SBA Form 468.1 Corporate Annual Financial Report

What Is SBA Form 468.1?

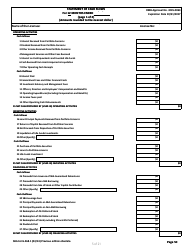

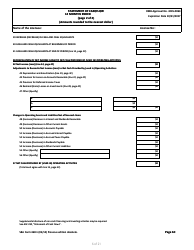

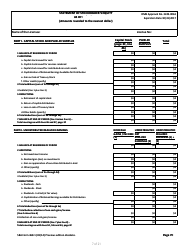

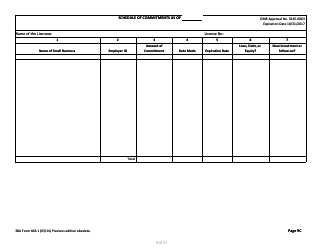

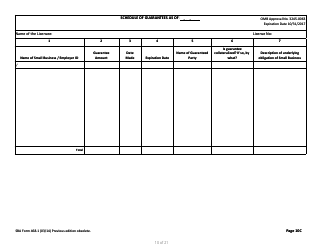

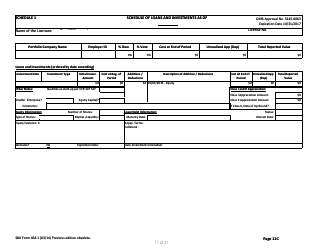

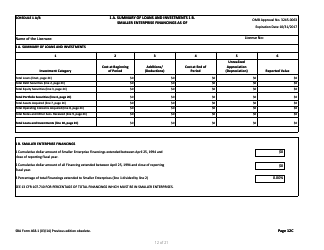

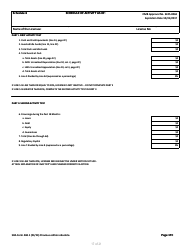

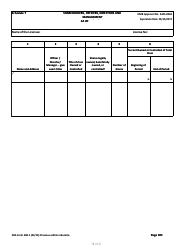

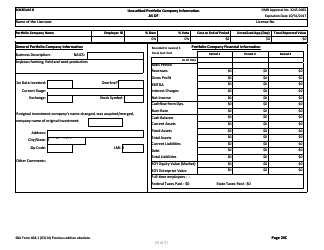

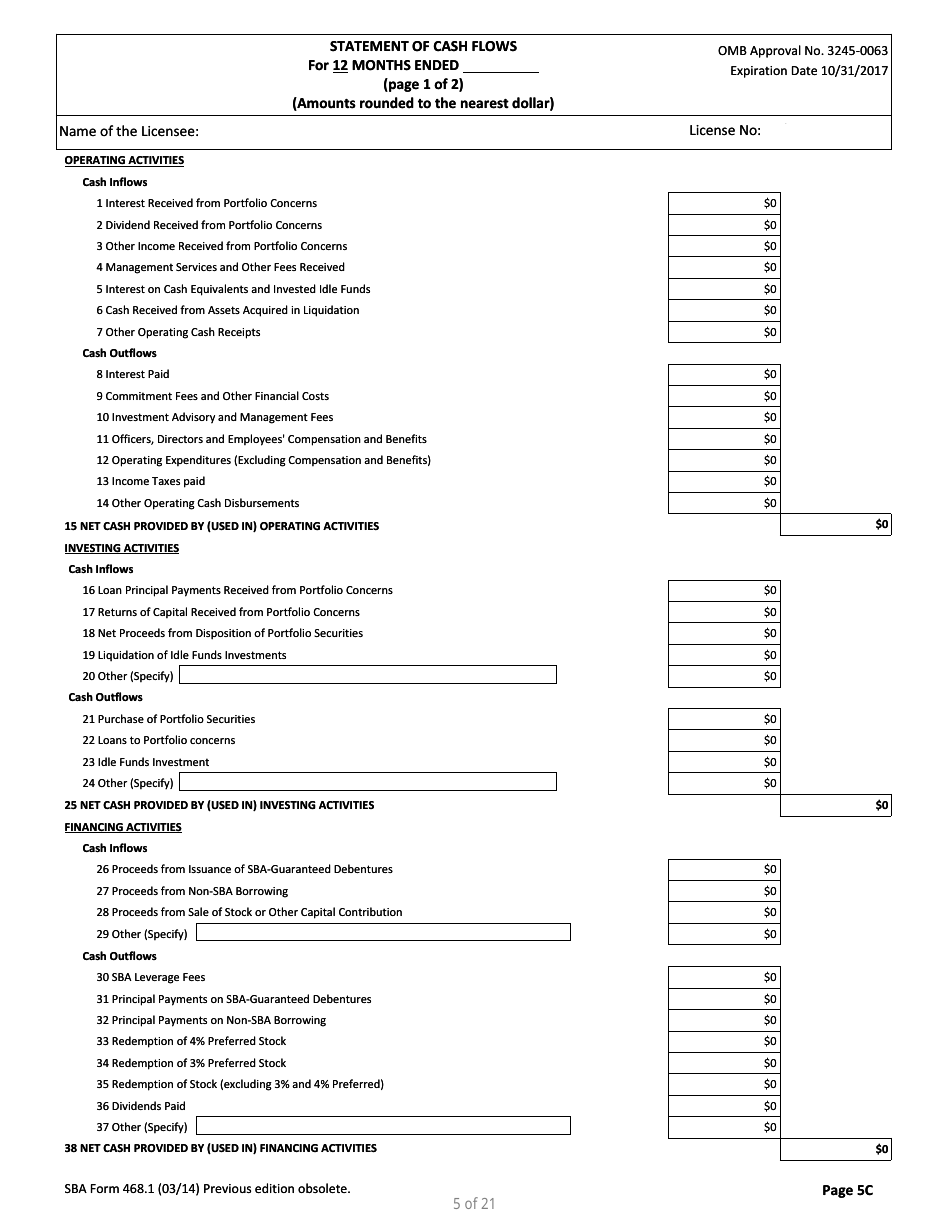

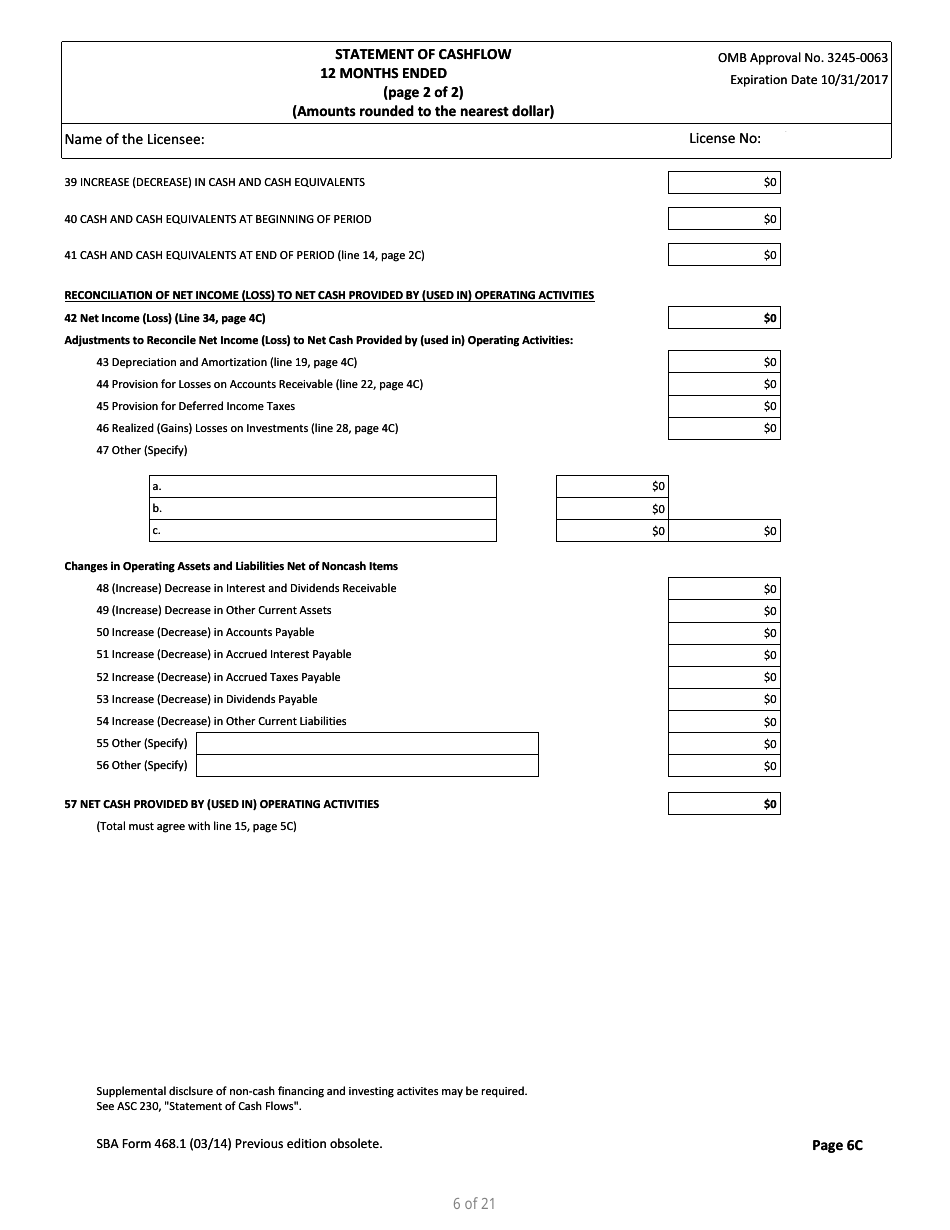

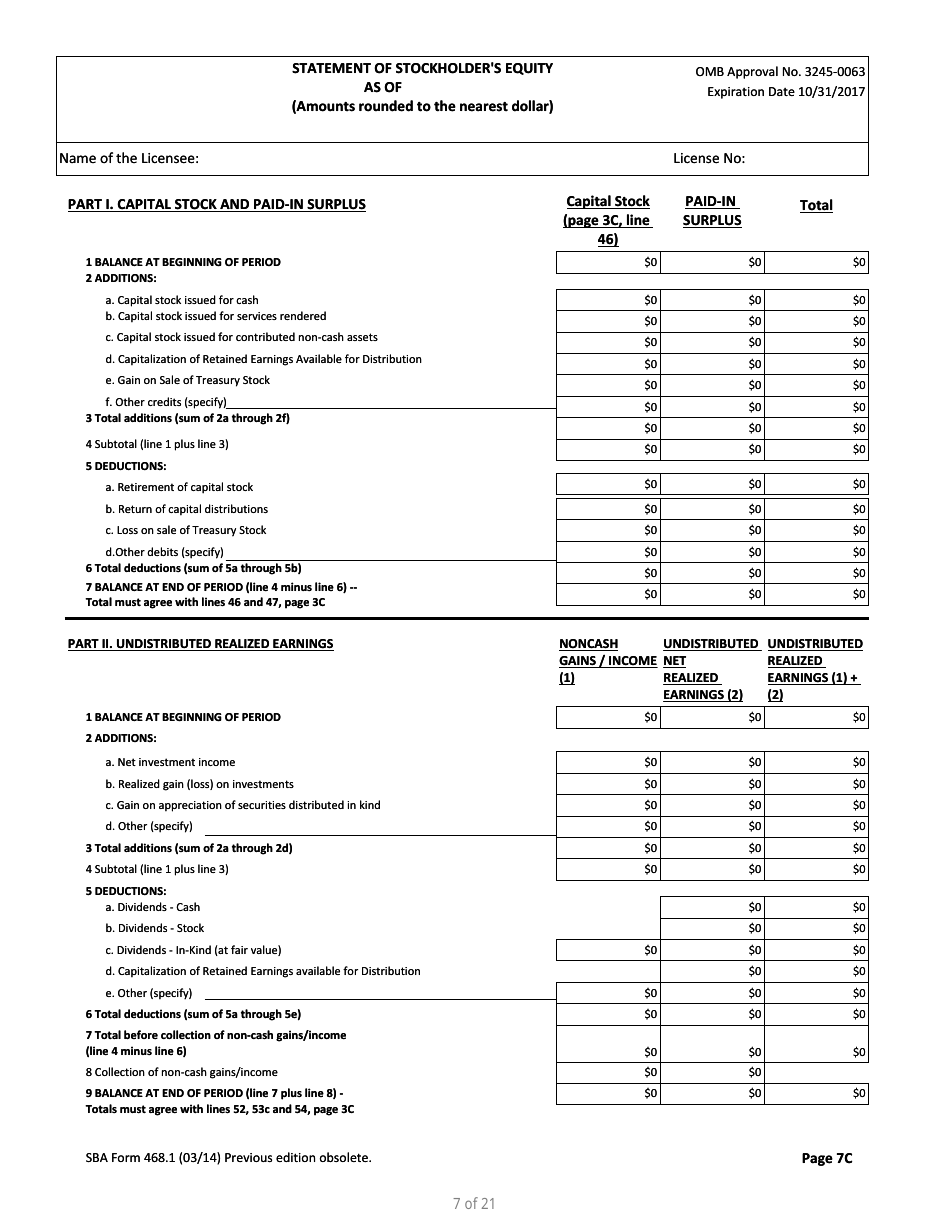

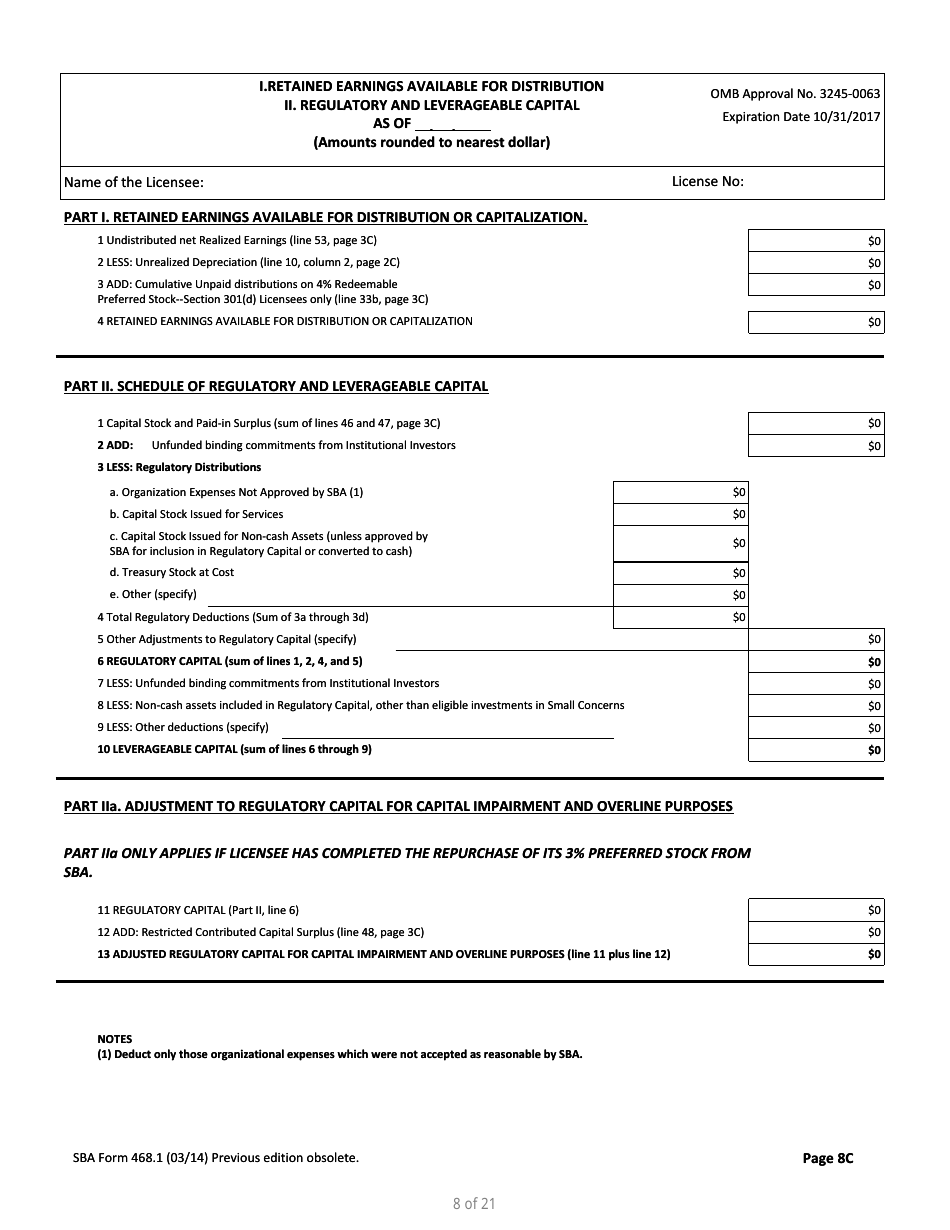

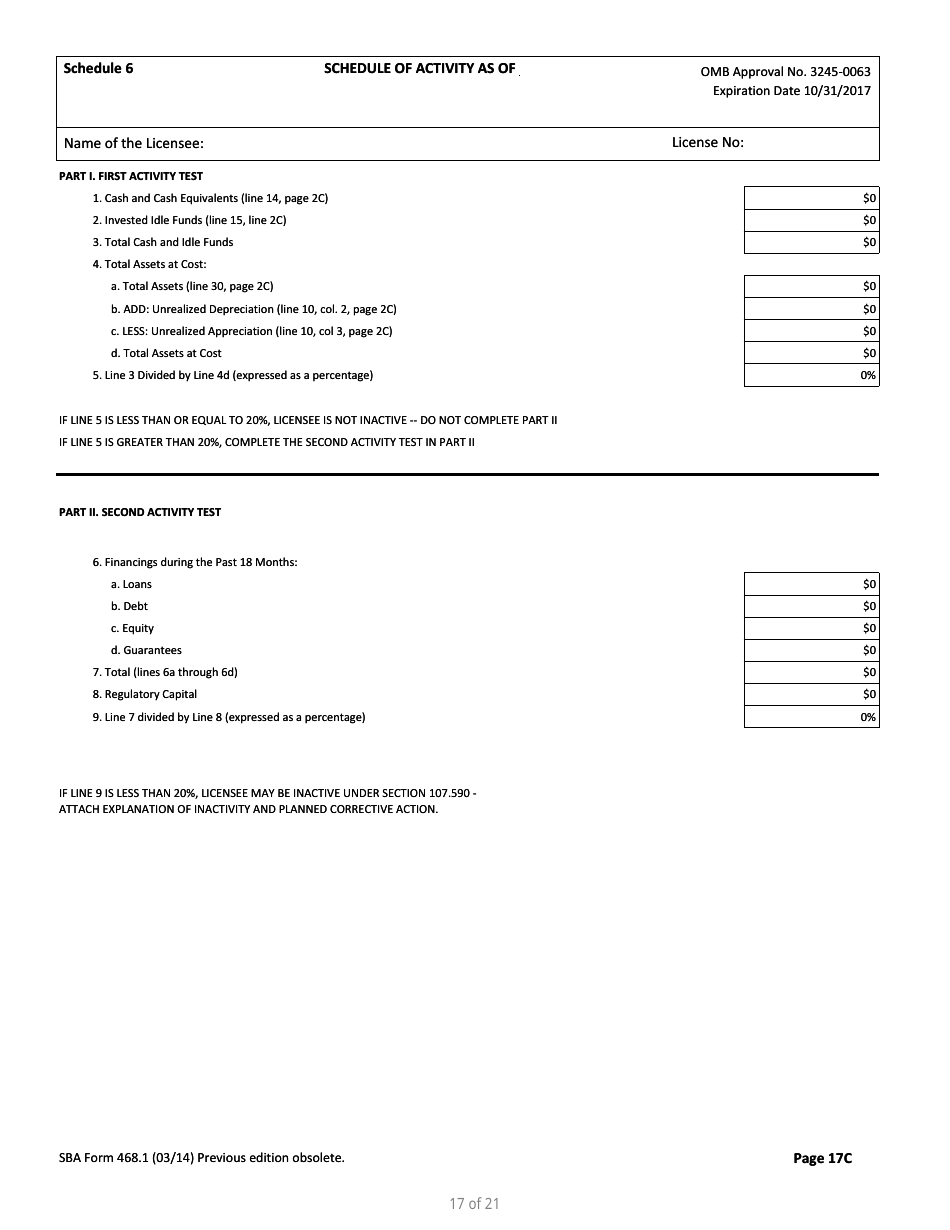

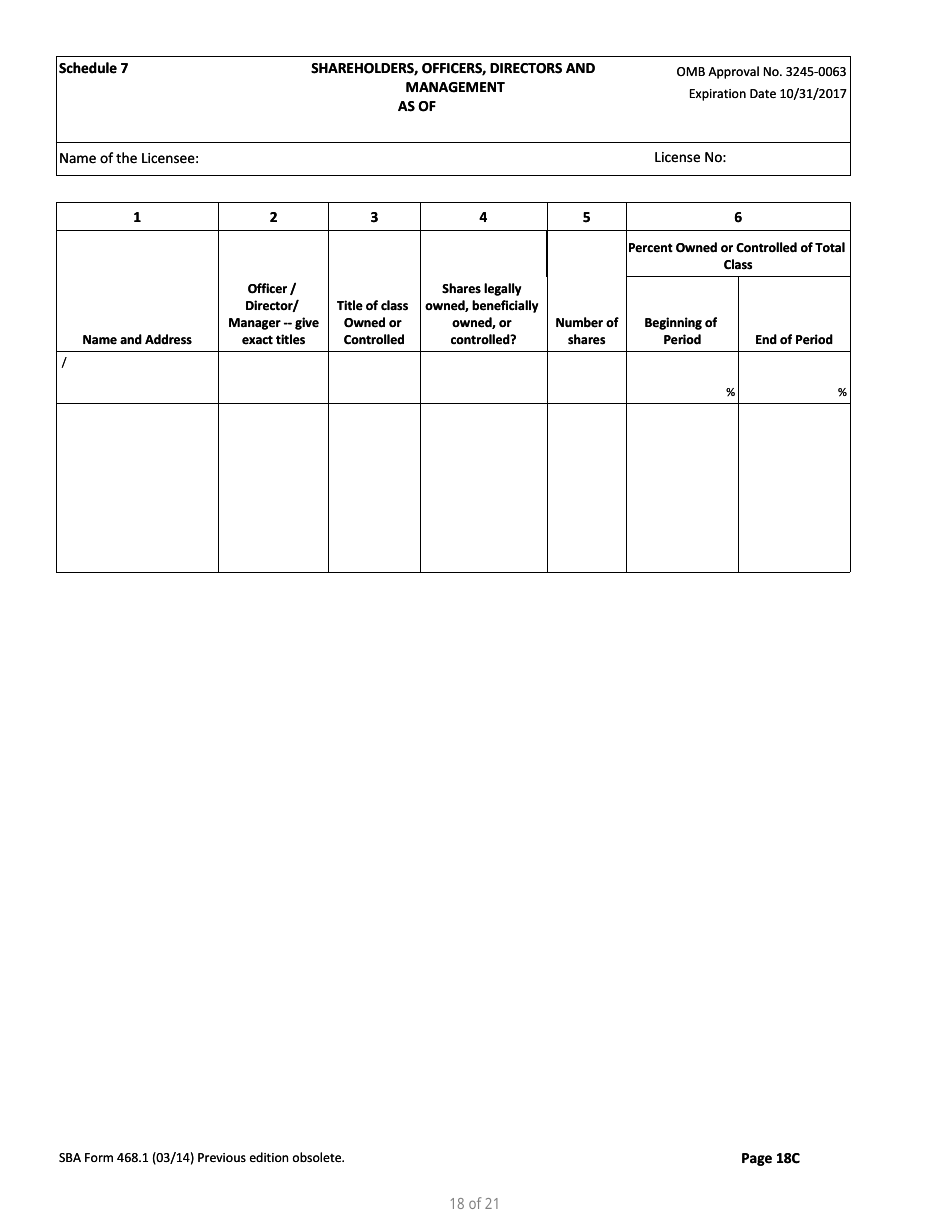

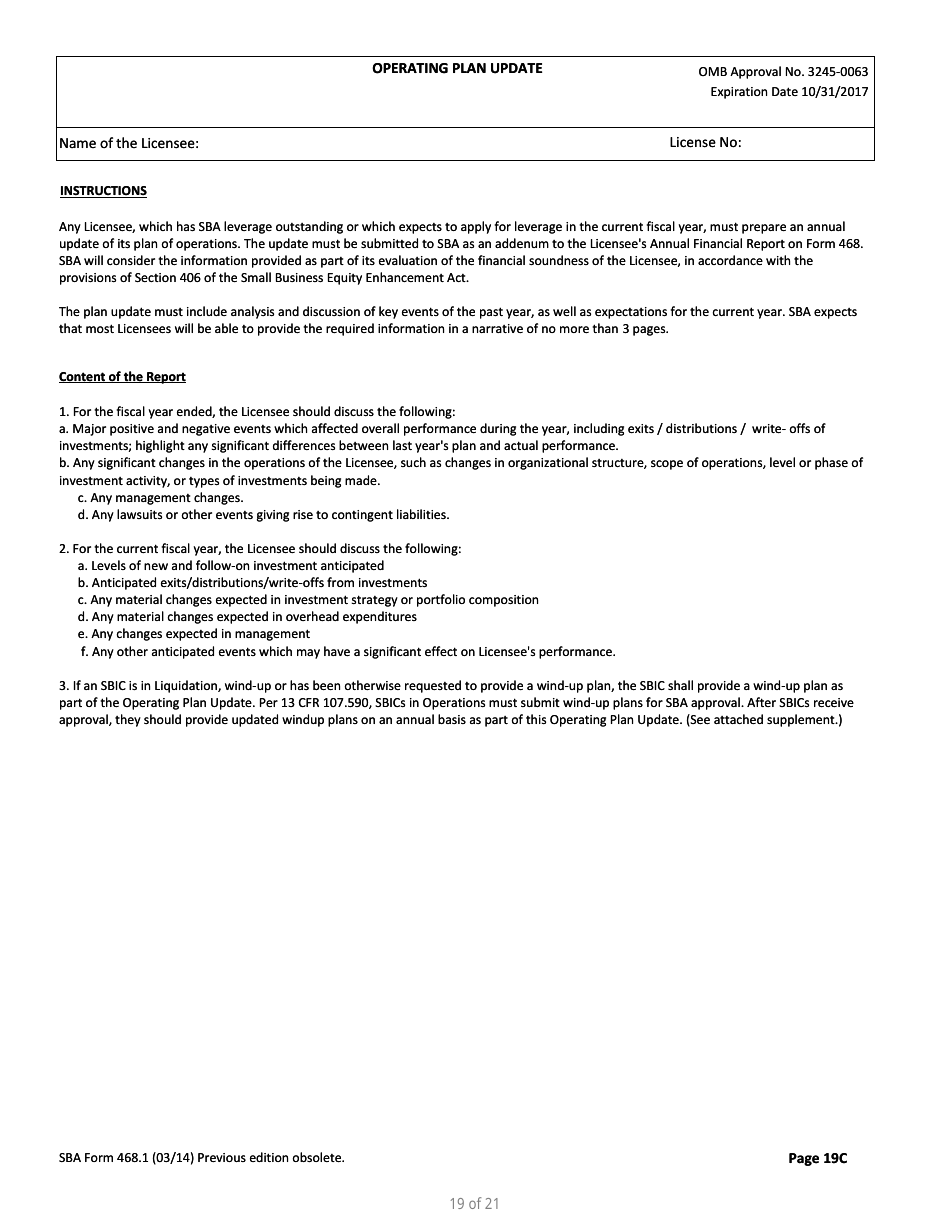

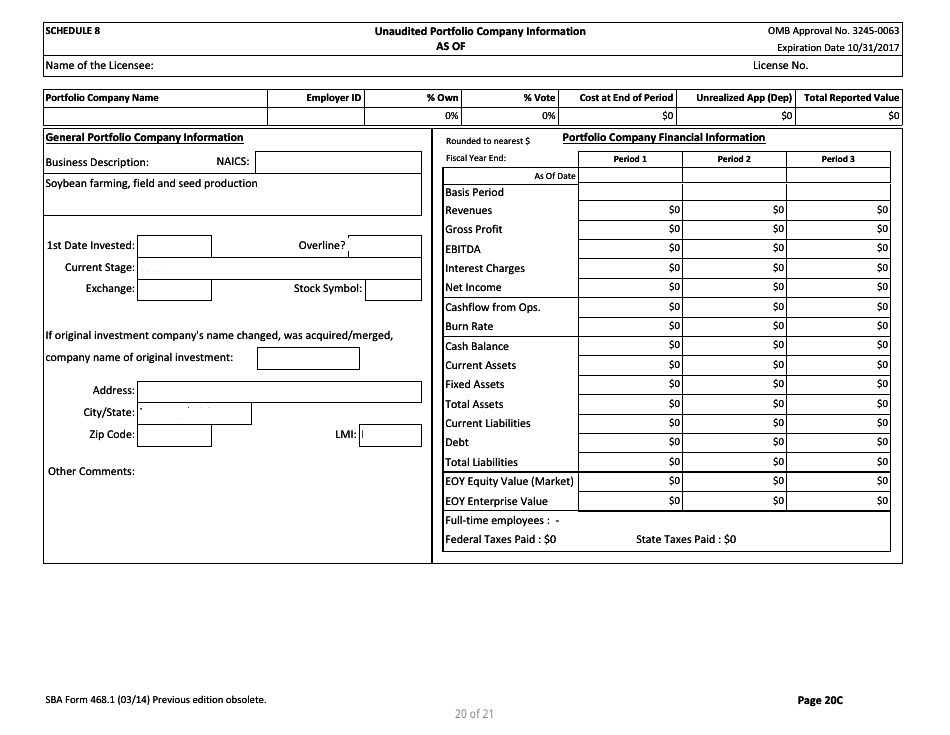

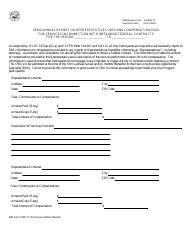

SBA Form 468.1, Corporate Annual Financial Report is a form used by Small Business Investment Companies (SBICs) to submit their corporate financial reports for a single year. The form is required for all SBIC Corporations and needs to be submitted annually within 3 months after the end of a fiscal year.

The latest version of the form was released by the Small Business Administration (SBA) on March 1, 2014 , and supersedes the SBA Form 468 (SBIC Financial Report) . An updated SBA Form 468.1 printable version is available for download below.

SBA Form 468.4 (Corporate Quarterly Financial Report) is a related form used by SBIC Corporations for submitting their quarterly financial reports.

SBA Form 468.1 Instructions

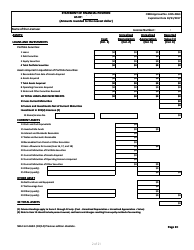

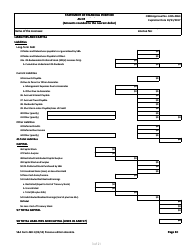

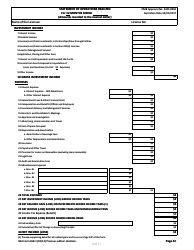

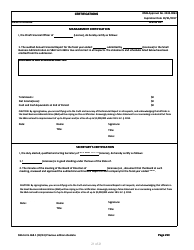

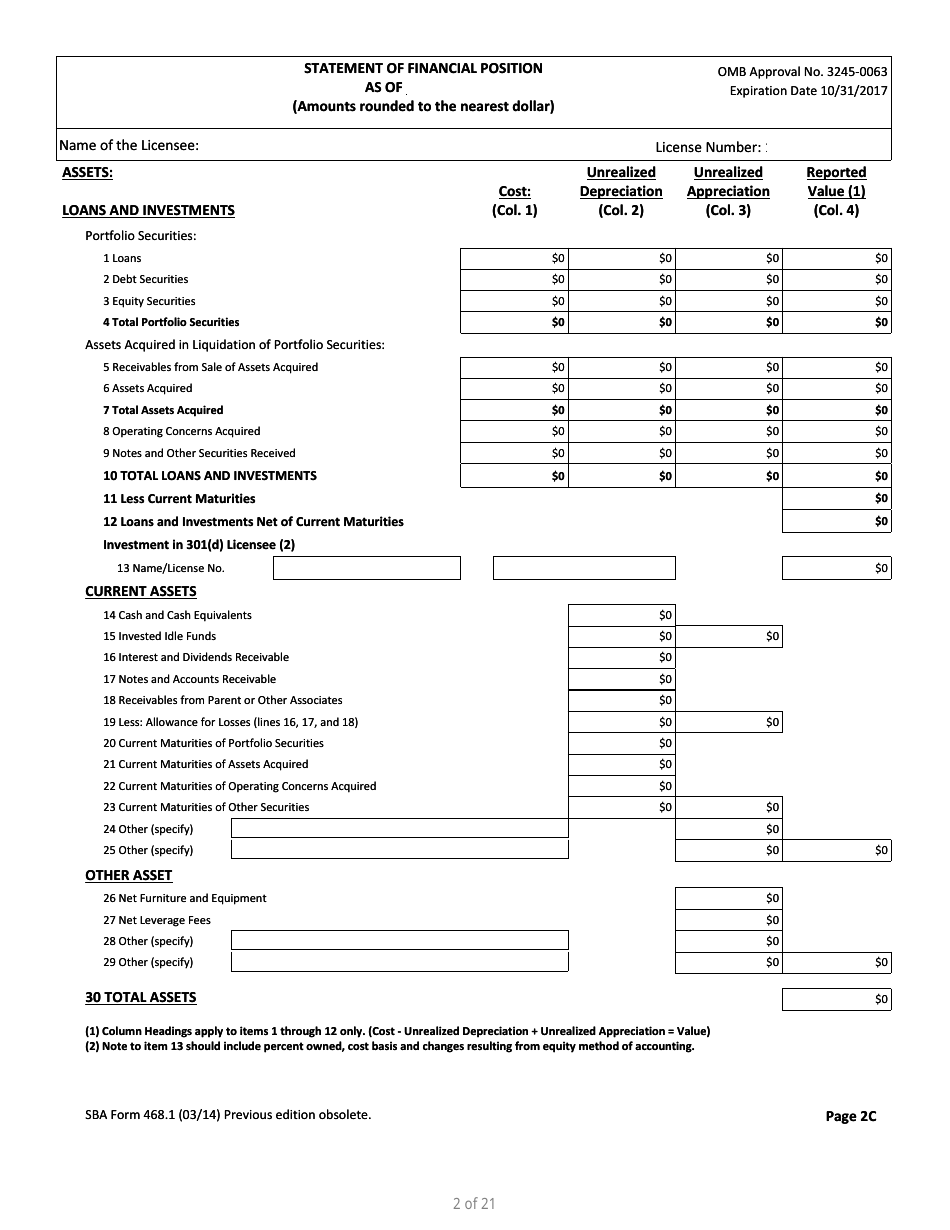

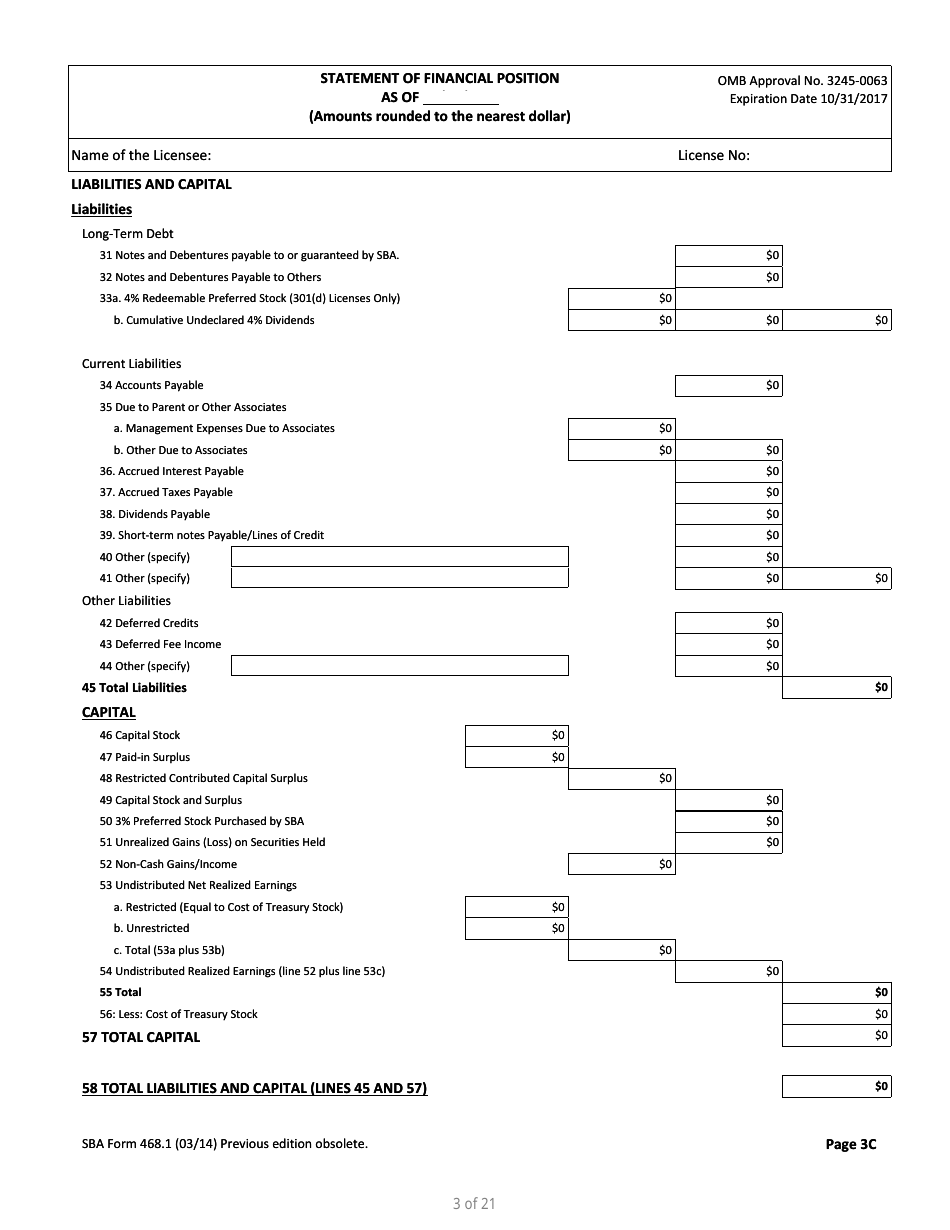

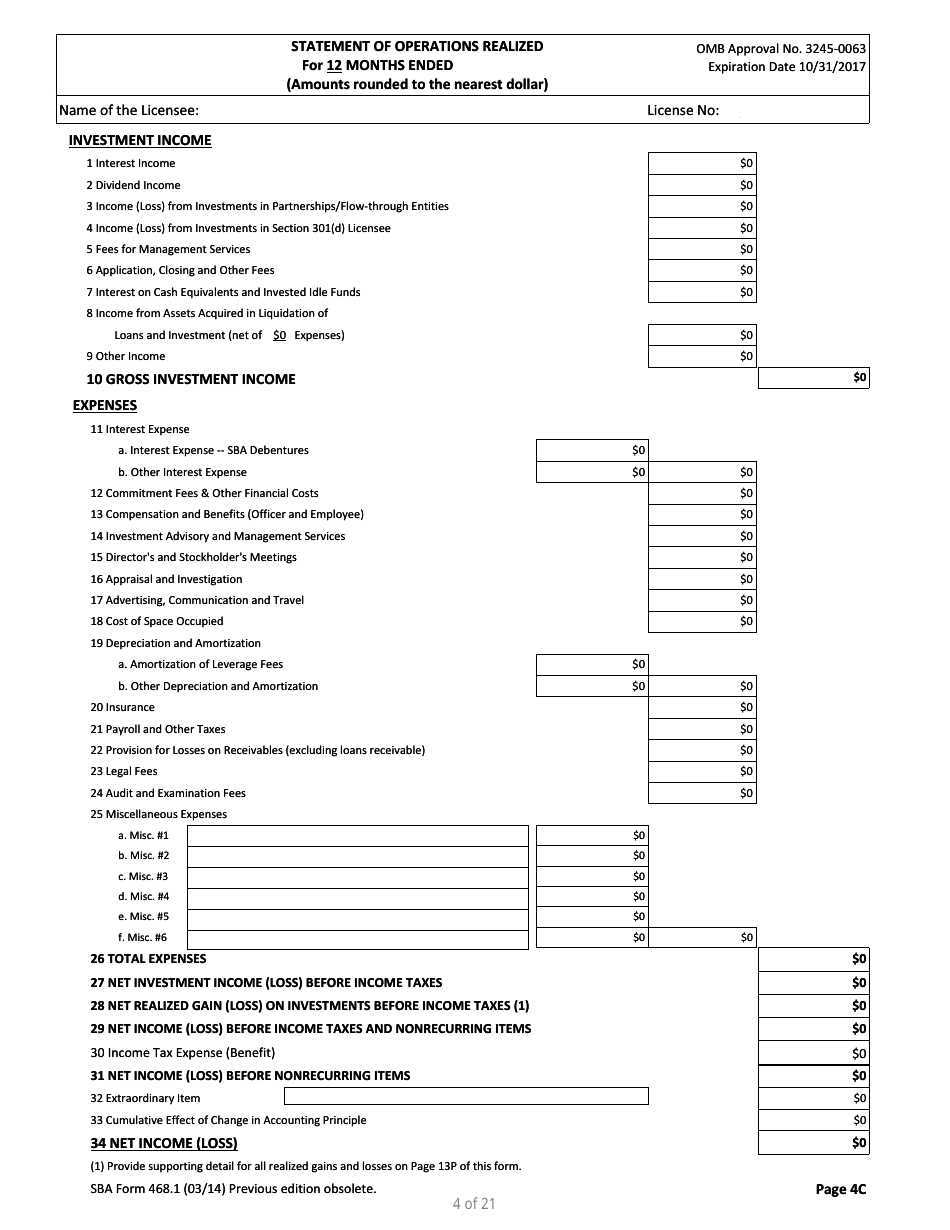

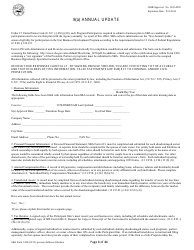

All SBIC Corporations are required to submit an audited annual report on the SBA 468.1 (with footnotes and an Independent Public Accountant's Opinion). SBICs with outstanding Leverage Commitments or Leverage and other SBA-required SBICs must also submit unaudited quarterly financial statements within 30 days of the close of each quarter using the SBA Short Form 468.

All SBICs must create their financial reports electronically through a secured and private application.

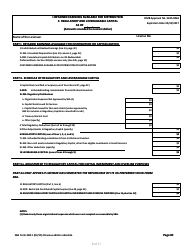

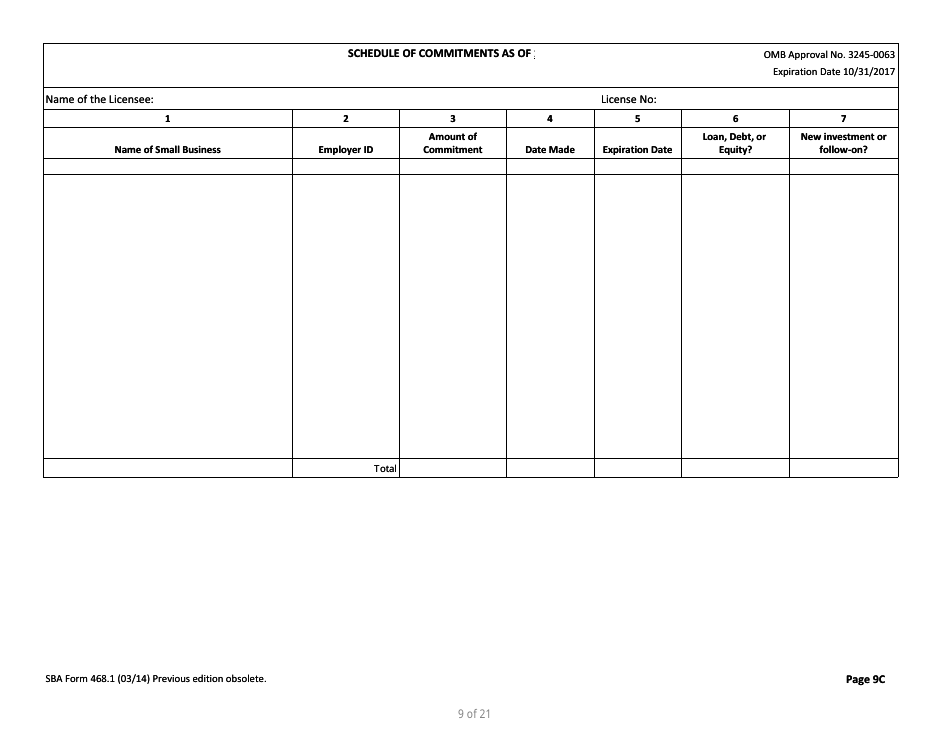

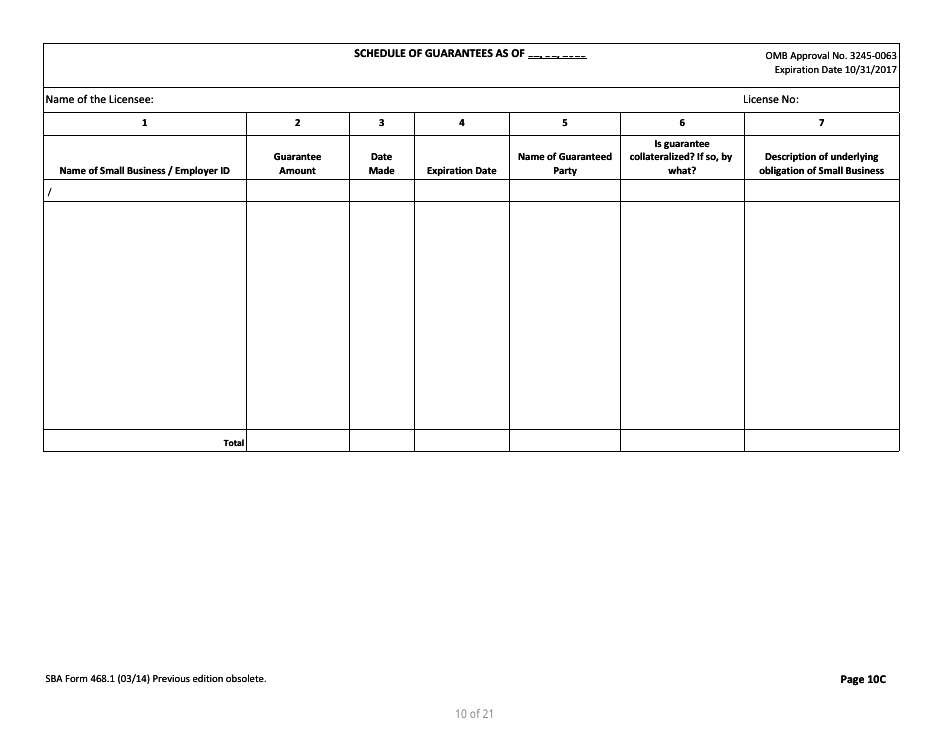

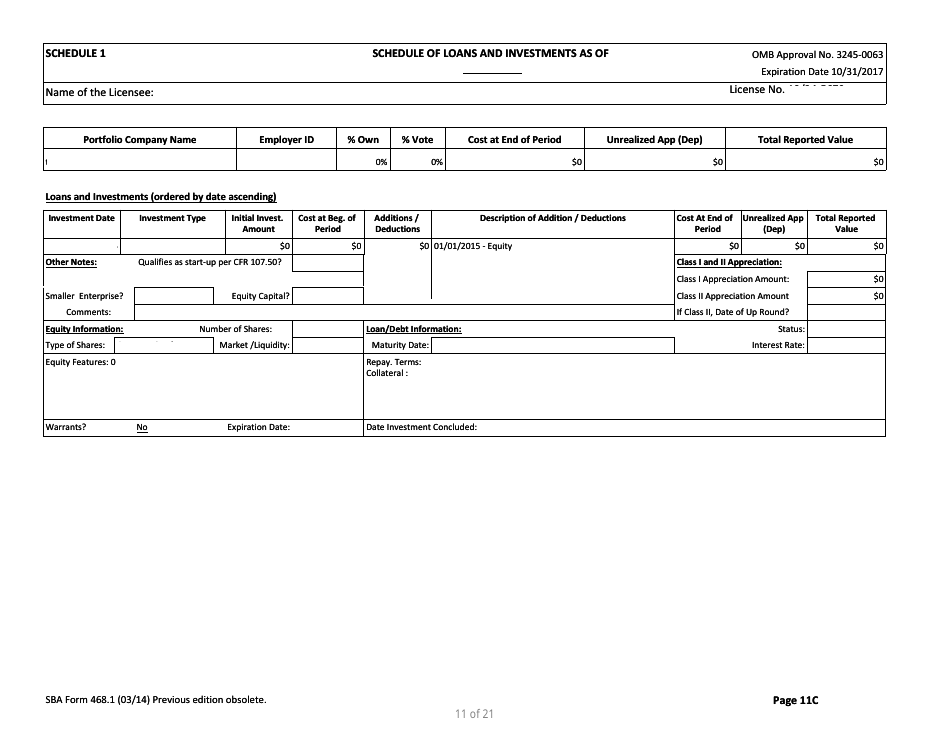

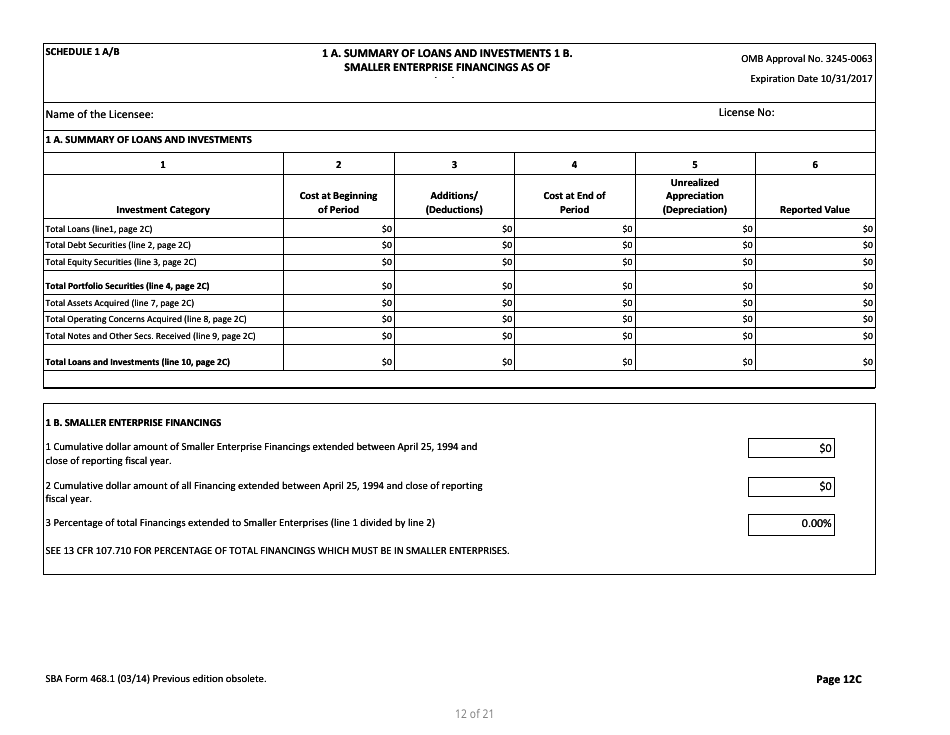

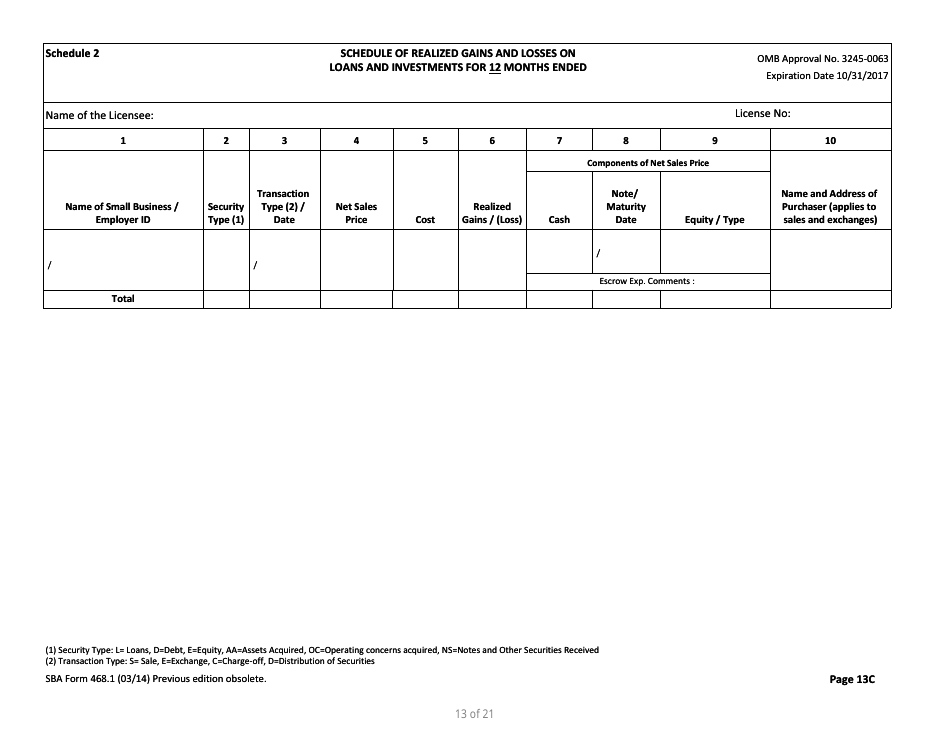

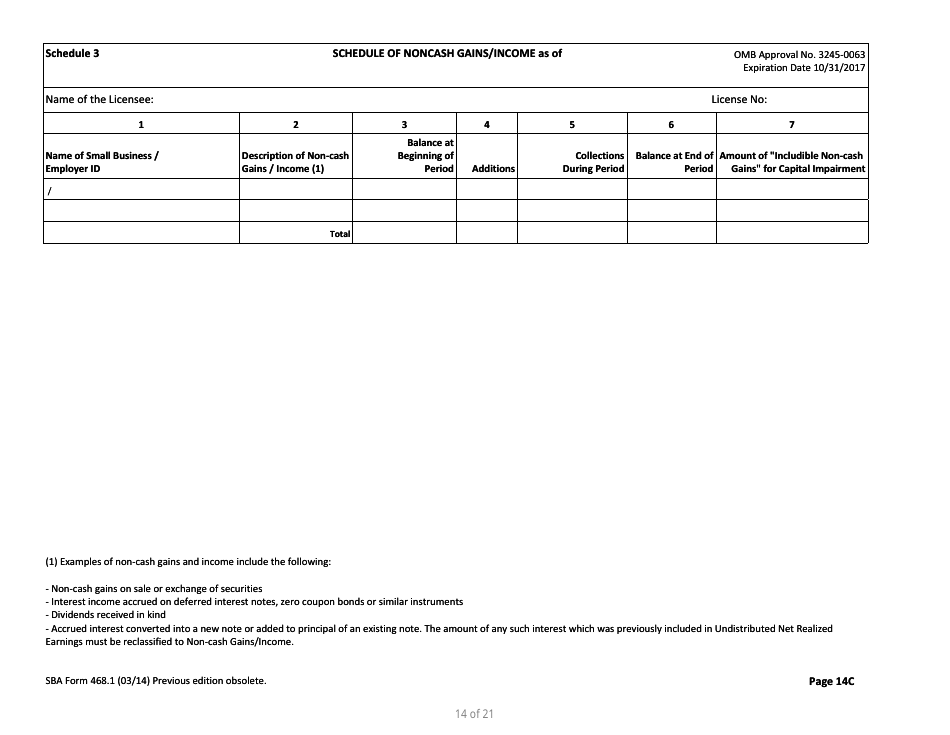

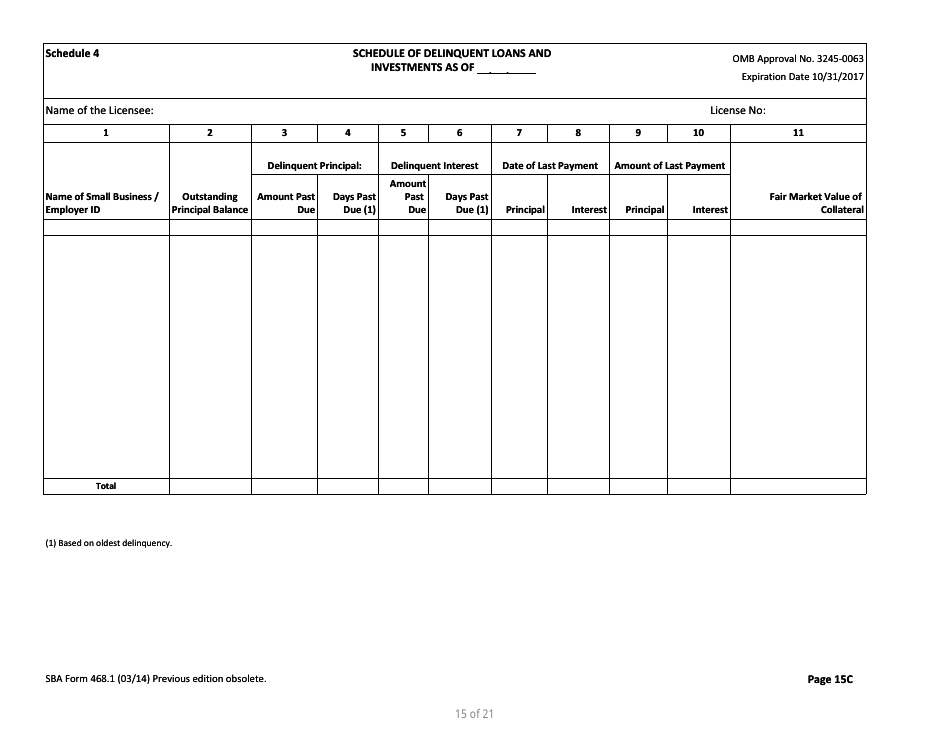

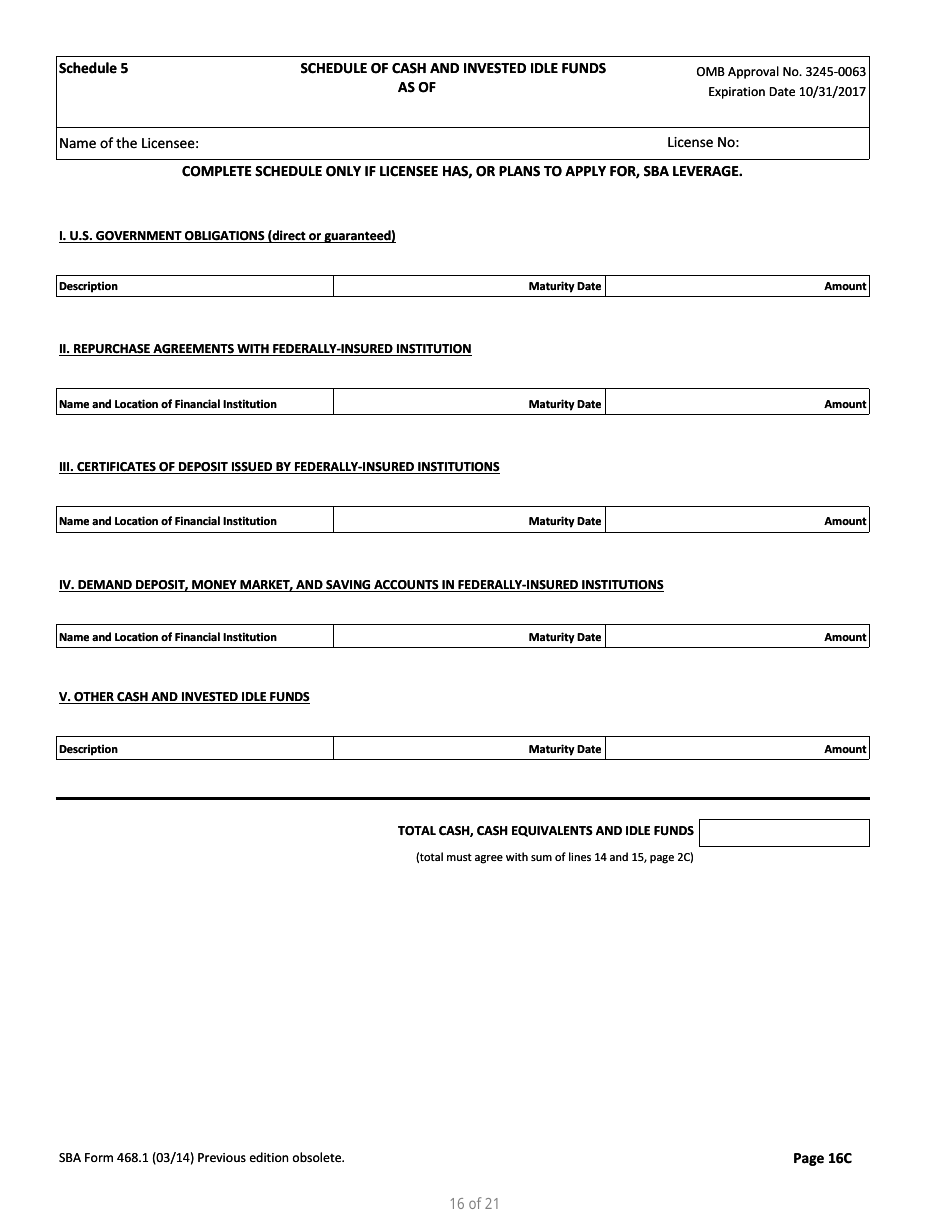

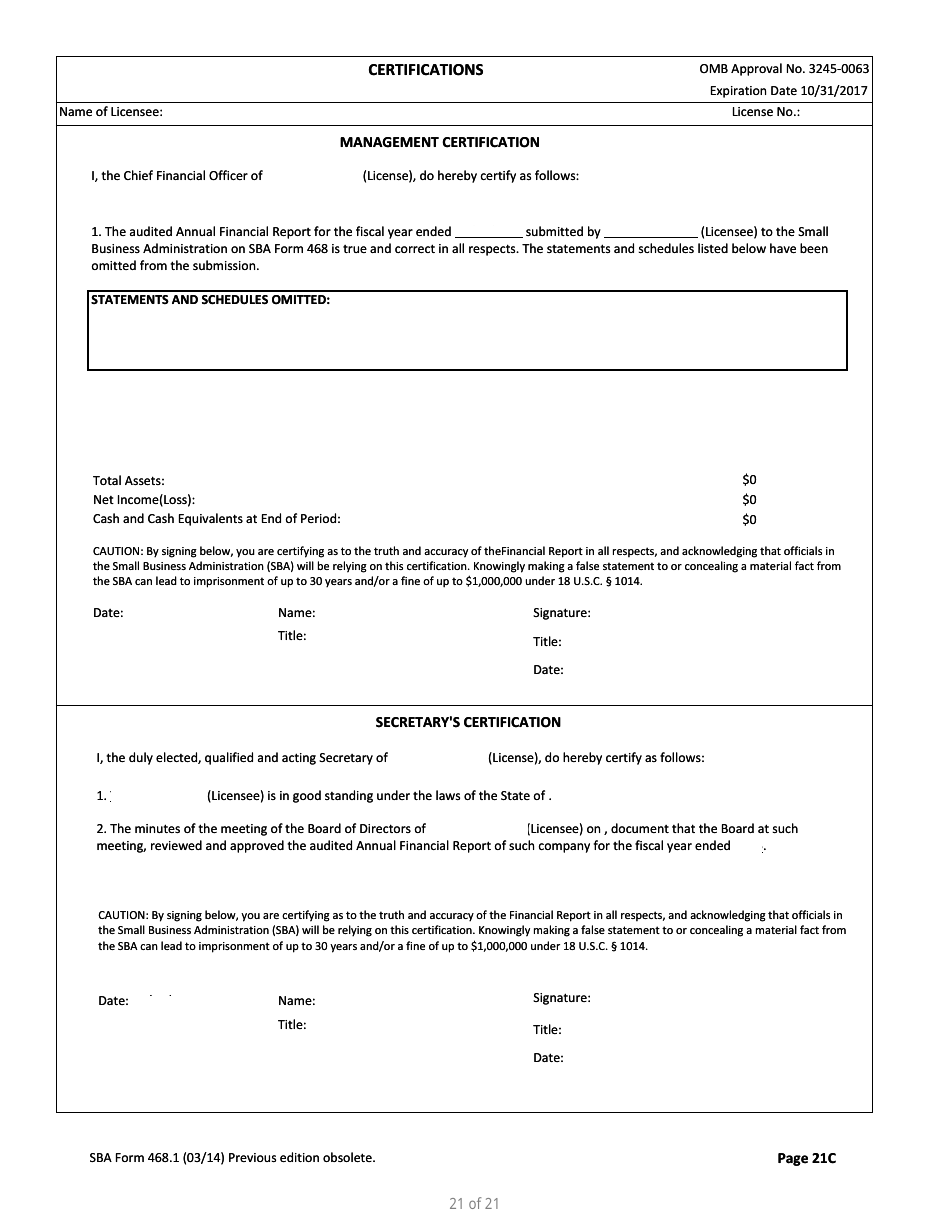

A complete report consists of the data files created by the electronic reporting software (including a supplementary Excel spreadsheet), two sets of software-generated schedules (with signed management certifications and a supplementary Excel file), the Independent Auditor's Report, the Notes to Financial Statements, and two copies of an Operating Plan Update narrative.

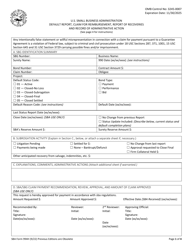

Send all software-generated files to the SBA Office of Investment by email at sbic@sba.gov or on a CD or diskette directly to their mailing address at U.S. Small Business Administration, Office of Investment, 409 3rd Street SW, Suite 6300, Washington, DC 20416.

For emails, the subject line must contain the name of the SBIC Licensee and the timeframe of the report. All SBA Form 468 files should have a file extension of *.sba or be created entirely in PDF format.

SBA Form 468.1 Related Publications: