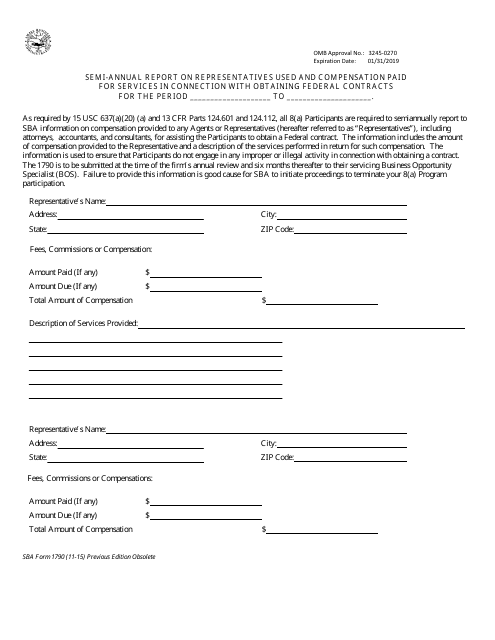

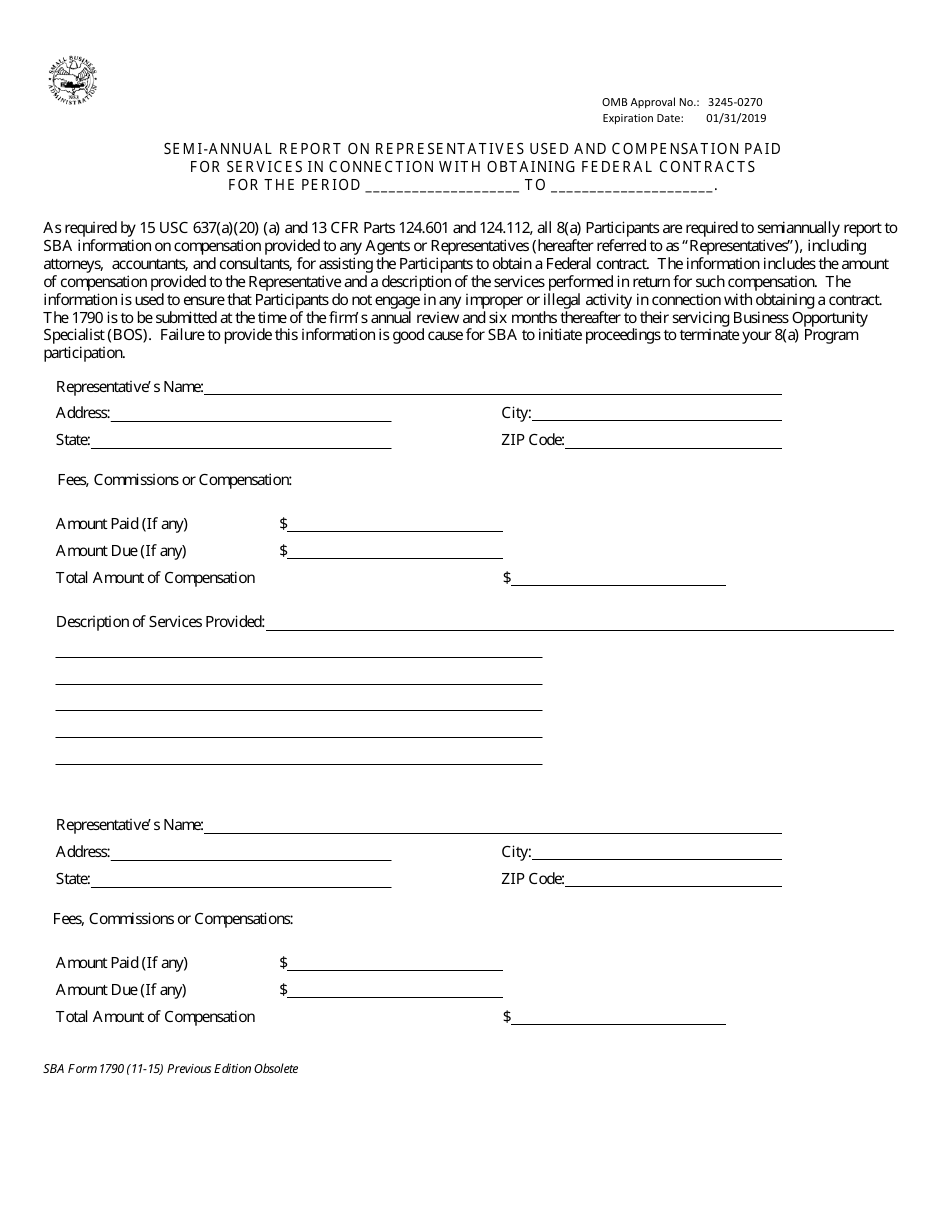

SBA Form 1790 Semi-annual Report on Representatives Used and Compensation Paid for Services in Connection With Obtaining Federal Contracts

What Is SBA Form 1790?

SBA Form 1790, Semi-annual Report on Representatives Used and Compensation Paid for Services in Connection With Obtaining Federal Contracts is a form used by all 8(a) participants for reporting any compensation provided to agents or representatives for assistance in obtaining a federal contract to the Small Business Administration (SBA) . Failure to provide the required information is good cause for the SBA to terminate 8(a) participation.

The SBA released the latest edition of the form on November 1, 2015 , with all previous editions obsolete. The SBA Form 1790 fillable version is available for download and digital filing below.

SBA Form 1790 Instructions

The 8(a) Business Development program is a federal initiative with a goal to award at least five percent of all federal contracts to small disadvantaged businesses every year. Eligible participants must qualify as a small business and be owned and controlled by U.S. citizens who are economically and socially disadvantaged with a potential for successful performance on contracts

All 8(a) Program participants and participants of SBA-certified government contracts are required to submit the following forms along to the SBA annually per SBA 8(a) financial reporting requirements:

- SBA Form 1010C, 8(a) Business Plan;

- SBA Form 413, Personal Financial Statement;

- SBA Form 1450, 8(a) Annual Update;

- A Financial Statement;

- SBA Form 1790, Representatives Used and Compensation Paid for Services in Connection with Obtaining Federal Contracts.

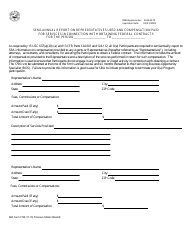

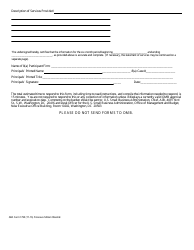

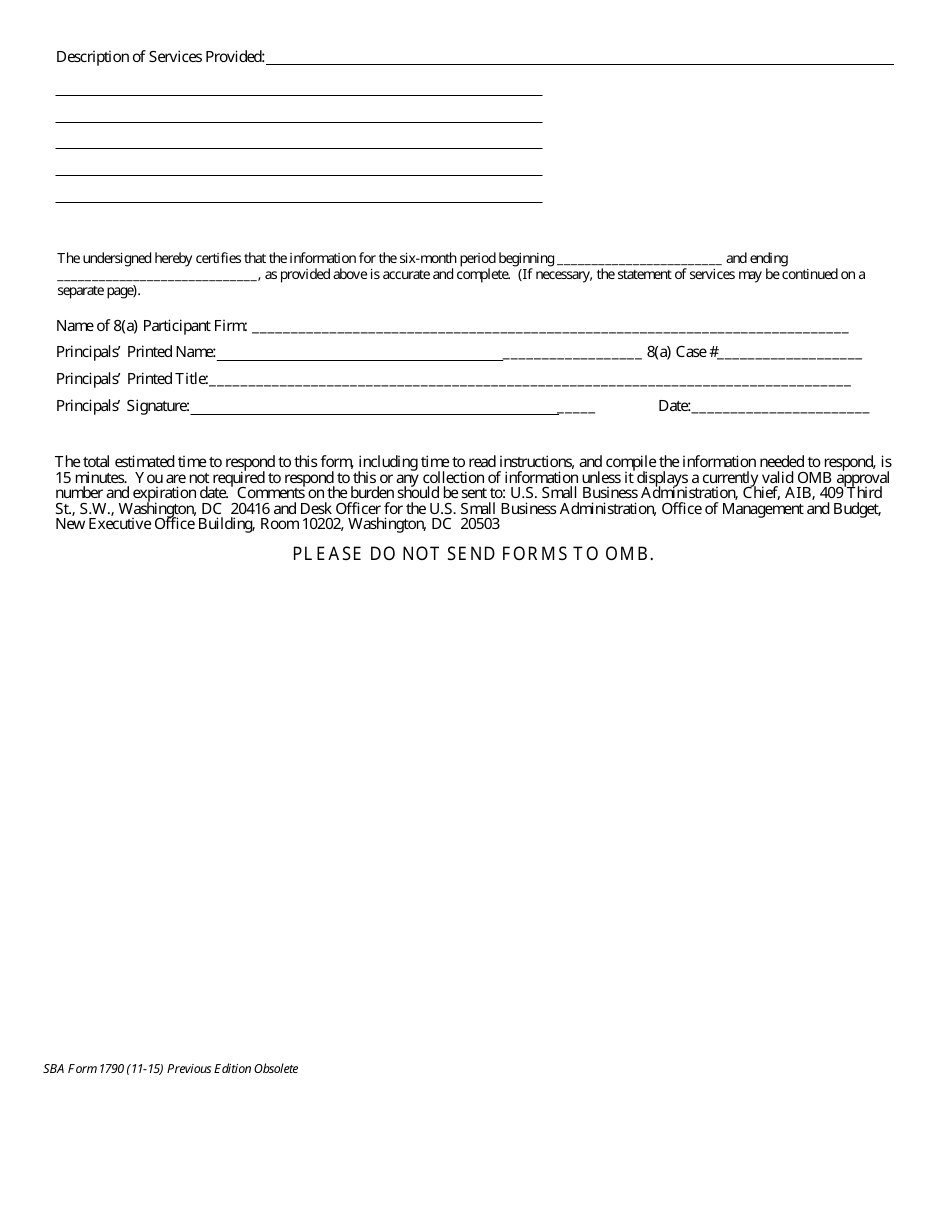

The SBA Form 1790 requires the applicant business to provide information about the amount of compensation provided to the representative and a description of the services performed in return for such compensation. The form has to be submitted at the end of each year at the time of the annual firm review first and then to the Business Opportunity Specialist in six months after the end of the reporting year.