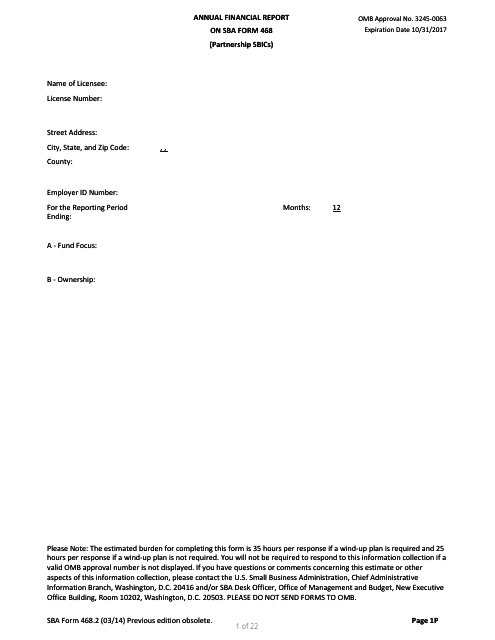

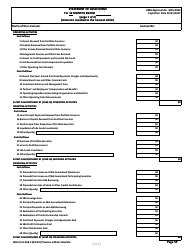

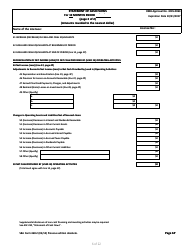

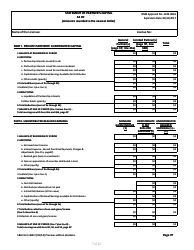

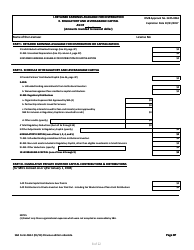

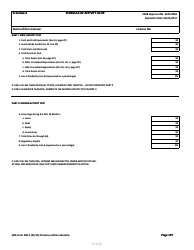

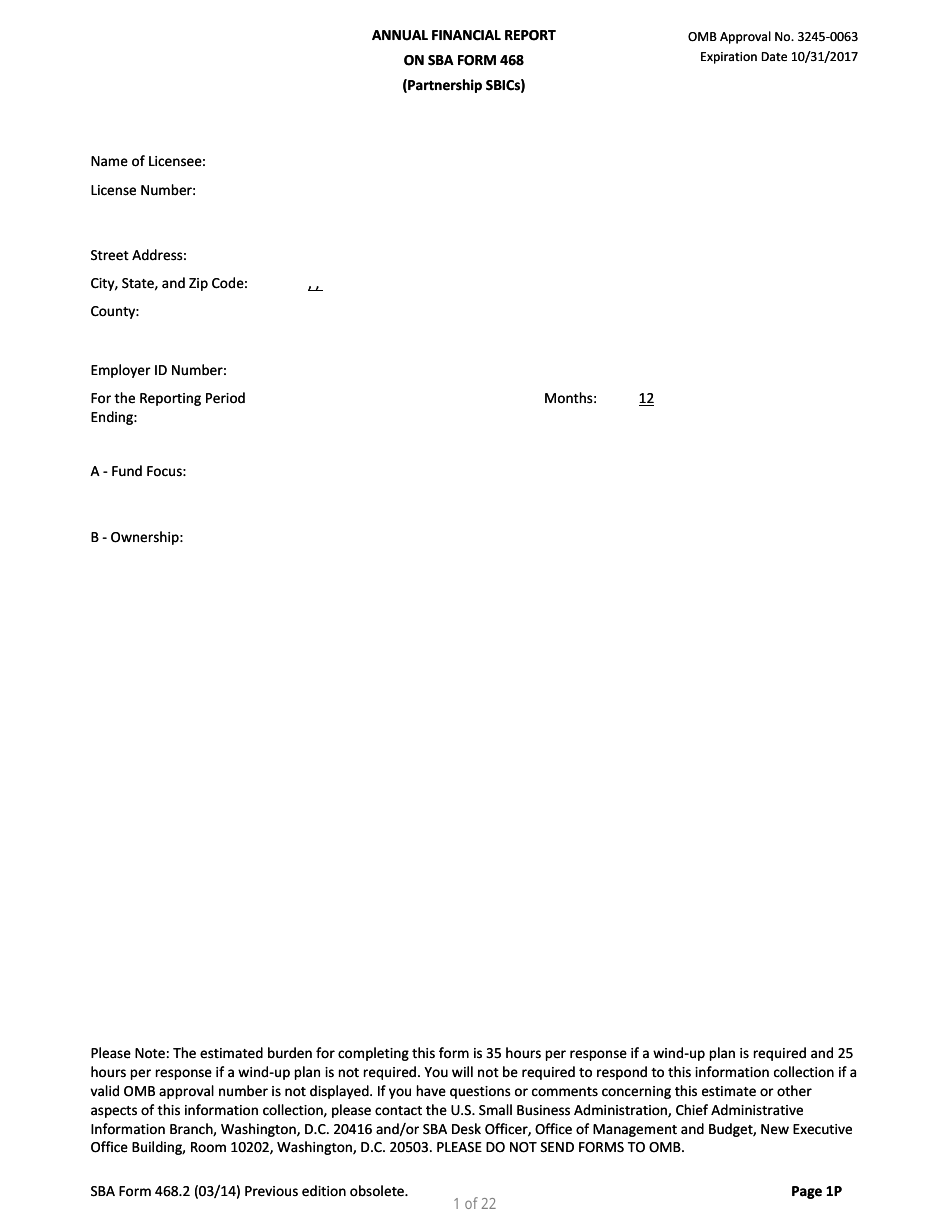

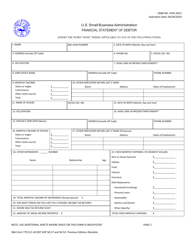

SBA Form 468.2 Partnership Annual Financial Report

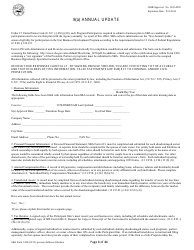

What Is SBA Form 468.2?

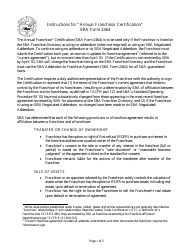

This is a legal form that was released by the U.S. Small Business Administration on March 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 468.2?

A: SBA Form 468.2 is the Partnership Annual Financial Report.

Q: Who needs to file SBA Form 468.2?

A: Partnerships need to file SBA Form 468.2.

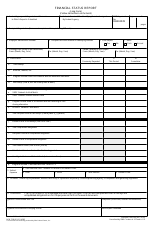

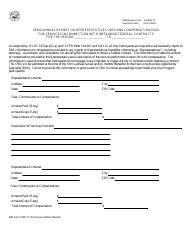

Q: What is the purpose of SBA Form 468.2?

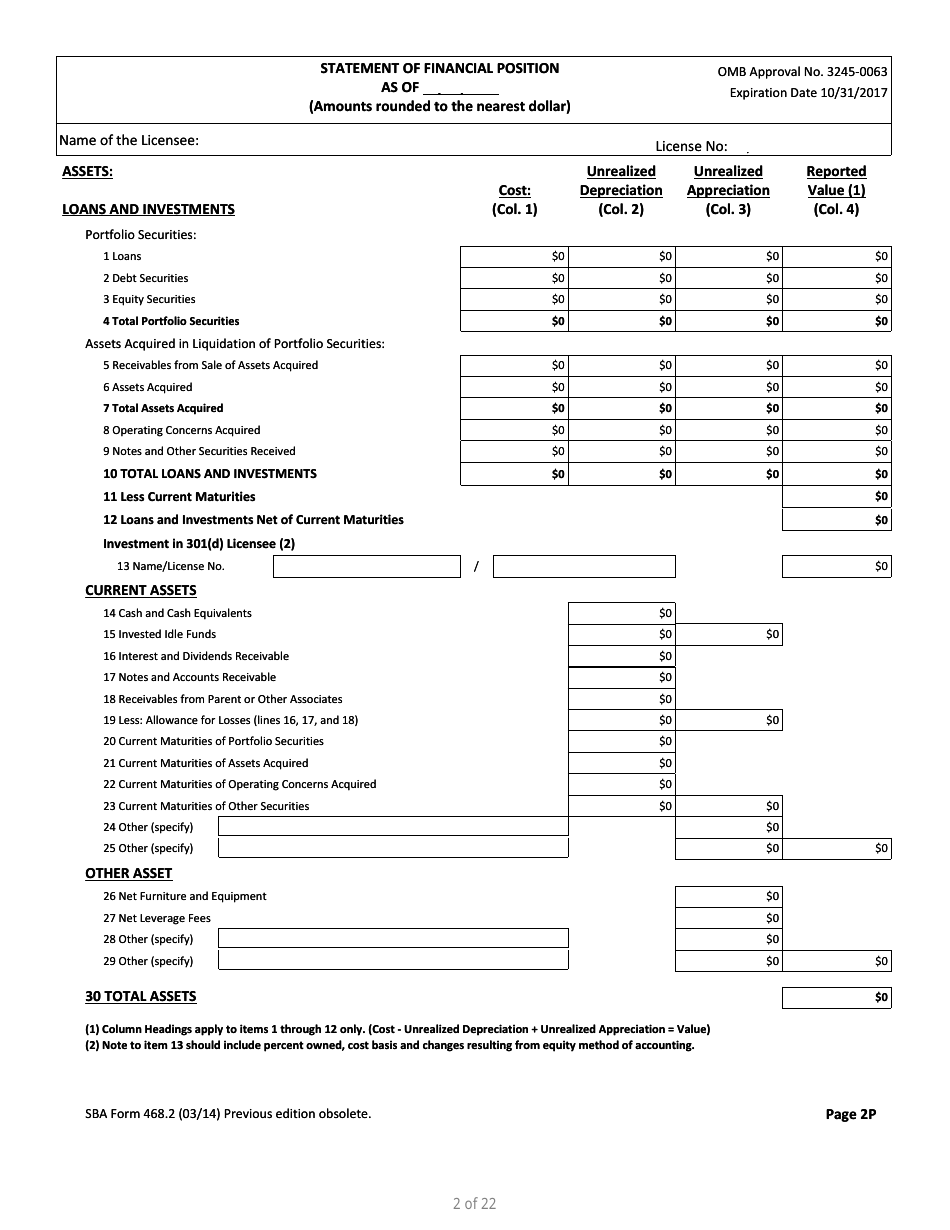

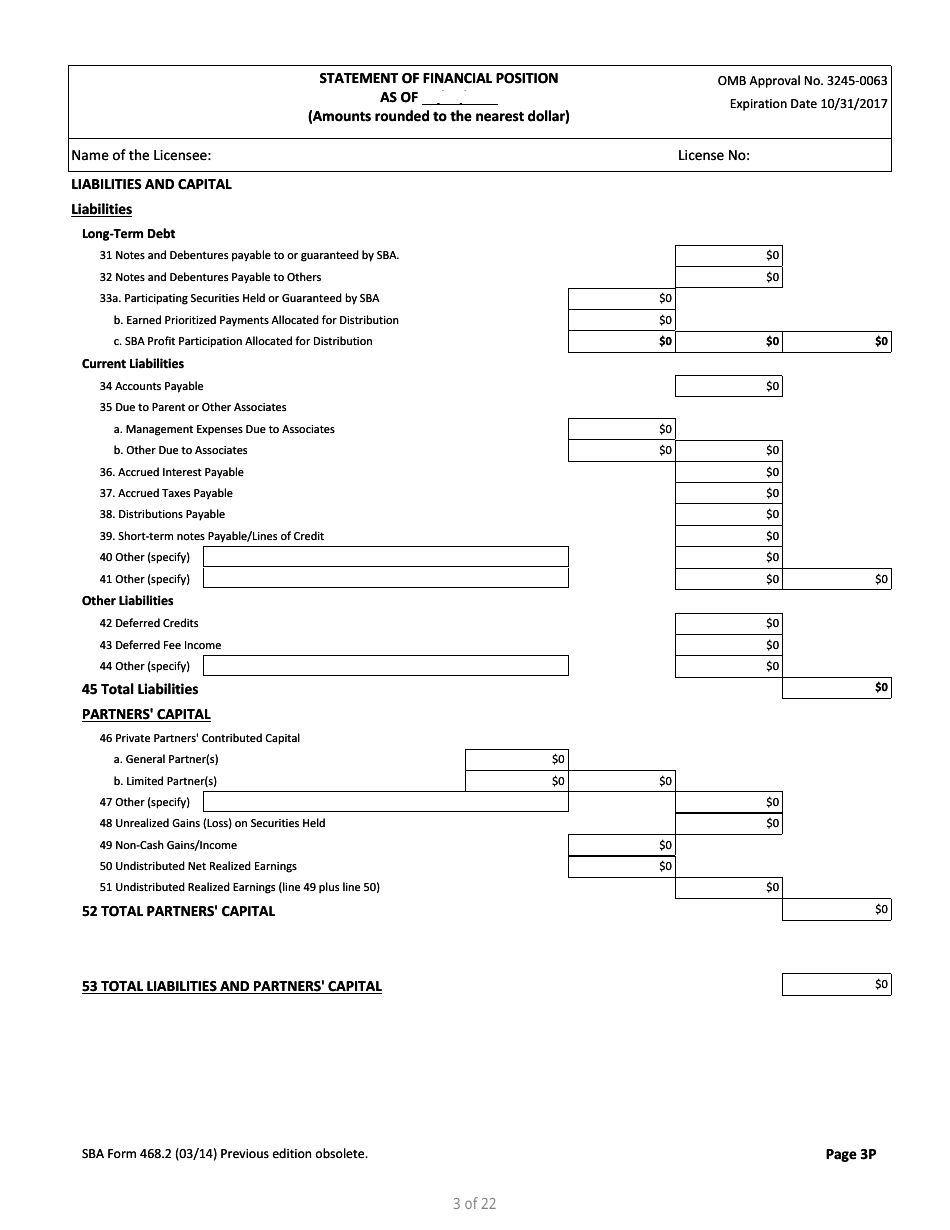

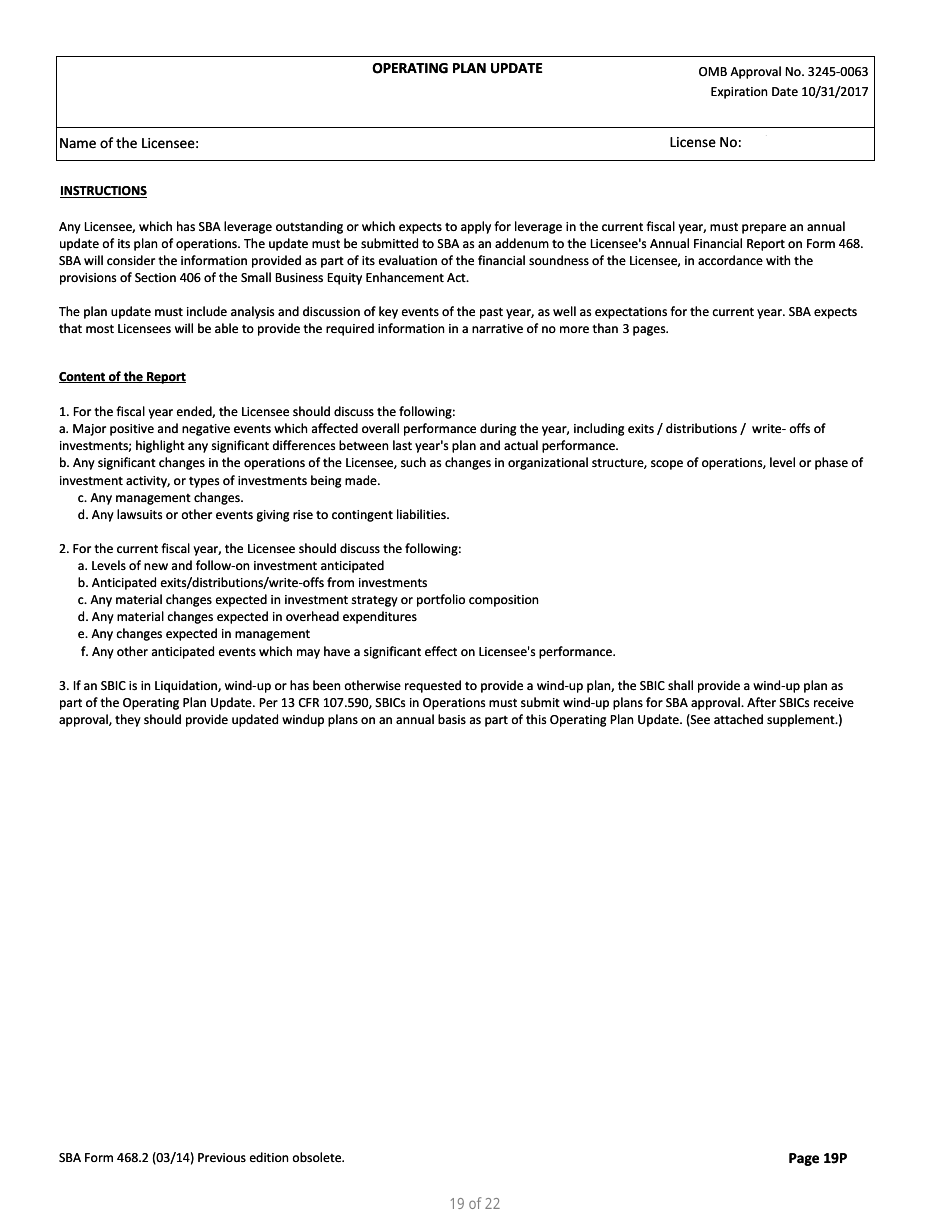

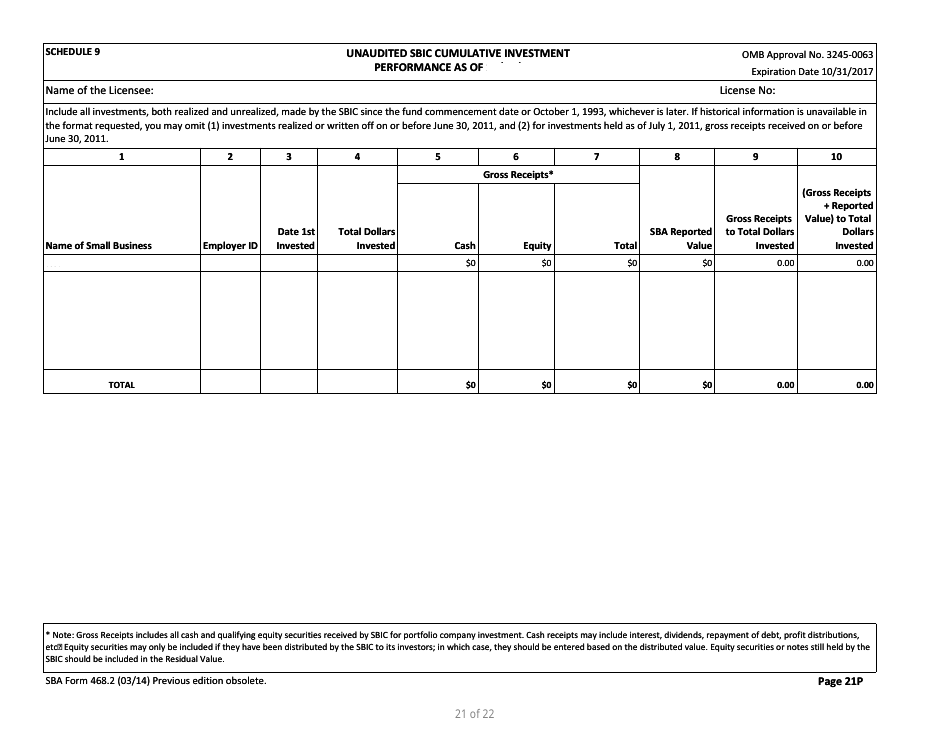

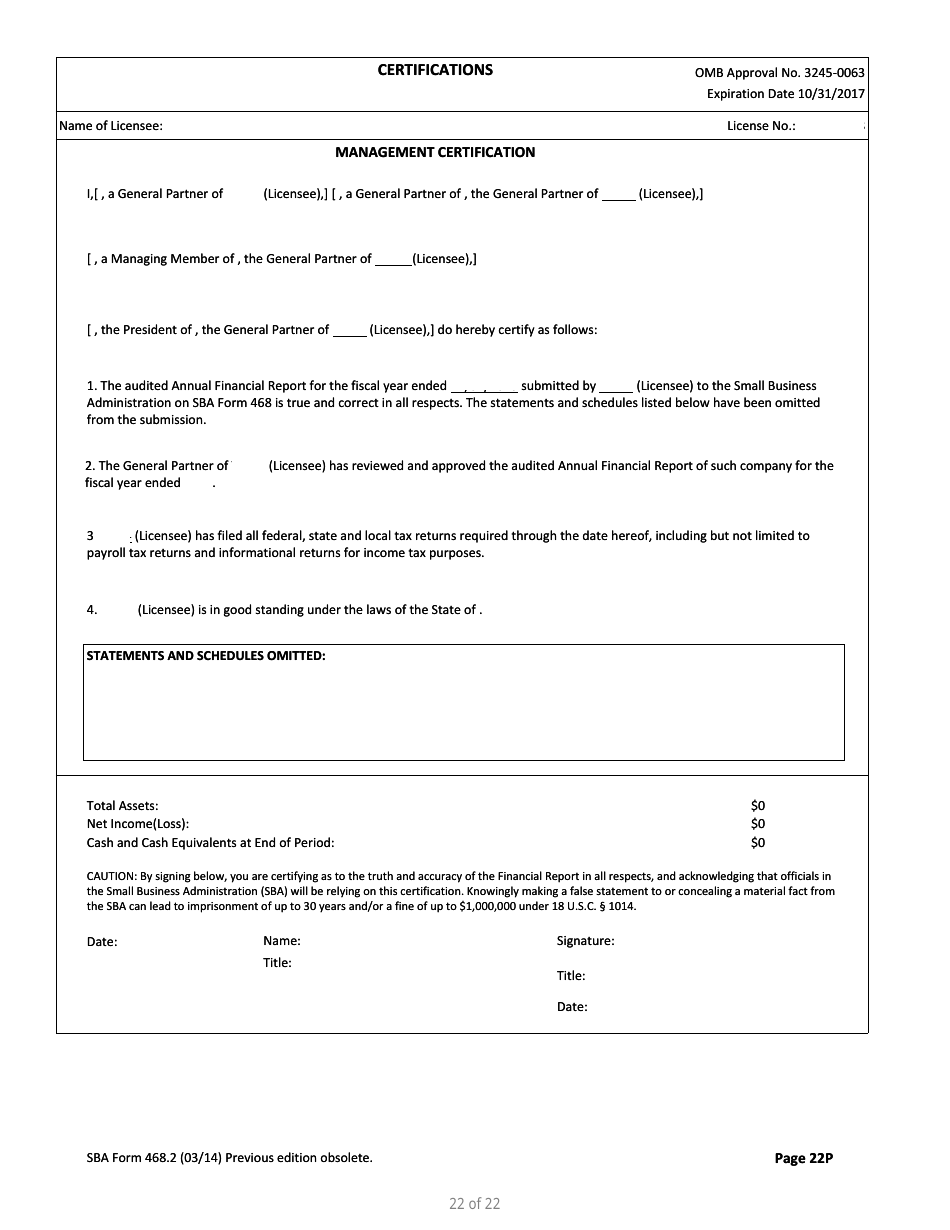

A: The purpose of SBA Form 468.2 is to report the annual financial information of a partnership.

Q: Are there any fees associated with filing SBA Form 468.2?

A: No, there are no fees associated with filing SBA Form 468.2.

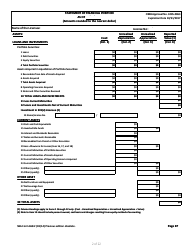

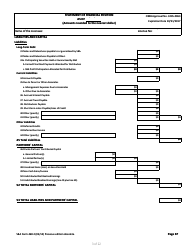

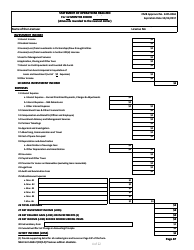

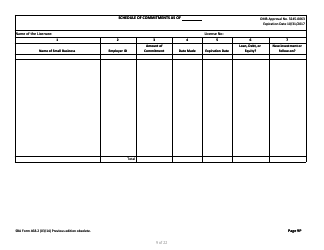

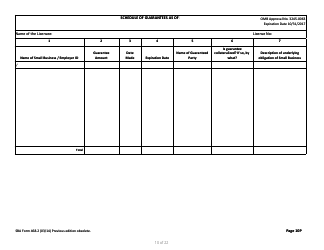

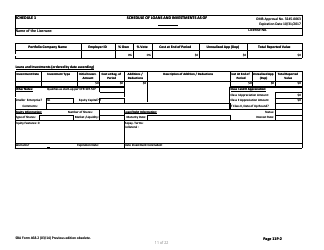

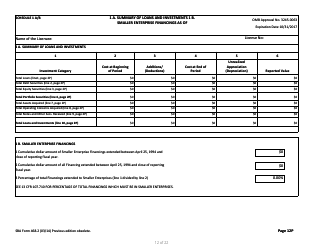

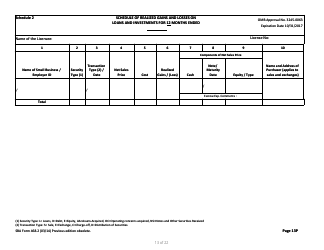

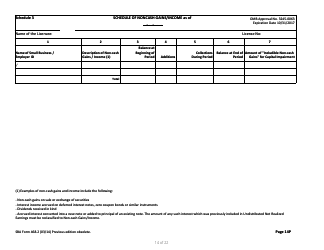

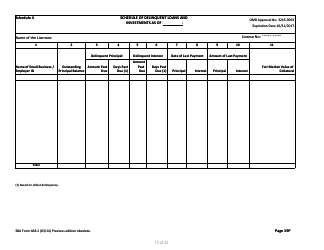

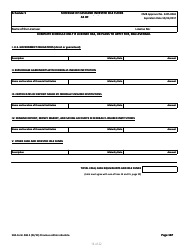

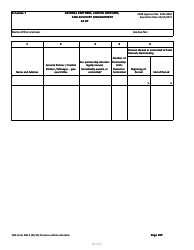

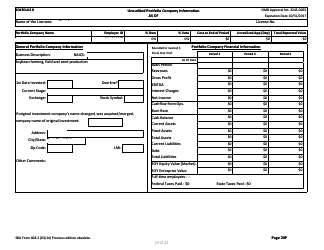

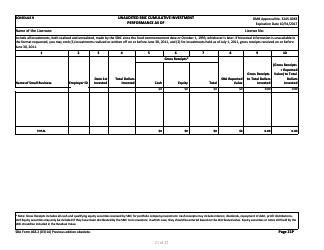

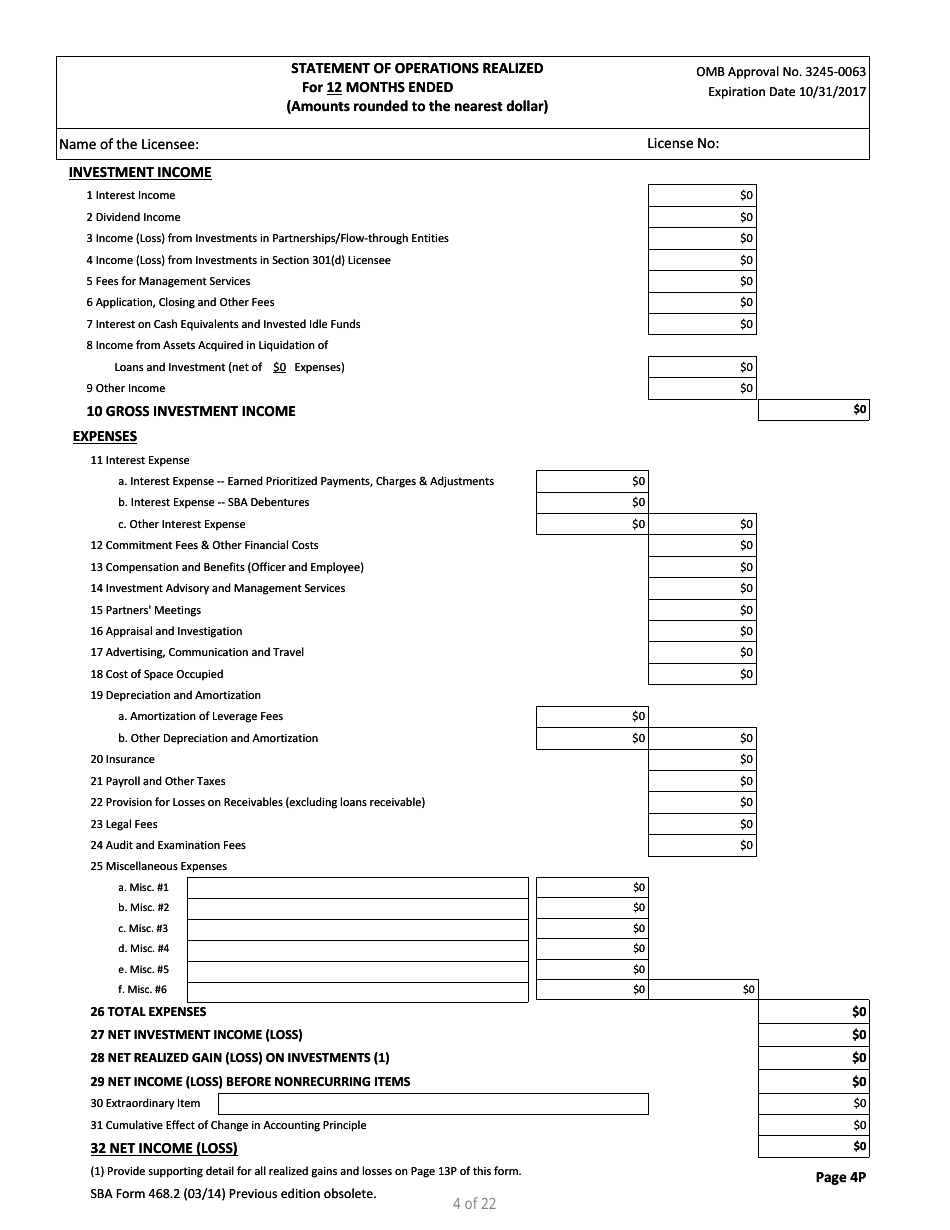

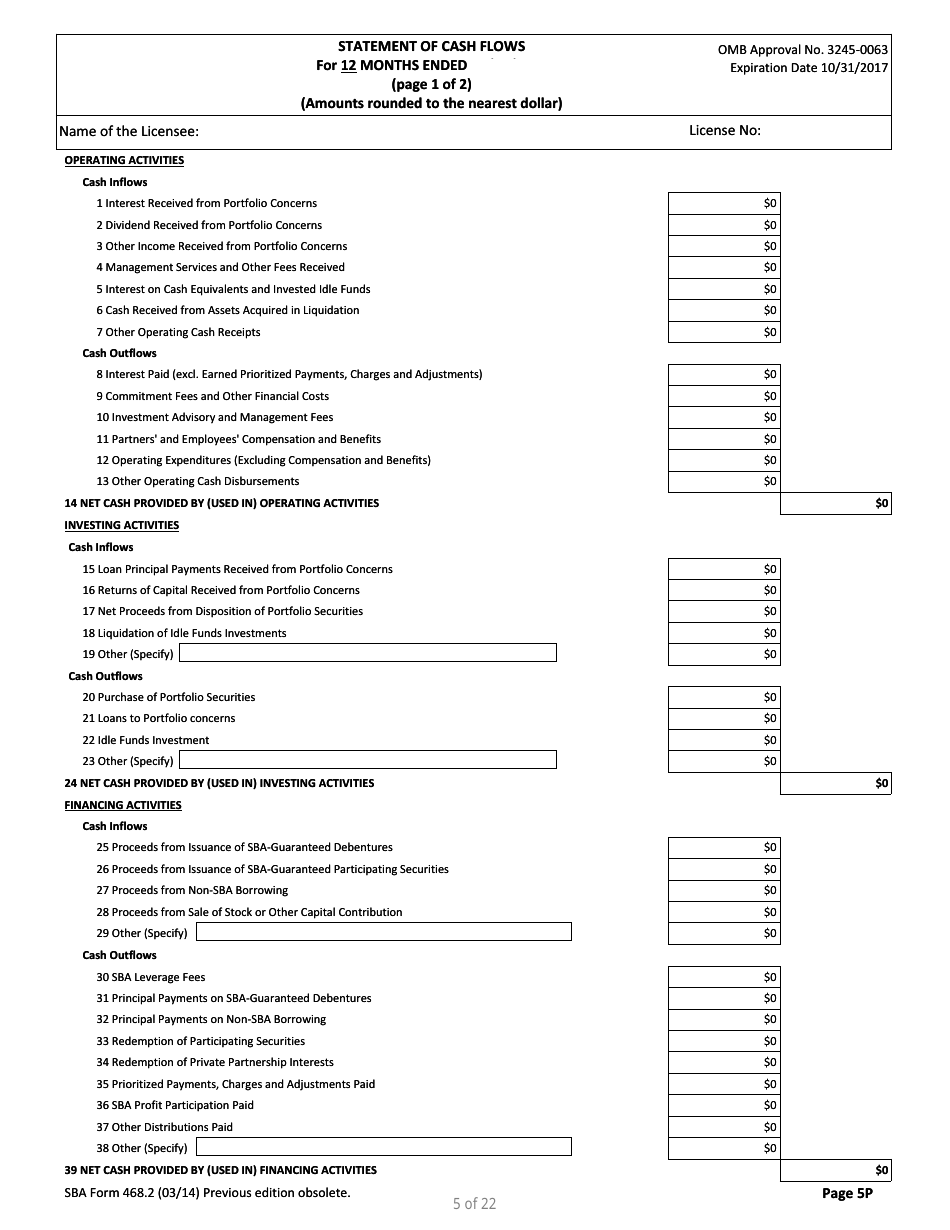

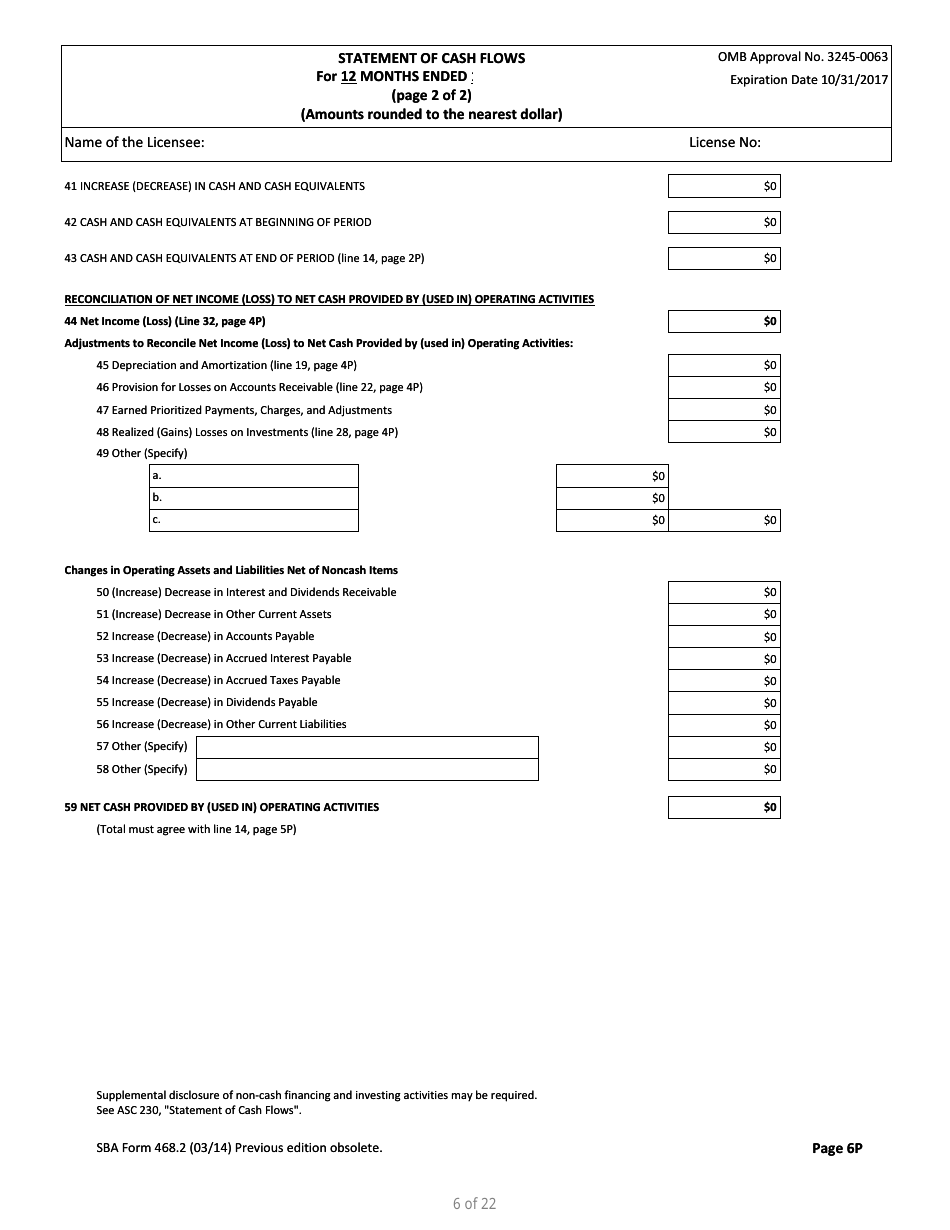

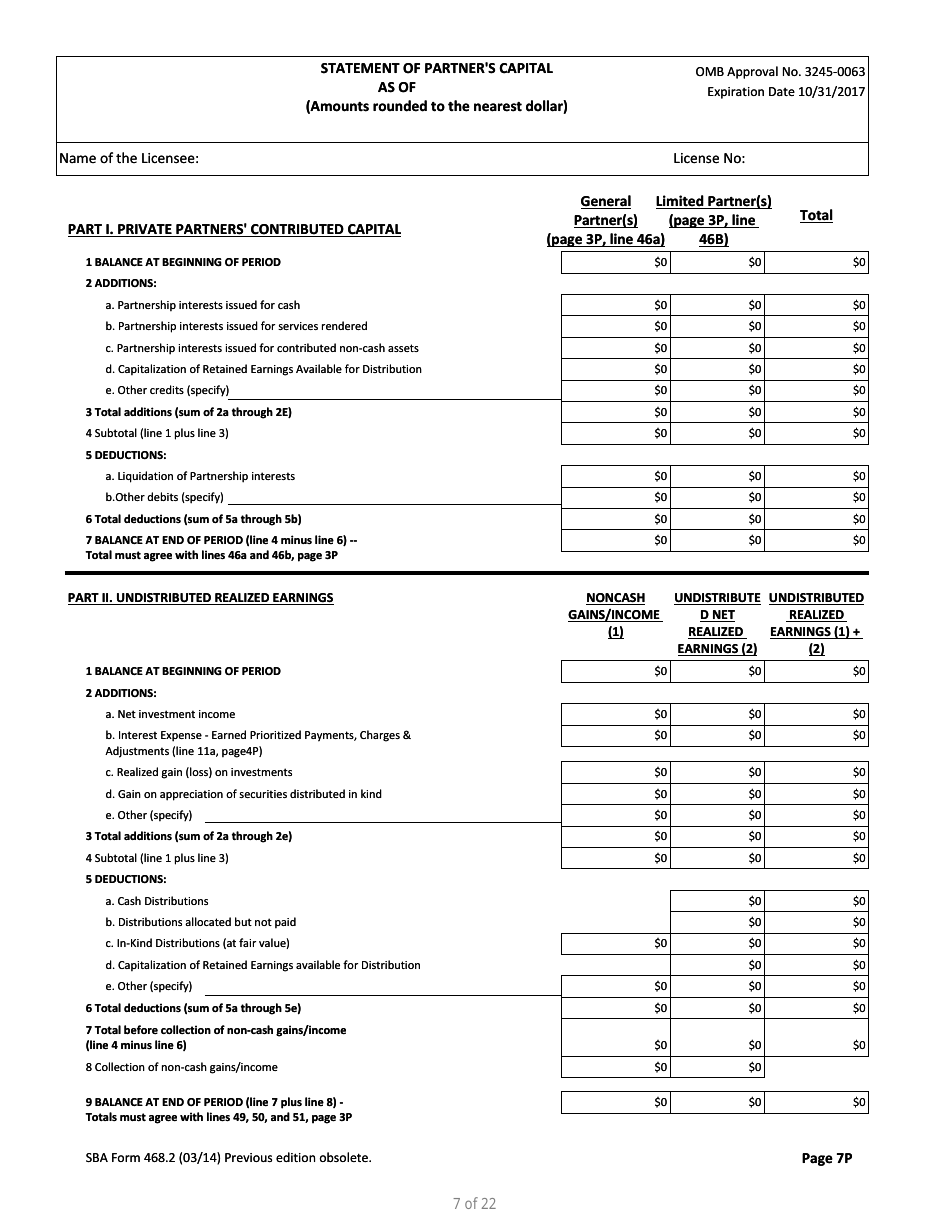

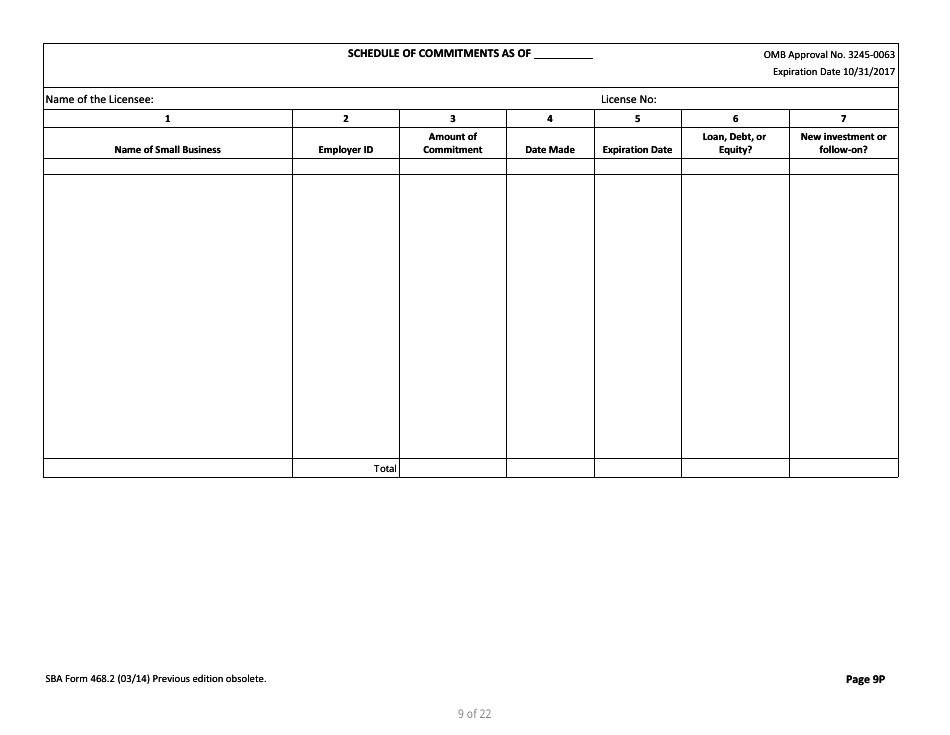

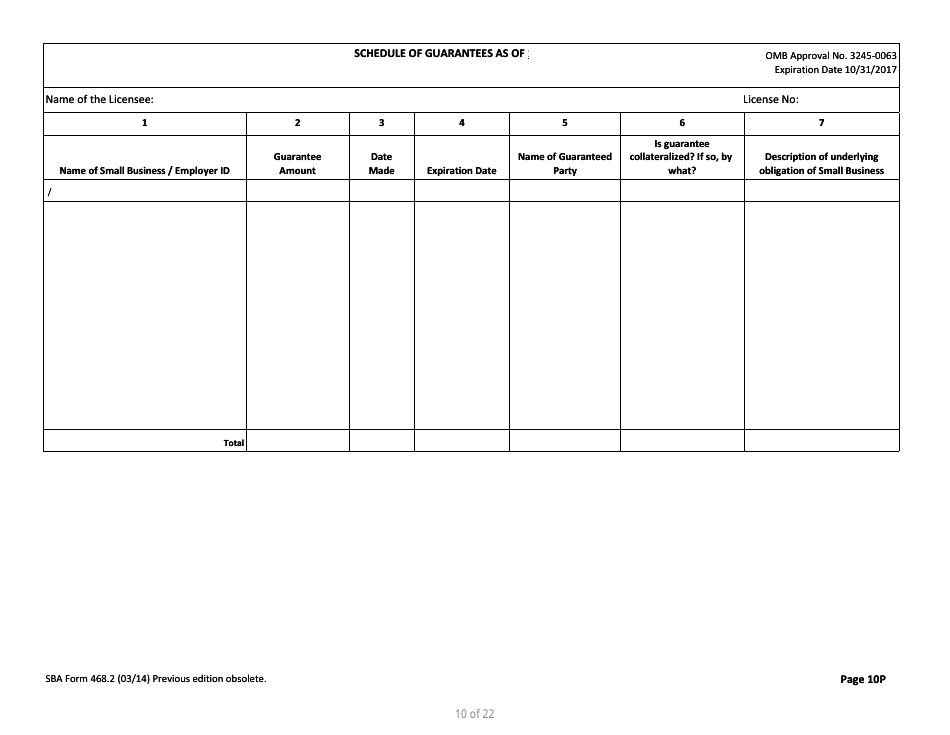

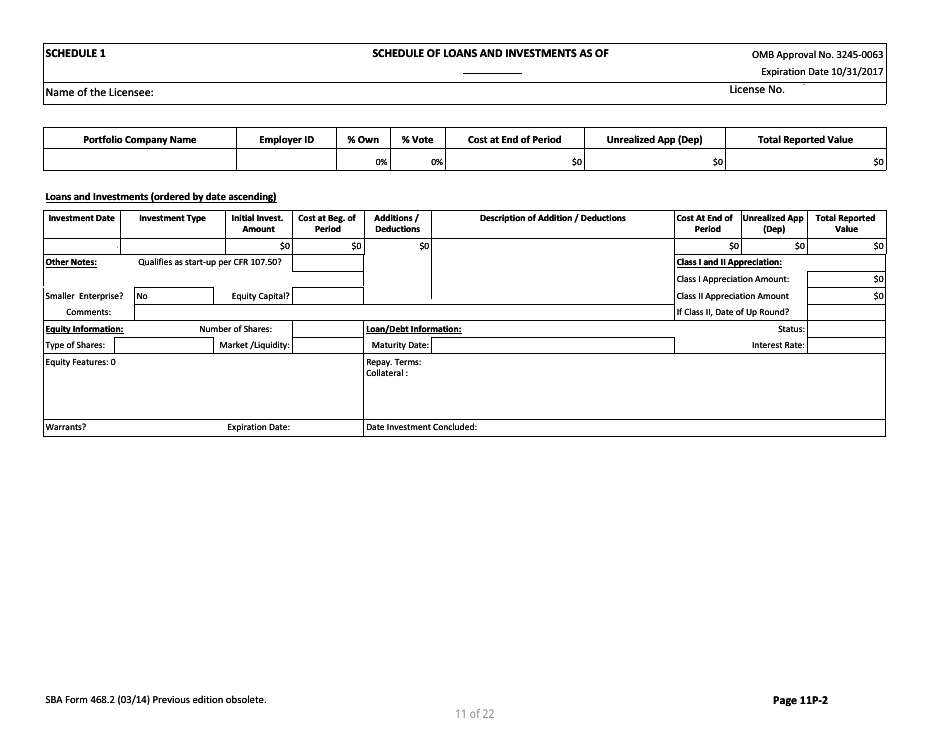

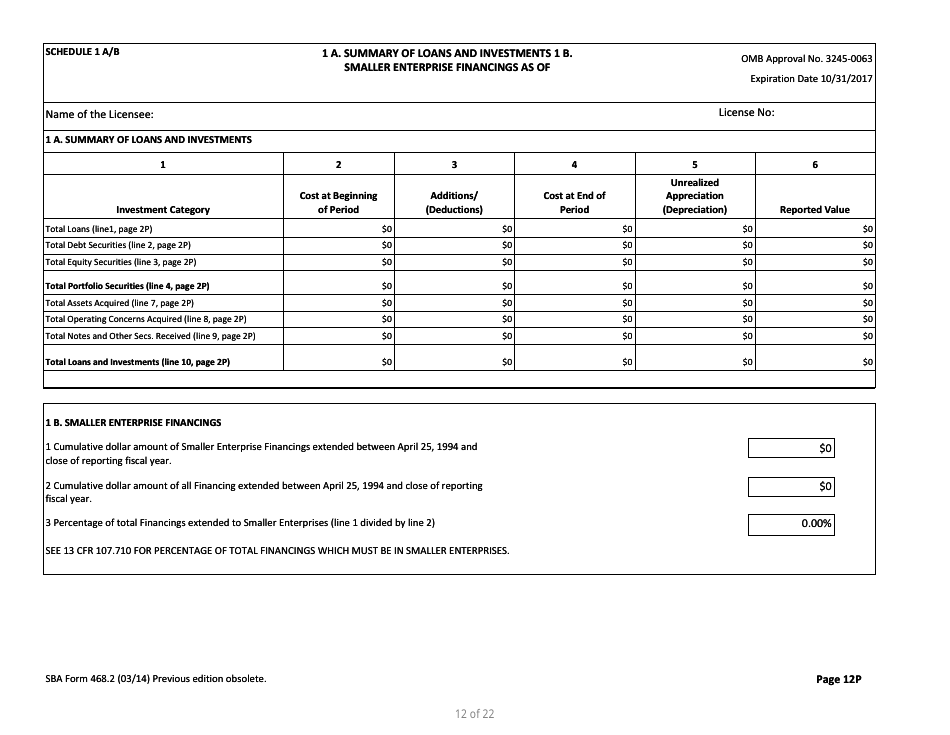

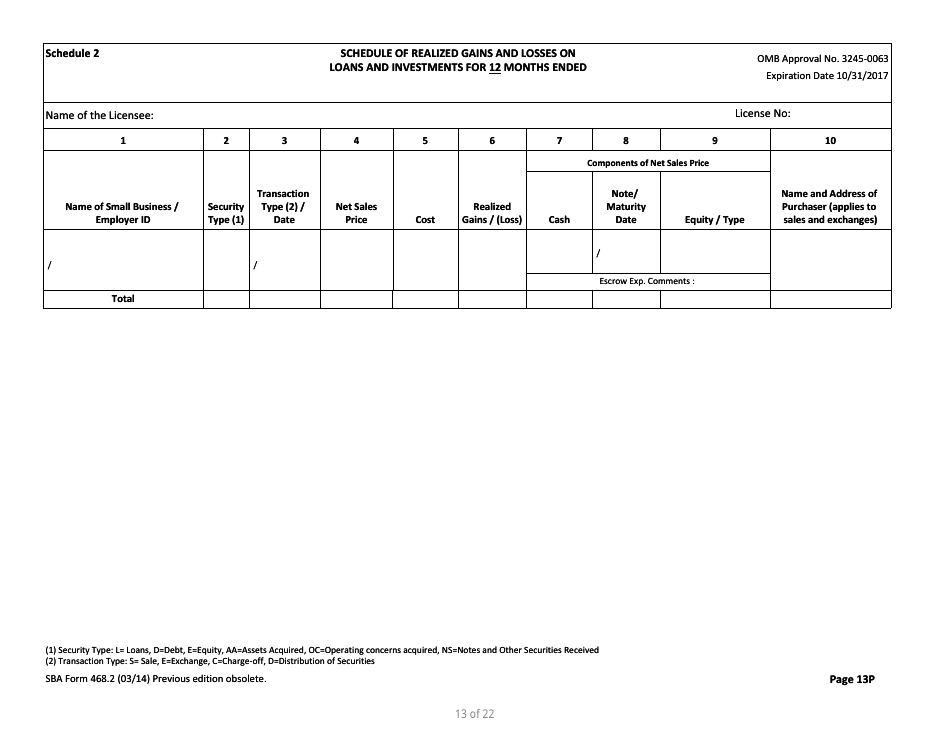

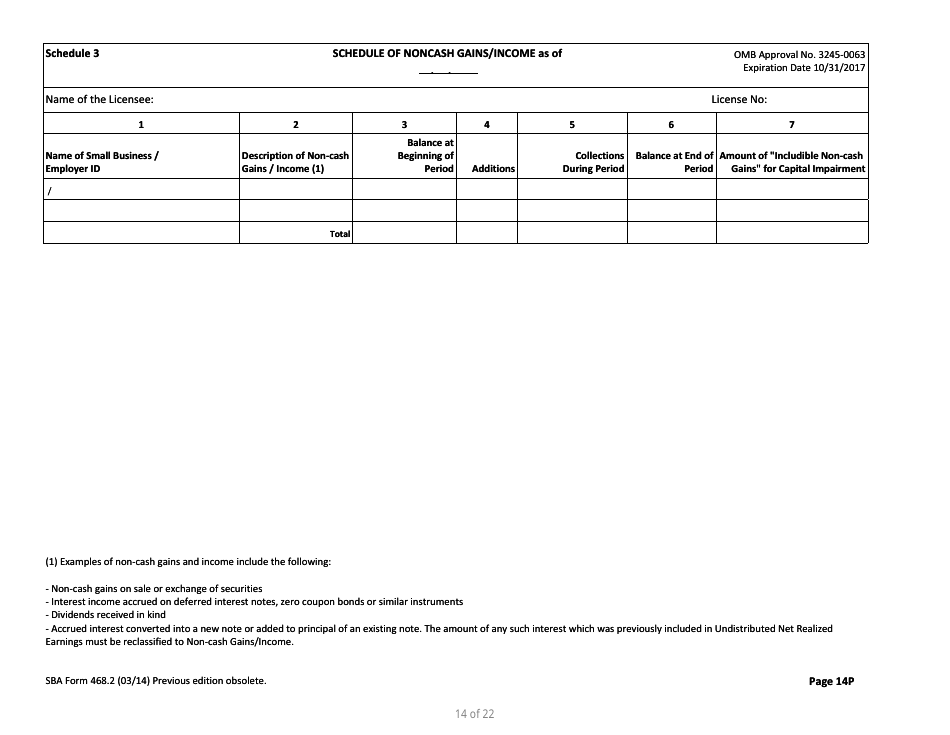

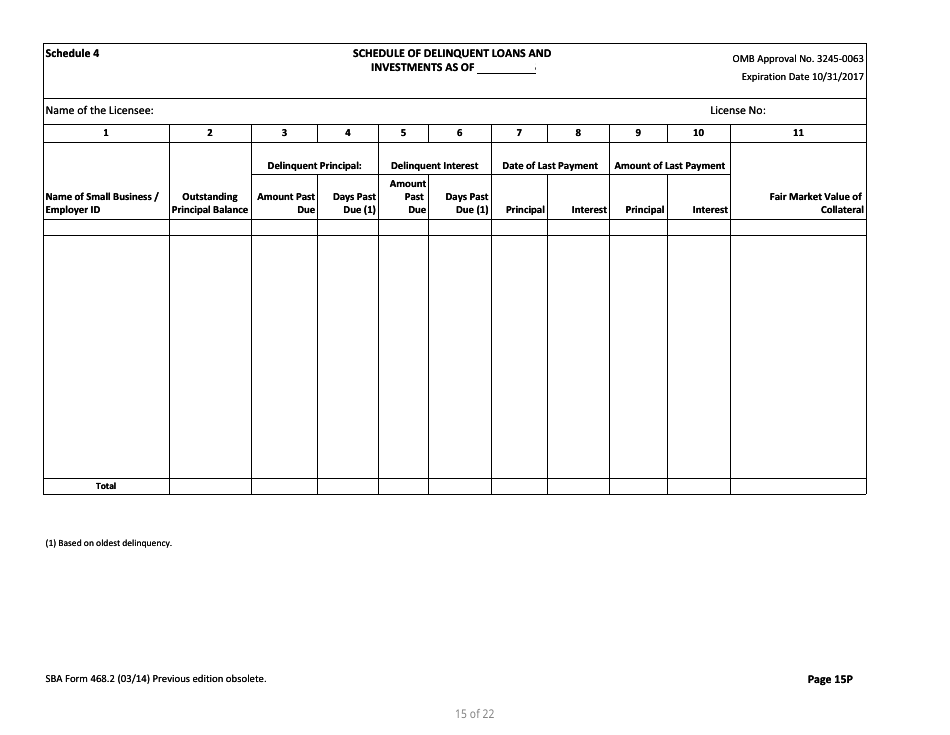

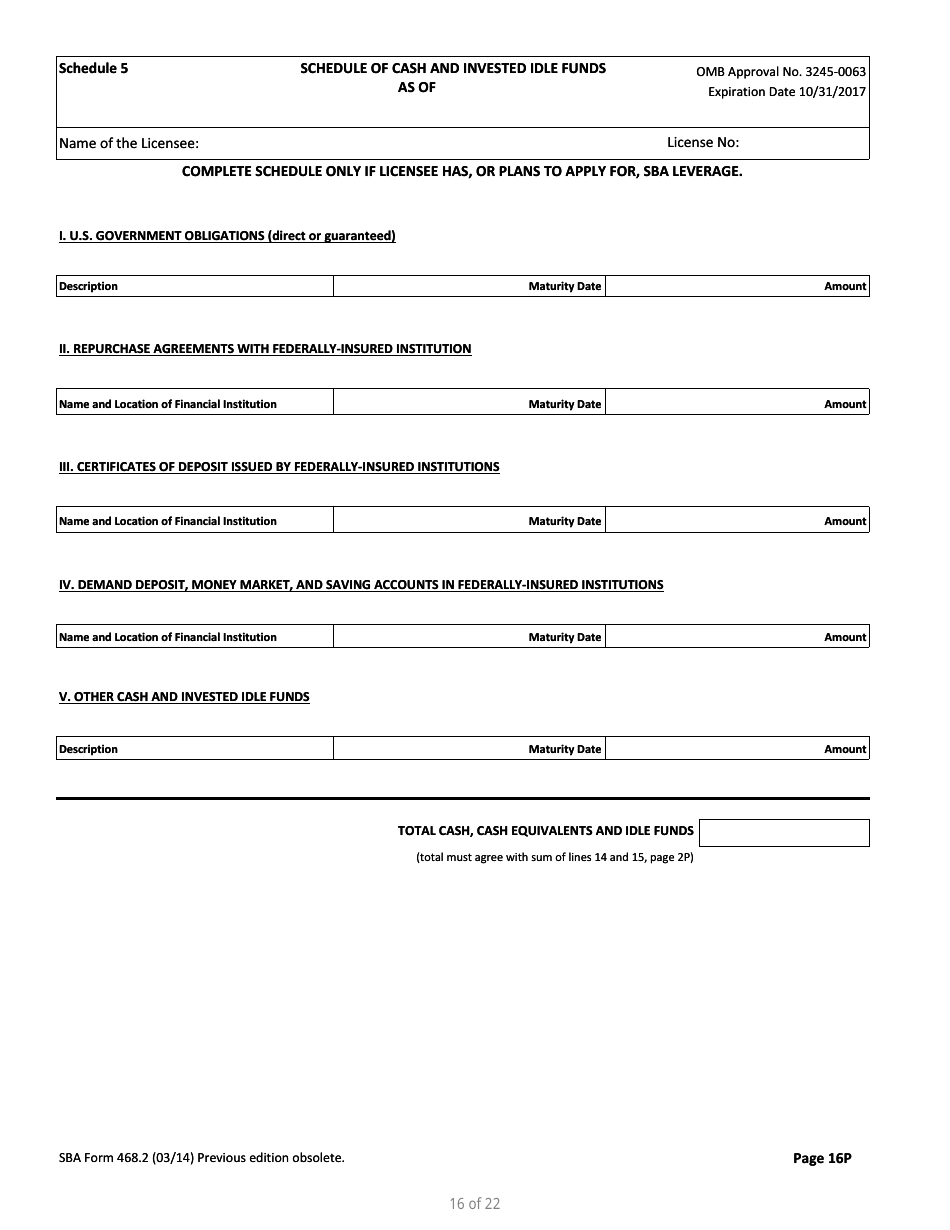

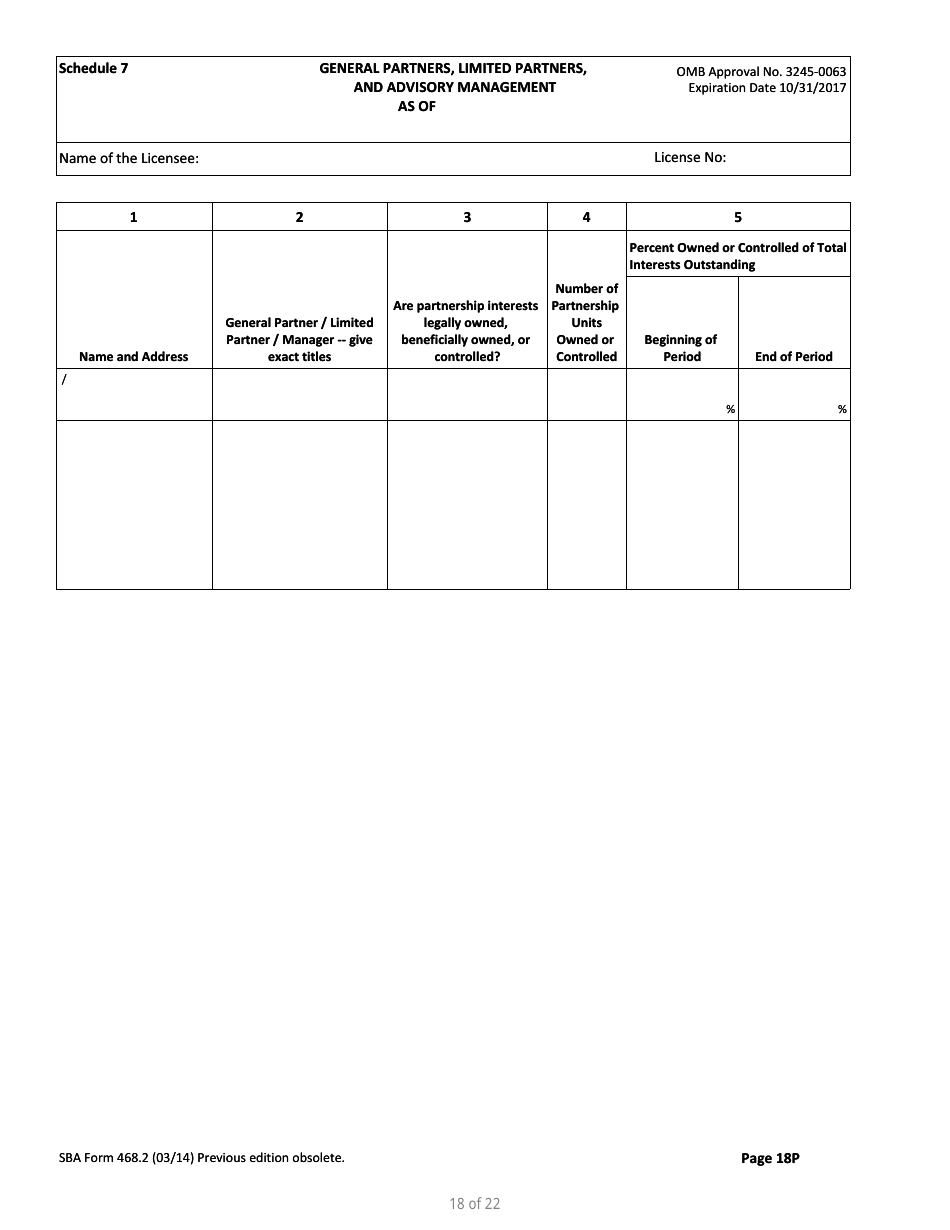

Q: What information is required on SBA Form 468.2?

A: SBA Form 468.2 requires information such as the partnership's income and expenses, assets and liabilities, and details about partners and ownership.

Q: When is SBA Form 468.2 due?

A: The due date for filing SBA Form 468.2 may vary, so it's important to check with the SBA or your local SBA office for specific deadlines.

Q: Is SBA Form 468.2 mandatory?

A: Yes, filing SBA Form 468.2 is mandatory for partnerships.

Q: What happens if I don't file SBA Form 468.2?

A: Failure to file SBA Form 468.2 may result in penalties or legal consequences, so it's important to comply with the filing requirements.

Form Details:

- Released on March 1, 2014;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of SBA Form 468.2 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.