This version of the form is not currently in use and is provided for reference only. Download this version of

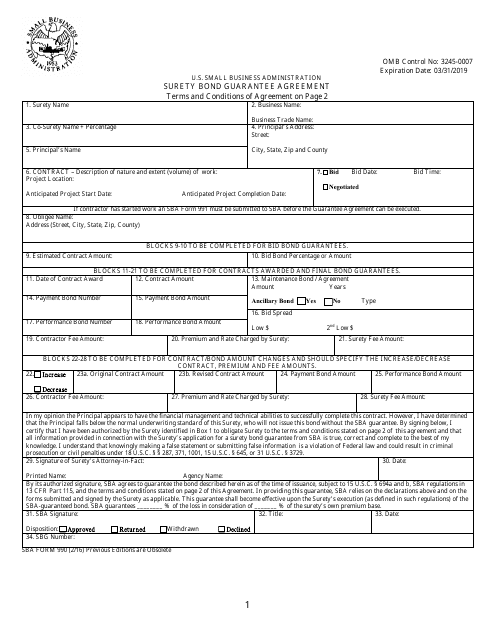

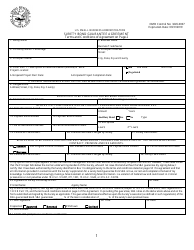

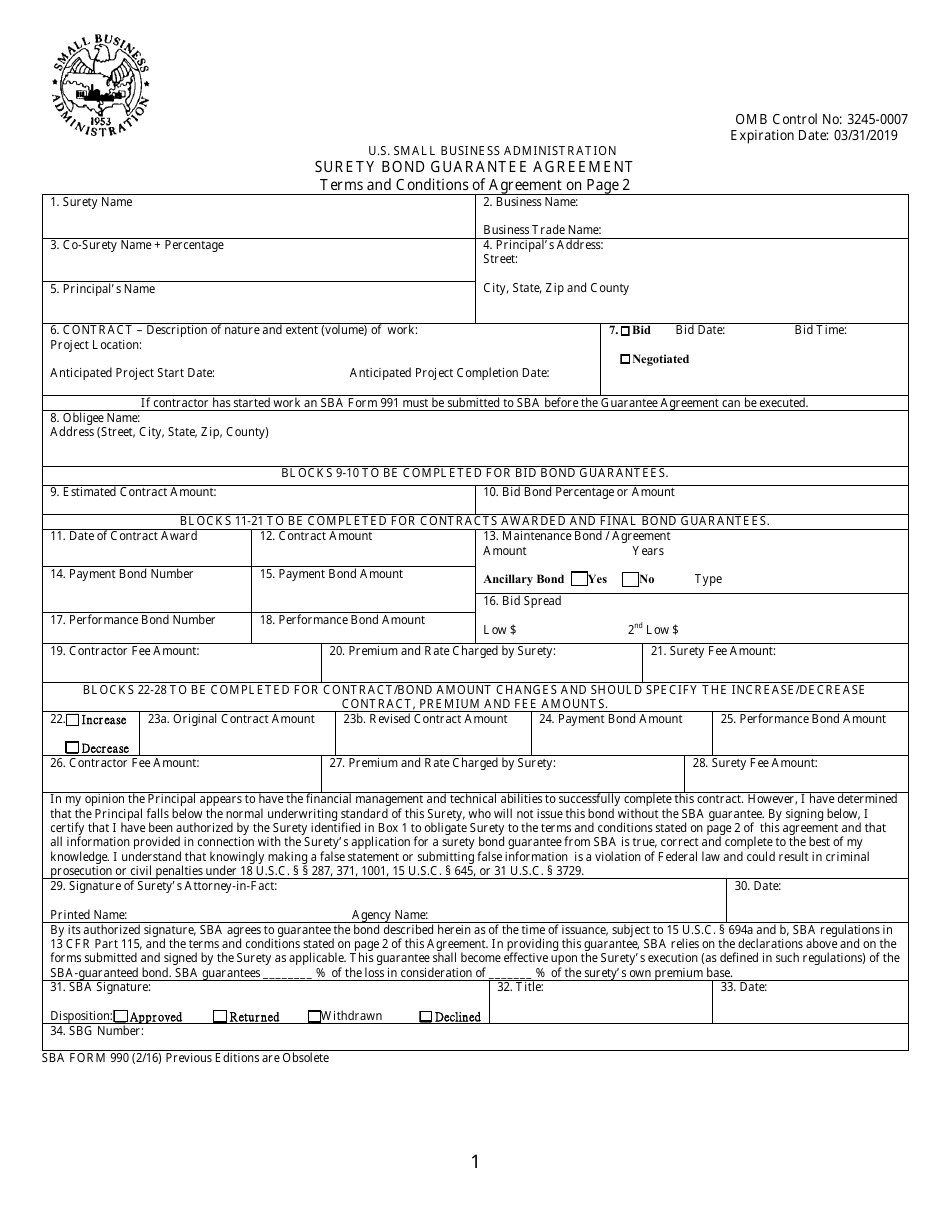

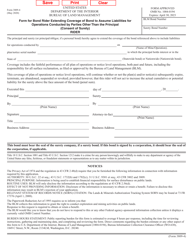

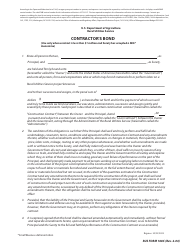

SBA Form 990

for the current year.

SBA Form 990 Surety Bond Guarantee Agreement

What Is SBA Form 990?

This is a legal form that was released by the U.S. Small Business Administration on February 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SBA Form 990 Surety Bond Guarantee Agreement?

A: The SBA Form 990 Surety Bond Guarantee Agreement is a form used by the Small Business Administration (SBA) to guarantee surety bonds for small businesses.

Q: Who needs to file the SBA Form 990 Surety Bond Guarantee Agreement?

A: Small businesses that require surety bonds may need to file the SBA Form 990.

Q: What is the purpose of the SBA Form 990 Surety Bond Guarantee Agreement?

A: The purpose of the SBA Form 990 is to provide a guarantee for surety bonds issued by approved sureties on behalf of small businesses.

Q: How does the SBA Form 990 Surety Bond Guarantee Agreement work?

A: The SBA guarantees a percentage of the surety bond issued by an approved surety company, providing assurance to contractors and others that the small business can fulfill its contractual obligations.

Q: Are there any fees associated with the SBA Form 990 Surety Bond Guarantee Agreement?

A: Yes, there may be fees associated with the SBA Form 990 Surety Bond Guarantee Agreement. You should check with the SBA or your surety company for more information on the specific fees.

Q: What happens if my application for the SBA Form 990 Surety Bond Guarantee Agreement is approved?

A: If your application is approved, the SBA will issue a guarantee to the surety company, which will then issue the surety bond.

Q: What happens if my application for the SBA Form 990 Surety Bond Guarantee Agreement is denied?

A: If your application is denied, you may need to explore alternative options for obtaining a surety bond, such as working with a different surety company or exploring other forms of collateral.

Q: Can the SBA Form 990 Surety Bond Guarantee Agreement be used for any type of surety bond?

A: No, the SBA Form 990 Surety Bond Guarantee Agreement is specifically for small businesses and certain types of bonds. You should check with the SBA to determine if your bond is eligible for the program.

Form Details:

- Released on February 1, 2016;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 990 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.