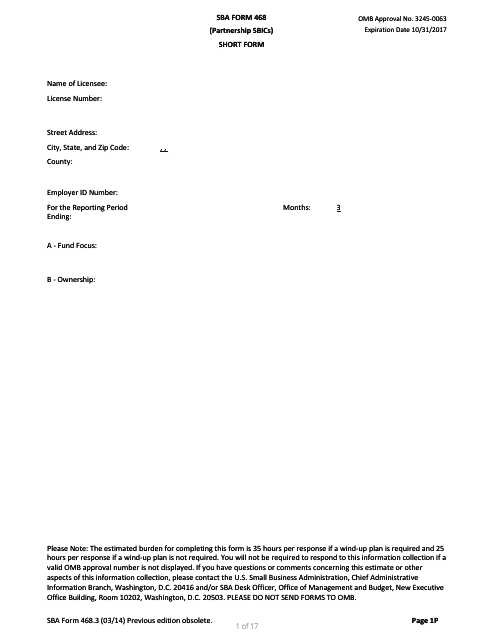

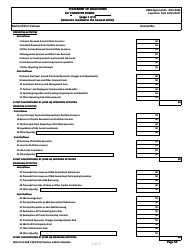

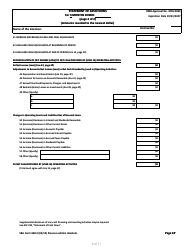

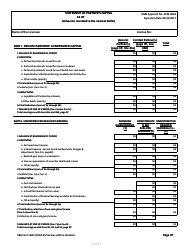

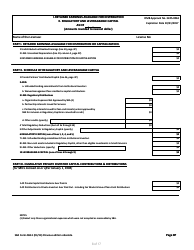

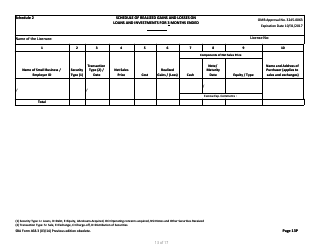

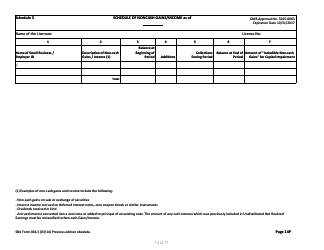

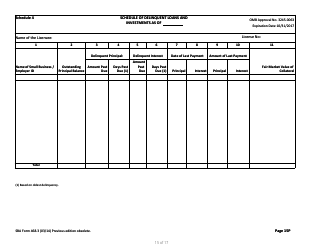

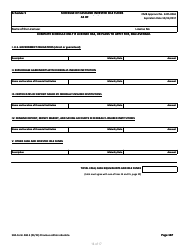

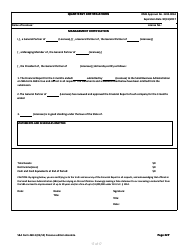

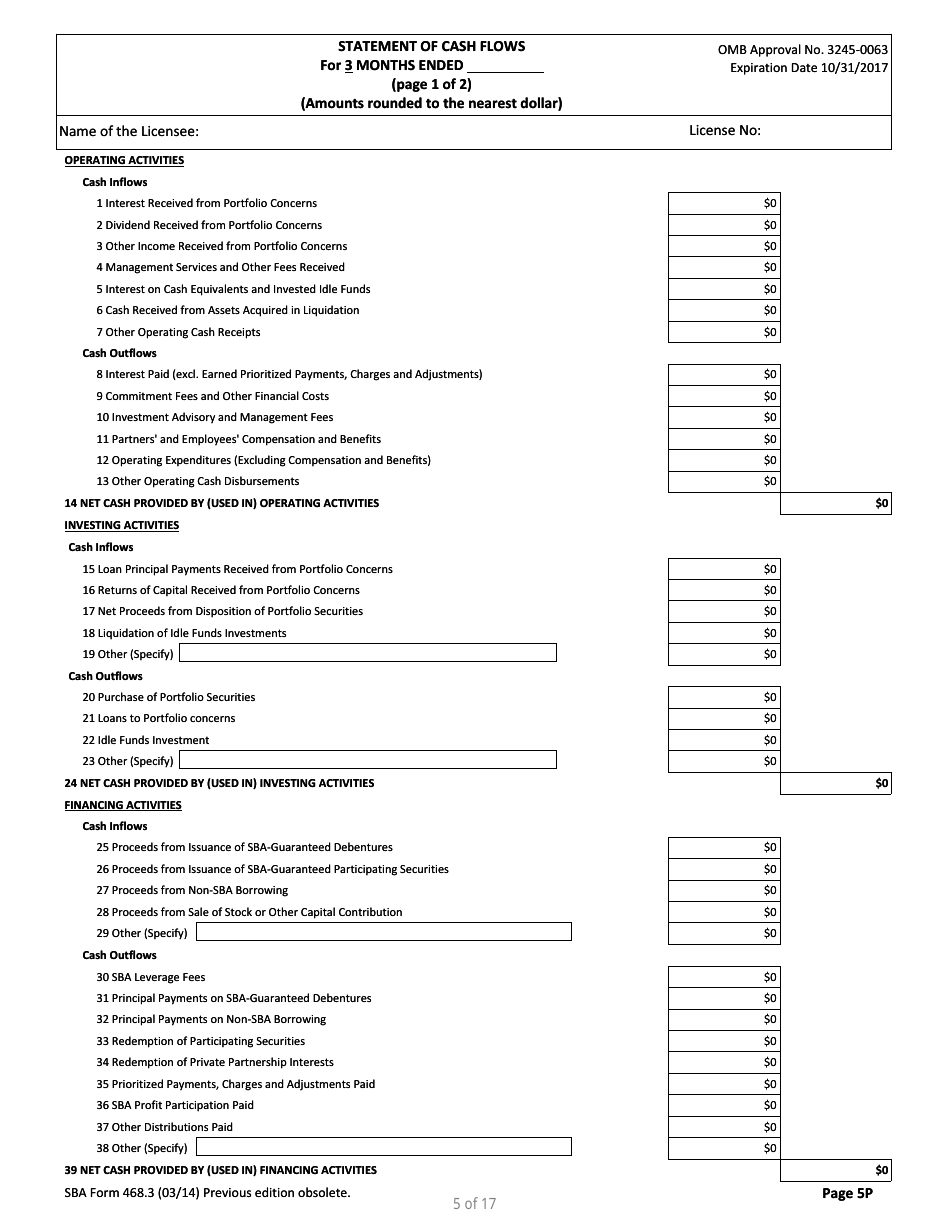

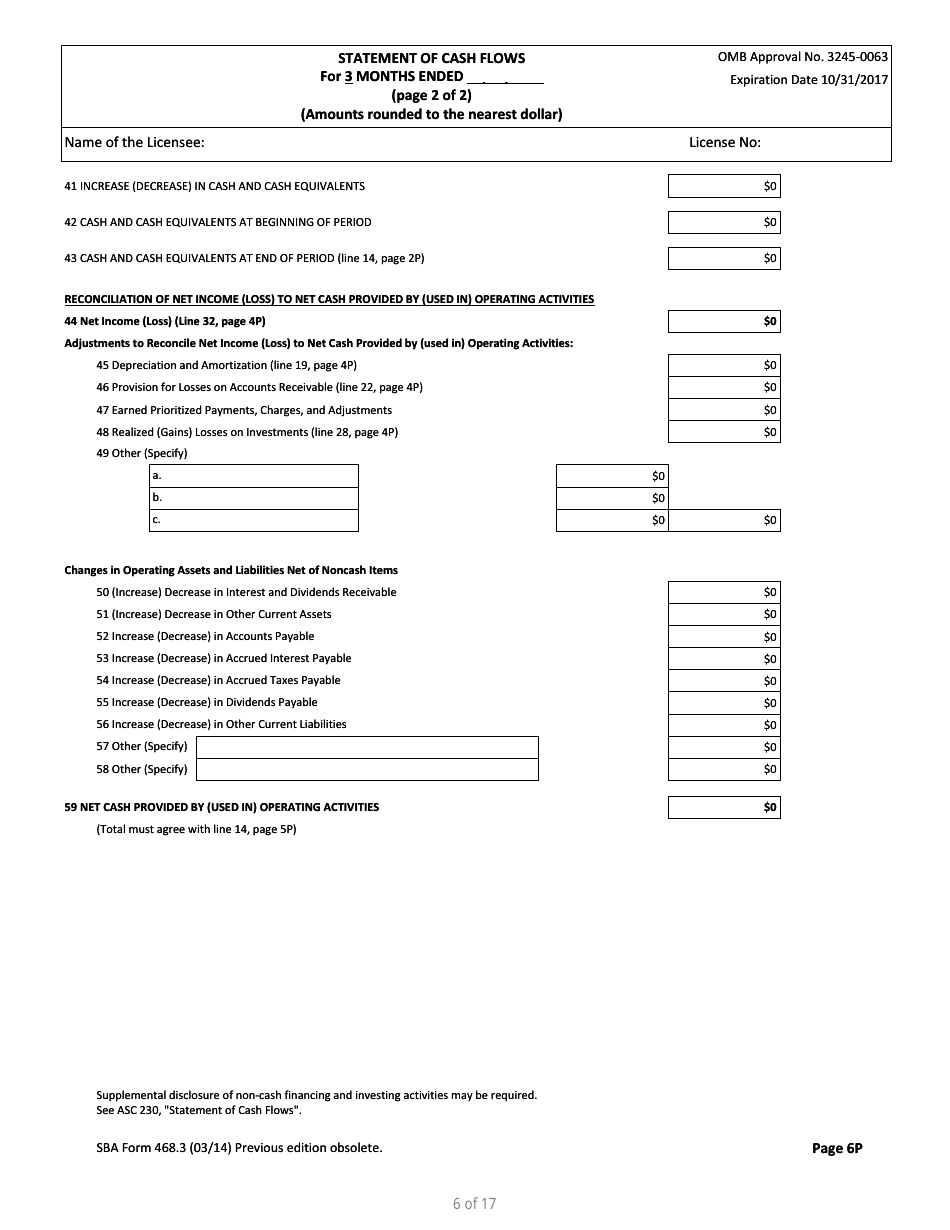

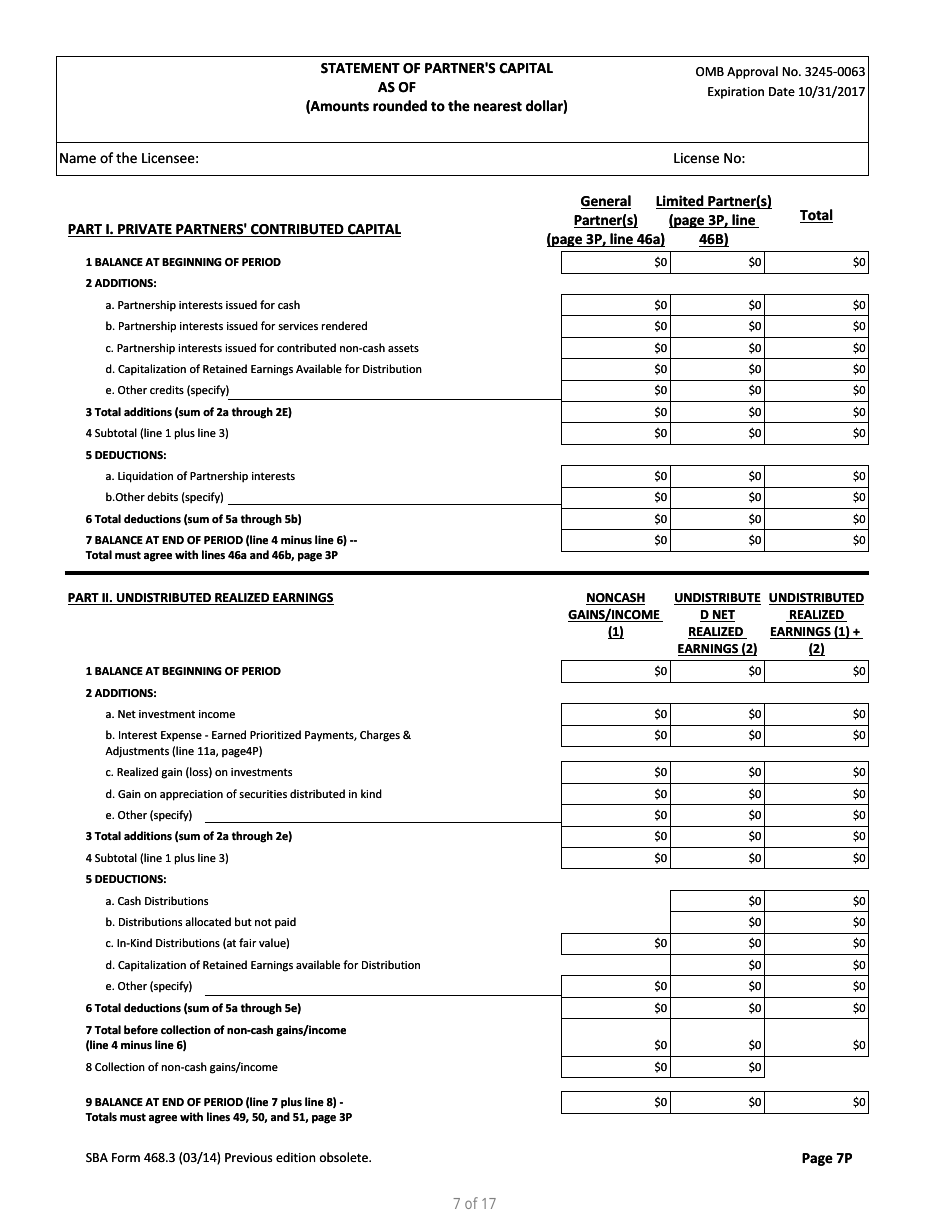

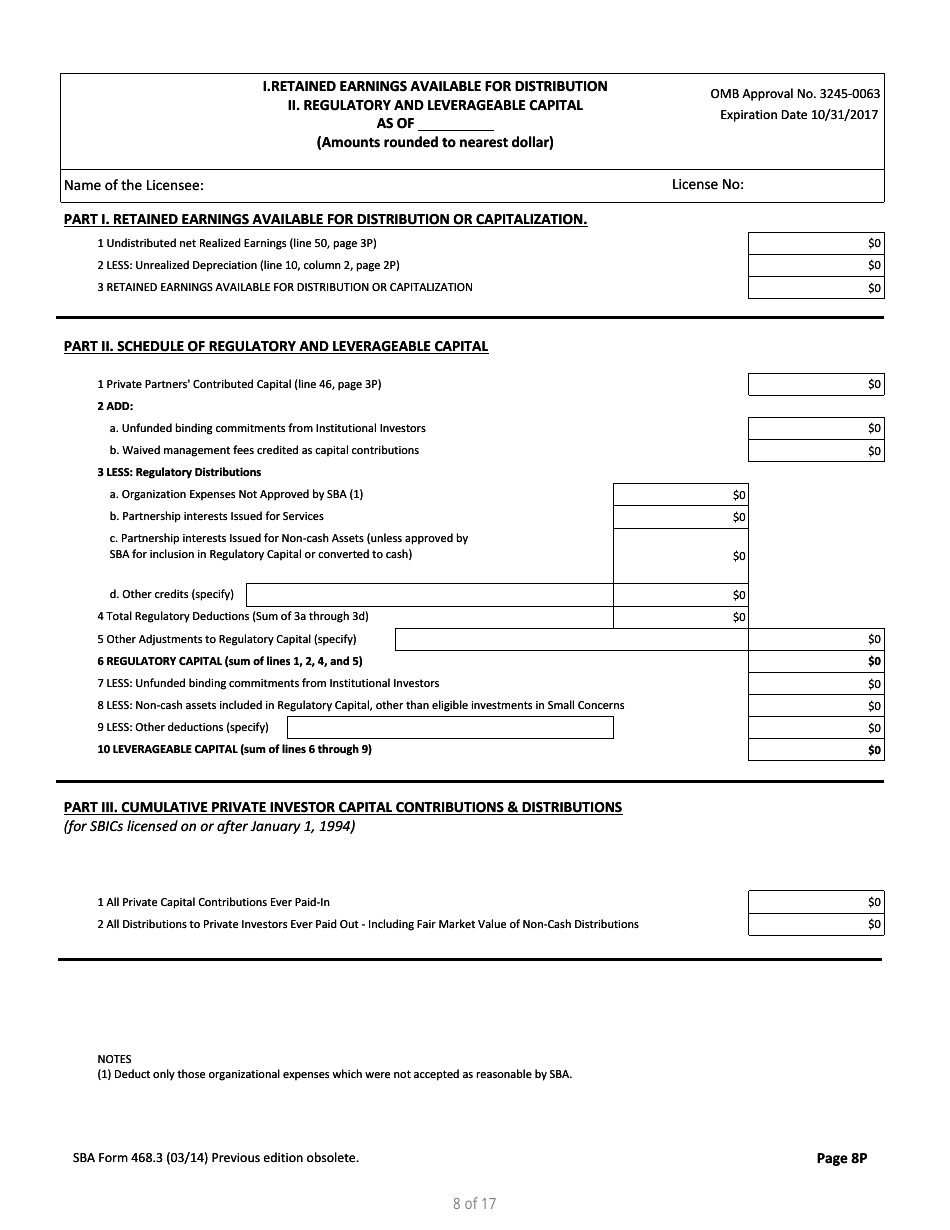

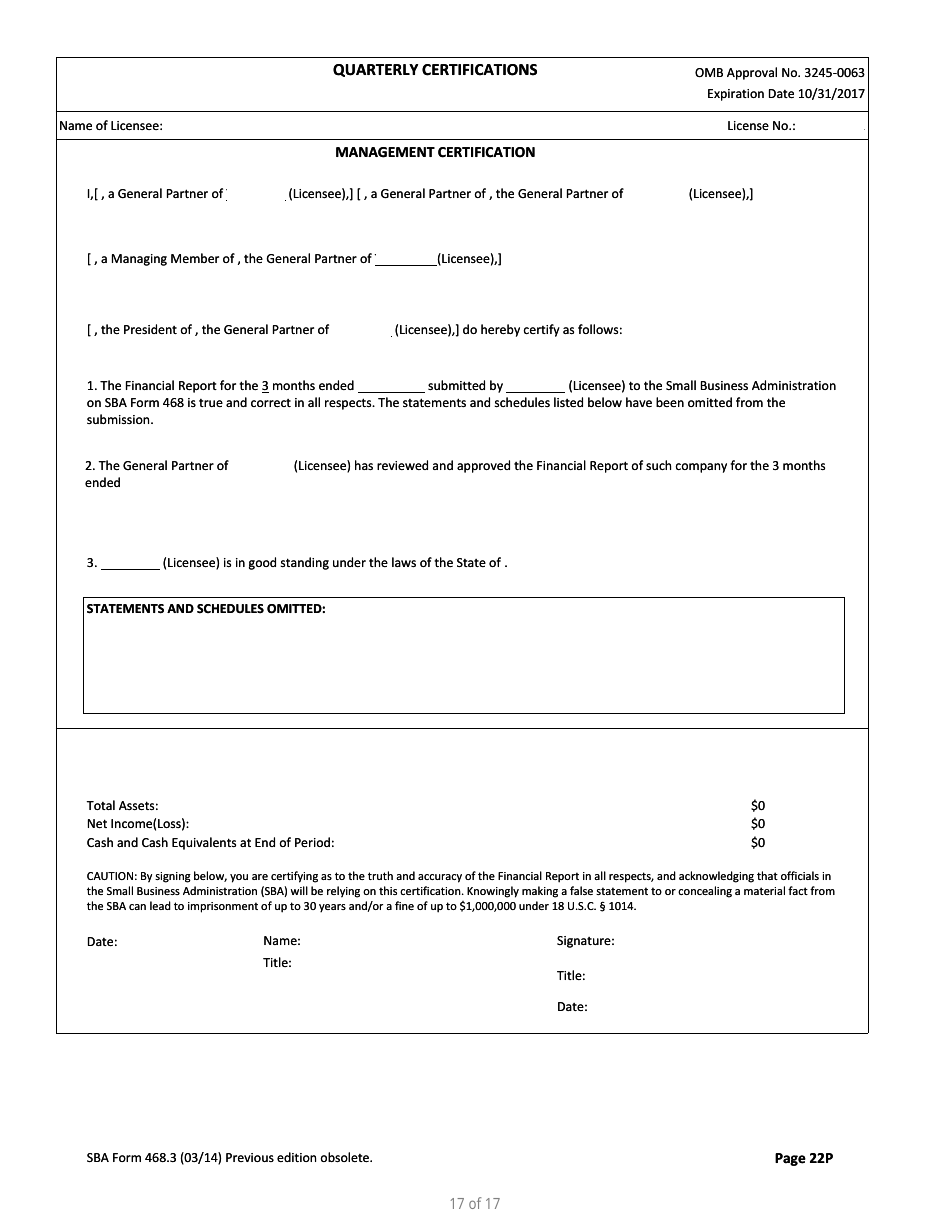

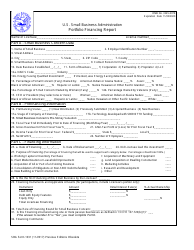

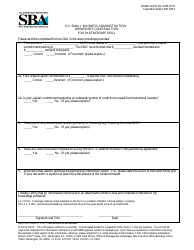

SBA Form 468.3 Partnership Quarterly Financial Report

What Is SBA Form 468.3?

This is a legal form that was released by the U.S. Small Business Administration on March 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 468.3?

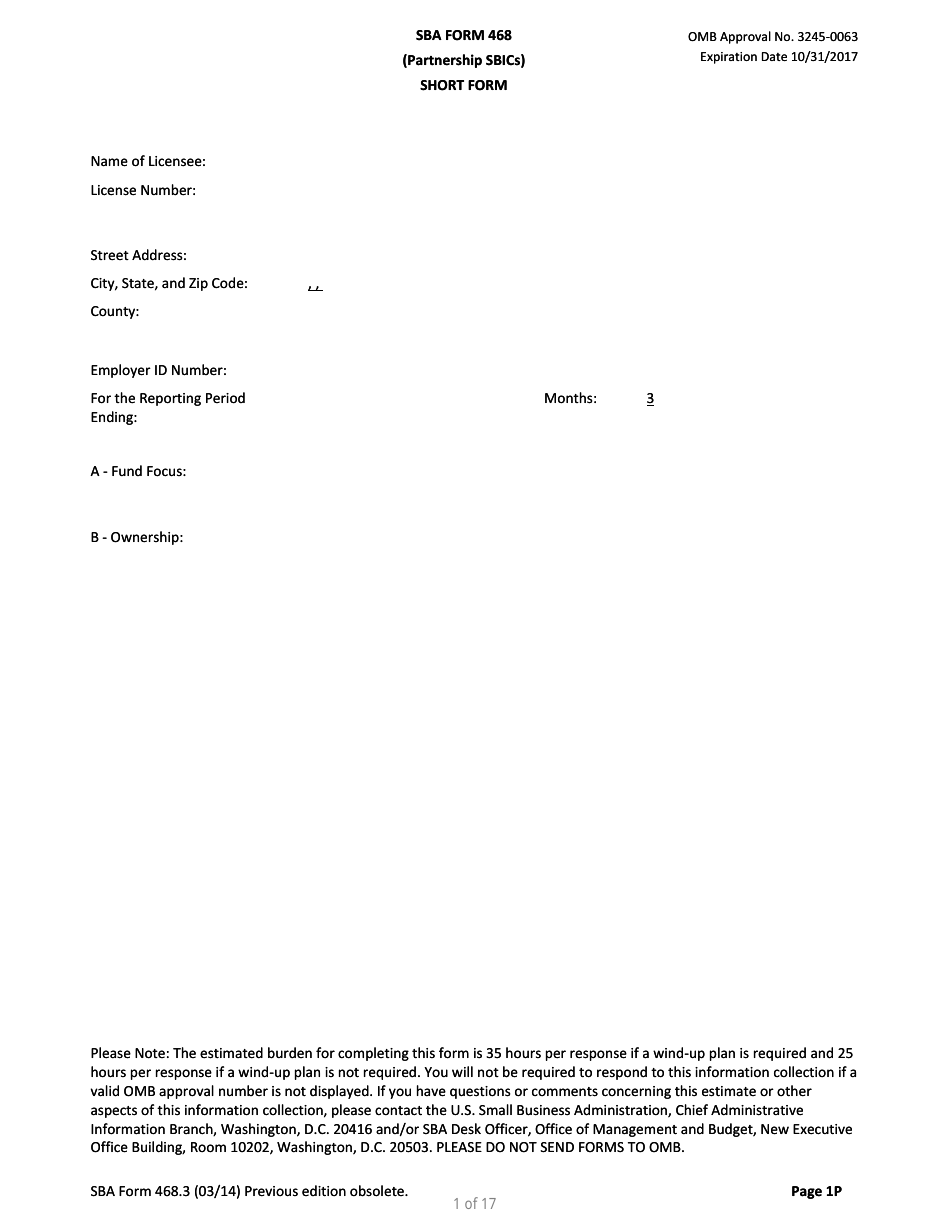

A: SBA Form 468.3 is the Partnership Quarterly Financial Report.

Q: What is the purpose of SBA Form 468.3?

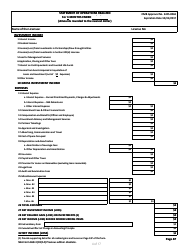

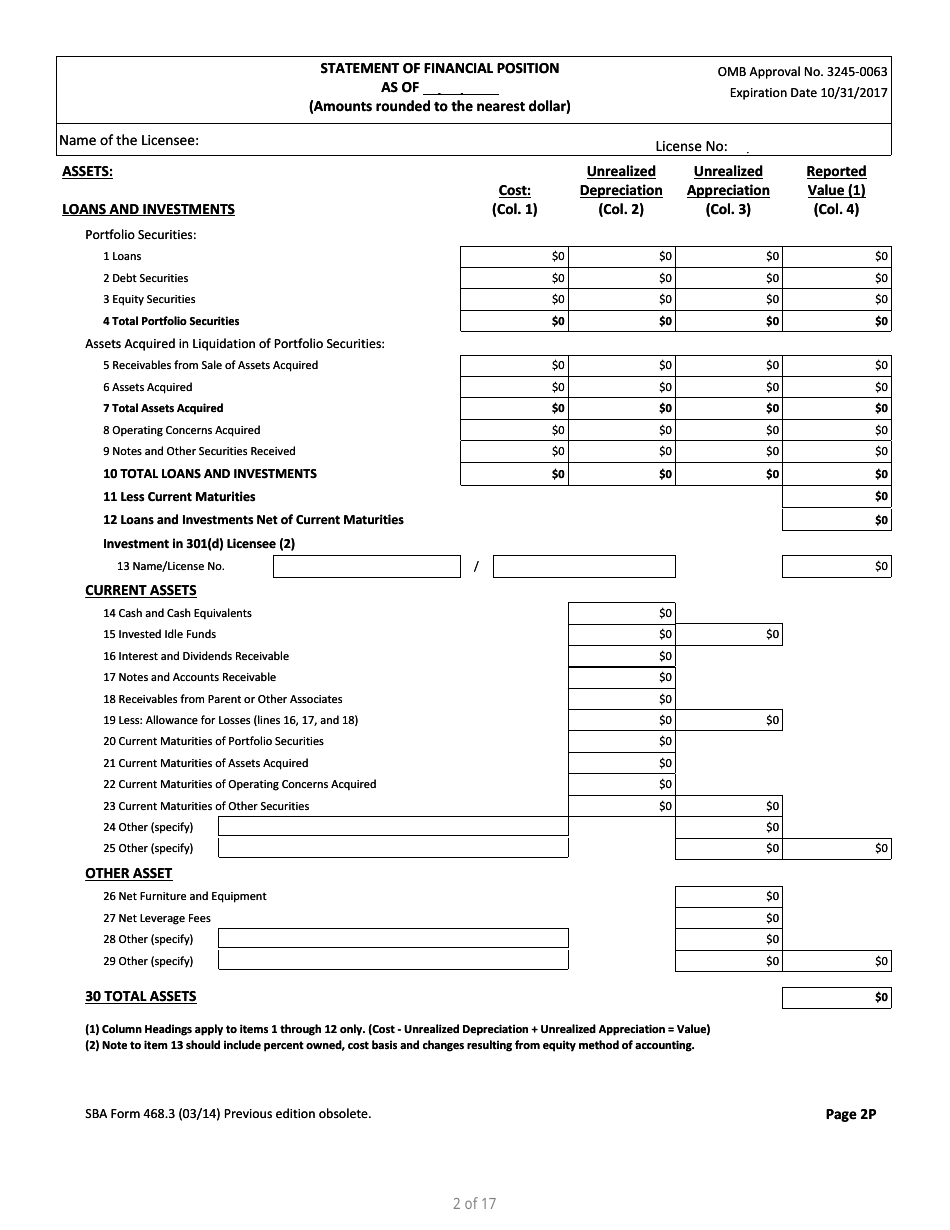

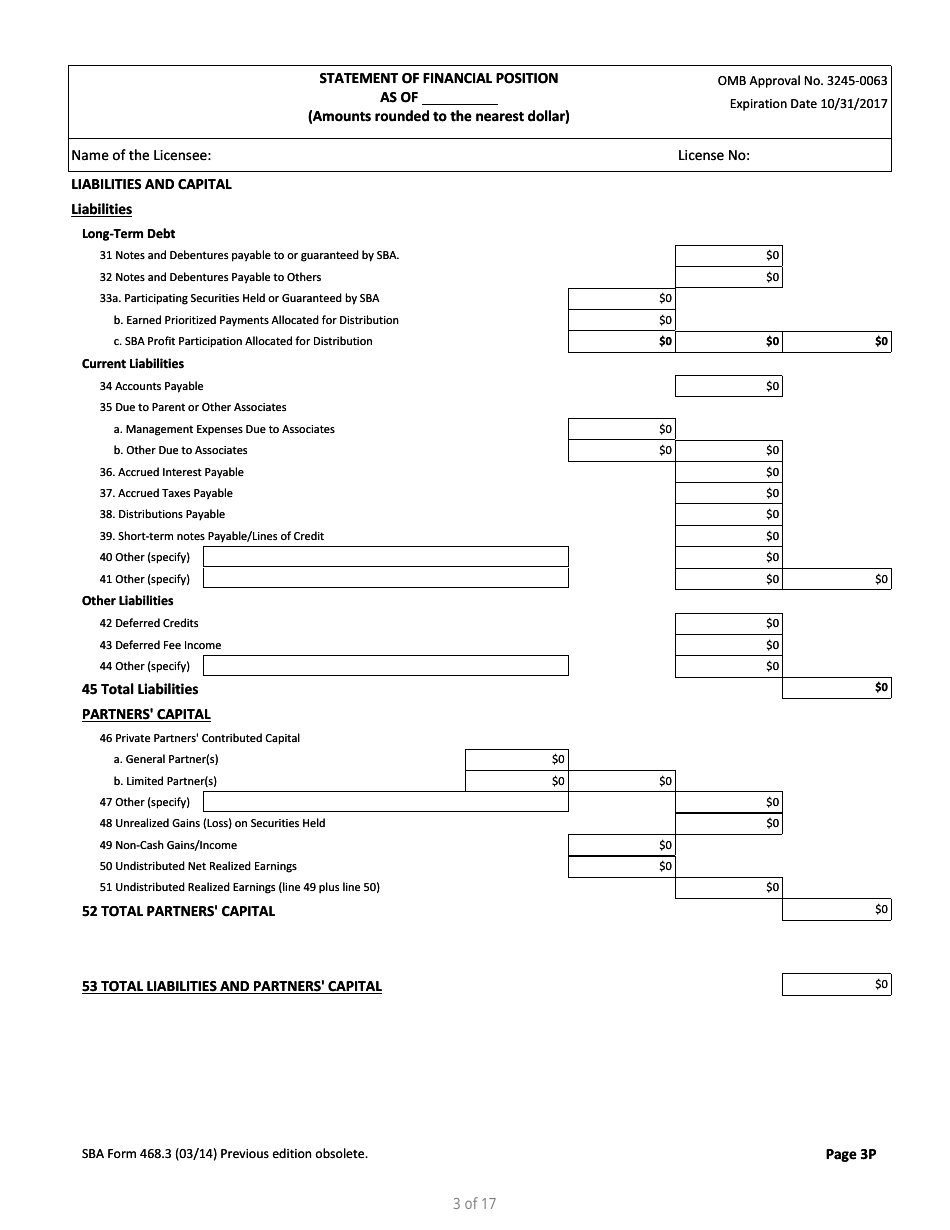

A: The purpose of SBA Form 468.3 is to report the financial information of a partnership on a quarterly basis.

Q: Who needs to file SBA Form 468.3?

A: Partnerships are required to file SBA Form 468.3.

Q: How often should SBA Form 468.3 be filed?

A: SBA Form 468.3 should be filed quarterly.

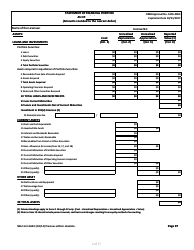

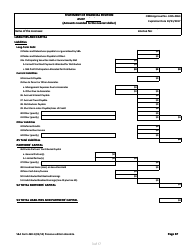

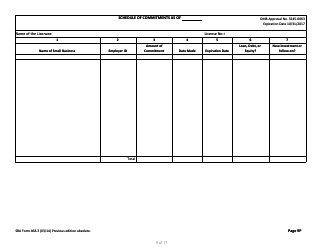

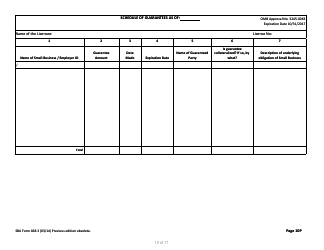

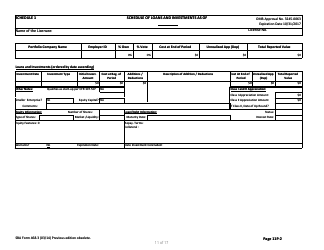

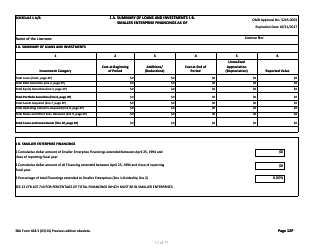

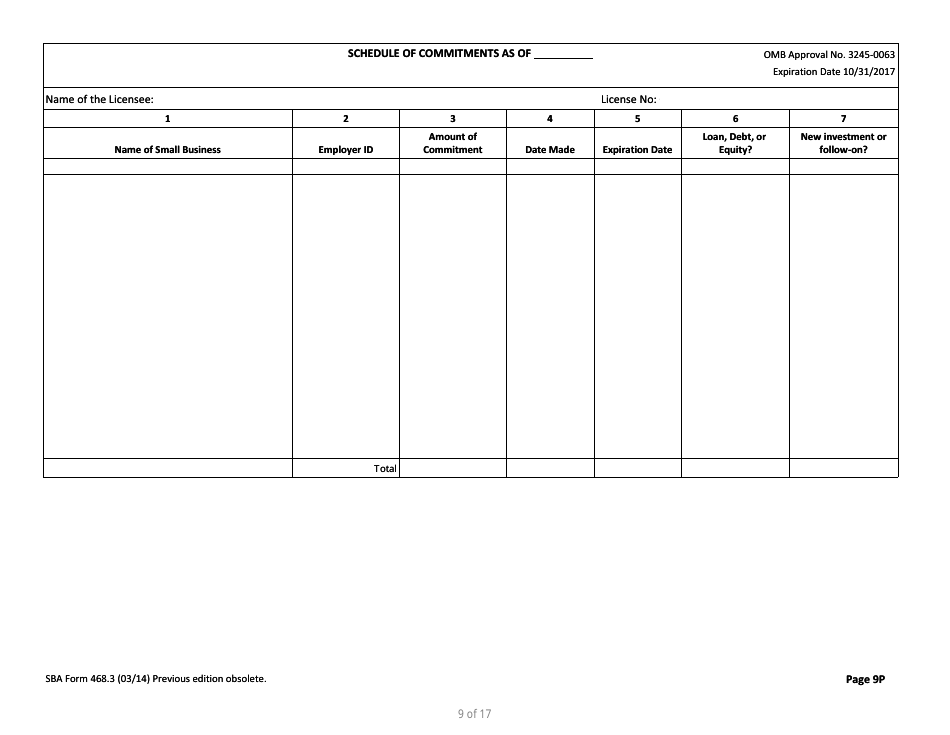

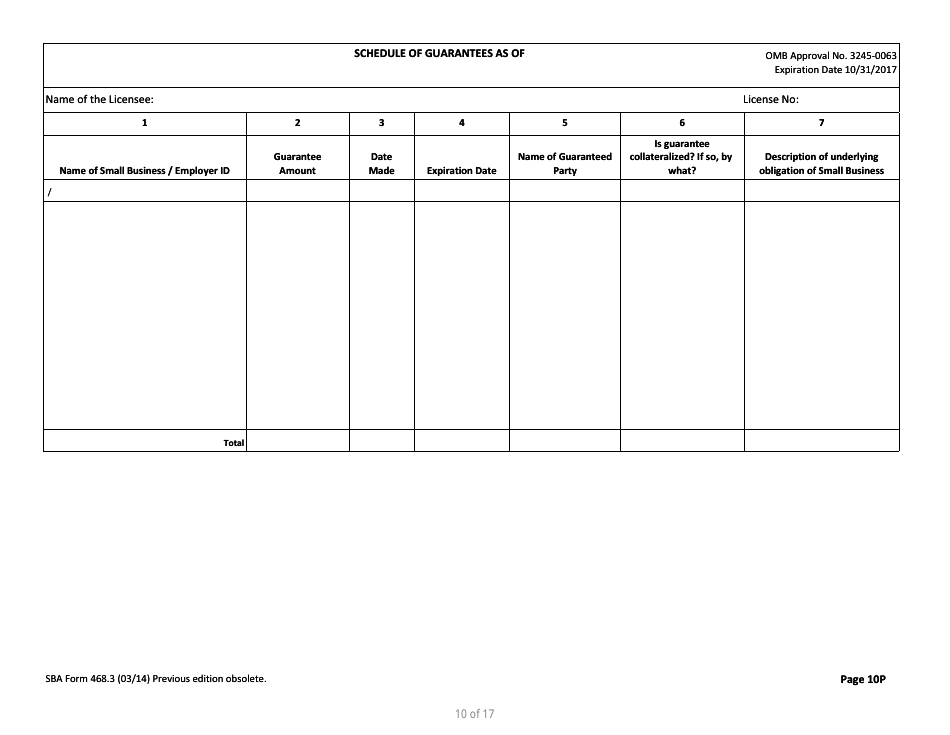

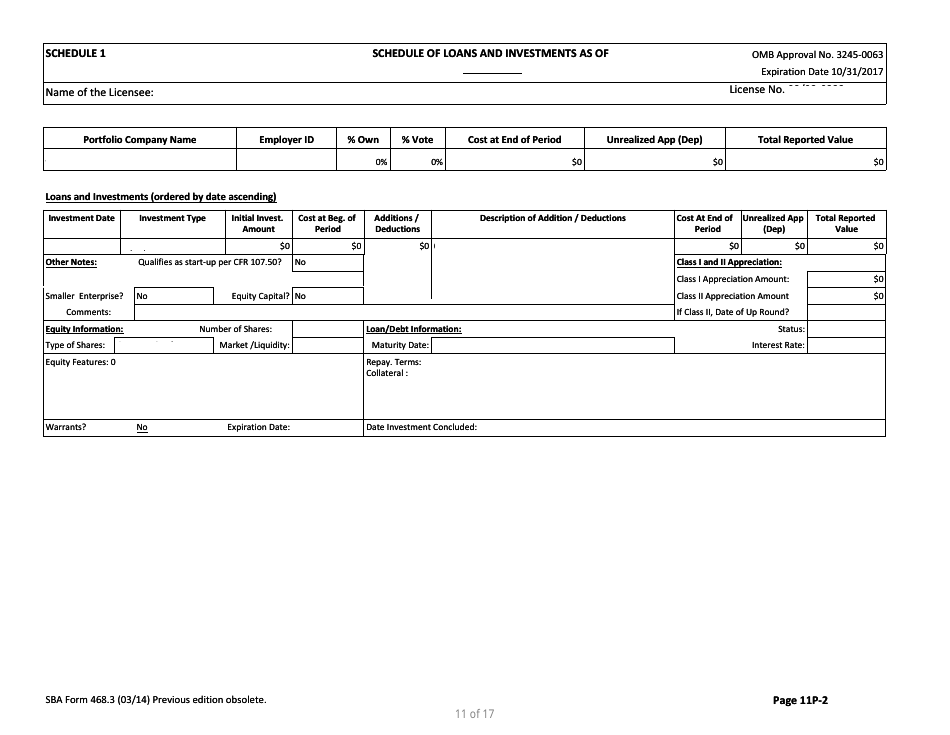

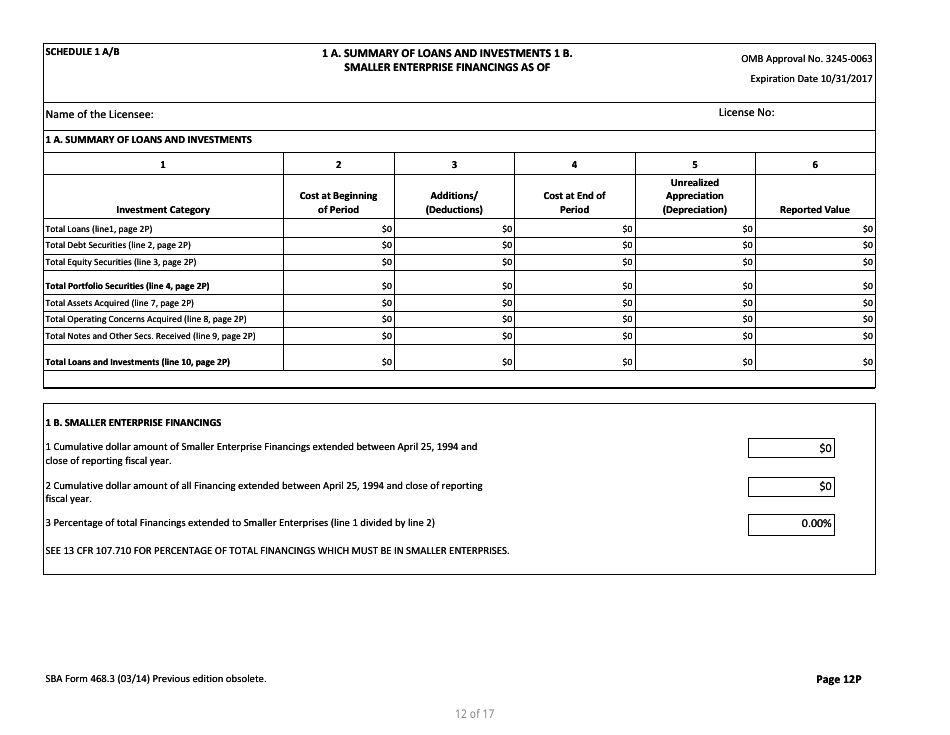

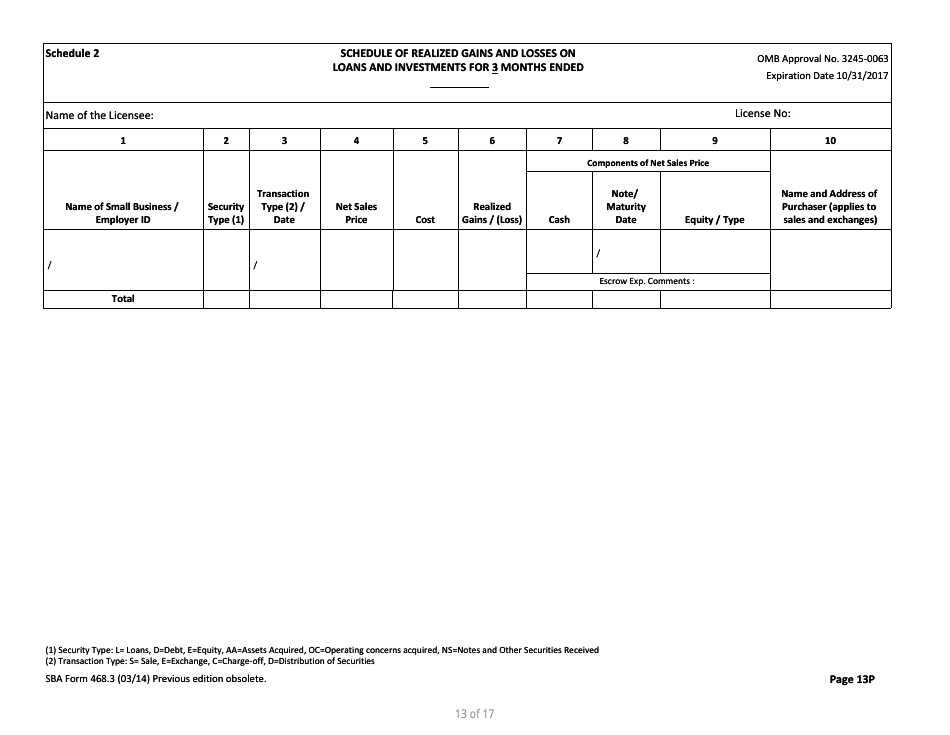

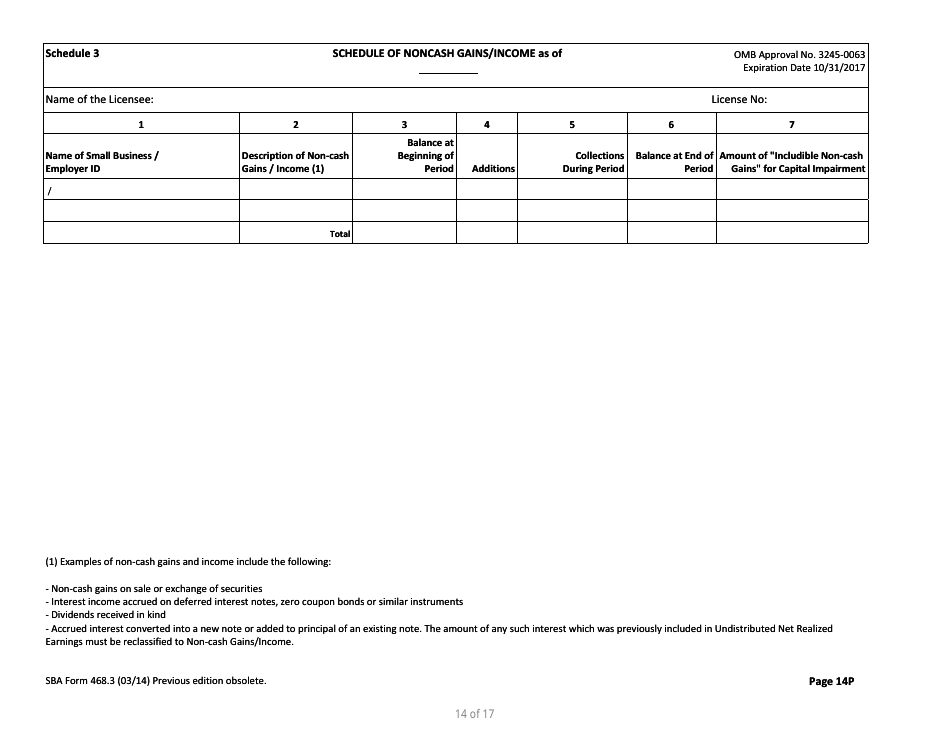

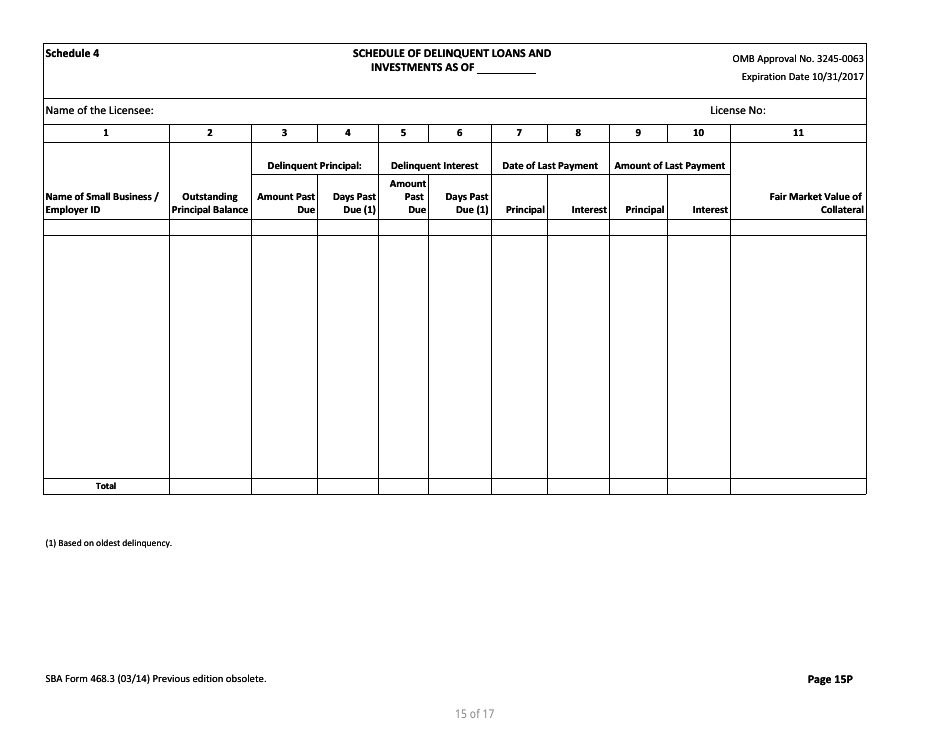

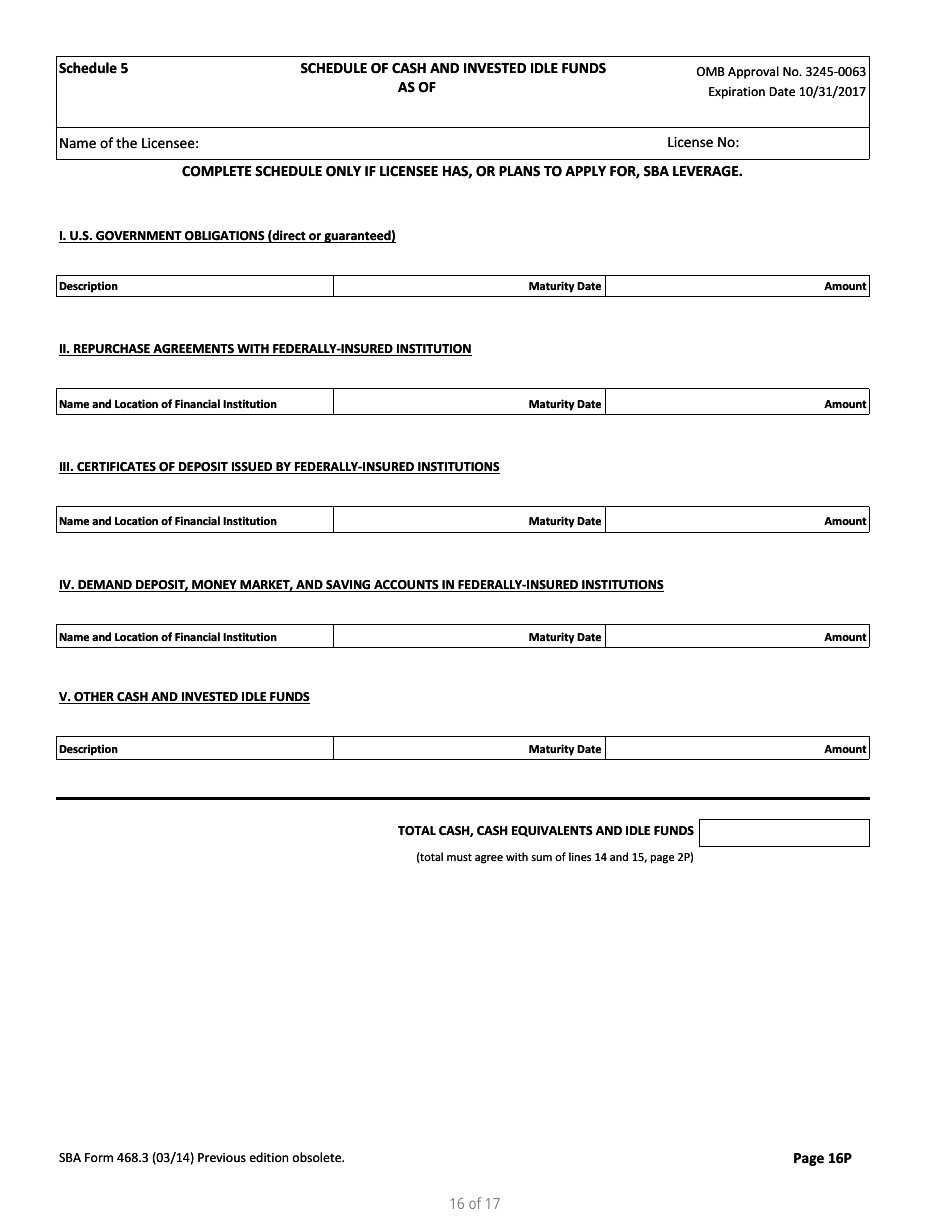

Q: What information is required in SBA Form 468.3?

A: SBA Form 468.3 requires information on the partnership's income, expenses, assets, and liabilities.

Form Details:

- Released on March 1, 2014;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of SBA Form 468.3 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.