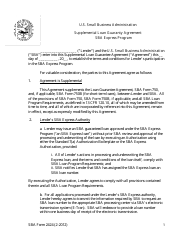

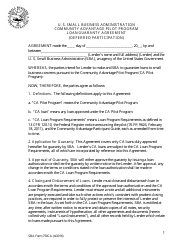

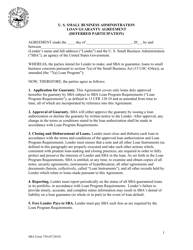

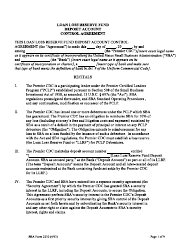

SBA Form 2426 Supplemental Loan Agreement - Export Express Program

What Is SBA Form 2426?

This is a legal form that was released by the U.S. Small Business Administration on September 1, 2011 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 2426?

A: SBA Form 2426 is the Supplemental Loan Agreement for the Export Express Program.

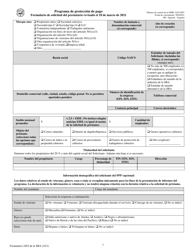

Q: What is the Export Express Program?

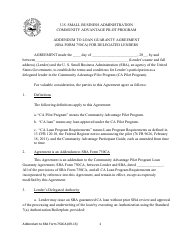

A: The Export Express Program is a loan program offered by the Small Business Administration (SBA) which provides financing for small businesses engaged in exporting goods and services.

Q: What is the purpose of SBA Form 2426?

A: The purpose of SBA Form 2426 is to outline the terms and conditions of the loan agreement between the borrower and the lender under the Export Express Program.

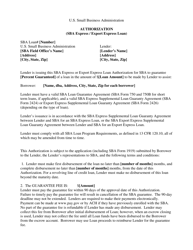

Q: Who needs to fill out SBA Form 2426?

A: Both the borrower and the lender involved in the Export Express Program need to fill out SBA Form 2426.

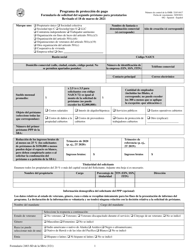

Q: What information is required in SBA Form 2426?

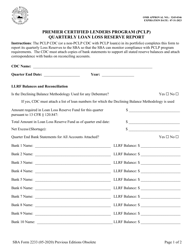

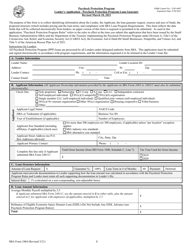

A: SBA Form 2426 requires information about the borrower, lender, loan terms, loan disbursement, collateral, and guarantees.

Q: Is SBA Form 2426 mandatory?

A: Yes, SBA Form 2426 is mandatory for borrowers and lenders participating in the Export Express Program.

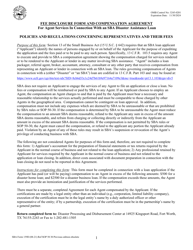

Q: Are there any fees associated with SBA Form 2426?

A: There may be fees associated with the loan application and processing, but there are no specific fees for SBA Form 2426 itself.

Q: What happens after submitting SBA Form 2426?

A: After submitting SBA Form 2426, the lender will review the application and determine whether to approve or deny the loan request based on their eligibility requirements and the terms outlined in the form.

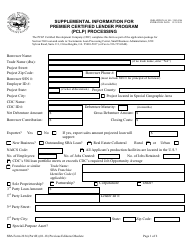

Form Details:

- Released on September 1, 2011;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 2426 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.