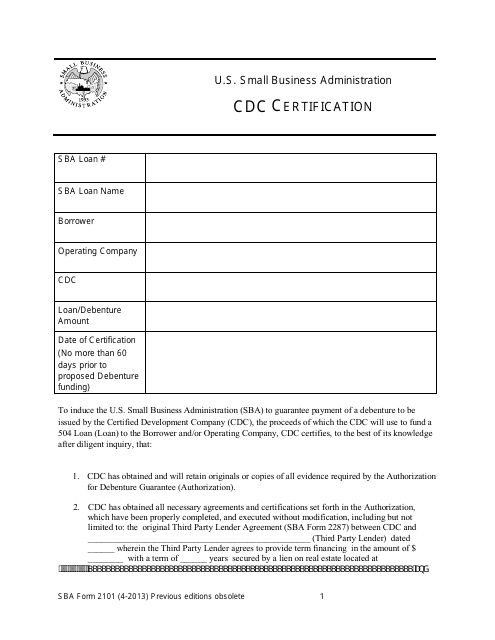

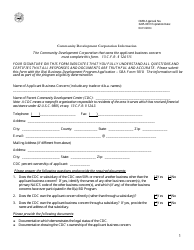

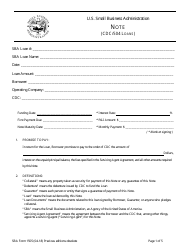

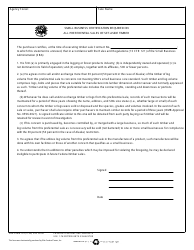

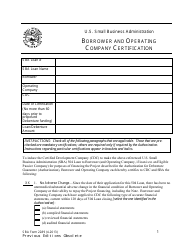

SBA Form 2101 CDC Certification

What Is SBA Form 2101?

This is a legal form that was released by the U.S. Small Business Administration on April 1, 2013 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 2101?

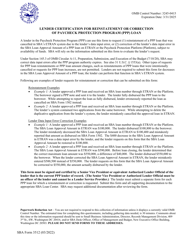

A: SBA Form 2101 is a form used for CDC (Certified Development Company) certification.

Q: What is CDC certification?

A: CDC certification refers to the certification of a CDC by the Small Business Administration (SBA).

Q: Why is CDC certification necessary?

A: CDC certification is necessary for CDCs to participate in the SBA 504 Loan Program.

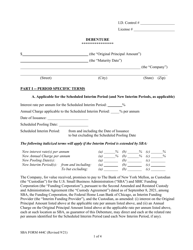

Q: What is the SBA 504 Loan Program?

A: The SBA 504 Loan Program is a long-term financing program for small businesses to acquire major fixed assets.

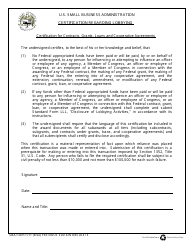

Q: What information is required on SBA Form 2101?

A: SBA Form 2101 requires information about the CDC's management, ownership, finances, and compliance with SBA regulations.

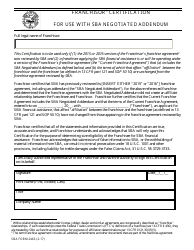

Q: Who is eligible for CDC certification?

A: Non-profit or for-profit corporations or similar organizations that meet the SBA's requirements can apply for CDC certification.

Q: How long does CDC certification last?

A: CDC certification is valid for a period of three years.

Q: What are the benefits of CDC certification?

A: CDC certification allows CDCs to participate in the SBA 504 Loan Program and access funds for small business financing.

Q: Are there any fees associated with CDC certification?

A: Yes, there are fees associated with CDC certification. The specific fees can vary and should be confirmed with the SBA or your local CDC.

Form Details:

- Released on April 1, 2013;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 2101 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.