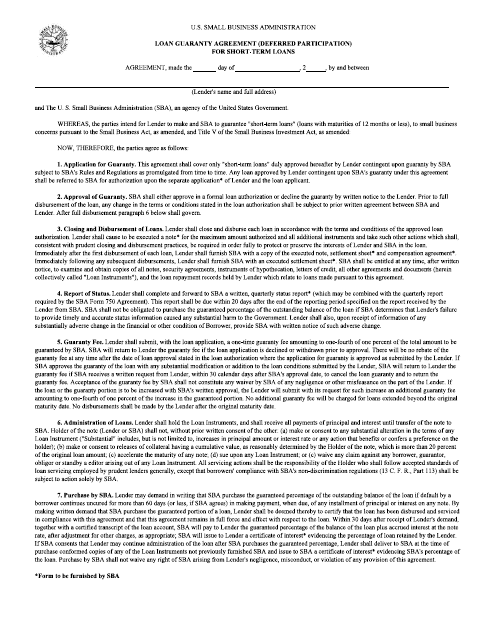

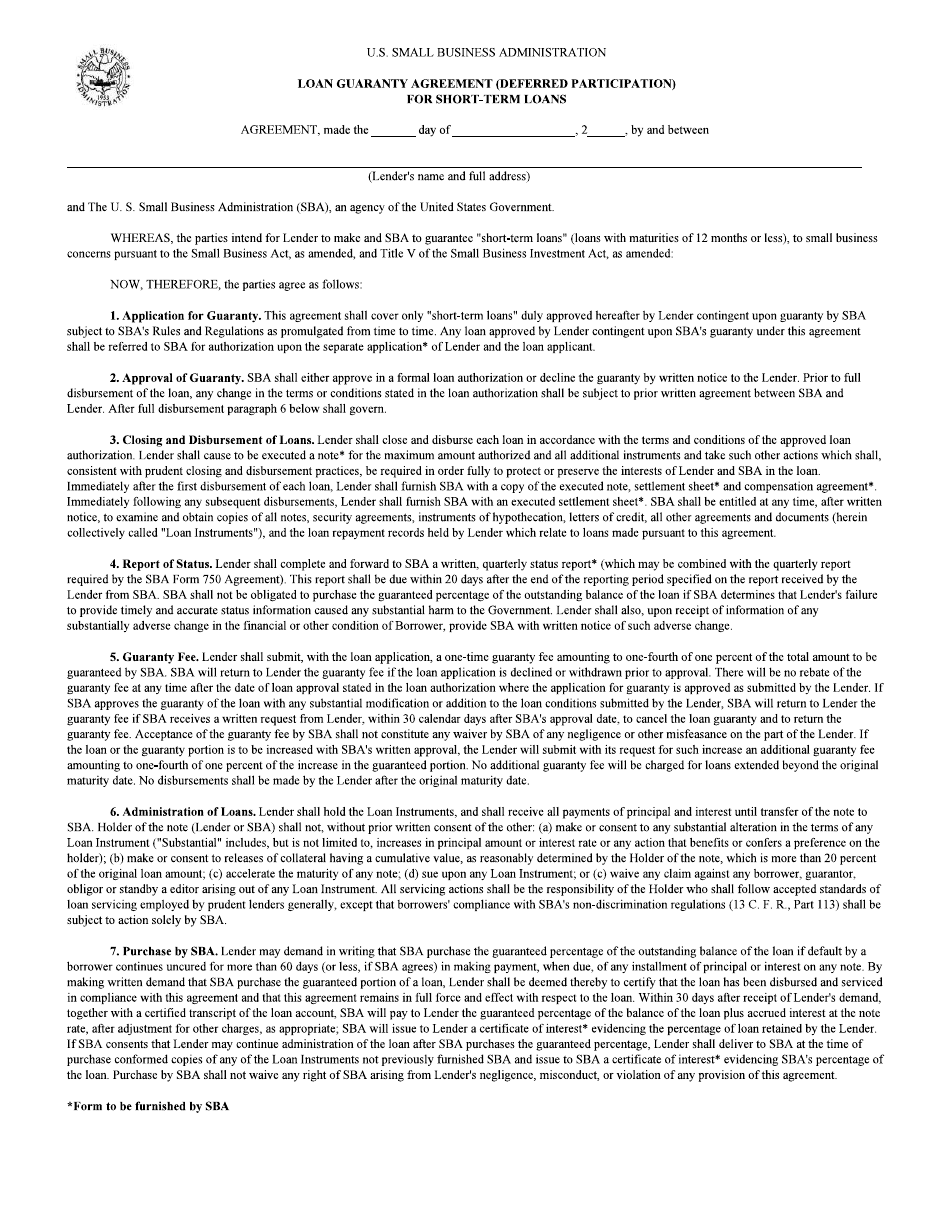

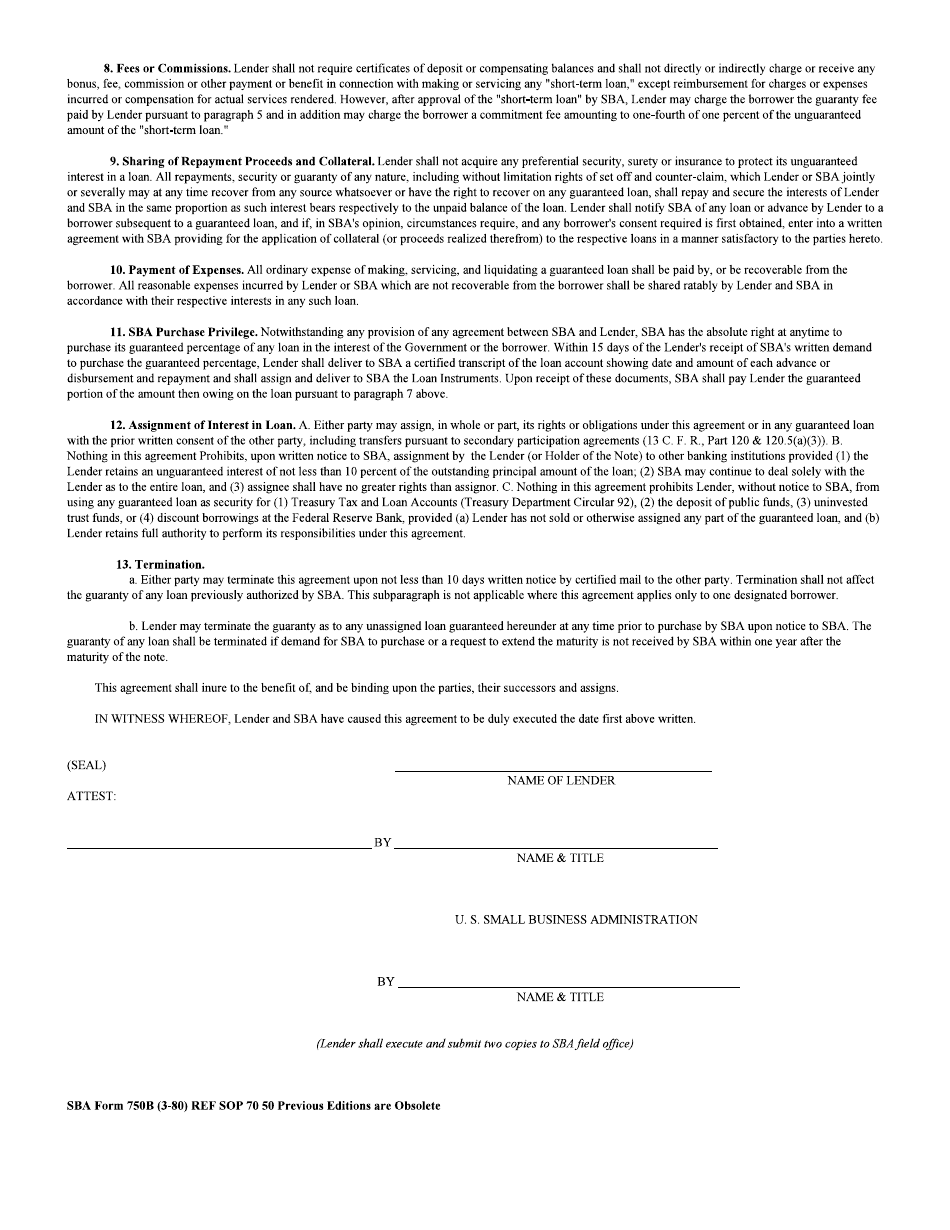

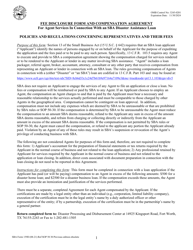

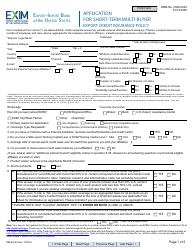

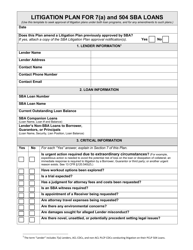

SBA Form 750B Loan Guaranty Agreement (Deferred Participation) for Short-Term Loans

What Is SBA Form 750B?

This is a legal form that was released by the U.S. Small Business Administration on March 1, 1980 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 750B?

A: SBA Form 750B is a Loan Guaranty Agreement for Short-Term Loans.

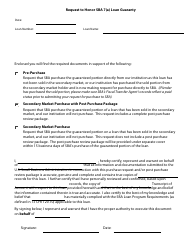

Q: What is the purpose of SBA Form 750B?

A: The purpose of SBA Form 750B is to establish the terms and conditions of a loan guaranty for short-term loans.

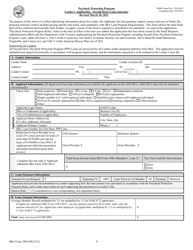

Q: What kind of loans does SBA Form 750B cover?

A: SBA Form 750B covers short-term loans.

Q: What is a loan guaranty?

A: A loan guaranty is when a third party, such as the SBA, guarantees to repay a loan if the borrower is unable to.

Q: Who is eligible to use SBA Form 750B?

A: Borrowers who meet the SBA's eligibility requirements for short-term loans are eligible to use SBA Form 750B.

Q: Can SBA Form 750B be used for long-term loans?

A: No, SBA Form 750B is specifically for short-term loans.

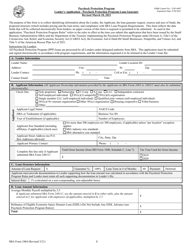

Q: What are the important terms and conditions outlined in SBA Form 750B?

A: Some important terms and conditions outlined in SBA Form 750B include loan amount, interest rate, repayment terms, and the responsibilities of the lender and borrower.

Q: Is using SBA Form 750B mandatory for obtaining a loan guaranty?

A: Yes, using SBA Form 750B is mandatory when applying for a loan guaranty for short-term loans.

Form Details:

- Released on March 1, 1980;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 750B by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.