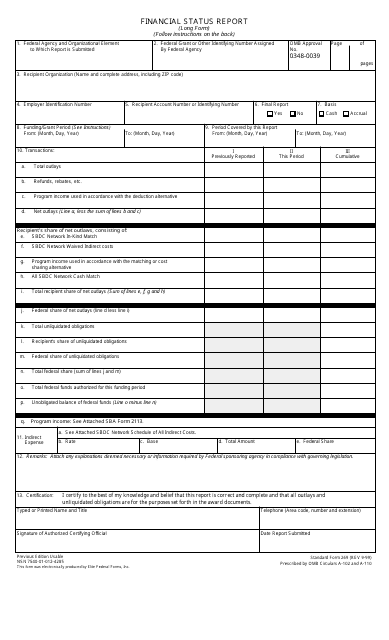

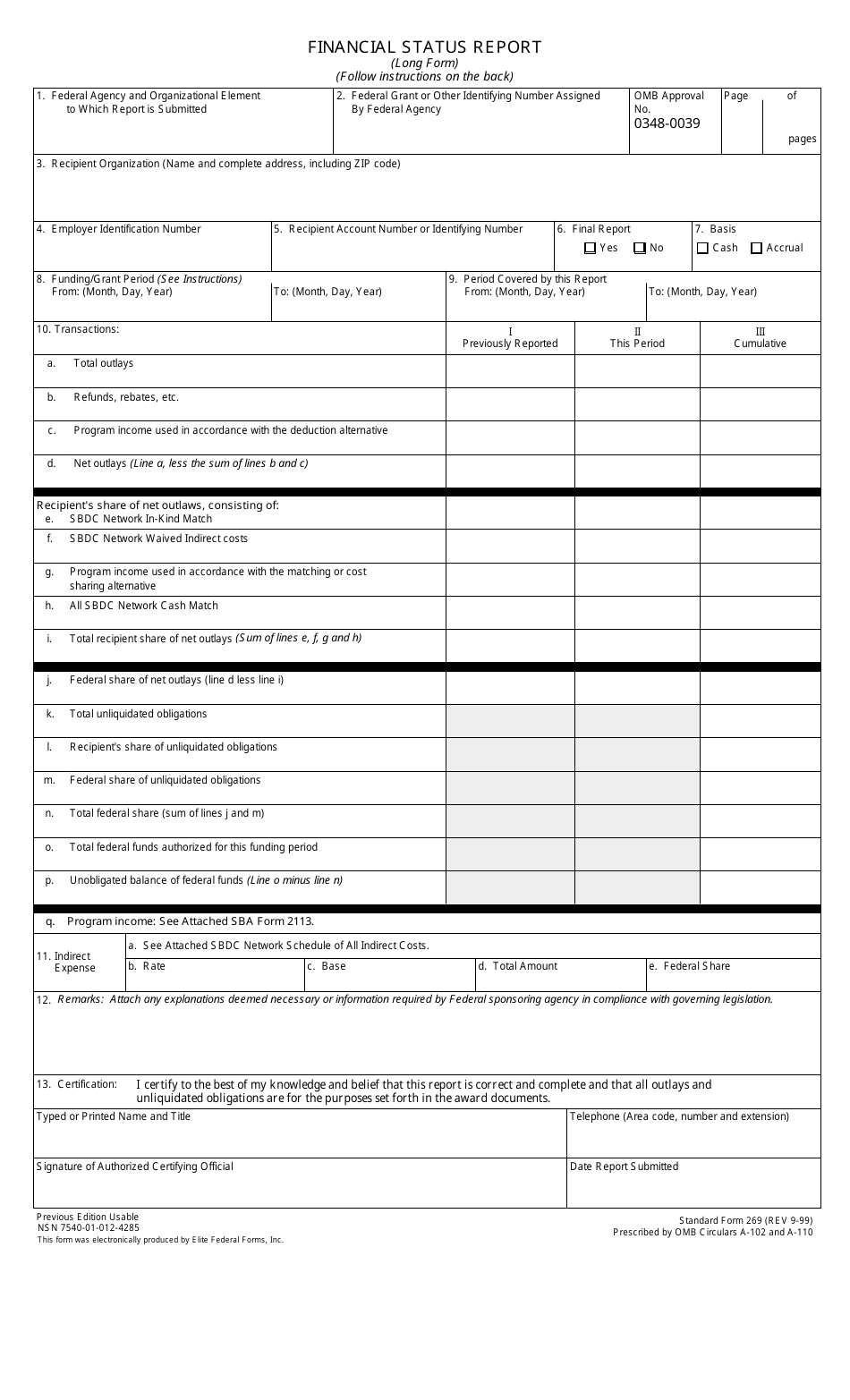

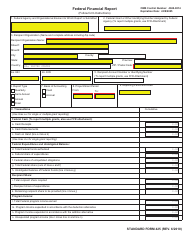

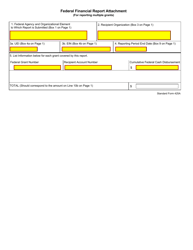

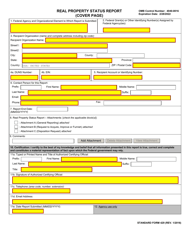

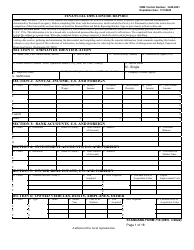

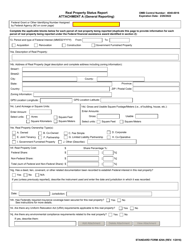

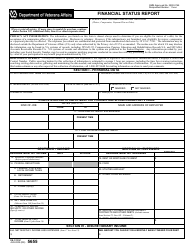

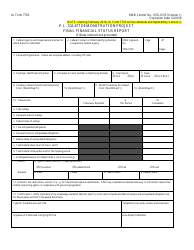

SBA Form SF-269 Financial Status Report

What Is SBA Form SF-269?

This is a legal form that was released by the U.S. Small Business Administration on September 1, 1999 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form SF-269?

A: SBA Form SF-269 is a Financial Status Report.

Q: Who needs to fill out SBA Form SF-269?

A: SBA Form SF-269 needs to be filled out by recipients of SBA loans or grants.

Q: What is the purpose of SBA Form SF-269?

A: The purpose of SBA Form SF-269 is to provide updated financial information to the Small Business Administration (SBA).

Q: How often should SBA Form SF-269 be submitted?

A: SBA Form SF-269 should be submitted on a quarterly basis.

Q: What information is required on SBA Form SF-269?

A: SBA Form SF-269 requires information such as current assets, liabilities, revenues, and expenses.

Q: Is SBA Form SF-269 confidential?

A: Yes, SBA Form SF-269 is confidential and should only be shared with authorized SBA personnel.

Form Details:

- Released on September 1, 1999;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form SF-269 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.