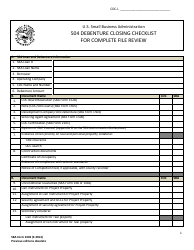

SBA Form 2286 504 Debenture Closing Checklist

What Is SBA Form 2286?

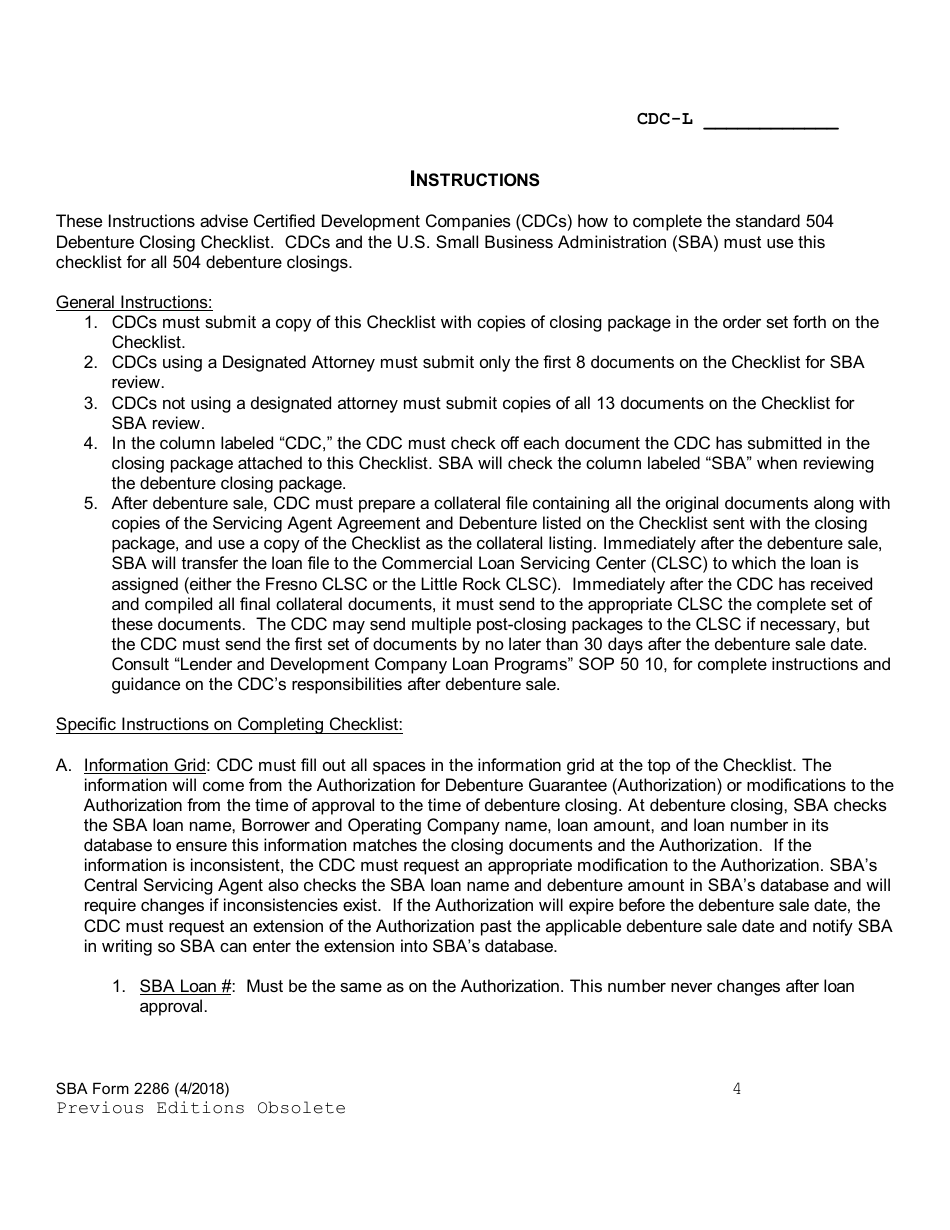

SBA Form 2286, 504 Debenture Closing Checklist is a form used by Certified Development Companies (CDCs) and the Small Business Administration (SBA) for all 504 debenture closings. This form is a list of documents required by the SBA to determine whether the debenture can be sold for loan funding. The SBA Form 2286 is not intended to include all items the CDC will need to properly close the loan.

The form was last updated on April 1, 2018 , with all previous editions obsolete. An up-to-date SBA Form 2286 fillable version is available for digital filing and download below or can be found through the SBA website.

The SBA 504 loan is a long-term fixed-rate loan designed to provide additional financing options for small businesses in need of expansion or an acquisition. To be considered eligible for the SBA 504 loan program, the company must operate for profit in the United States, be owned by U.S. citizens or aliens with a green card, have a tangible net worth of $15 million or less, and an average net income of $5 million or less for the two years prior to application.

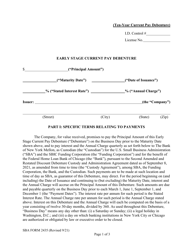

SBA Form 1504, Development Company 504 Debenture, is a related form filed by the CDC for each debenture to be sold in order to fund a 504 loan for a small business borrower.

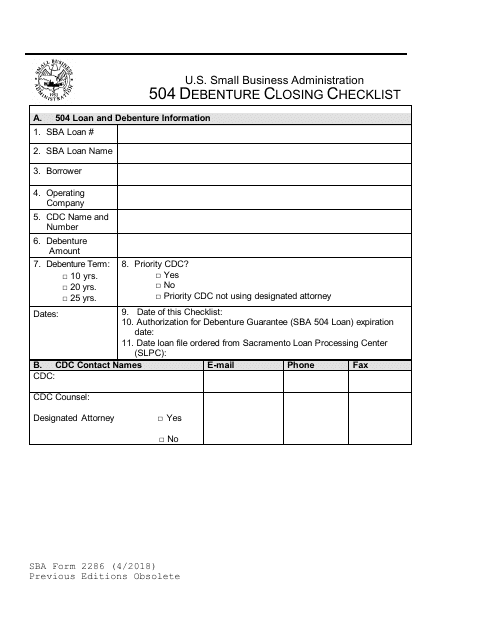

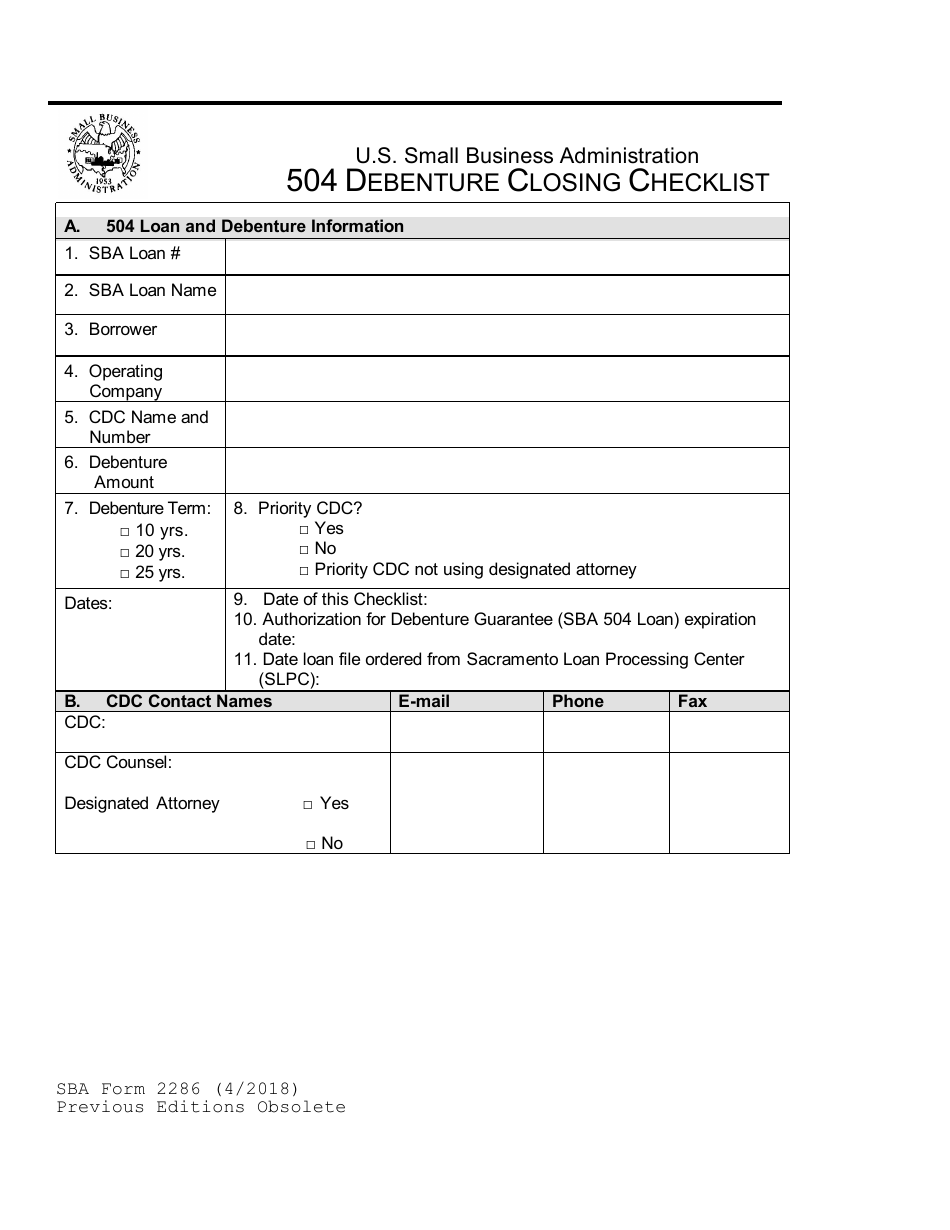

SBA 504 Debenture Closing Checklist

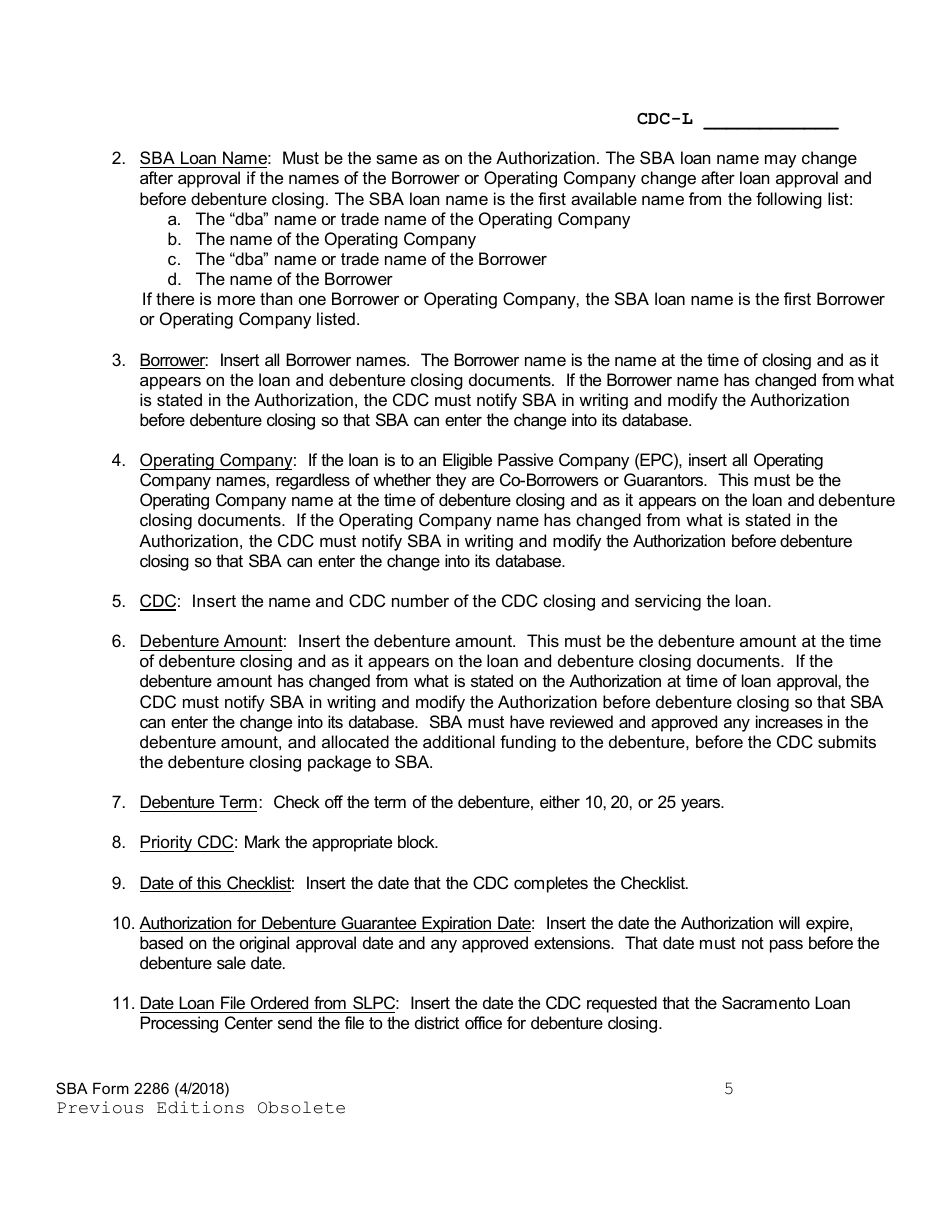

A representative of a CDC must provide the required 504 loan and debenture information when filing the SBA 2286 Form. The checklist also requires the names, email addresses, phone, and fax numbers of the CDC representative filling the form and CDC counsel responsible for debenture closing.

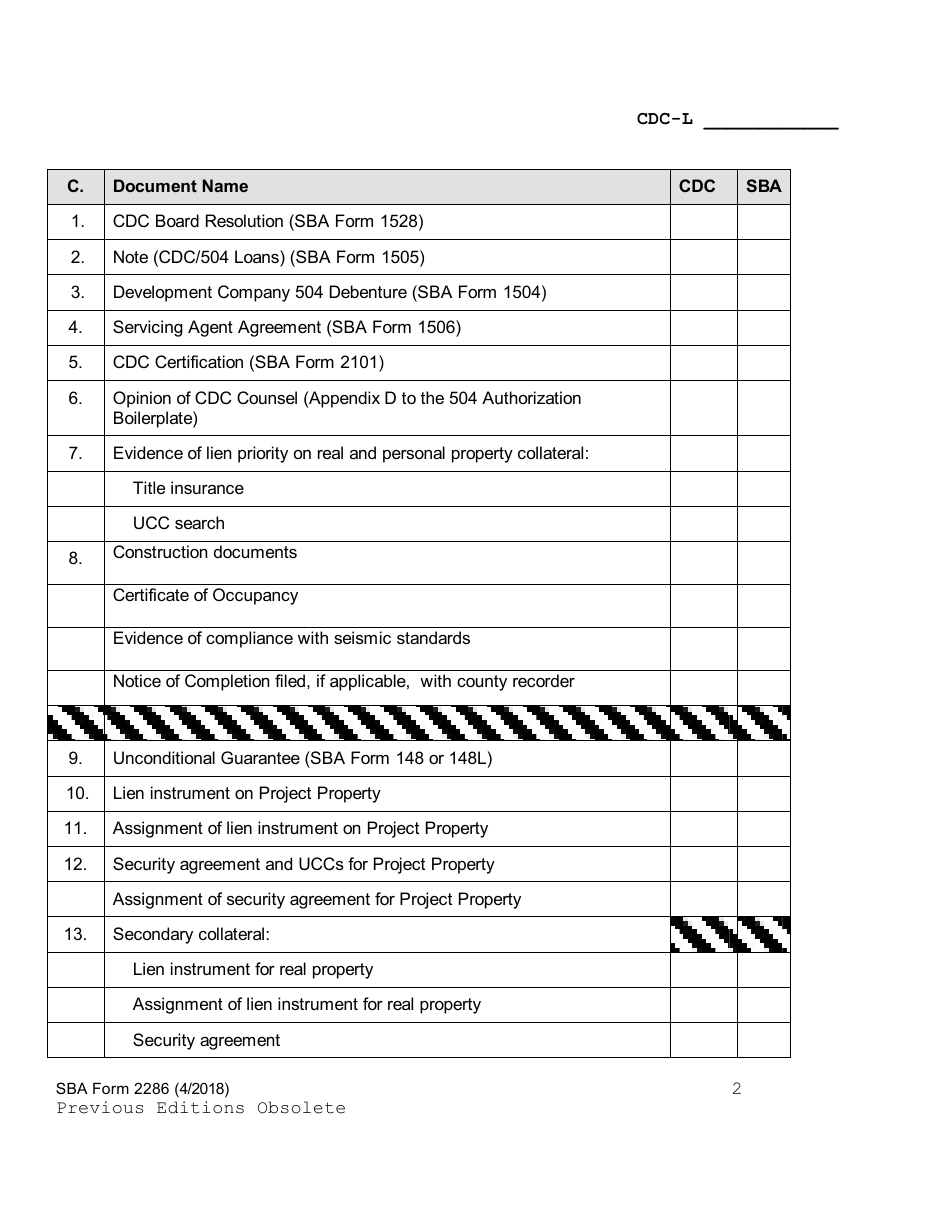

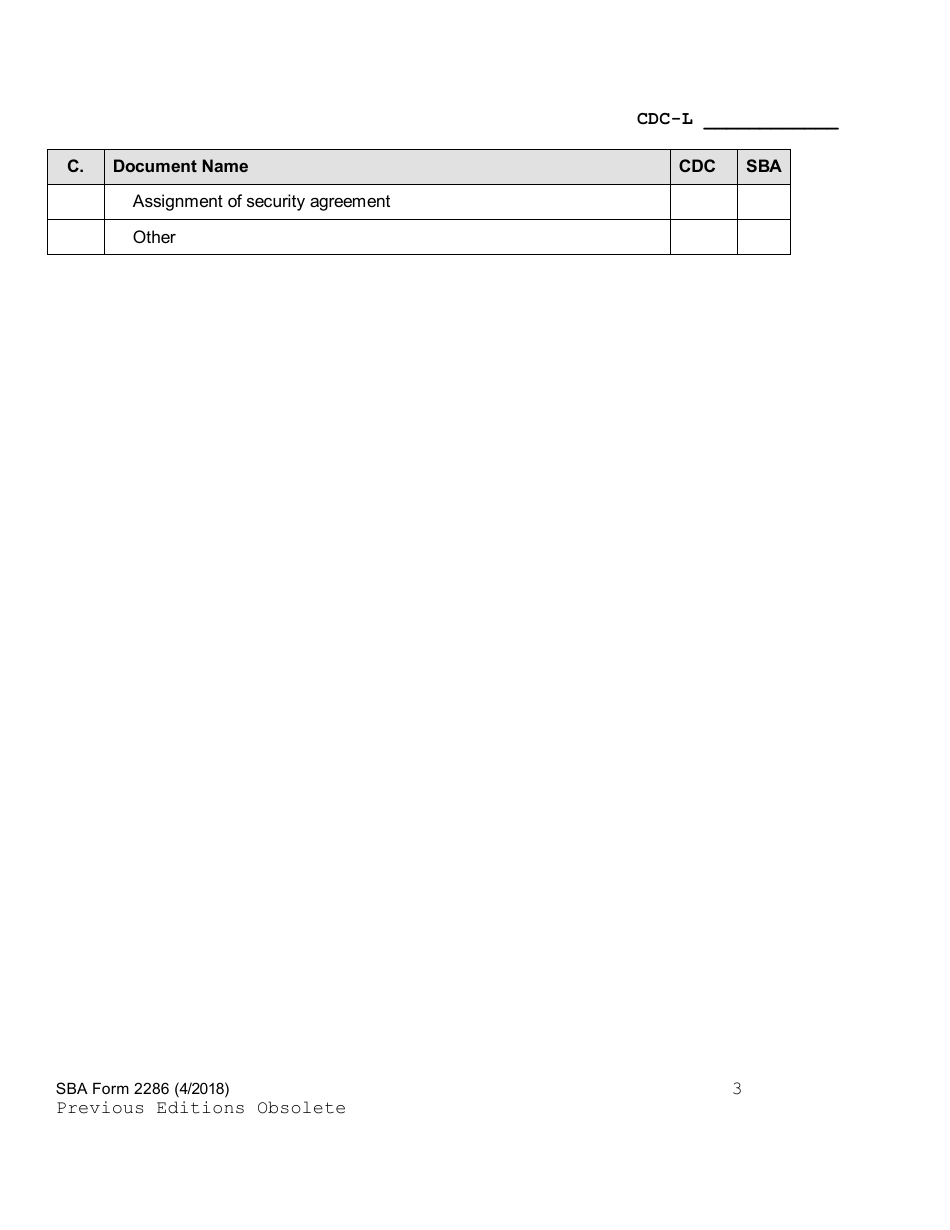

The checklist contains a list of the documents that the SBA will review to determine whether it may guarantee the debenture and approve the debenture sale to fund the 504 loans. The required SBA forms include the following:

- SBA Form 1528, Resolution of the Board of Directors, used to authorize the CDC to execute the application for a 504 debenture guaranty.

- SBA Form 1505, Note - CDC/504 Loans, used as evidence of a 504 Loan made to a small business from the proceeds of a 504 Debenture.

- SBA Form 1504, Development Company 504 Debenture, used to report about the debenture payment schedule of development companies.

- SBA Form 1506, Servicing Agent Agreement, used to certify the use of 504 loan proceeds.

- SBA Form 2101, CDC Certification, completed by the CDC for each 504 loan in order to receive SBA guarantees.

- SBA Form 148, Unconditional Guarantee or SBA Form 148L, Unconditional Limited Guarantee, used to unconditionally guarantee the payment of all amounts owed to the Lender.