This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

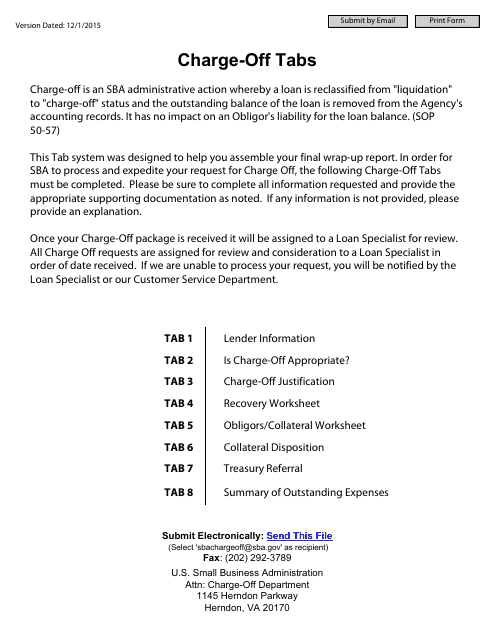

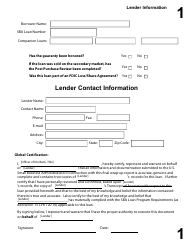

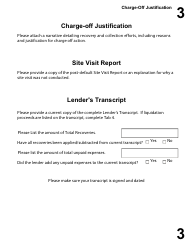

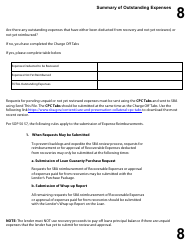

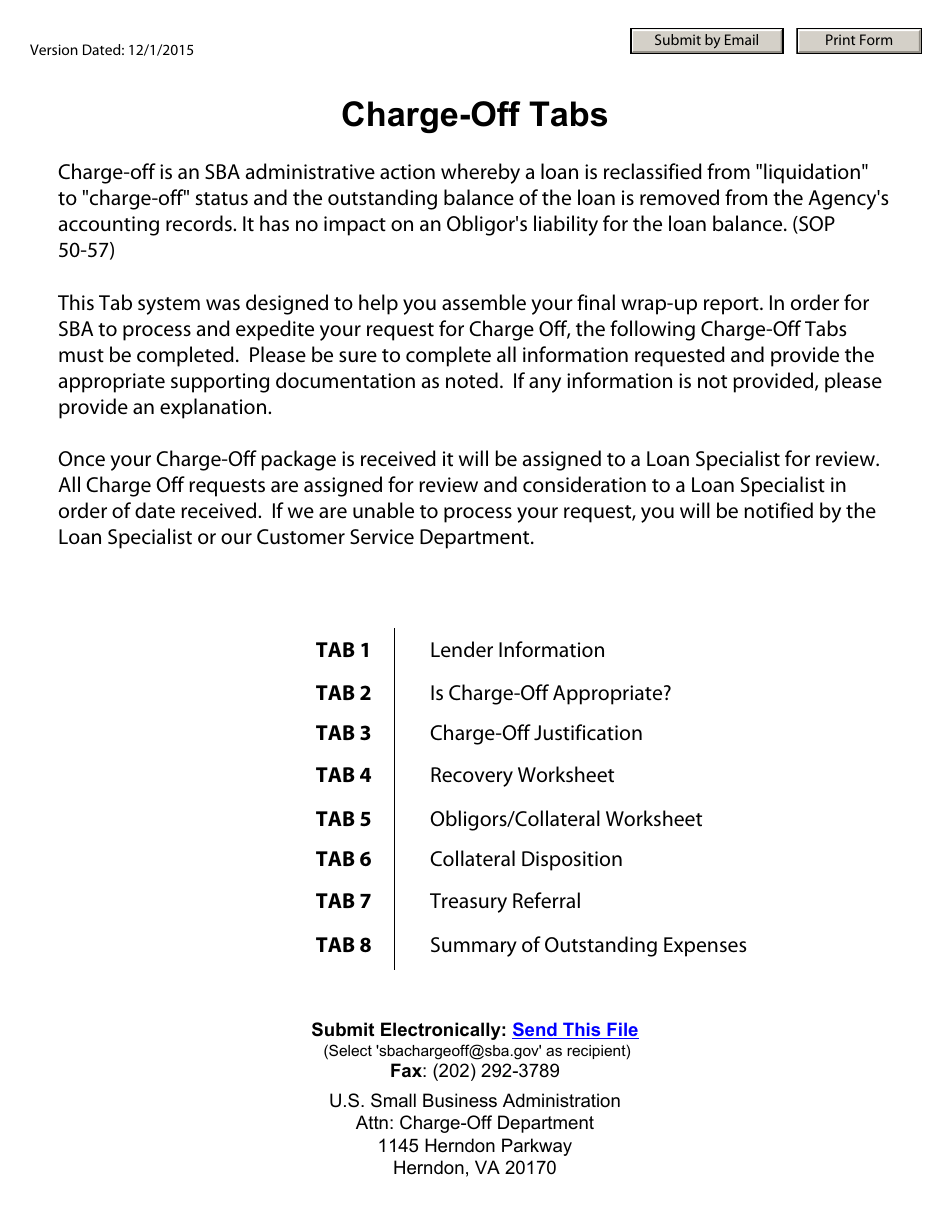

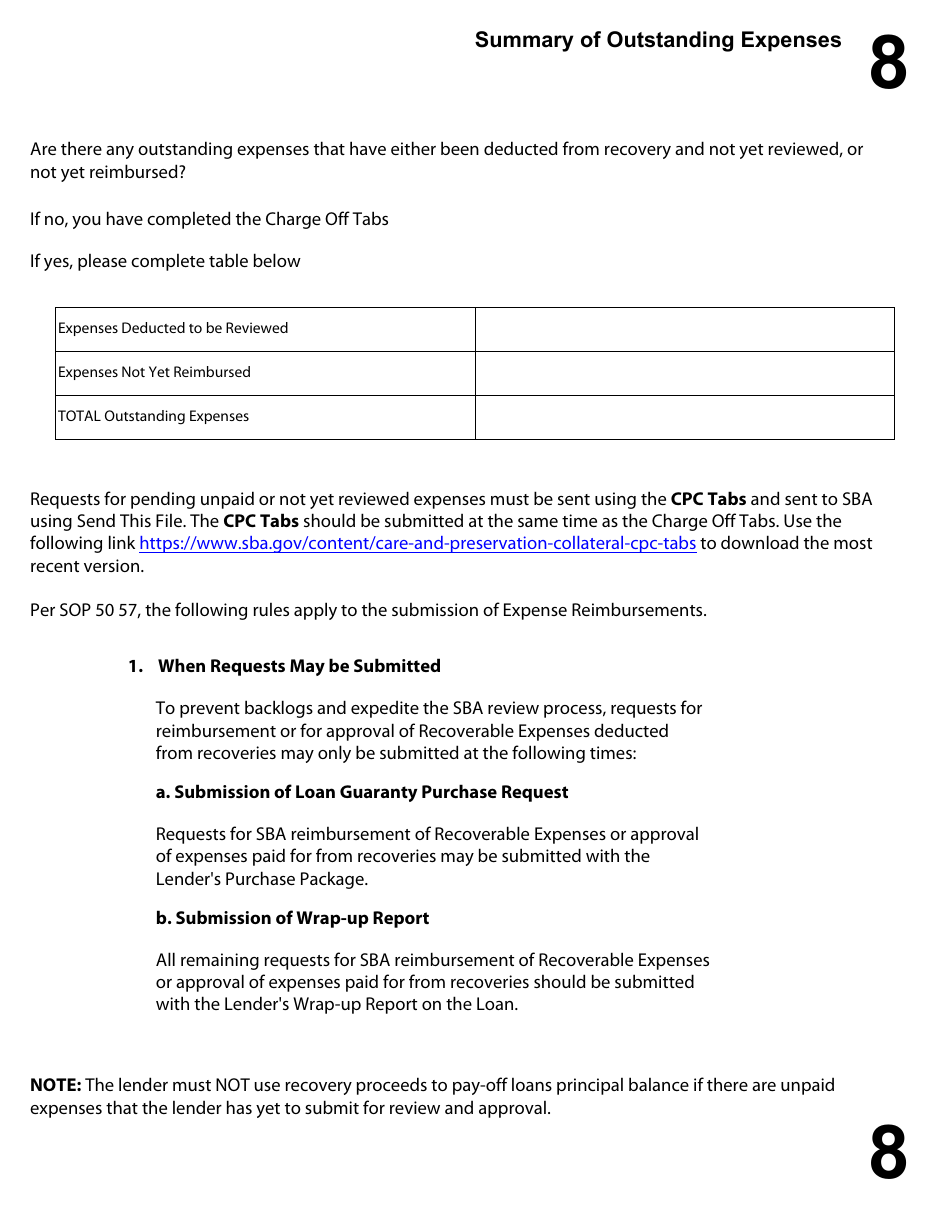

Charge-Off Tabs

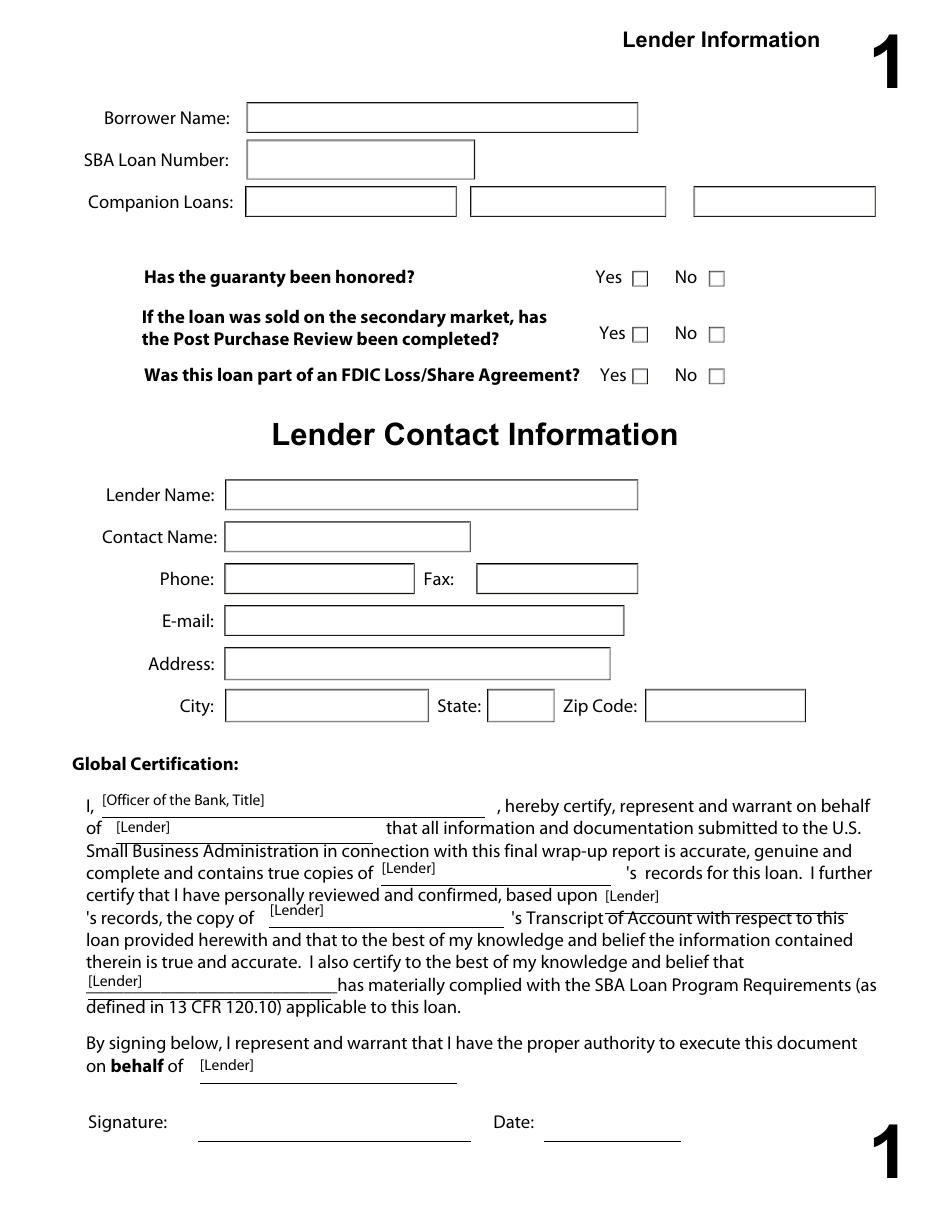

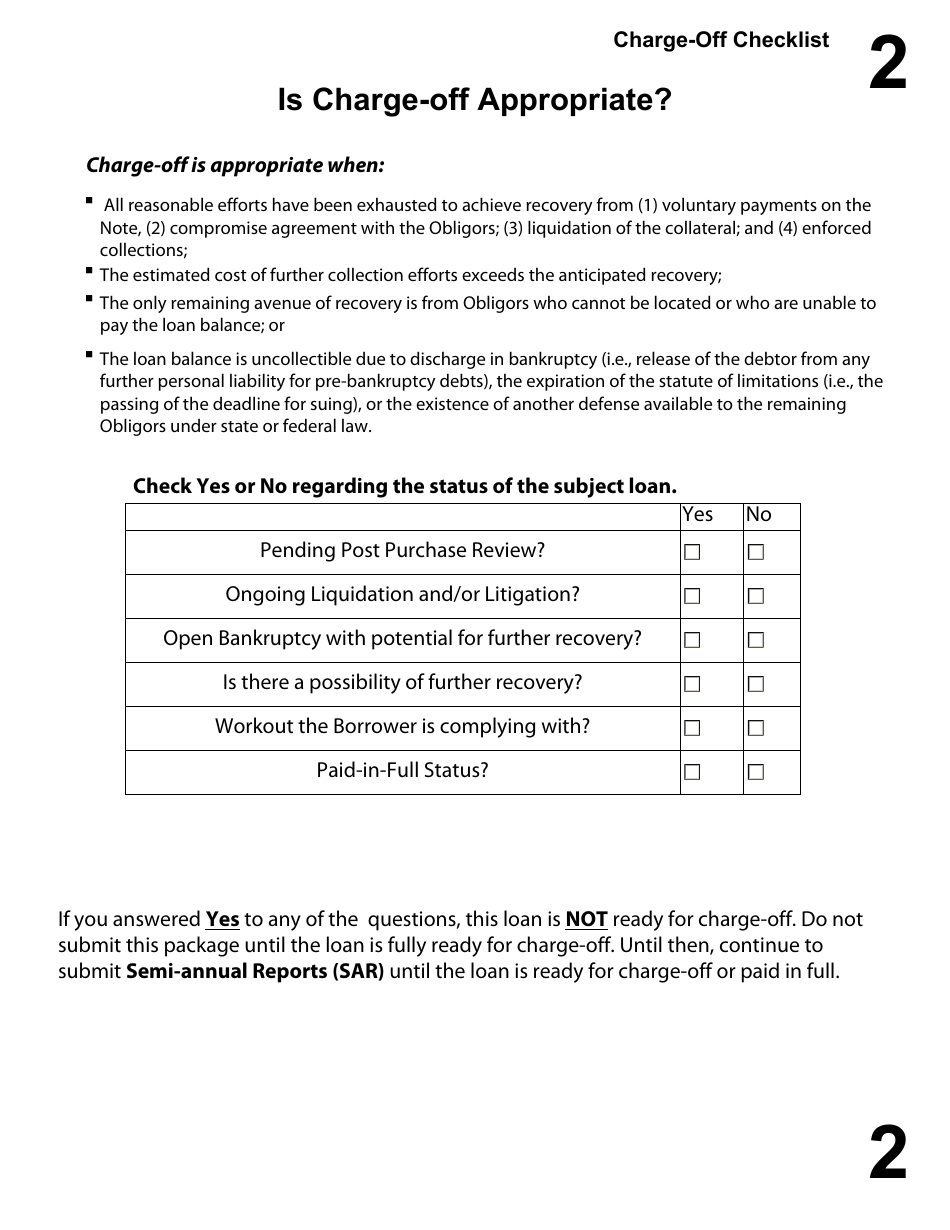

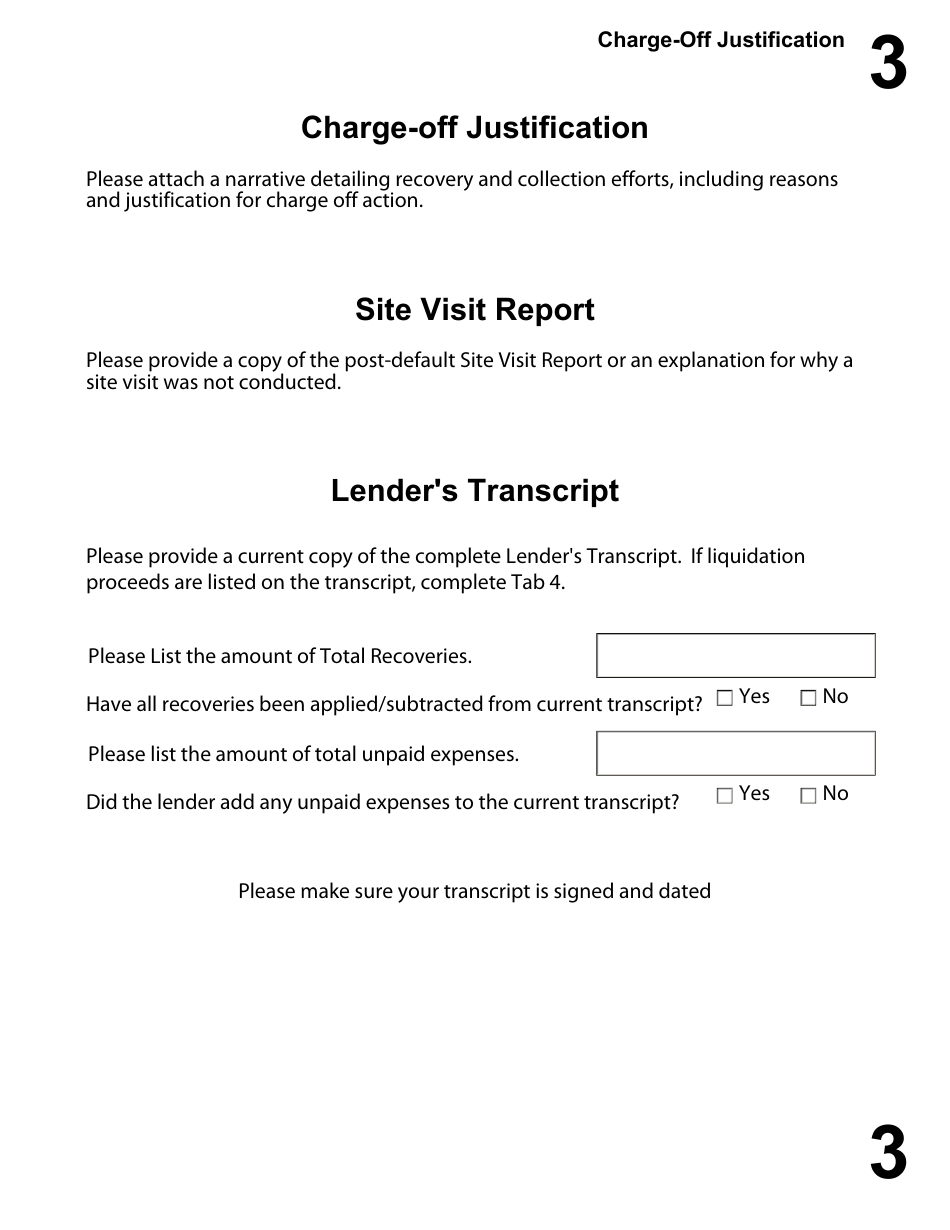

Charge-Off Tabs is a 9-page legal document that was released by the U.S. Small Business Administration on December 1, 2015 and used nation-wide.

FAQ

Q: What is a charge-off?

A: A charge-off is when a lender writes off a debt as uncollectible.

Q: How does a charge-off affect my credit?

A: A charge-off can significantly impact your credit score and make it harder to secure future credit.

Q: Can a charge-off be removed from my credit report?

A: A charge-off can remain on your credit report for up to seven years, but you can work with the lender to negotiate its removal.

Q: What should I do if I have a charge-off on my credit report?

A: If you have a charge-off on your credit report, it's important to pay off the debt or work out a settlement with the lender to improve your credit.

Q: Can I get a loan with a charge-off on my credit report?

A: Having a charge-off on your credit report can make it more difficult to get approved for a loan, but it's not impossible. You may need to explore alternative lenders or provide additional documentation.

Q: How can I prevent a charge-off?

A: To prevent a charge-off, it's important to make timely payments on your debts and communicate with your lenders if you're experiencing financial hardship. You may be able to work out a payment plan or settlement to avoid a charge-off.

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.