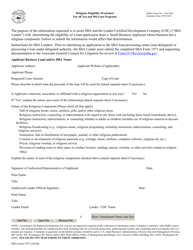

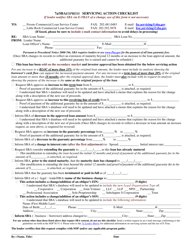

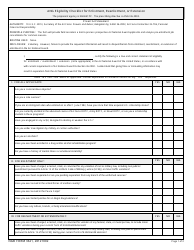

SBA Form 2450 504 Eligibility Checklist (Non-PCLP)

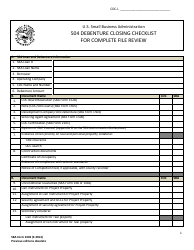

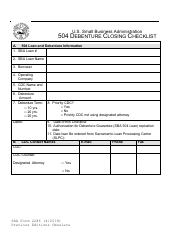

What Is SBA Form 2450?

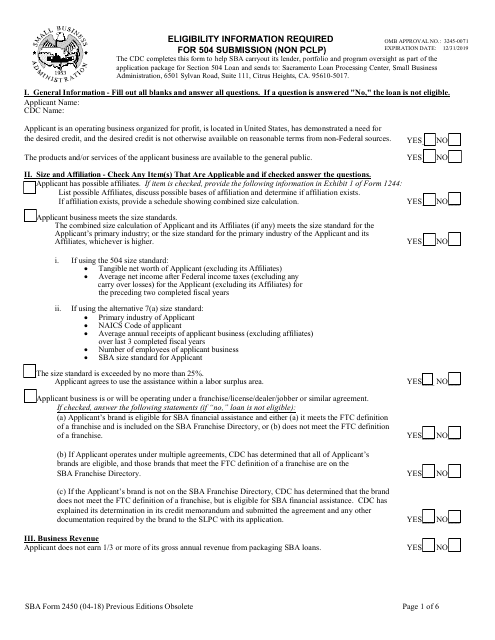

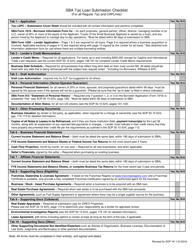

SBA Form 2450, 504 Eligibility Checklist (non-PCLP) is a document completed by a Certified Development Company (CDC) to help the Small Business Administration (SBA) to carry out its lender, portfolio and program oversight as part of the process of applying for a Section 504 Loan.

The form was last updated on April 1, 2018 , with all previous editions obsolete. An up-to-date SBA Form 2450 fillable version is available for digital filing and download below or can be found through the SBA website.

The SBA 504 Loan program is an economic developmentloan program that offers small businesses an additional opportunity to receive financing. To meet the SBA 504 criteria, the business must operate for profit and meet the SBA-determined size standards. Under the 504 Program, a business qualifies if it has a tangible net worth of $15 million or less, and an average net income of $5 million or less after federal income taxes for the two years prior to application. 504 loans cannot be given to non-profit businesses or companies engaged in passive or speculative activities.

SBA Form 2450 Instructions

-

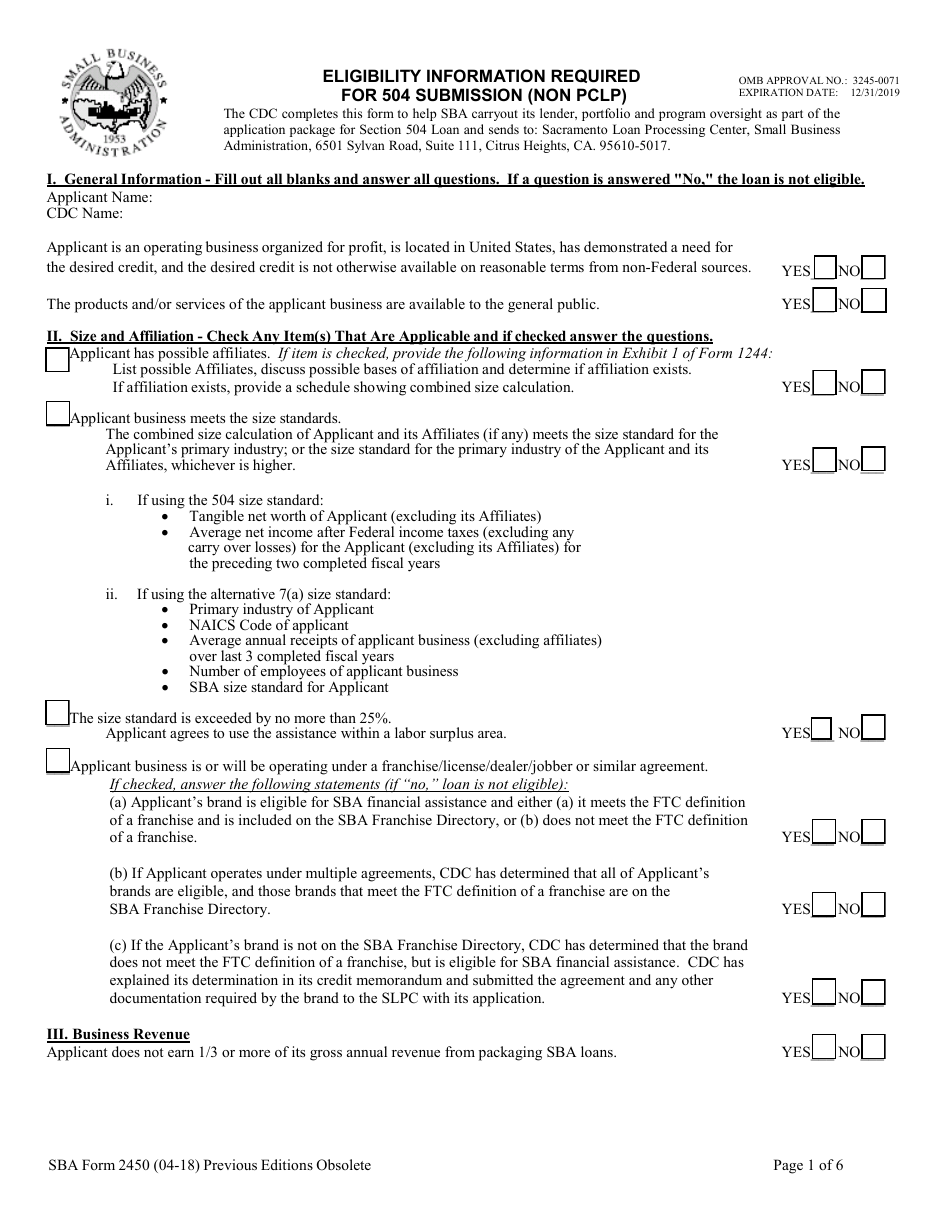

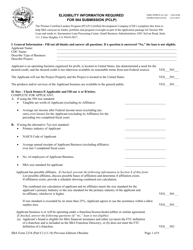

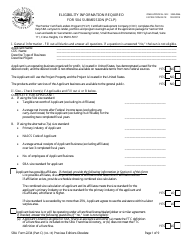

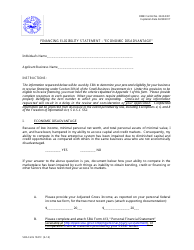

Section I - General information - requires the business owner to confirm that their business is operating for-profit, is located in the United States, and demonstrates a need for financial assistance available otherwise on reasonable terms from non-federal sources.

-

Section II - Size and Affiliation - is a checklist that lists the criteria for business size and possible affiliations.

-

Section III - Business Revenue - certifies that the business earns less than a third of its gross annual revenue from packaging SBA loans.

-

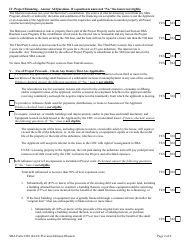

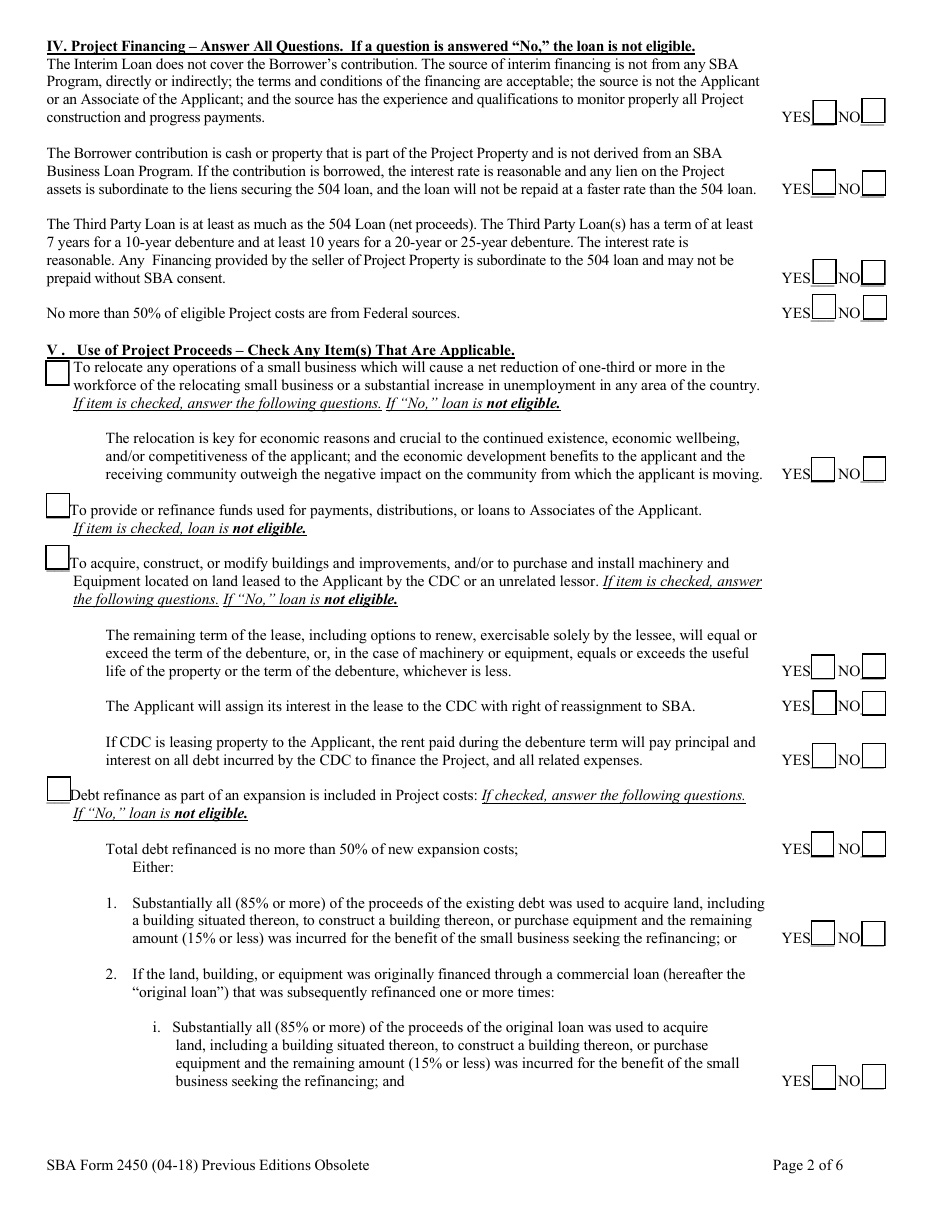

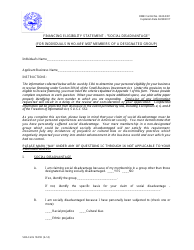

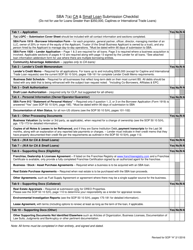

Section IV - Project Financing - contains a series of questions that determine loan eligibility. This section requires the applicant to certify the following:

- The source of their interim financing does not come directly or indirectly from any SBA Program;

- The Project Property is not derived from an SBA Business Loan Program;

- Less than 50% of project costs come from Federal sources;

- The Third Party Loan is at least as much as the 504 Loan.

-

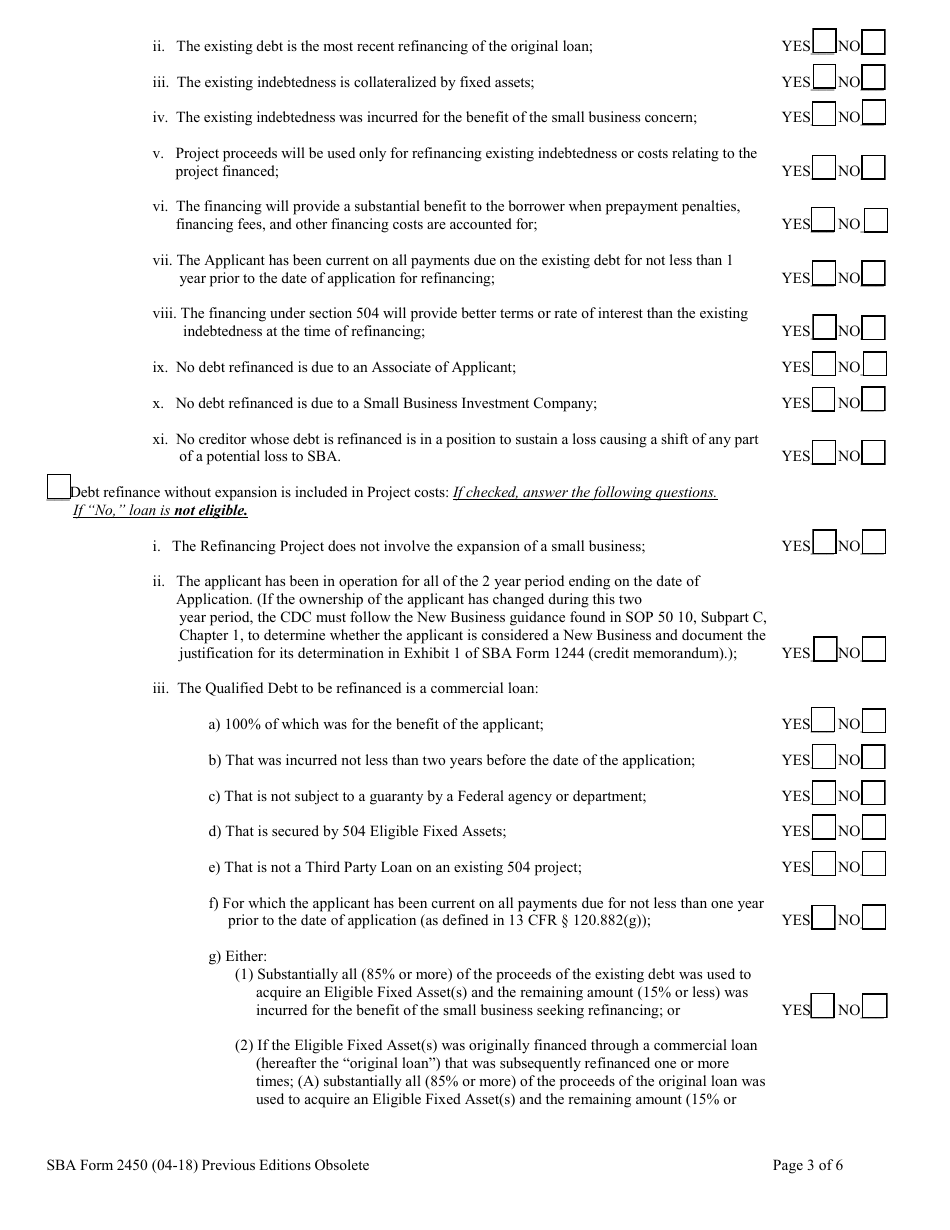

Section V - Use of Project Proceeds - requires to check all applicable items relating to the uses for the requested loan. This section also covers debt refinance as part of the expansion or without the expansion included in project costs.

-

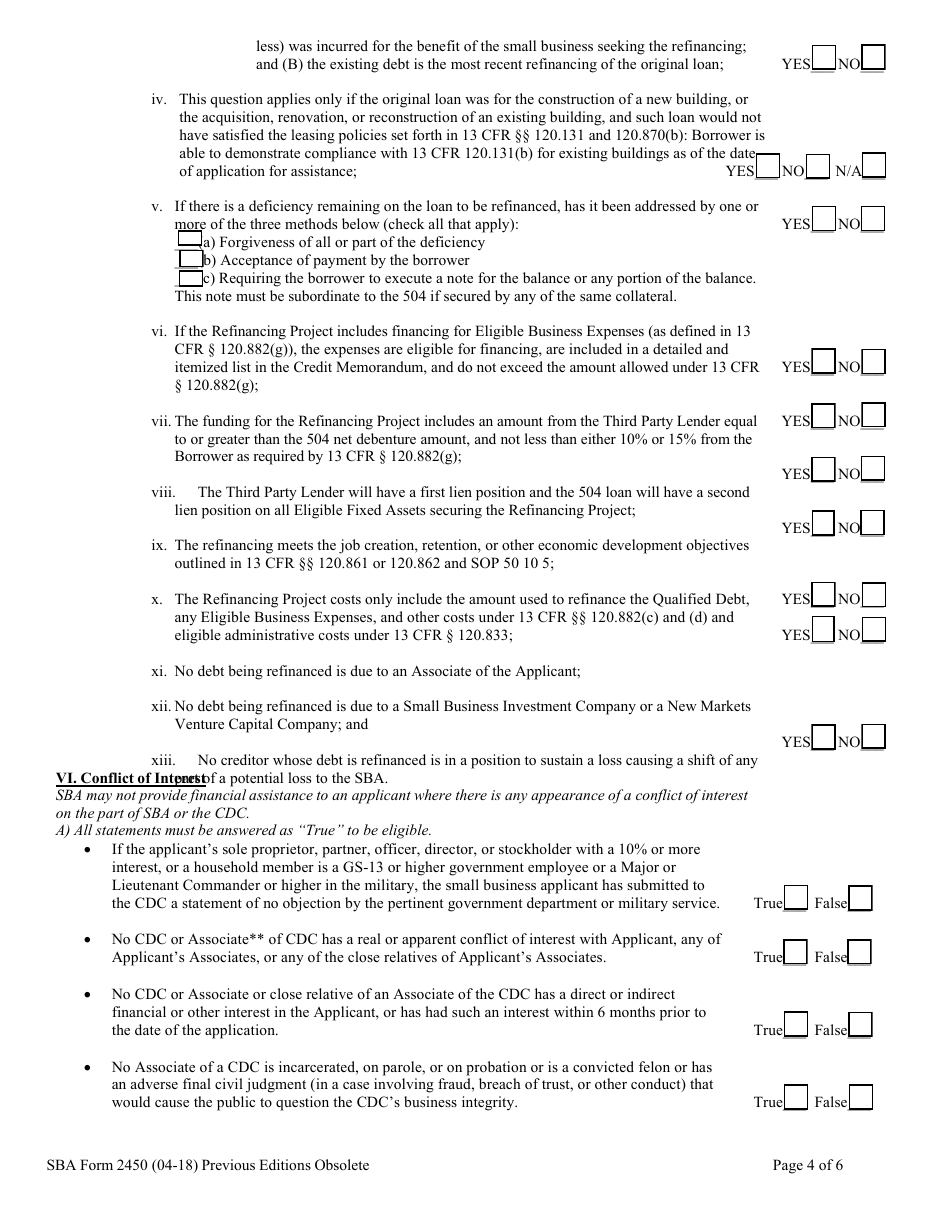

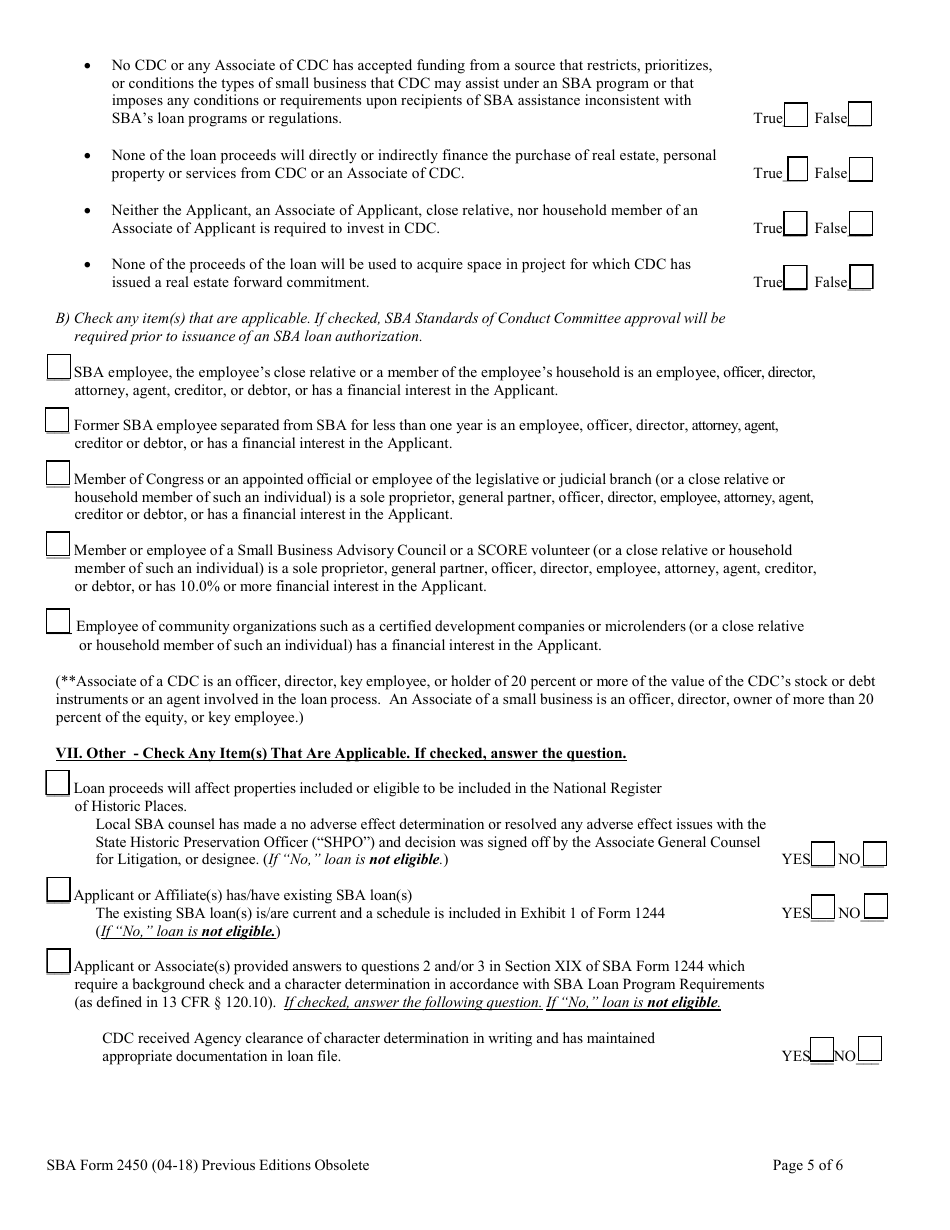

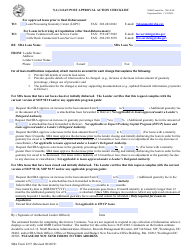

Section VI - Conflict of Interest - requires the applicant to certify that there is no conflicting interest on the part of SBA or the CDC.

-

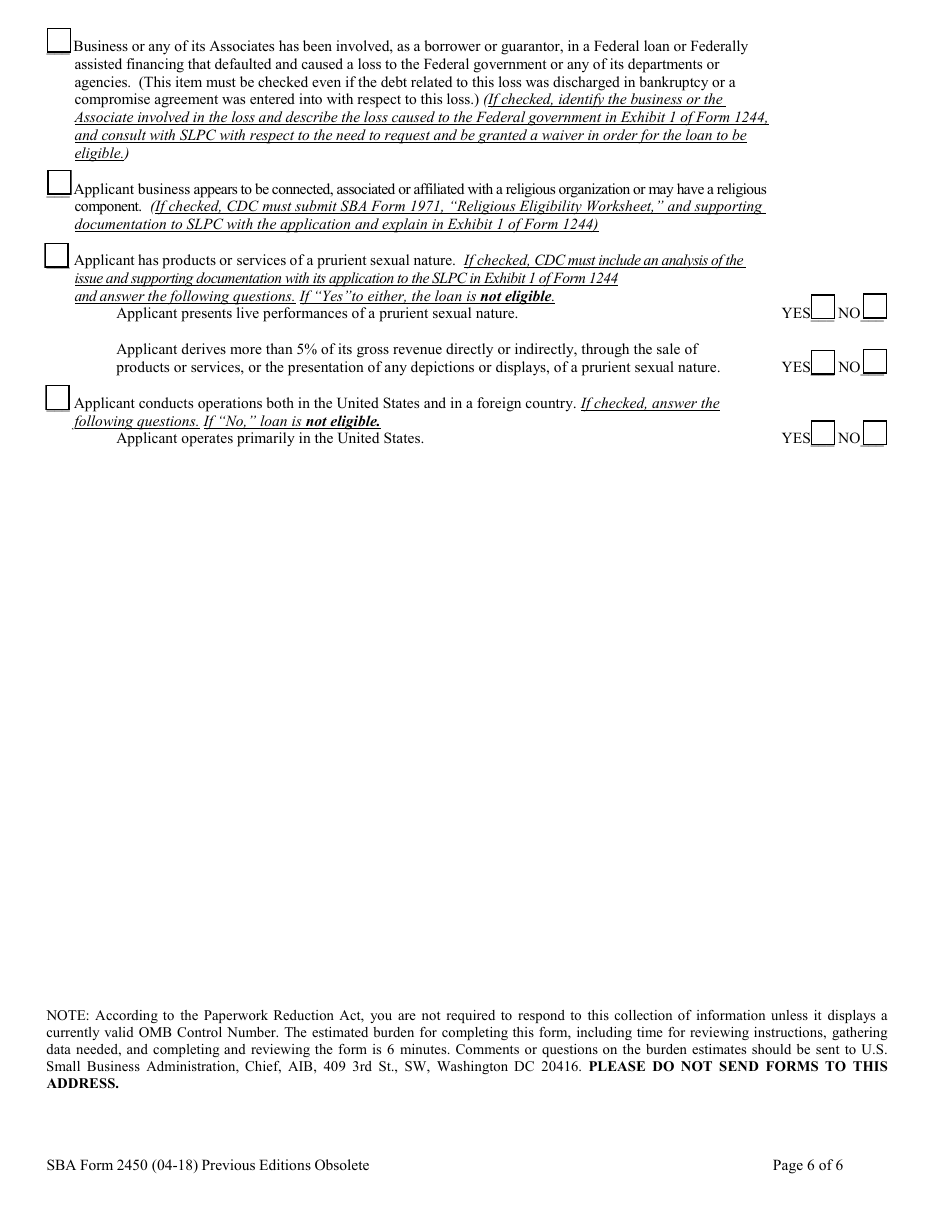

Section VII - Other - contains additional questions that may influence the business's eligibility for the 504 loan.