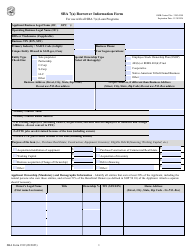

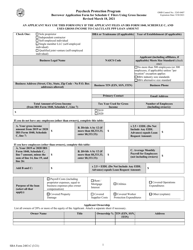

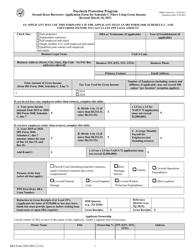

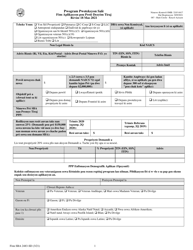

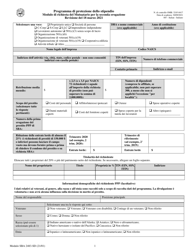

SBA Form 1366 Borrower's Progress Certification - SBA Disaster Assistance Program

What Is SBA Form 1366?

This is a legal form that was released by the U.S. Small Business Administration on December 1, 2009 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

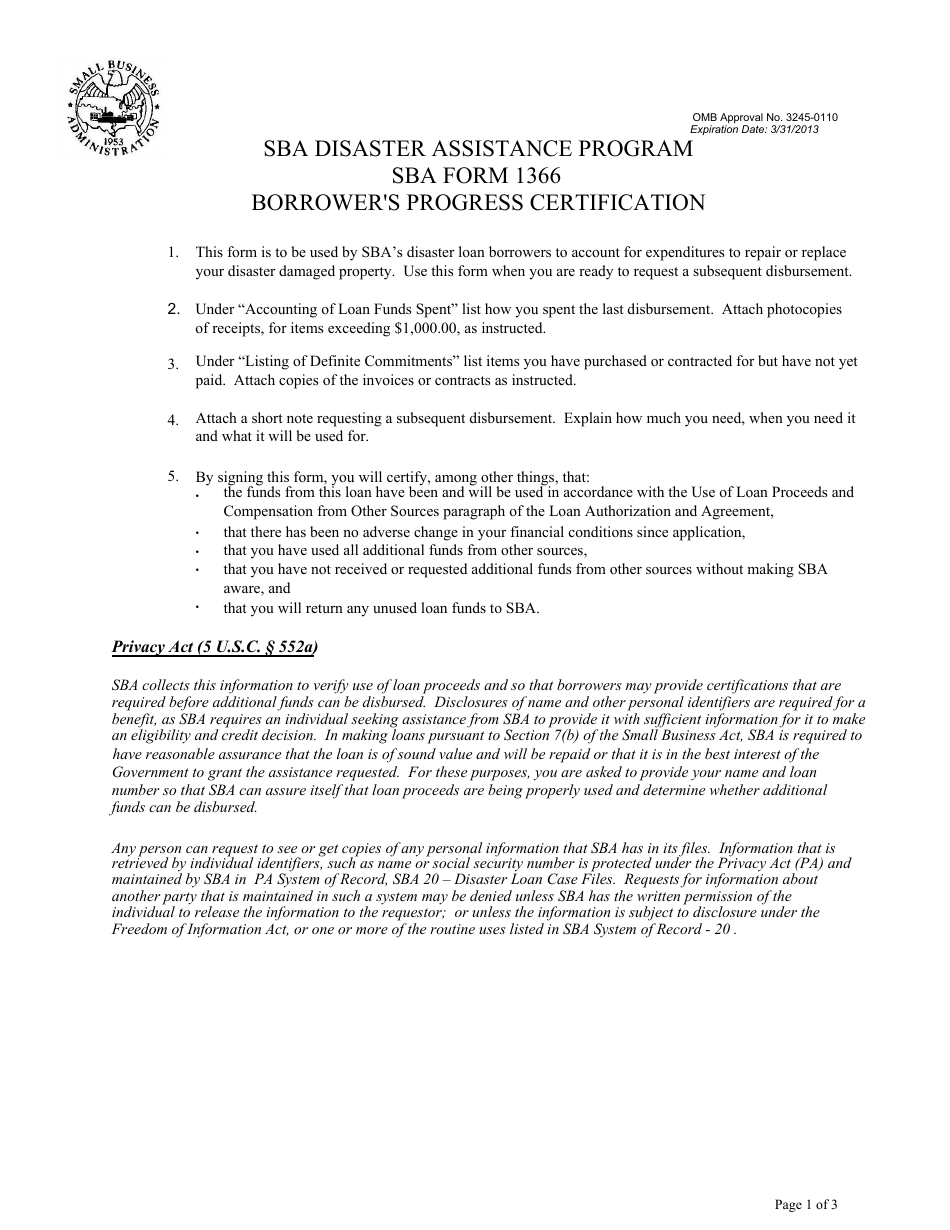

Q: What is SBA Form 1366?

A: SBA Form 1366 is the Borrower's Progress Certification for the SBA Disaster Assistance Program.

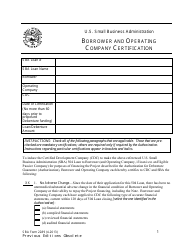

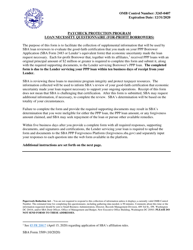

Q: What is the purpose of SBA Form 1366?

A: The purpose of SBA Form 1366 is to certify the progress of a borrower in using the SBA disaster loan funds.

Q: Who needs to fill out SBA Form 1366?

A: Borrowers who have received SBA disaster loan funds need to fill out SBA Form 1366.

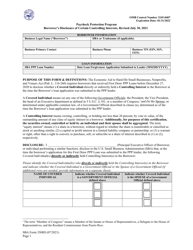

Q: What information is required on SBA Form 1366?

A: SBA Form 1366 requires information about the loan amount, disbursement date, and how the funds were used.

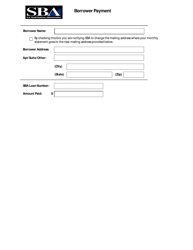

Q: When should SBA Form 1366 be submitted?

A: SBA Form 1366 should be submitted annually, starting from the date of initial disbursement, until the loan is fully paid off.

Q: Are there any penalties for not submitting SBA Form 1366?

A: Failure to submit SBA Form 1366 may result in default of the loan and loss of eligibility for future SBA disaster assistance.

Form Details:

- Released on December 1, 2009;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 1366 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.