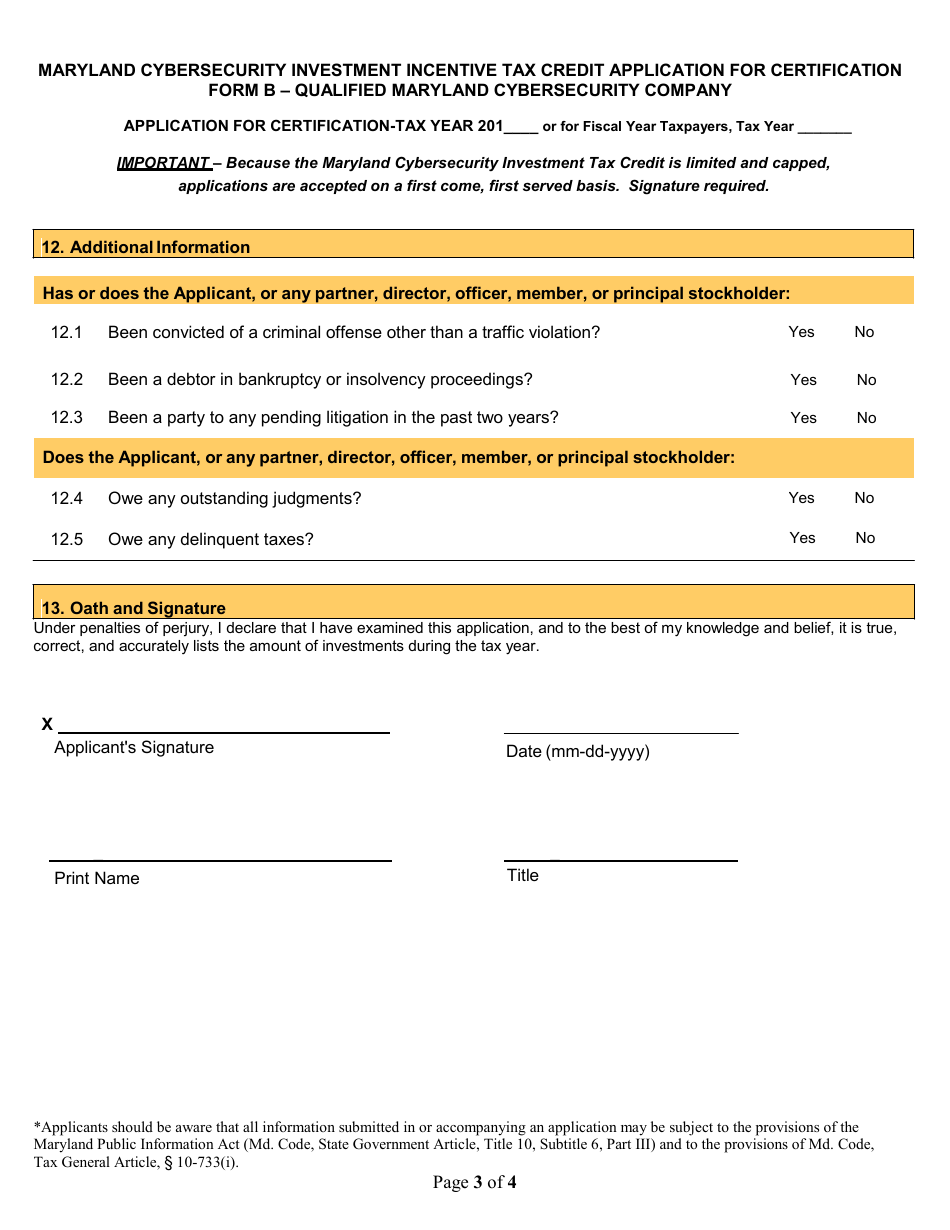

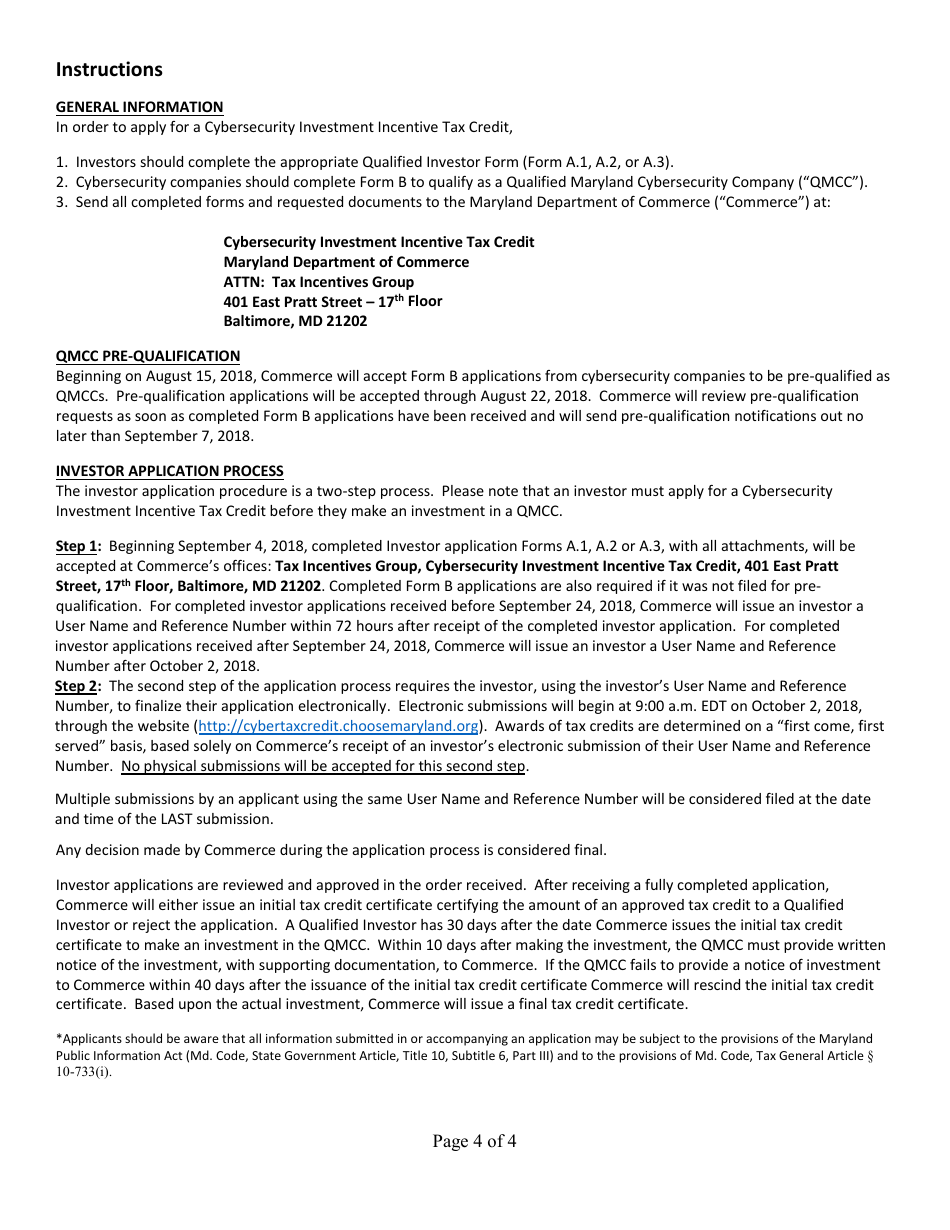

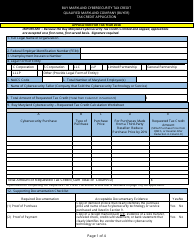

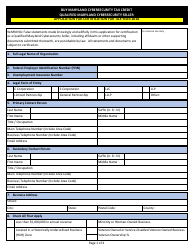

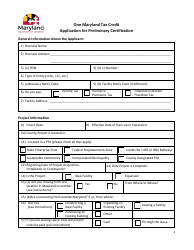

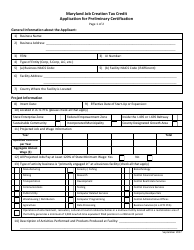

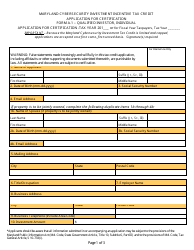

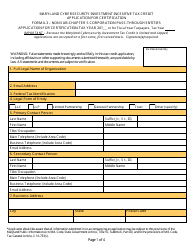

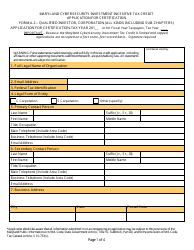

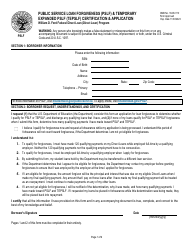

Form B Application for Certification - Qualified Maryland Cybersecurity Company - Maryland Cybersecurity Investment Incentive Tax Credit - Maryland

What Is Form B?

This is a legal form that was released by the Maryland Department of Commerce - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form B Application for Certification?

A: The Form B Application for Certification is a form that Maryland cybersecurity companies can use to apply for certification.

Q: What is the Qualified Maryland Cybersecurity Company certification?

A: The Qualified Maryland Cybersecurity Company certification is a certification that Maryland cybersecurity companies can obtain to demonstrate their eligibility for tax incentives.

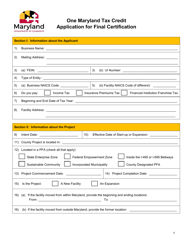

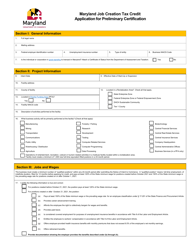

Q: What is the Maryland Cybersecurity Investment Incentive Tax Credit?

A: The Maryland Cybersecurity Investment Incentive Tax Credit is a tax incentive program that provides tax credits to qualifying cybersecurity companies in Maryland.

Q: How can a cybersecurity company apply for the Maryland Cybersecurity Investment Incentive Tax Credit?

A: Cybersecurity companies can apply for the Maryland Cybersecurity Investment Incentive Tax Credit by submitting the Form B Application for Certification.

Q: What are the benefits of the Maryland Cybersecurity Investment Incentive Tax Credit?

A: The Maryland Cybersecurity Investment Incentive Tax Credit provides tax credits to eligible cybersecurity companies, which can help them reduce their tax liabilities and encourage investment in the cybersecurity industry in Maryland.

Q: Who is eligible to apply for the Maryland Cybersecurity Investment Incentive Tax Credit?

A: Maryland cybersecurity companies that meet certain criteria are eligible to apply for the Maryland Cybersecurity Investment Incentive Tax Credit.

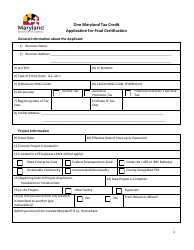

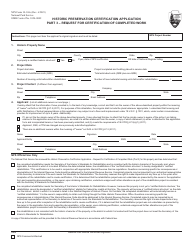

Form Details:

- The latest edition provided by the Maryland Department of Commerce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.