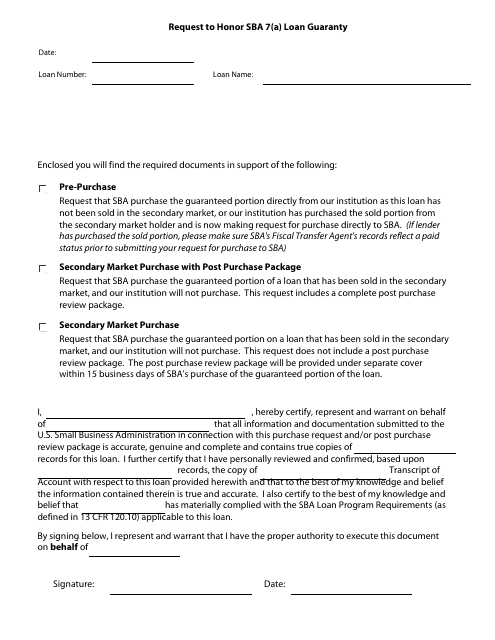

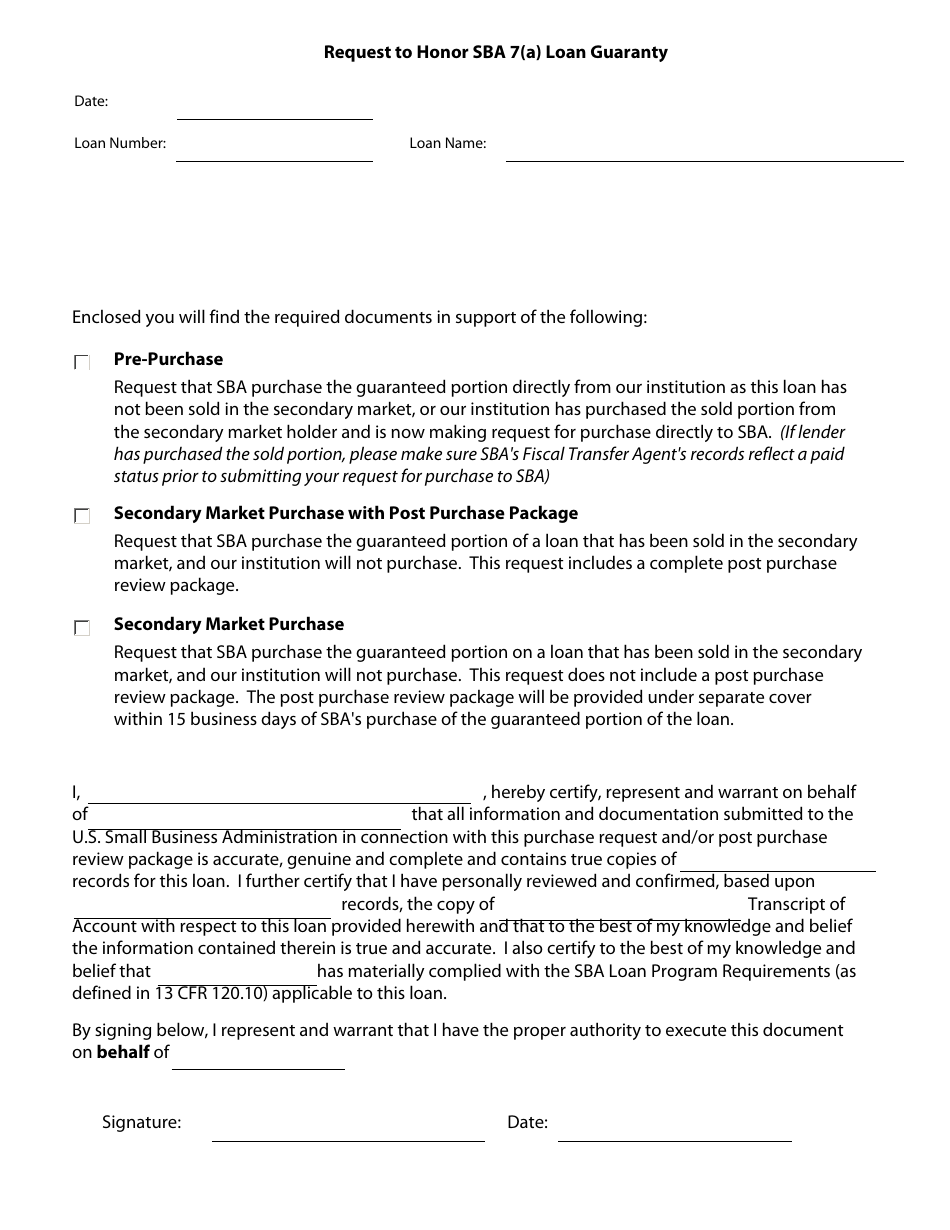

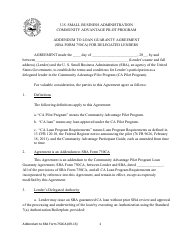

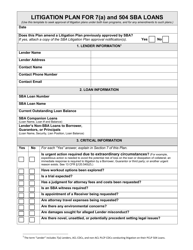

Request to Honor SBA 7(A) Loan Guaranty

Request to Honor SBA 7(A) Loan Guaranty is a 1-page legal document that was released by the U.S. Small Business Administration and used nation-wide.

FAQ

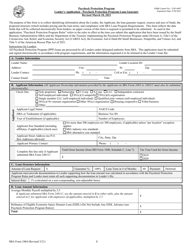

Q: What is an SBA 7(A) loan guaranty?

A: An SBA 7(A) loan guaranty is a loan program provided by the Small Business Administration.

Q: How does an SBA 7(A) loan guaranty work?

A: Under this program, the SBA provides a guarantee to lenders, reducing their risk and encouraging them to provide loans to small businesses.

Q: Who can take advantage of the SBA 7(A) loan guaranty?

A: Small businesses that meet certain eligibility criteria can apply for an SBA 7(A) loan guaranty.

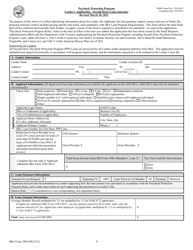

Q: What can an SBA 7(A) loan guaranty be used for?

A: SBA 7(A) loans can be used for various purposes, such as starting a new business, expanding an existing business, or purchasing equipment or real estate.

Q: Is collateral required for an SBA 7(A) loan guaranty?

A: Collateral requirements may vary depending on the lender, but the SBA generally requires collateral for loans over $25,000.

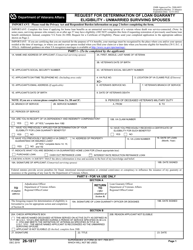

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.