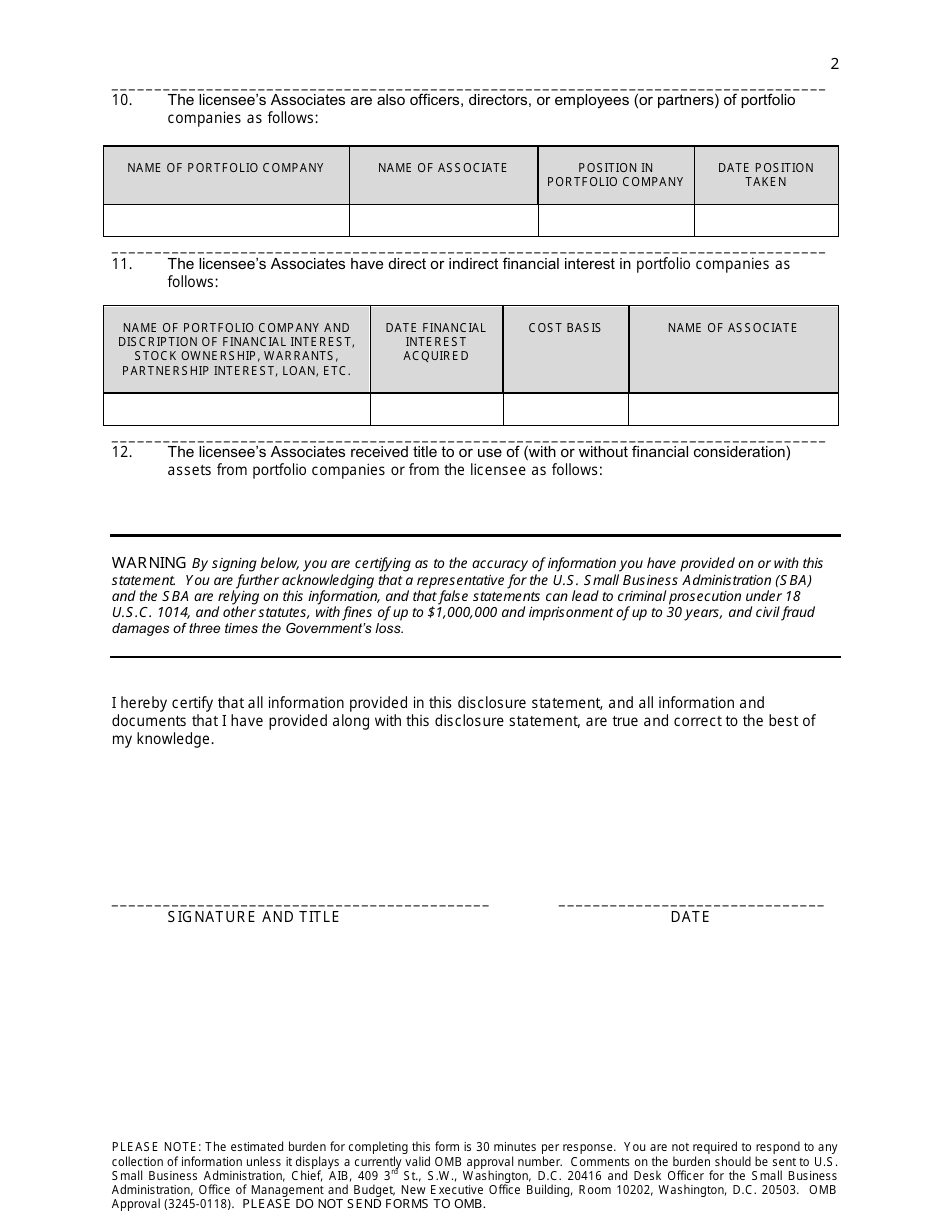

SBA Form 856 Disclosure Statement - Leveraged Licensees

What Is SBA Form 856?

This is a legal form that was released by the U.S. Small Business Administration on May 1, 2012 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 856?

A: SBA Form 856 is a Disclosure Statement for Leveraged Licensees.

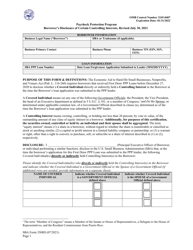

Q: Who is required to complete SBA Form 856?

A: Leveraged Licensees are required to complete SBA Form 856.

Q: What is a Leveraged Licensee?

A: A Leveraged Licensee is a licensee under the Small Business Administration's (SBA) regulations who has borrowed funds to finance the acquisition or operation of a business.

Q: What is the purpose of SBA Form 856?

A: The purpose of SBA Form 856 is to gather information about the financial condition and operations of Leveraged Licensees.

Q: What information is required on SBA Form 856?

A: SBA Form 856 requires information about the licensee's financial statements, business operations, and loan details.

Form Details:

- Released on May 1, 2012;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 856 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.