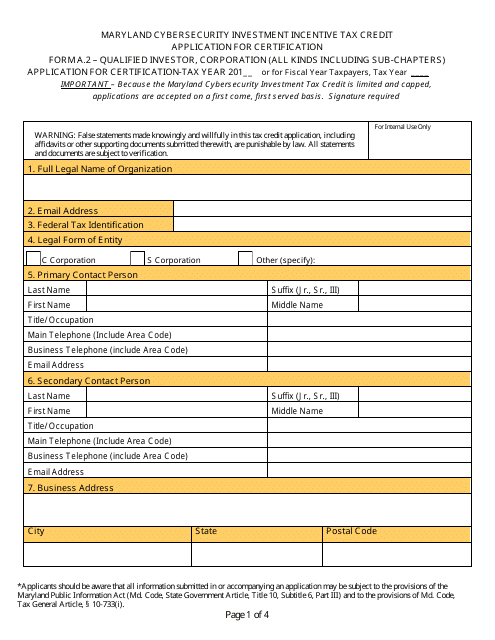

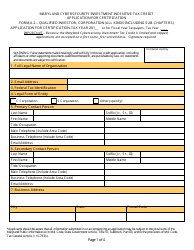

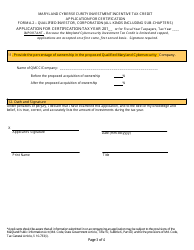

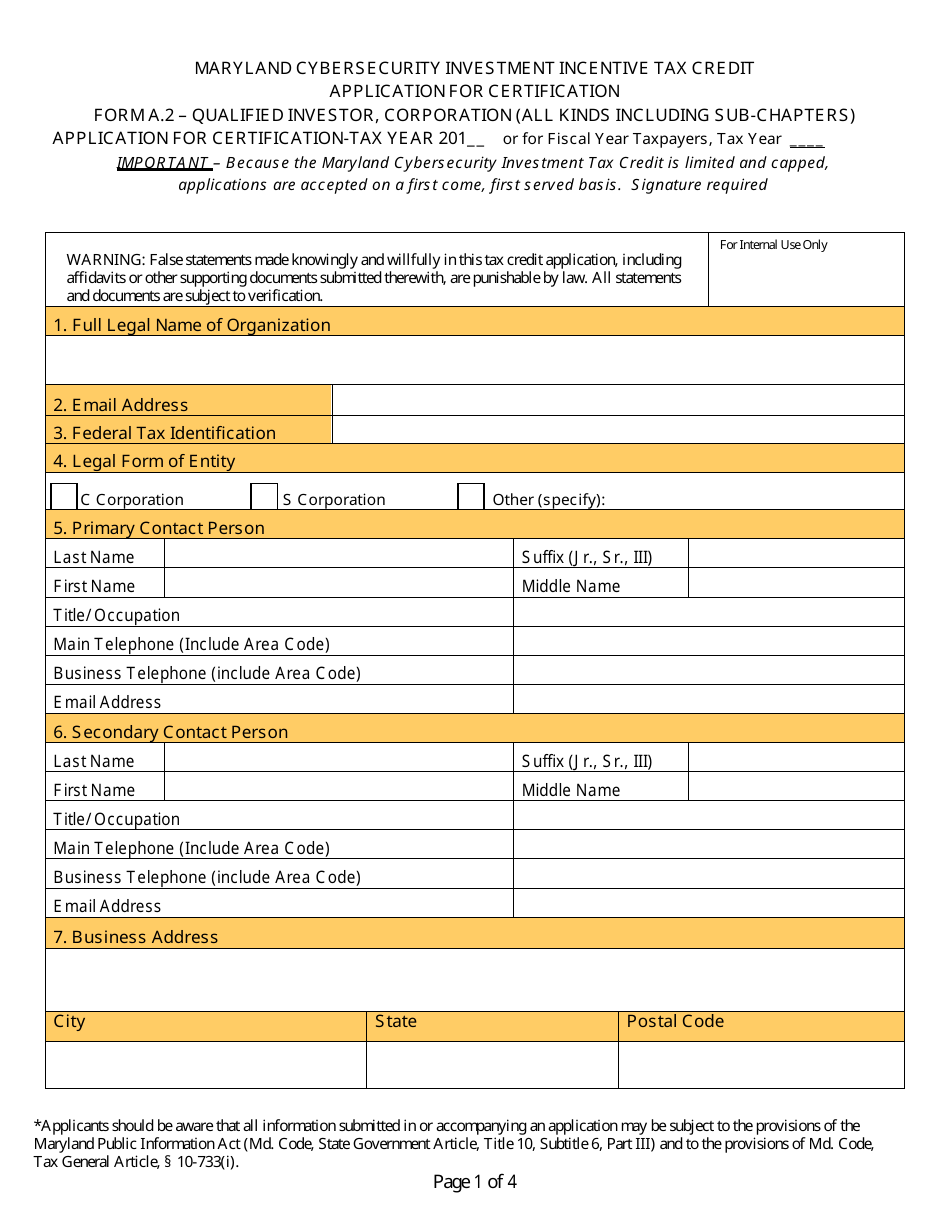

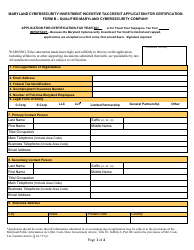

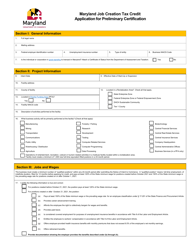

Form A.2 Application for Certification - Qualified Investor, Corporation (All Kinds Including Sub-chapters) - Maryland Cybersecurity Investment Incentive Tax Credit - Maryland

What Is Form A.2?

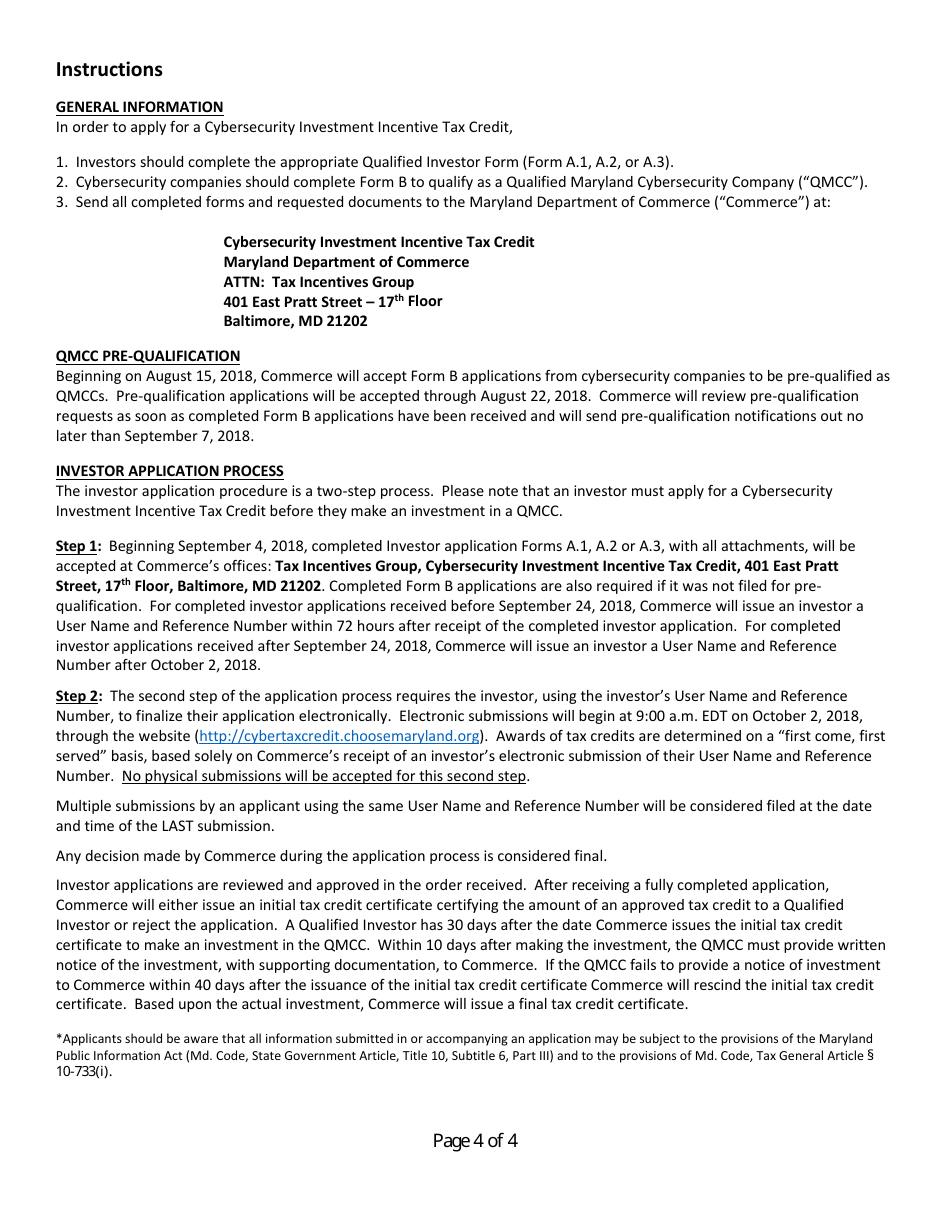

This is a legal form that was released by the Maryland Department of Commerce - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A.2?

A: Form A.2 is the Application for Certification for Qualified Investor, Corporation - Maryland Cybersecurity Investment Incentive Tax Credit.

Q: Who can apply for Form A.2?

A: Any qualified investor or corporation, including sub-chapters, can apply for Form A.2.

Q: What is the purpose of Form A.2?

A: The purpose of Form A.2 is to apply for certification for the Maryland Cybersecurity Investment Incentive Tax Credit.

Q: What is the Maryland Cybersecurity Investment Incentive Tax Credit?

A: The Maryland Cybersecurity Investment Incentive Tax Credit is a tax credit offered to qualified investors and corporations who invest in Maryland-based cybersecurity companies.

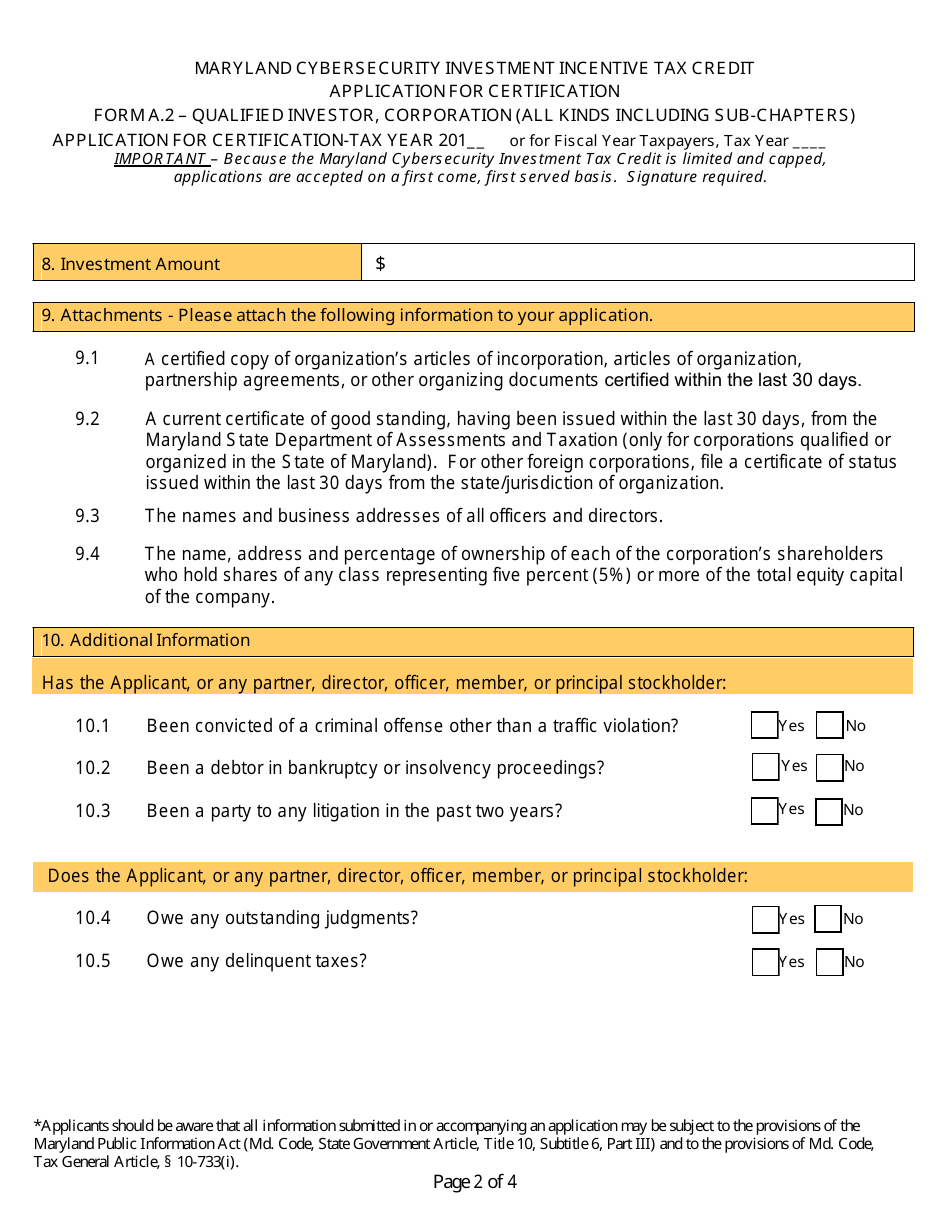

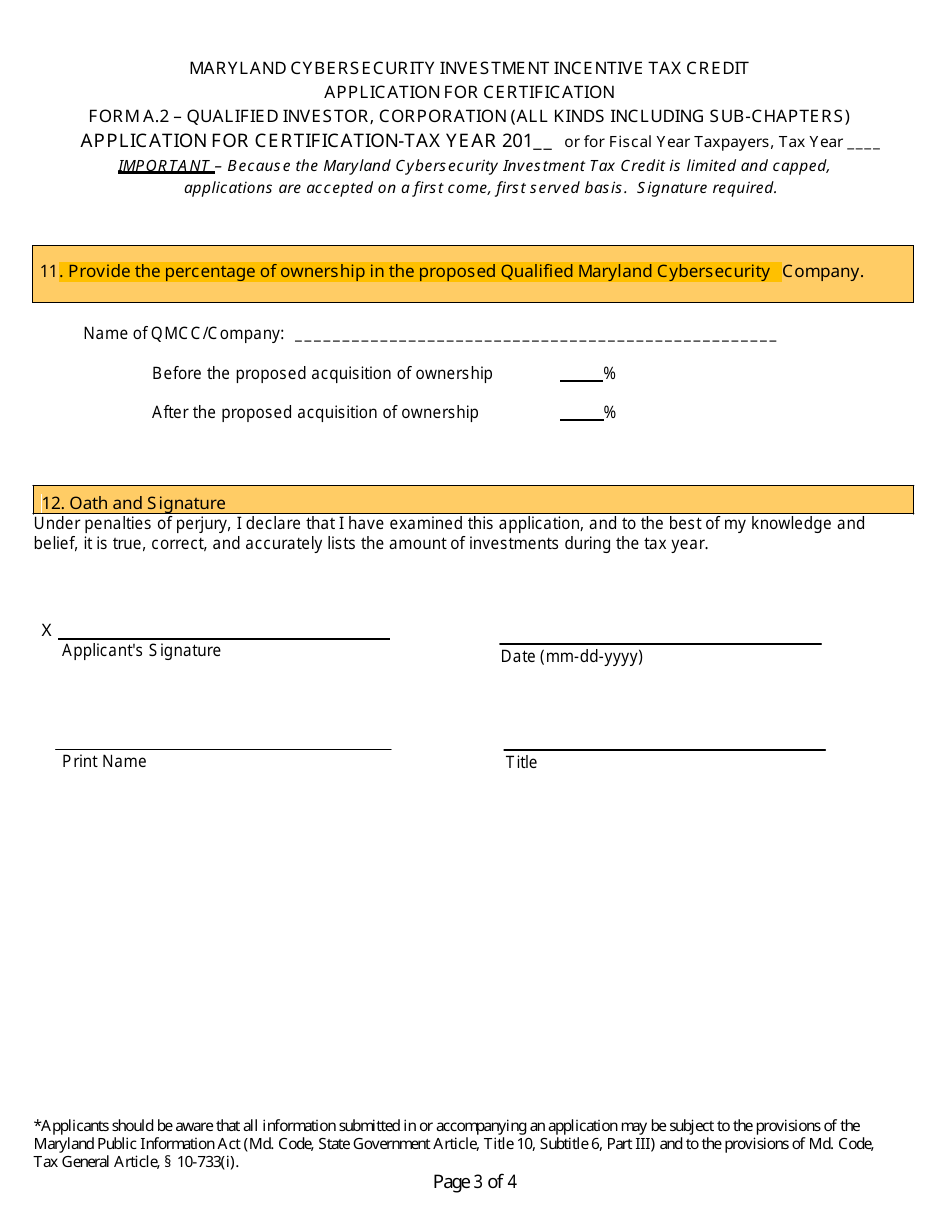

Q: What information is required on Form A.2?

A: Form A.2 requires information about the applicant's qualifications, investment details, and other relevant information as specified in the form itself.

Q: Are there any deadlines for submitting Form A.2?

A: Yes, there are typically deadlines for submitting Form A.2. It is advisable to check the official guidelines or contact the relevant authority to determine the specific deadlines.

Q: What are the benefits of the Maryland Cybersecurity Investment Incentive Tax Credit?

A: The benefits of this tax credit include a reduction in taxes owed by the qualified investor or corporation, as well as support for the development of the cybersecurity industry in Maryland.

Q: Can a non-Maryland resident or corporation apply for Form A.2?

A: Yes, non-Maryland residents or corporations can apply for Form A.2 if they meet the eligibility requirements outlined in the application guidelines.

Form Details:

- The latest edition provided by the Maryland Department of Commerce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A.2 by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.