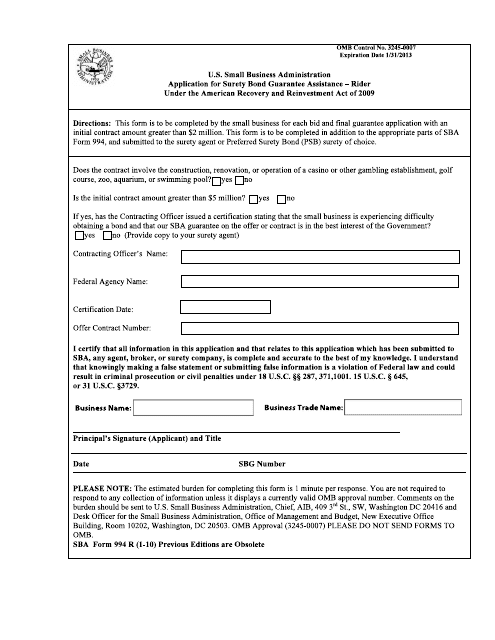

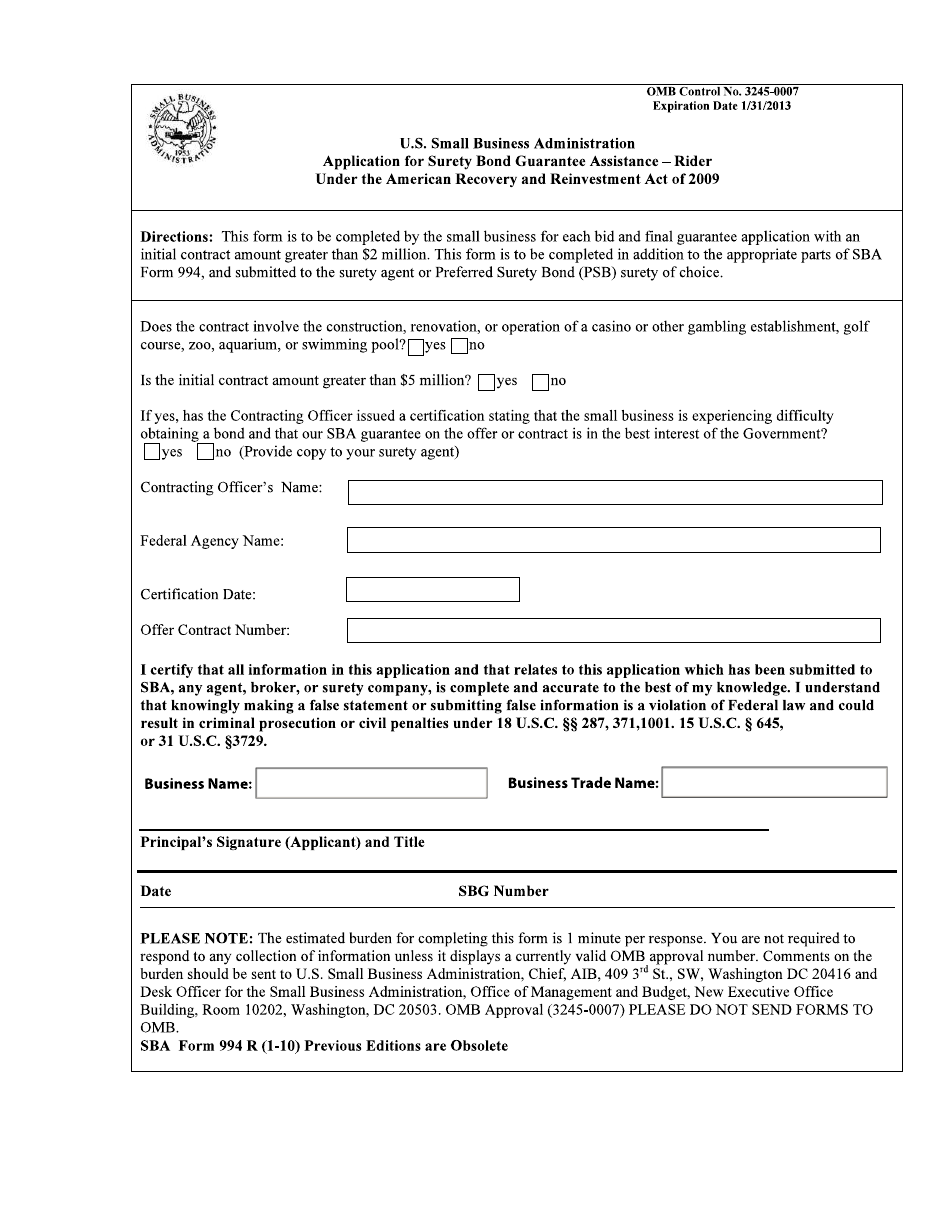

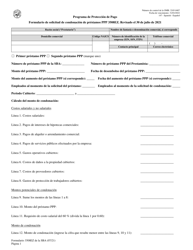

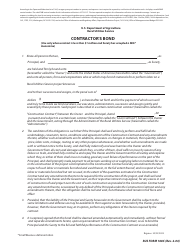

SBA Form 994 R Application for Surety Bond Guarantee Assistance - Rider Under the American Recovery and Reinvestment Act of 2009

What Is SBA Form 994 R?

This is a legal form that was released by the U.S. Small Business Administration on January 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 994 R?

A: SBA Form 994 R is an application for Surety Bond Guarantee Assistance.

Q: What is the purpose of SBA Form 994 R?

A: The purpose of SBA Form 994 R is to apply for Surety Bond Guarantee Assistance.

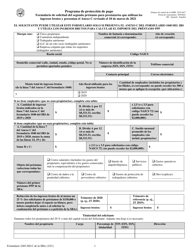

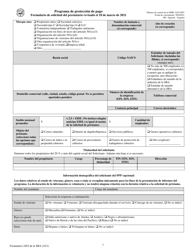

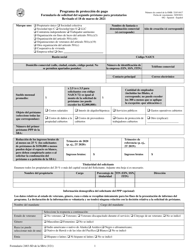

Q: What is Surety Bond Guarantee Assistance?

A: Surety Bond Guarantee Assistance provides a guarantee to surety companies for bid, payment, and performance bonds provided to small businesses.

Q: What is the Rider Under the American Recovery and Reinvestment Act of 2009?

A: The Rider Under the American Recovery and Reinvestment Act of 2009 is a provision that allows for additional bonding assistance for small businesses.

Q: Who can use SBA Form 994 R?

A: Small businesses that need surety bonds can use SBA Form 994 R to apply for assistance.

Q: Is there a fee for applying for Surety Bond Guarantee Assistance?

A: Yes, there is a fee for applying for Surety Bond Guarantee Assistance. The fee amount depends on the bond amount and type of assistance requested.

Q: What is the deadline for submitting SBA Form 994 R?

A: The deadline for submitting SBA Form 994 R depends on the specific bond and project requirements. It is recommended to submit the application as early as possible.

Q: What other documents may be required in addition to SBA Form 994 R?

A: Additional documents, such as financial statements, tax returns, and project-related information, may be required along with SBA Form 994 R.

Form Details:

- Released on January 1, 2010;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 994 R by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.