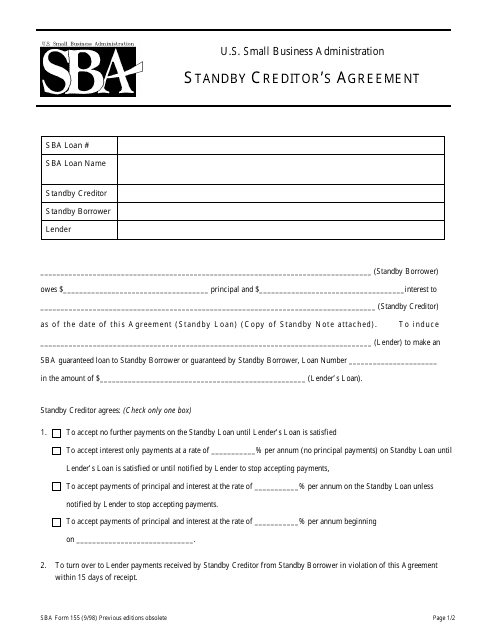

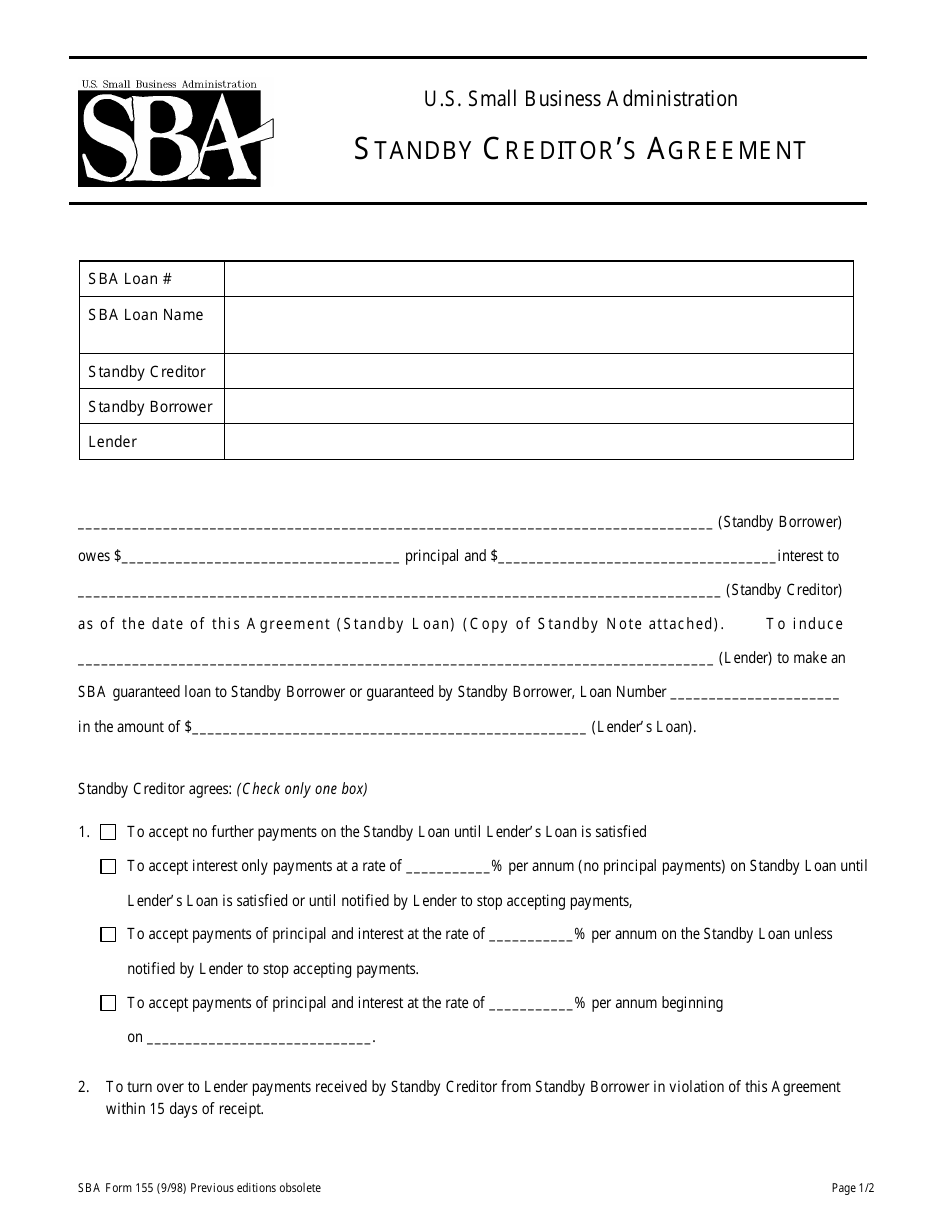

SBA Form 155 Standby Creditor's Agreement

What Is SBA Form 155?

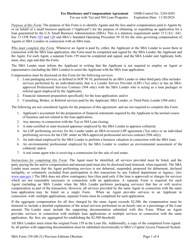

SBA Form 155, Standby Agreement or the Standby Creditor's Agreement is a form used to formalize the subordination of lien rights of the Standby Creditor to the Small Business Administration (SBA) Lender's rights in the collateral. Additionally, the SBA 155 states that the Standby Creditor will take no action against the Borrower or any collateral securing the standby debt without SBA Lender's consent.

The latest version of the form was released by the SBA on September 1, 1998 , with all previous editions obsolete. An up-to-date SBA Form 155 fillable version is available for download and digital filing below.

The SBA Standby Agreement is a part of the paperwork for the SBA 7(a) and 504 loan programs. SBA loans are lender-approved, funded by a participant qualified lender and guaranteed by the SBA. The SBA does not loan money to the business directly and only provides a guarantee for the lender in case if the borrower fails to repay their loan. The percentage of the loan covered by the SBA depends on the chosen program.

The SBA Standby Agreement form is used as a part of supporting documentation for debt standby together with a promissory note. A lender's personal standby agreement form can also be used instead of the recommended SBA Form 155.

SBA Form 155 Instructions

The SBA 155 is distributed without any procedural guidelines. SBA loan standby agreement filing instructions are provided below:

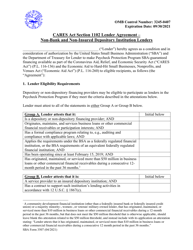

- The first block of the form is the information chart. It requires the number and the name of the SBA loan and names of the Standby Creditor, the Standby Borrower, and the Lender.

- The next part of the form is the agreement. The first line requires the name of the Standby Borrower. Then the principal amount of money is specified. The next line is for the interest rate and the name of the Standby Creditor. The name of the Lender to make SBA guaranteed loan, the loan number and the amount of the loan in U.S. dollars are all specified in the corresponding lines.

- The next block is a set of agreement options. Only one option can be checked. The interest rate and effective dates should be given, if necessary.

- The last block of the form is for the certification. The representative of the Standby Creditor should provide their name in the corresponding line before signing and dating the form.