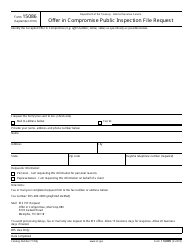

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

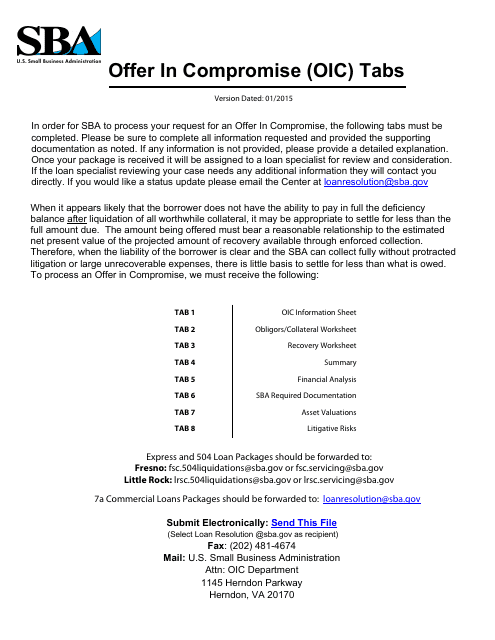

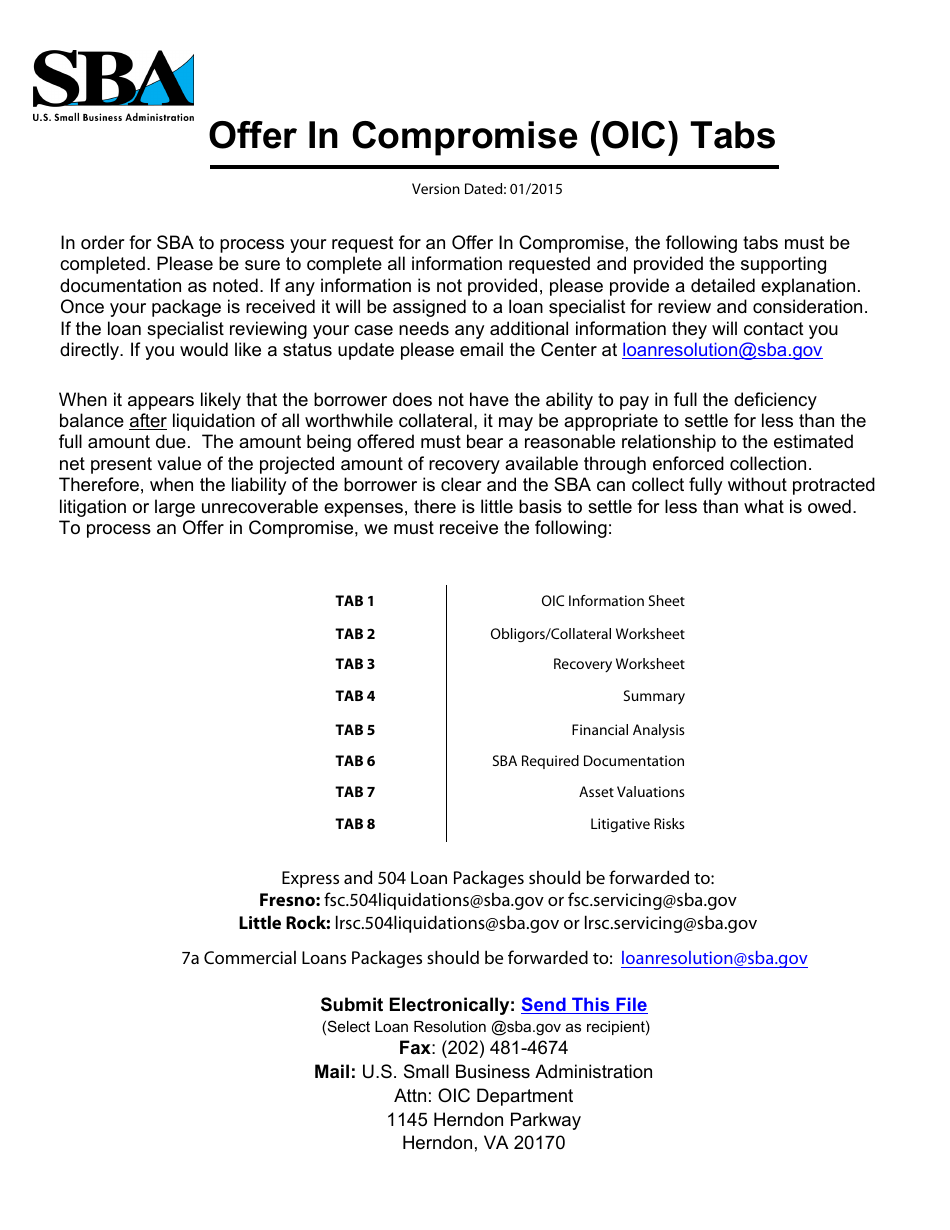

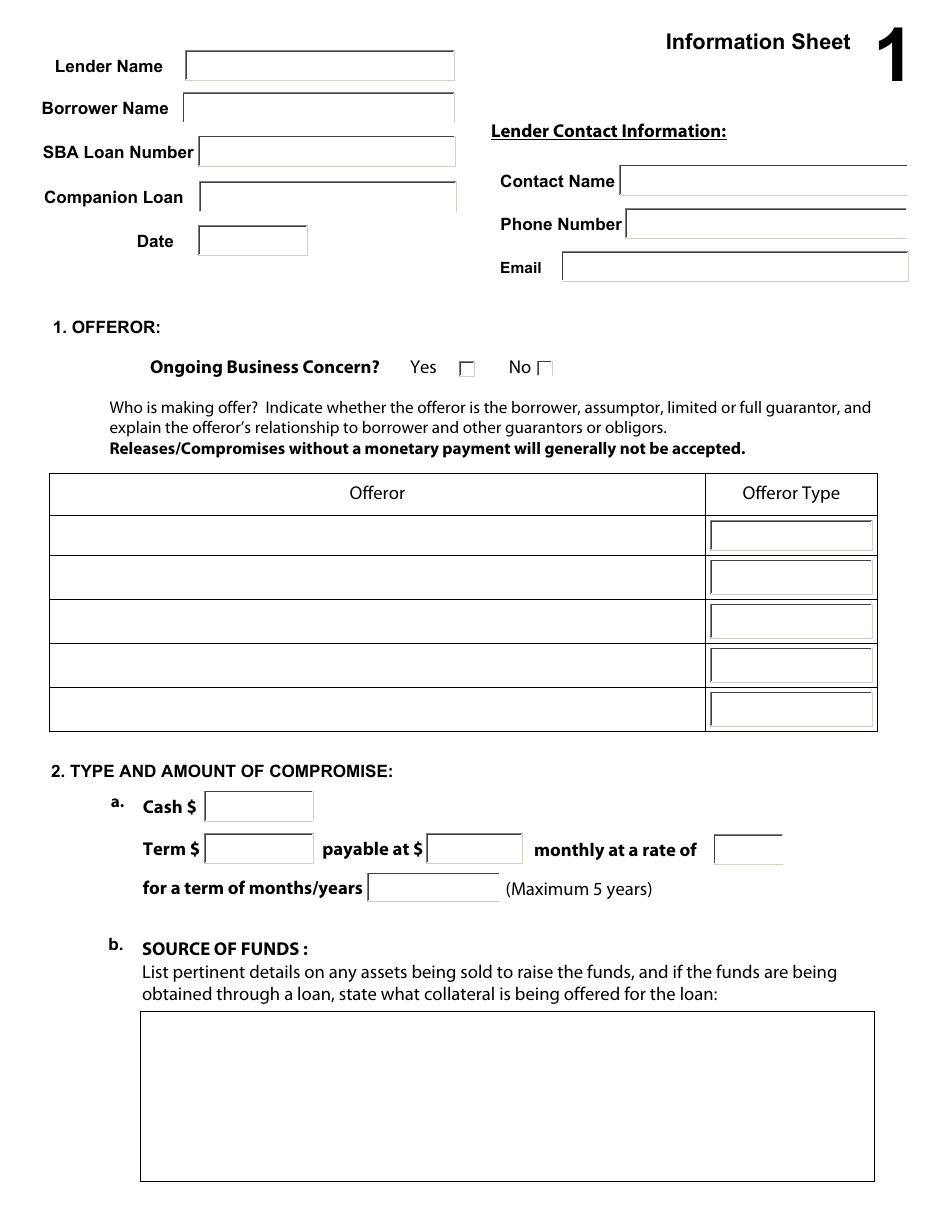

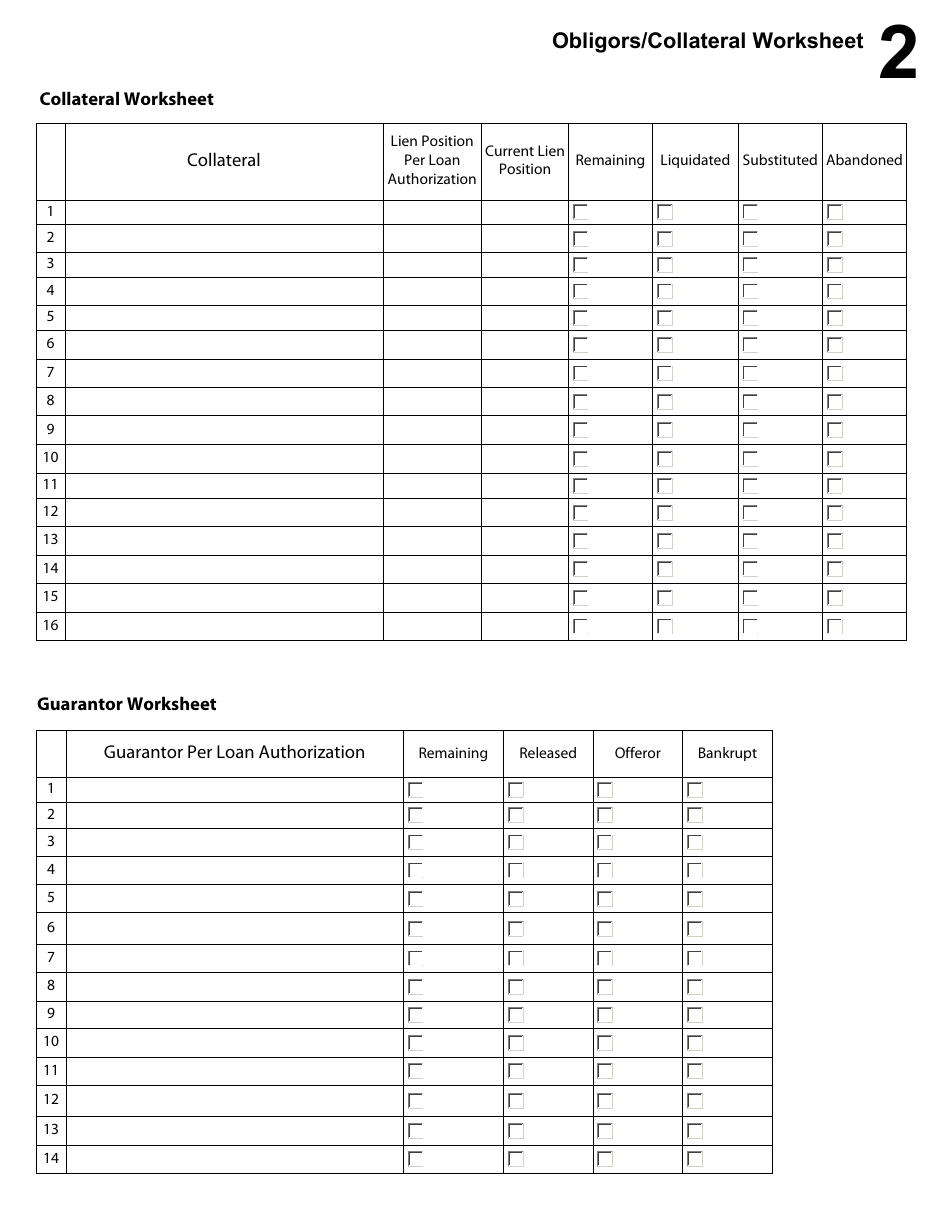

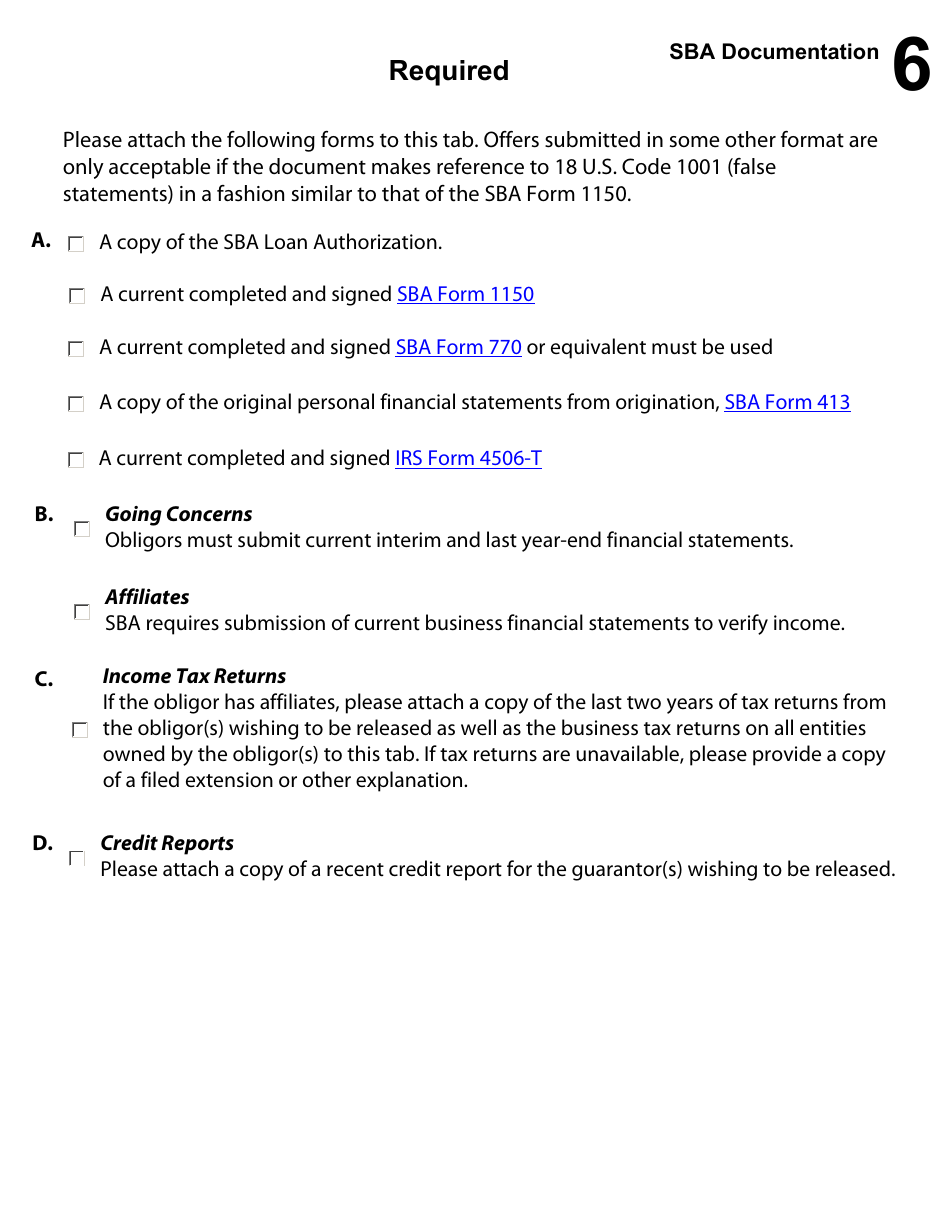

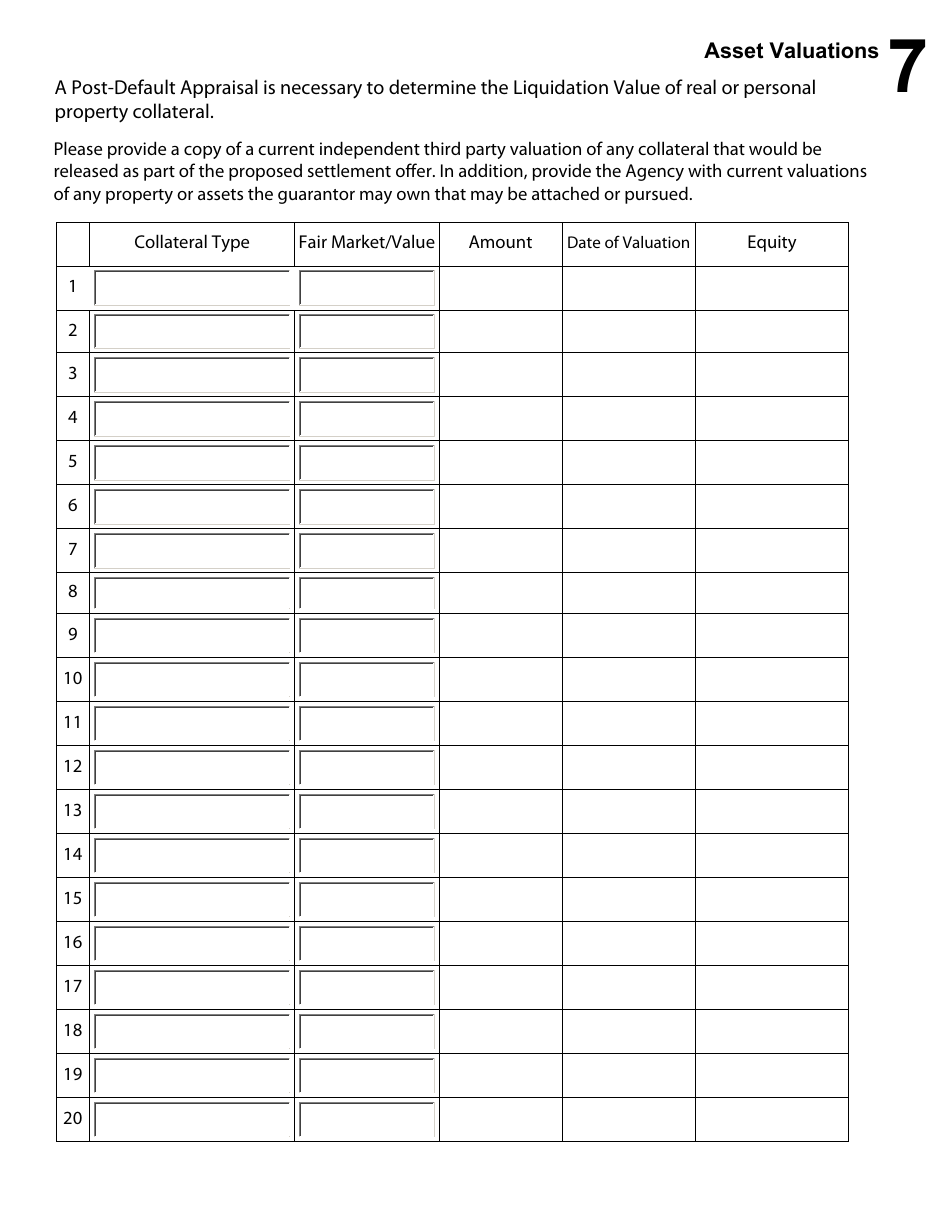

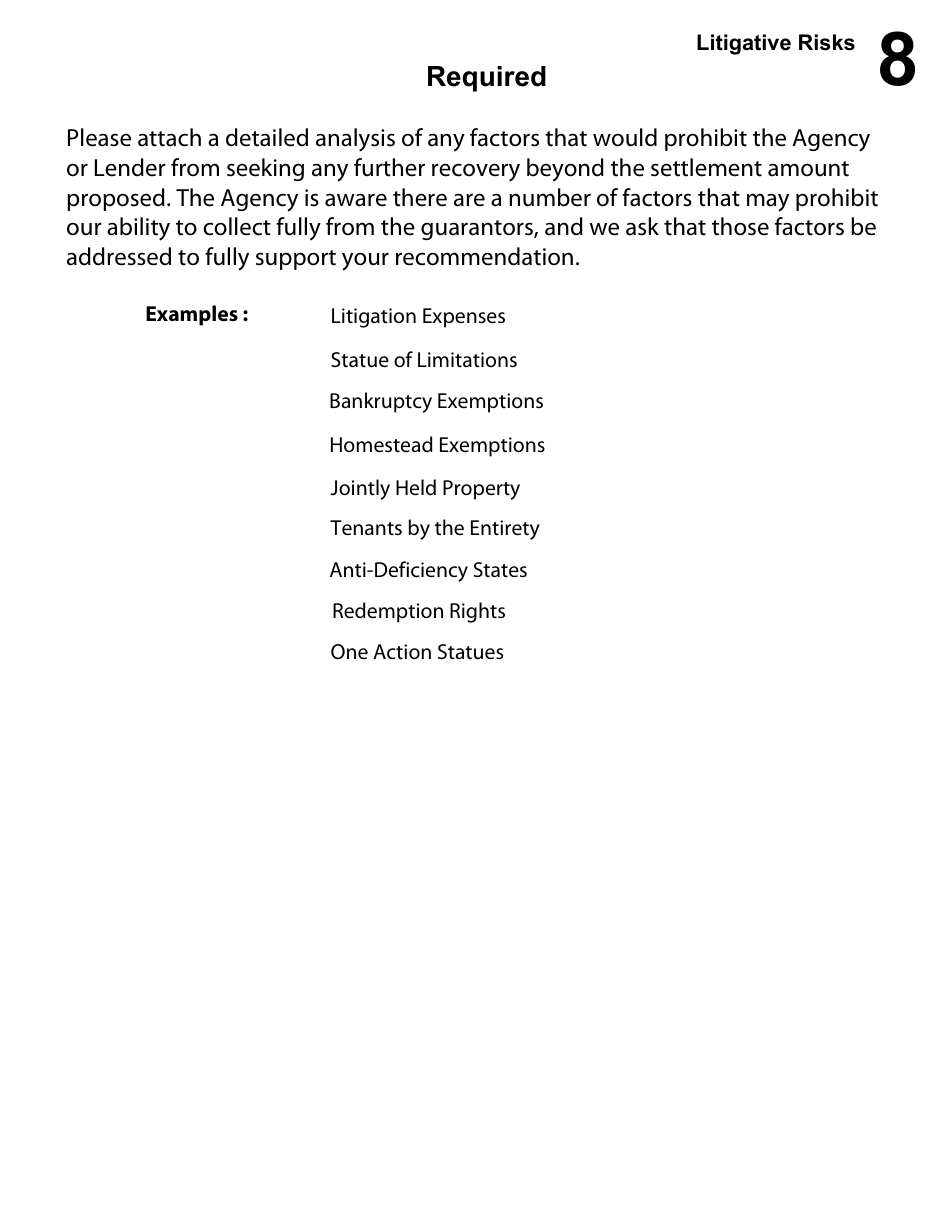

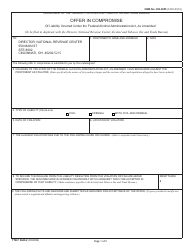

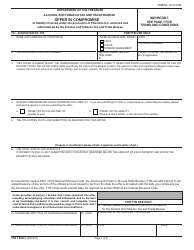

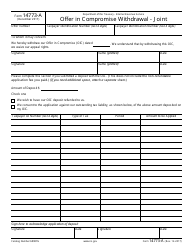

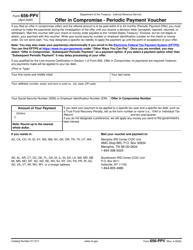

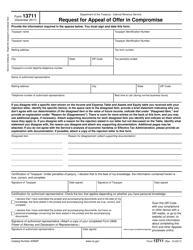

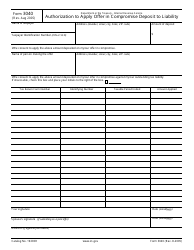

Offer in Compromise (OIC) Tabs

Offer in Compromise (OIC) Tabs is a 9-page legal document that was released by the U.S. Small Business Administration and used nation-wide.

FAQ

Q: What is an Offer in Compromise (OIC)?

A: An Offer in Compromise is a program that allows taxpayers to settle their tax debt for less than the total amount owed.

Q: Who is eligible for an Offer in Compromise?

A: Individuals and businesses who are unable to pay their tax debt in full and can demonstrate financial hardship may be eligible for an Offer in Compromise.

Q: What are the benefits of an Offer in Compromise?

A: The benefits of an Offer in Compromise include the opportunity to settle tax debt for less, the potential to stop collections activities, and the chance for a fresh start with your tax obligations.

Q: How do I apply for an Offer in Compromise?

A: To apply for an Offer in Compromise, you need to complete and submit Form 656, along with supporting documentation and the required application fee.

Q: How long does it take for the IRS to process an Offer in Compromise?

A: The processing time for an Offer in Compromise can vary, but it generally takes several months for the IRS to review and make a decision on your offer.

Q: What happens if my Offer in Compromise is accepted?

A: If your Offer in Compromise is accepted, you will need to follow the terms of the agreement, including making the agreed-upon payments and staying in compliance with your tax obligations for several years.

Q: What happens if my Offer in Compromise is rejected?

A: If your Offer in Compromise is rejected, you have the option to appeal the decision or explore other tax resolution options with the IRS.

Q: Can I hire a tax professional to help me with an Offer in Compromise?

A: Yes, it is recommended to seek the assistance of a tax professional who specializes in tax debt resolution to guide you through the Offer in Compromise process and increase your chances of success.

Q: Are there any fees associated with an Offer in Compromise?

A: Yes, there is a non-refundable application fee for an Offer in Compromise. However, eligible low-income taxpayers may qualify for a waiver of this fee.

Q: What is the Fresh Start Initiative?

A: The Fresh Start Initiative is a set of IRS policies aimed at helping taxpayers with tax debt to resolve their financial obligations more easily, including expanding eligibility for the Offer in Compromise program.

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.