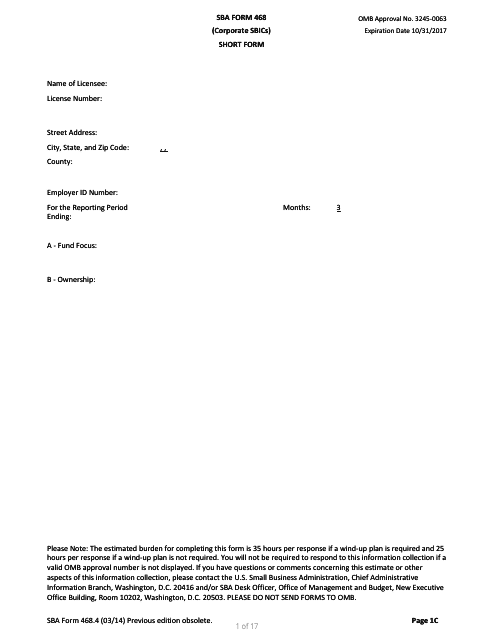

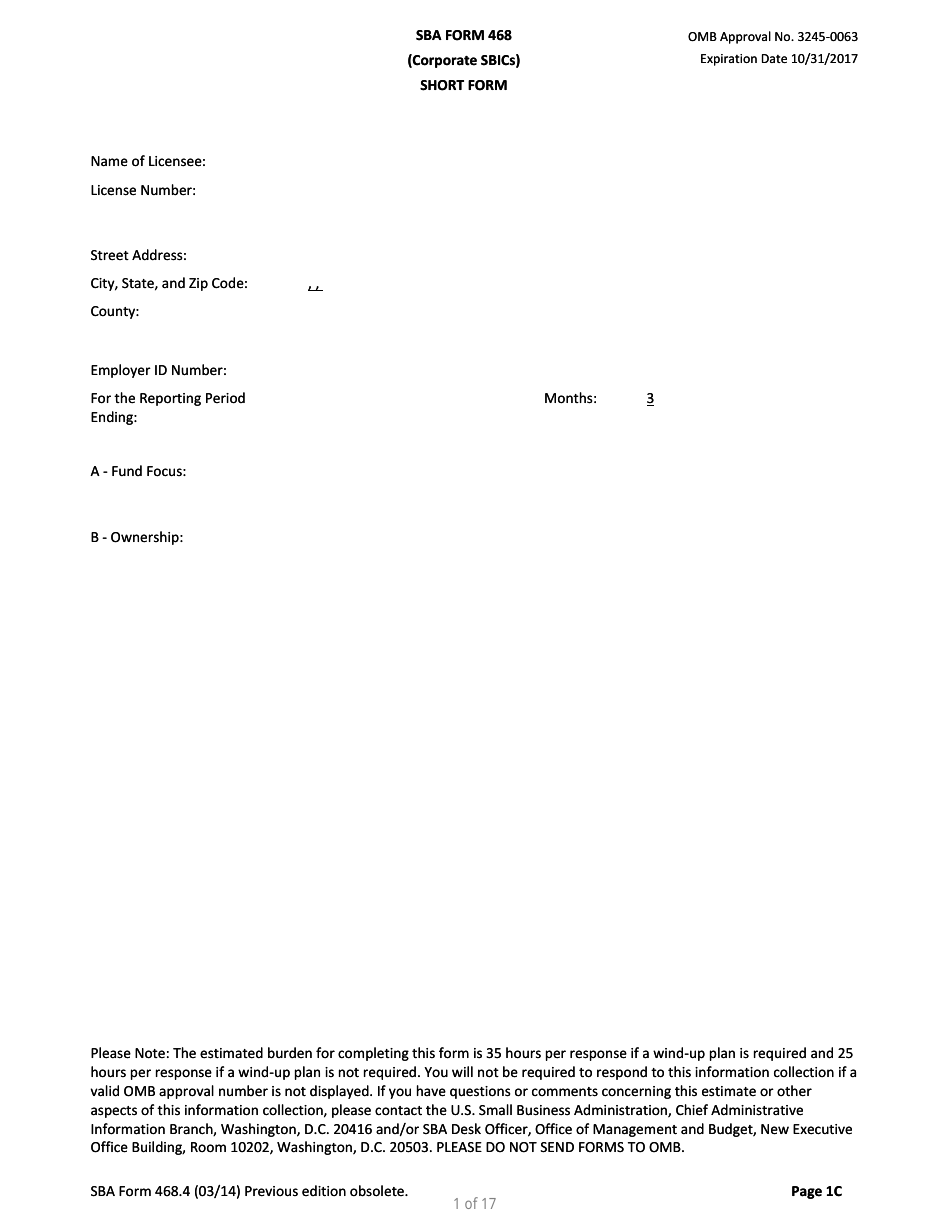

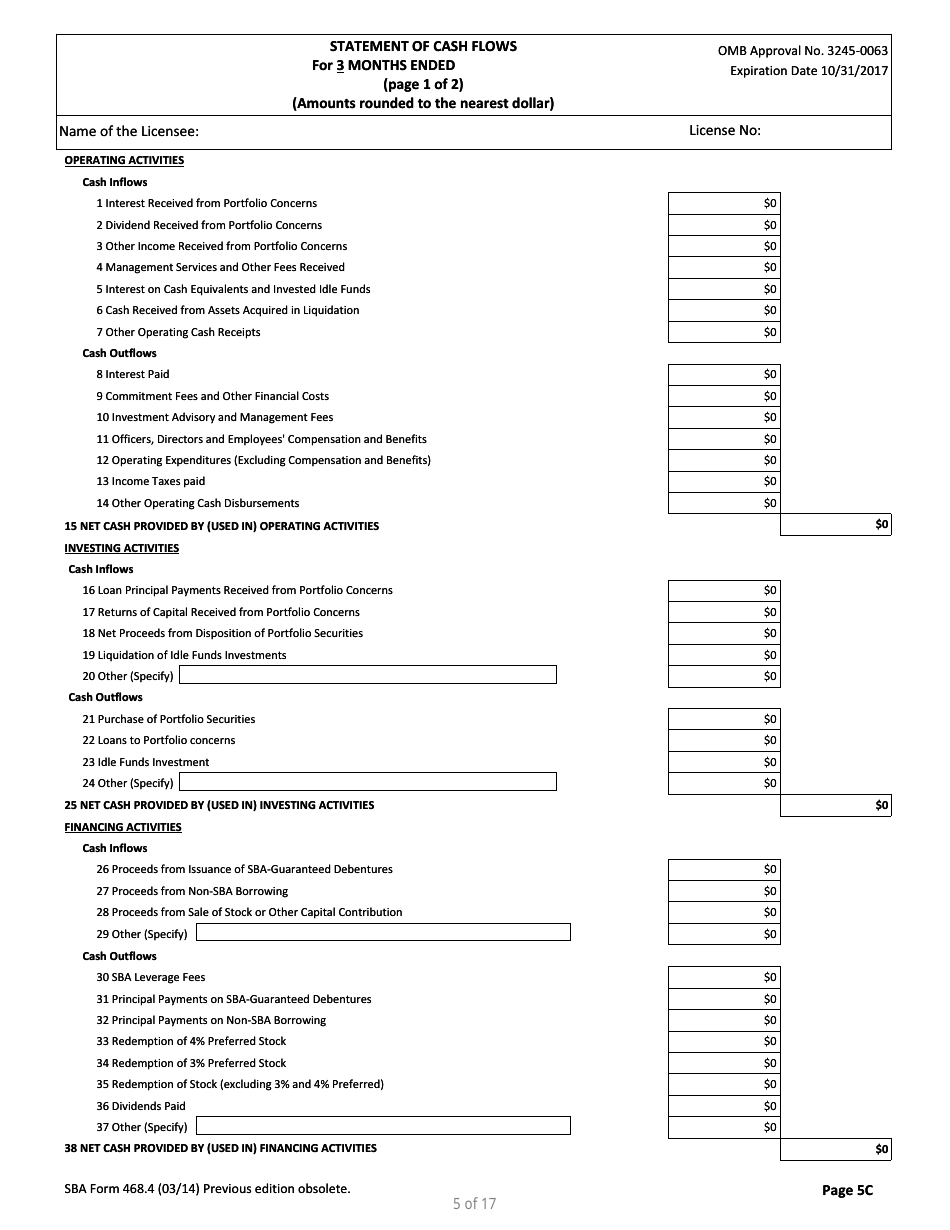

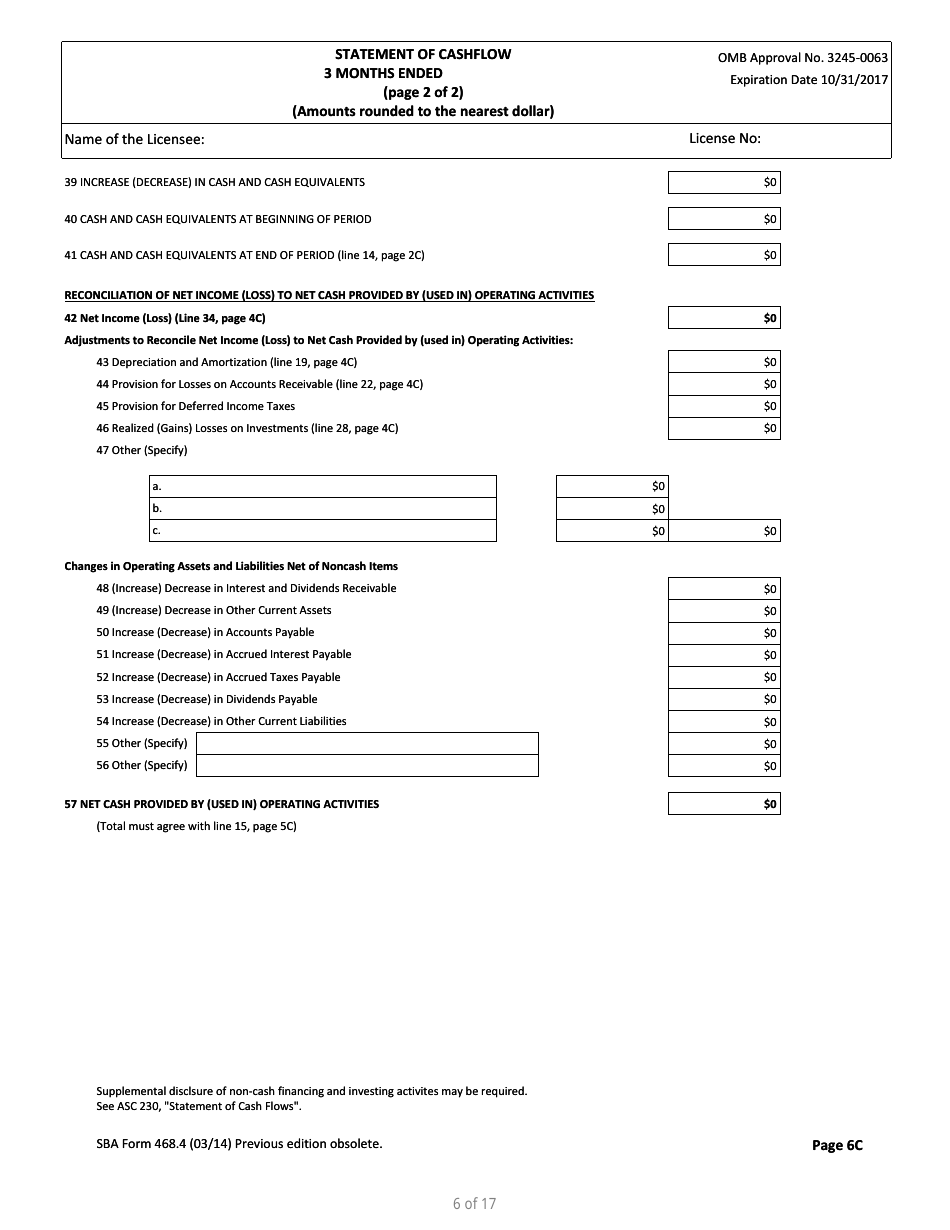

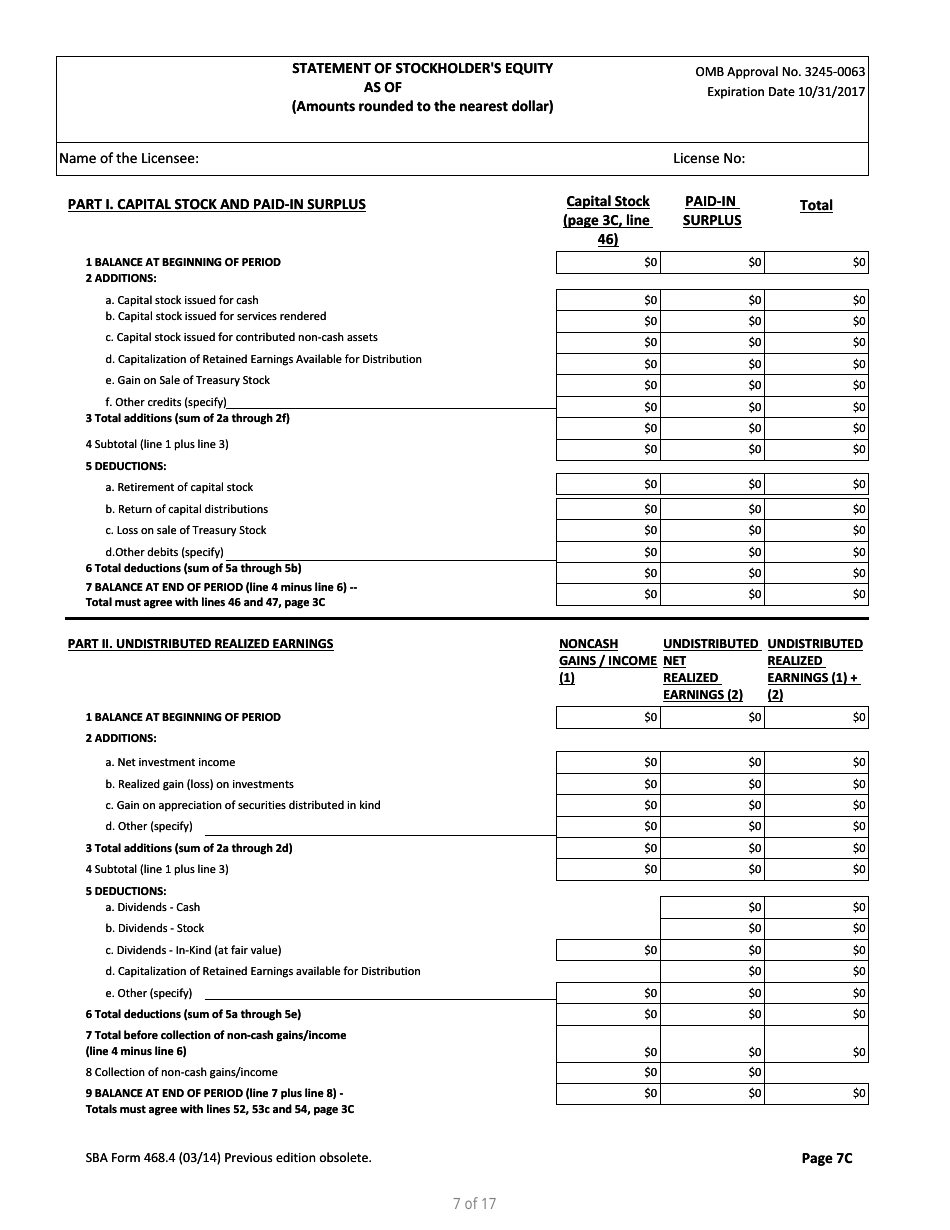

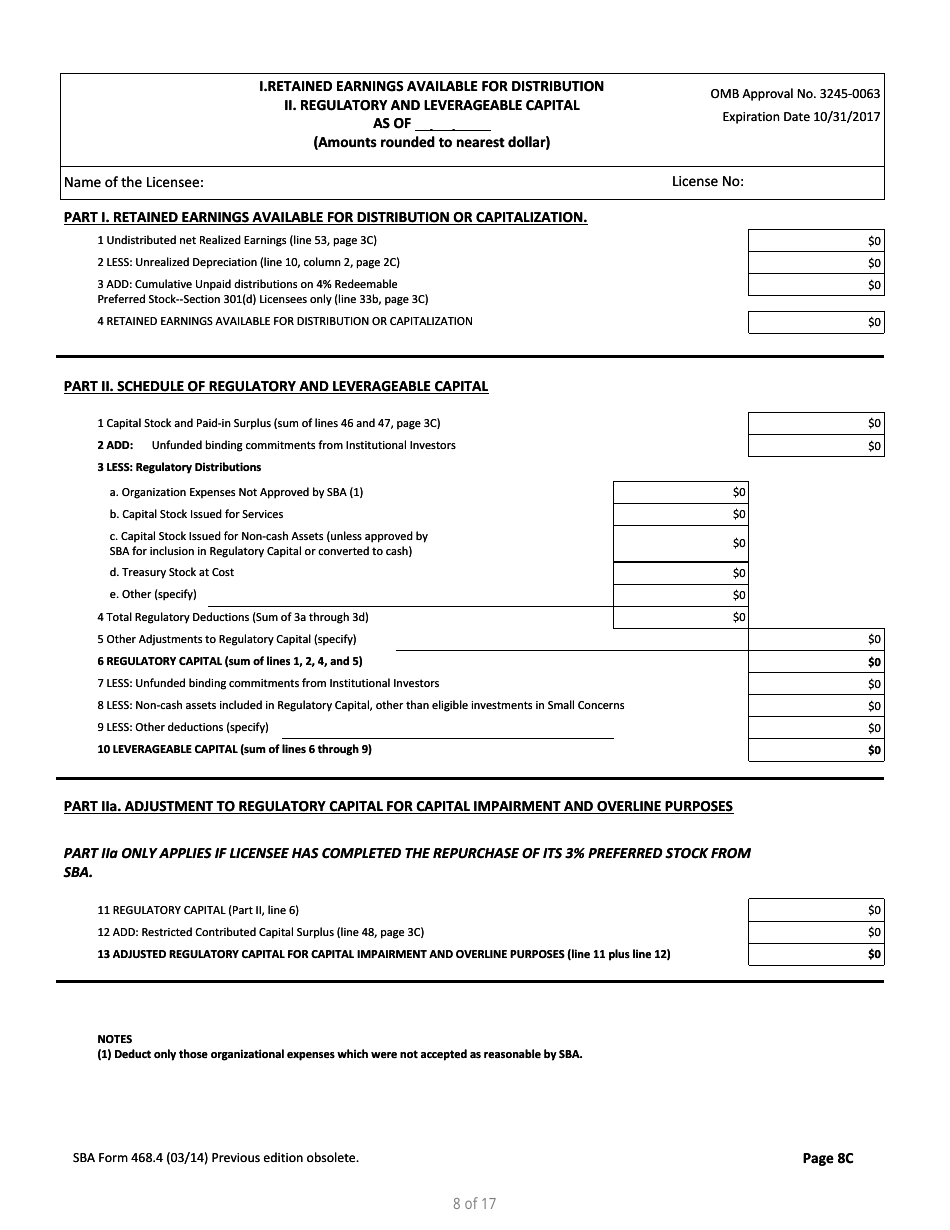

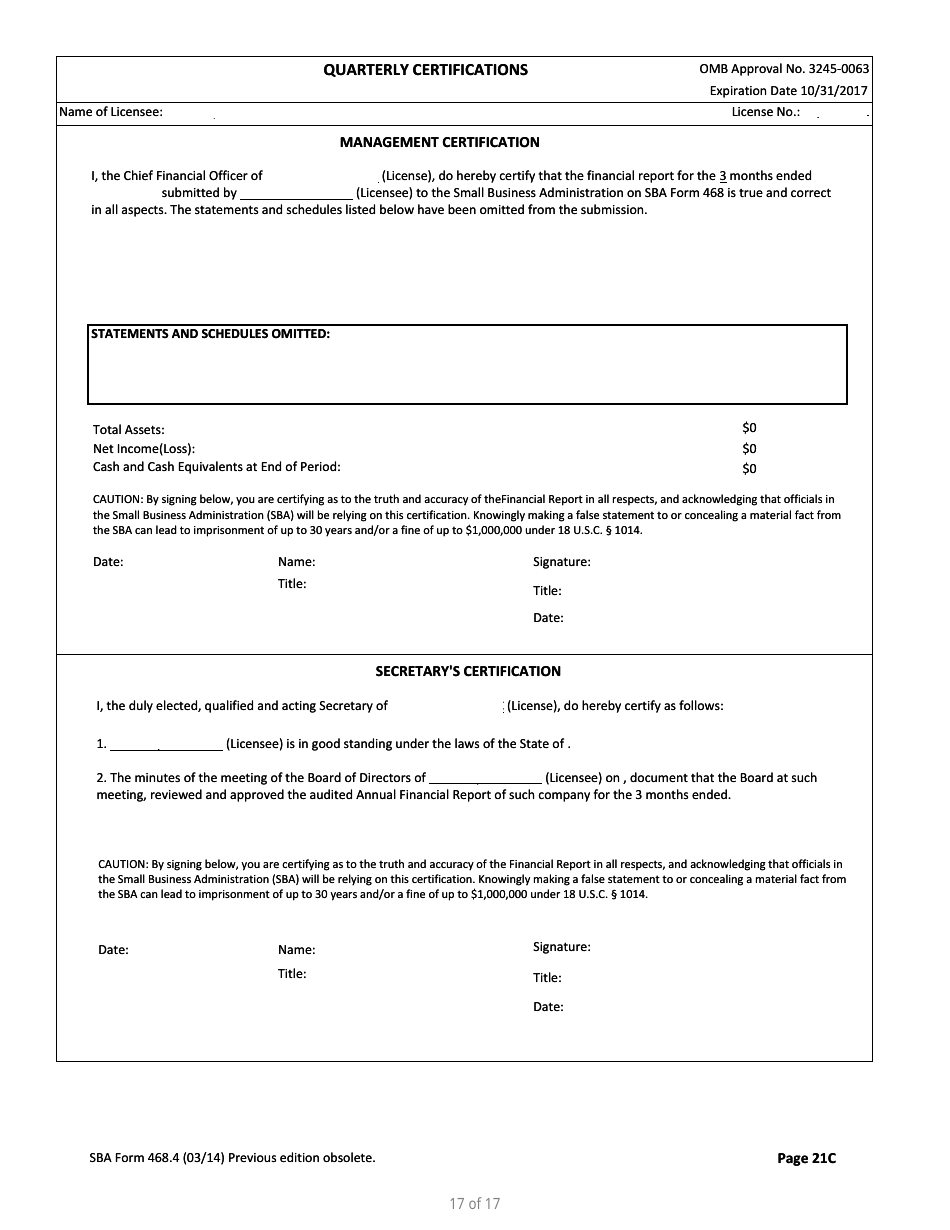

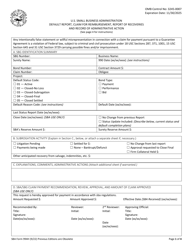

SBA Form 468.4 Corporate Quarterly Financial Report

What Is SBA Form 468.4?

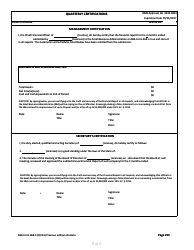

This is a legal form that was released by the U.S. Small Business Administration on March 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 468.4?

A: SBA Form 468.4 is a Corporate Quarterly Financial Report.

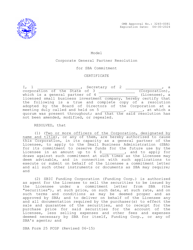

Q: Who needs to file SBA Form 468.4?

A: Any corporation that has received financial assistance from the Small Business Administration (SBA) may need to file Form 468.4.

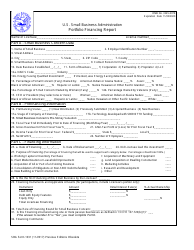

Q: What is the purpose of SBA Form 468.4?

A: The purpose of Form 468.4 is to provide the SBA with an updated financial snapshot of the corporation.

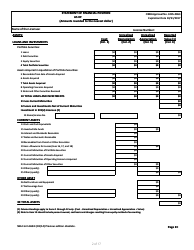

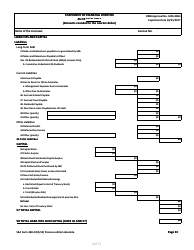

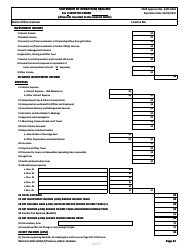

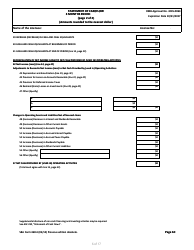

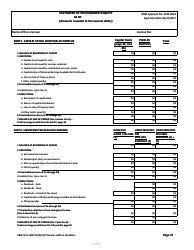

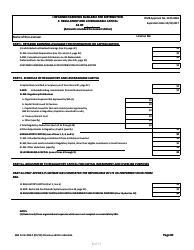

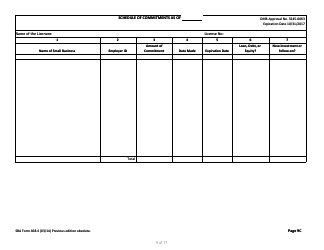

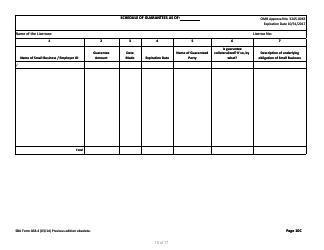

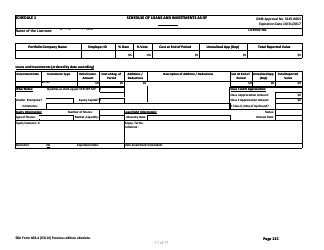

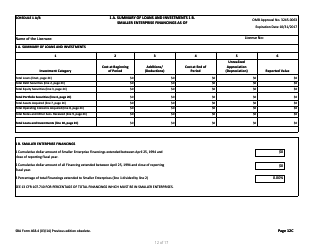

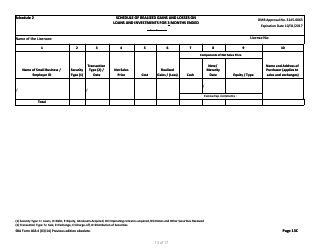

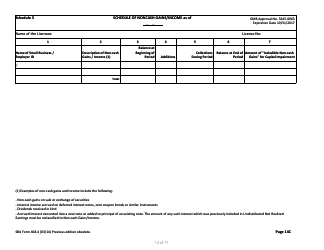

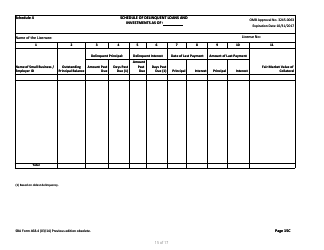

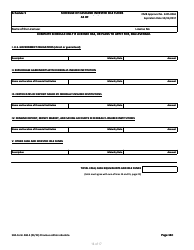

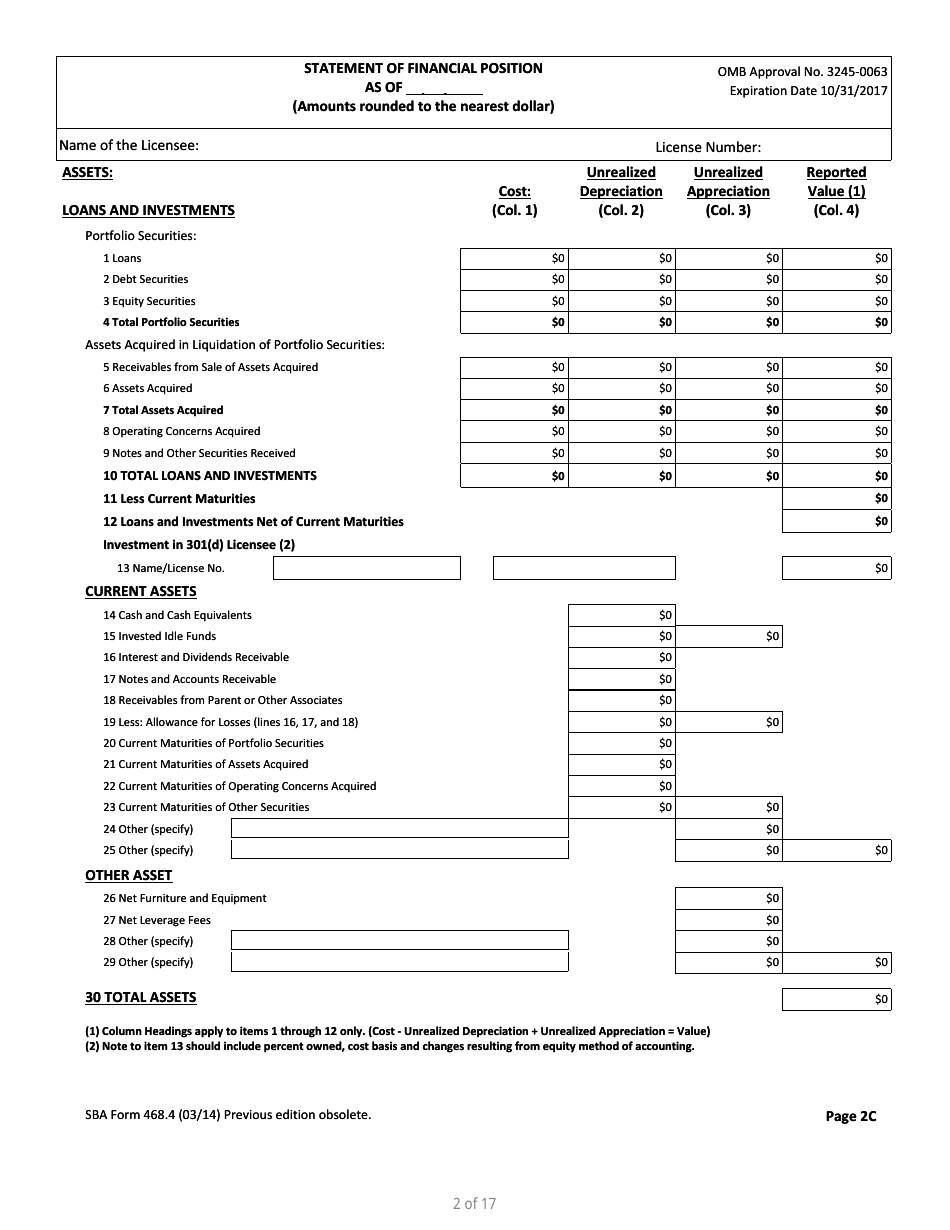

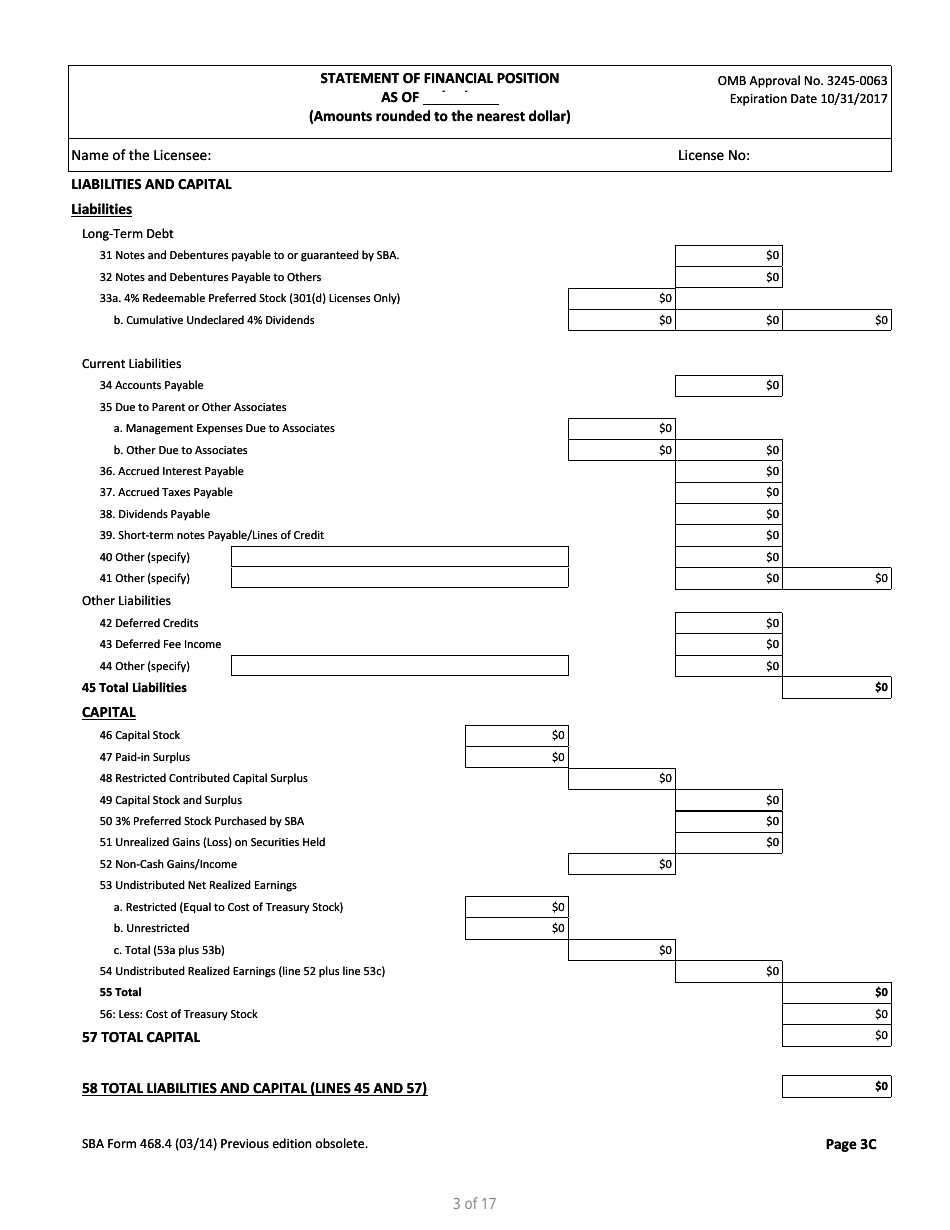

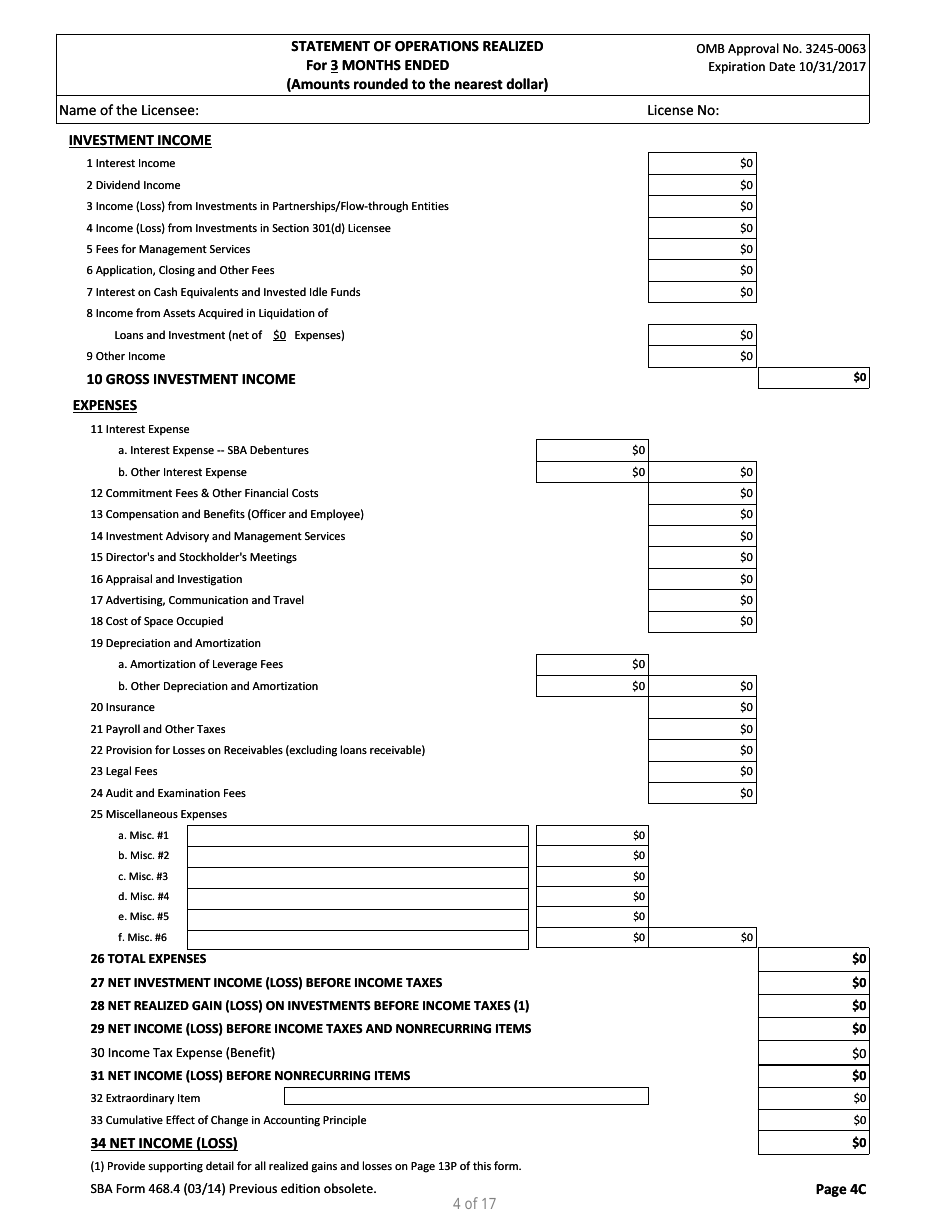

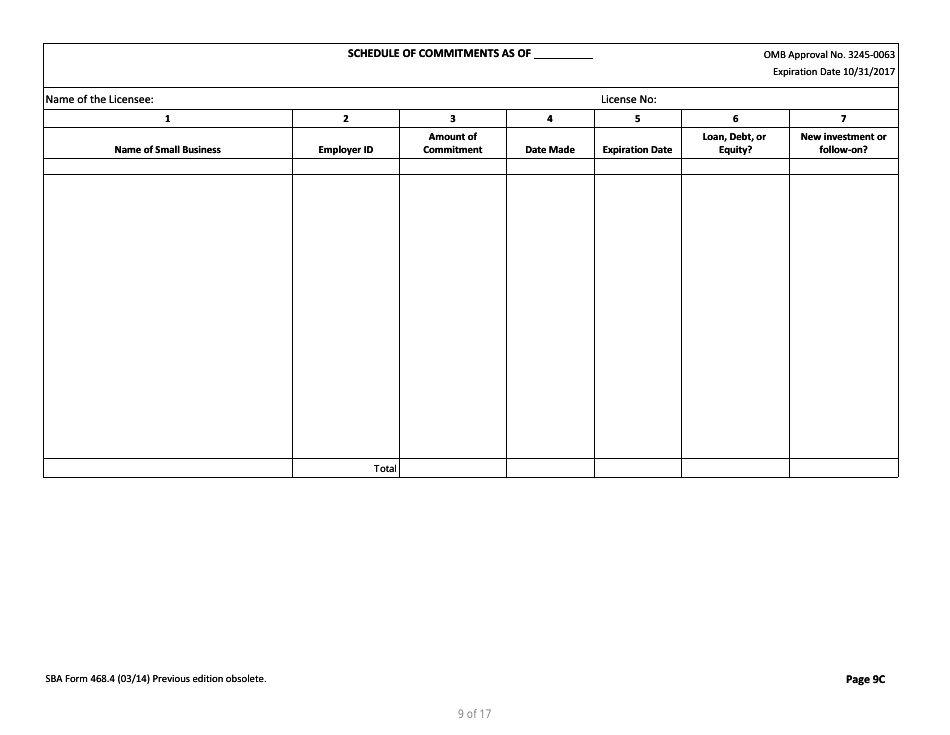

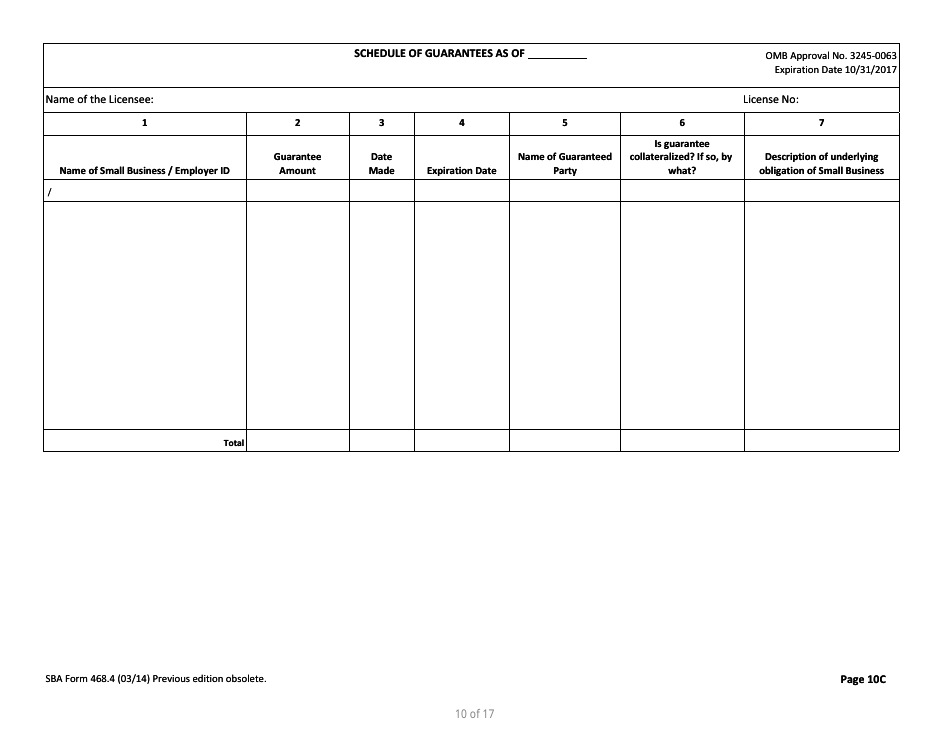

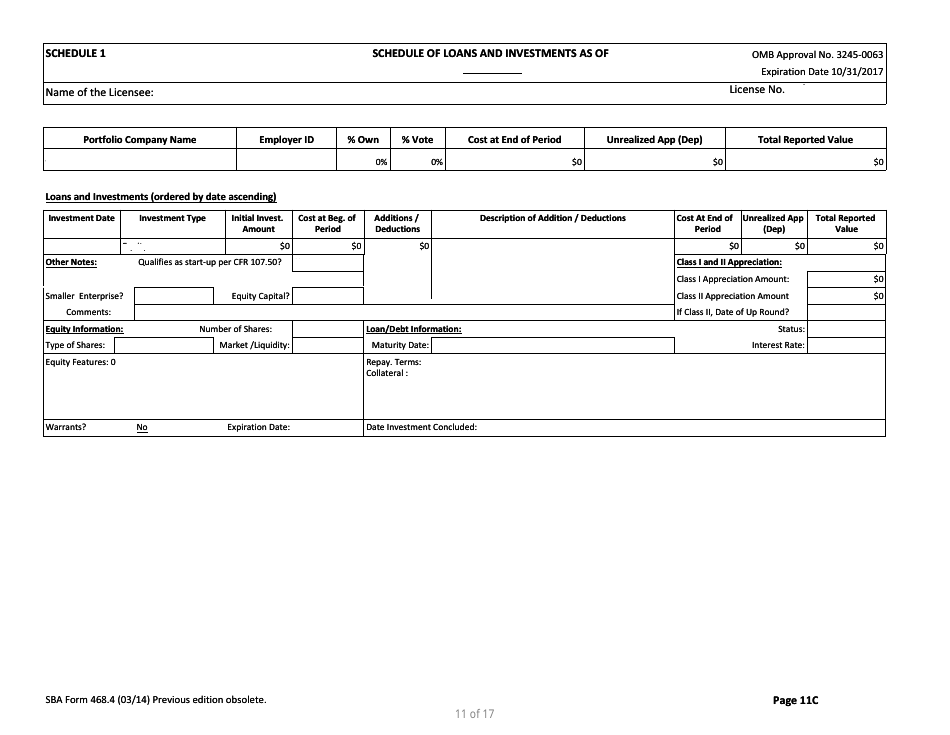

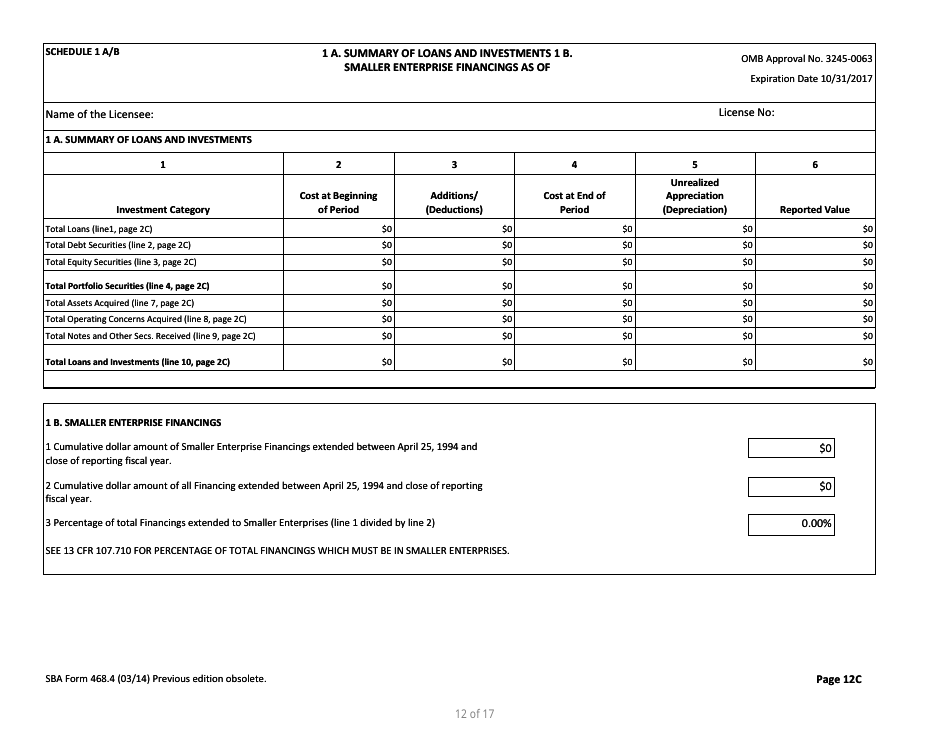

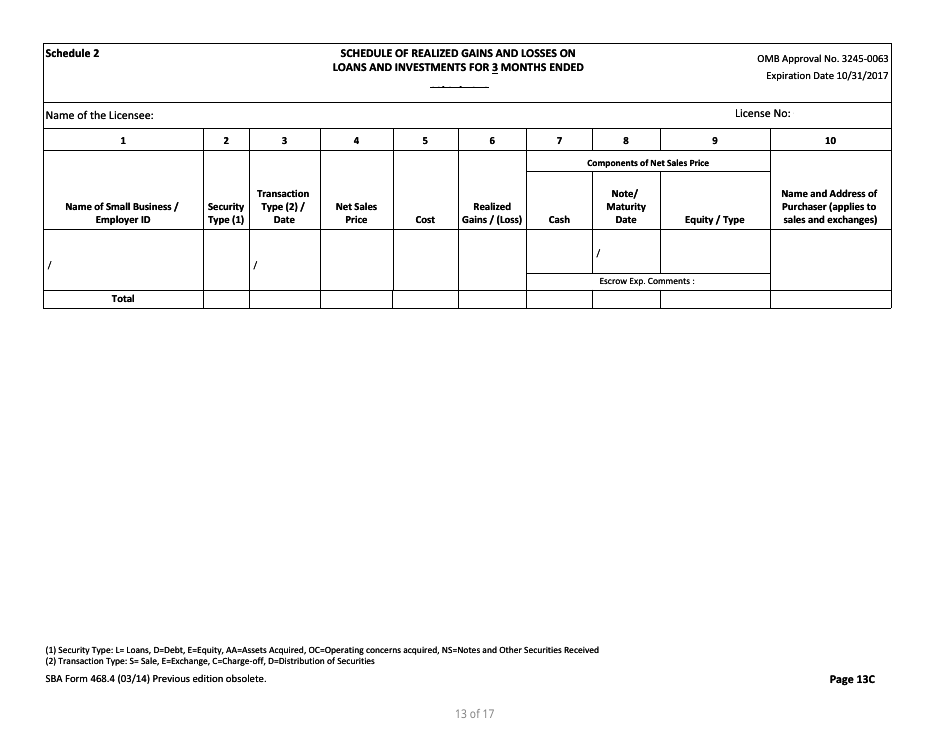

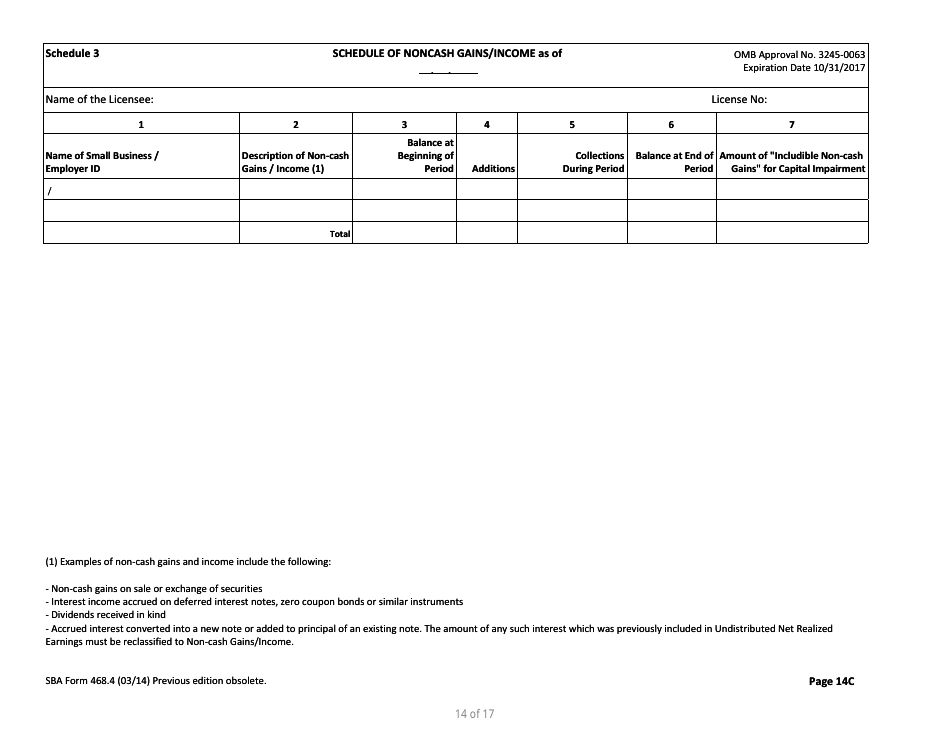

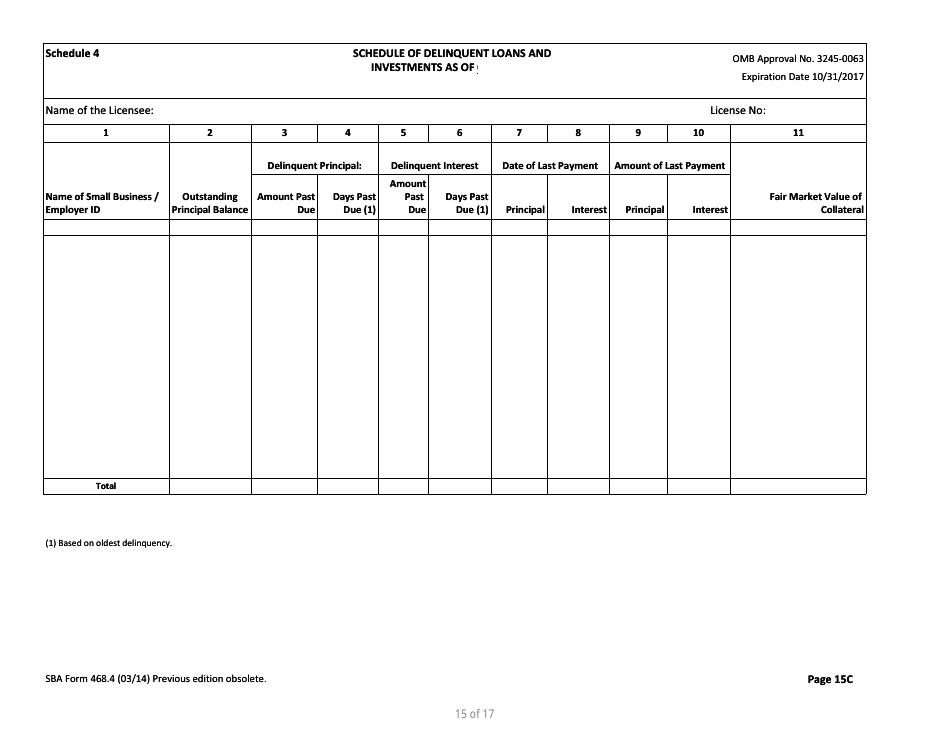

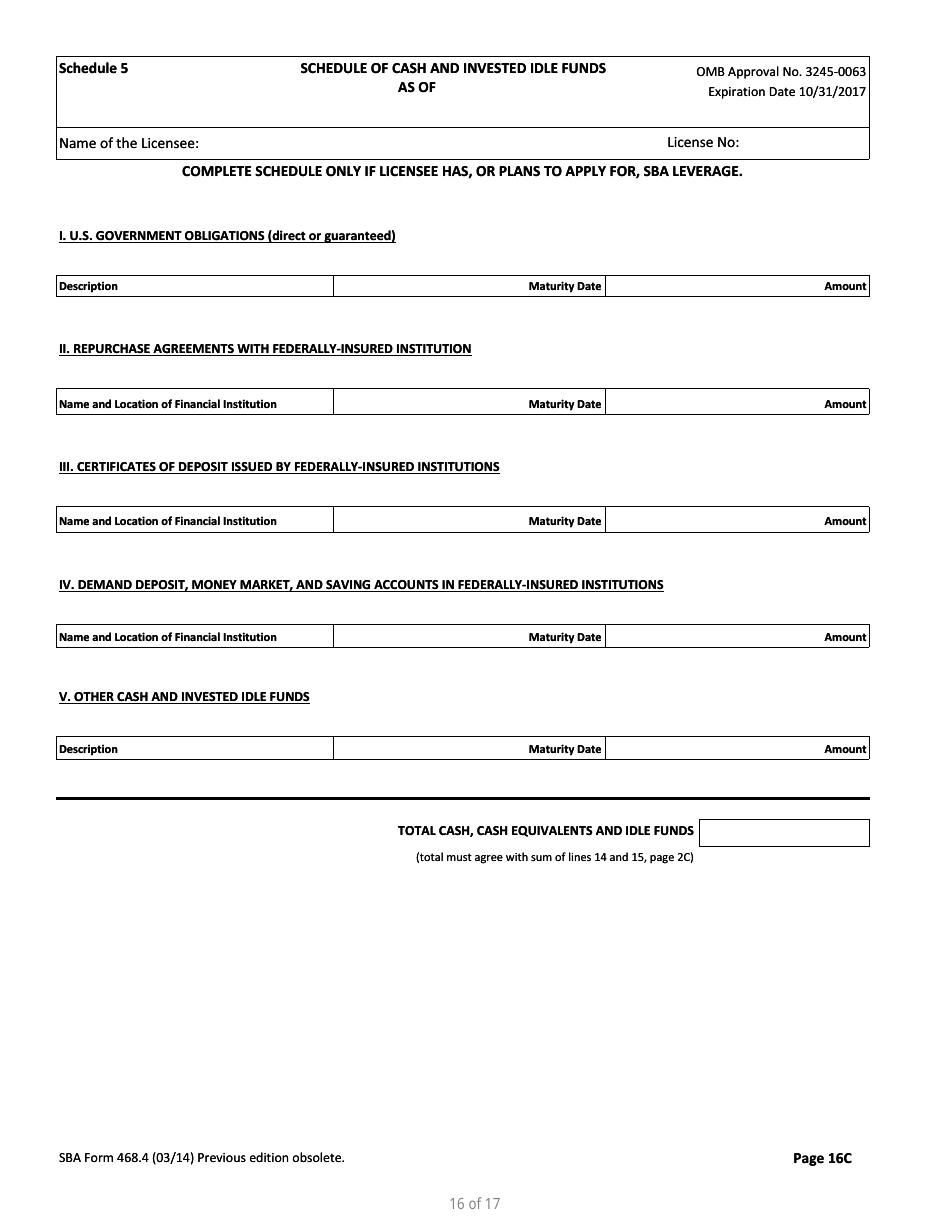

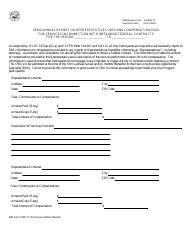

Q: What information is required on SBA Form 468.4?

A: The form requires information on the corporation's assets, liabilities, income, and expenses.

Q: How often does SBA Form 468.4 need to be filed?

A: Form 468.4 should be filed on a quarterly basis.

Form Details:

- Released on March 1, 2014;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of SBA Form 468.4 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.