This version of the form is not currently in use and is provided for reference only. Download this version of

SBA Form 2233

for the current year.

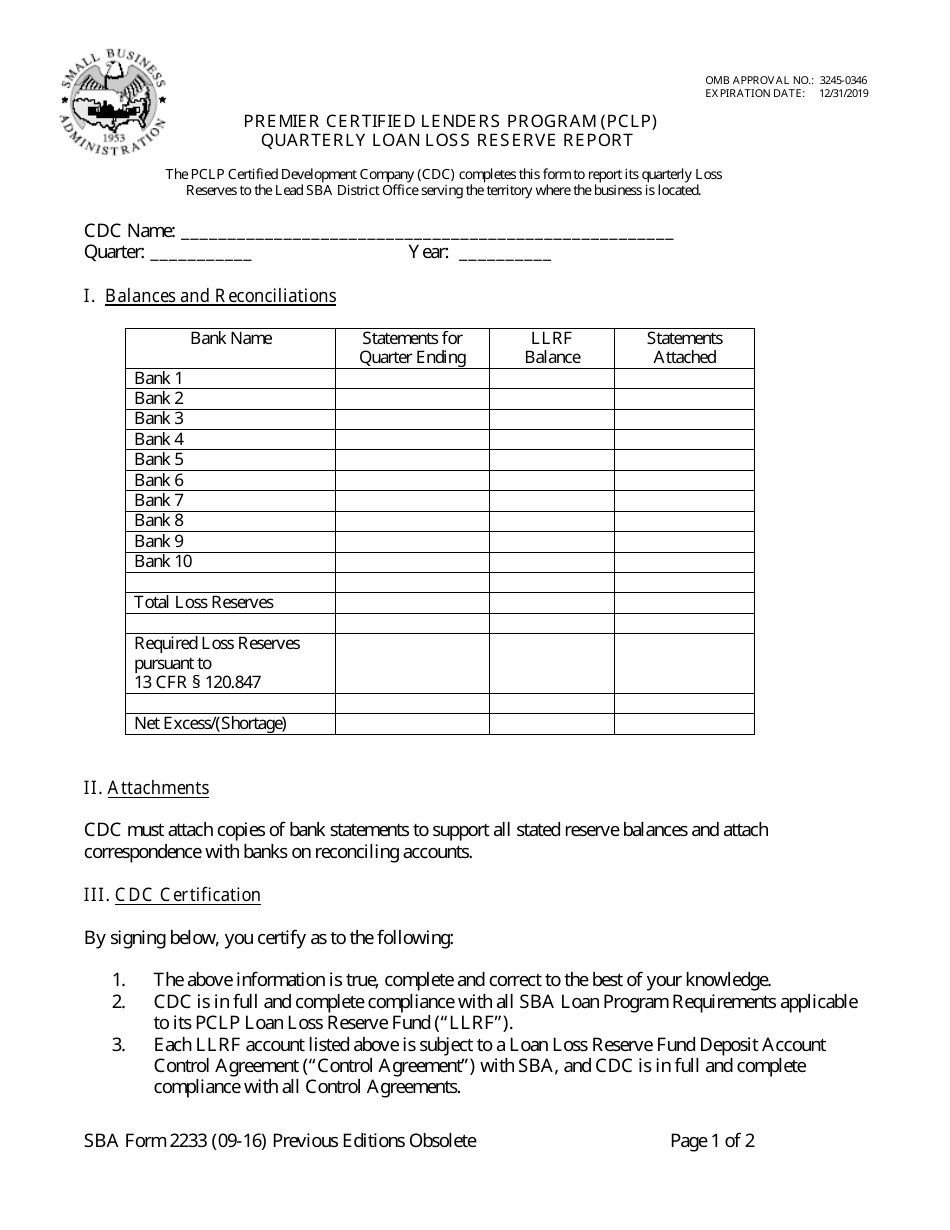

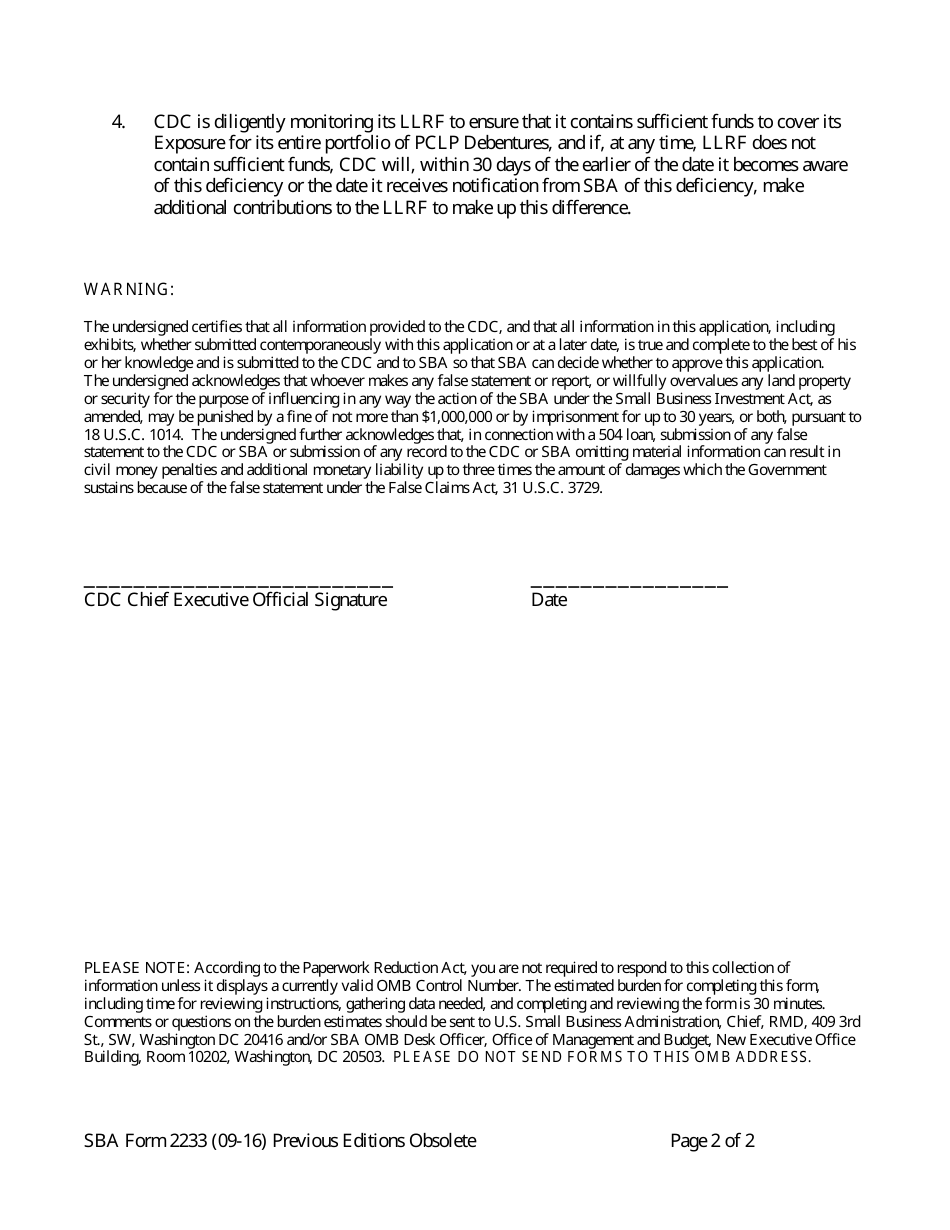

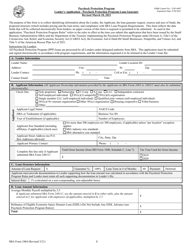

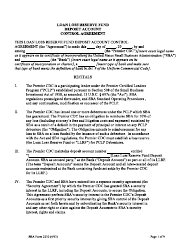

SBA Form 2233 Quarterly Loan Loss Reserve Report - Premier Certified Lenders Program (PCLP)

What Is SBA Form 2233?

This is a legal form that was released by the U.S. Small Business Administration on September 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 2233?

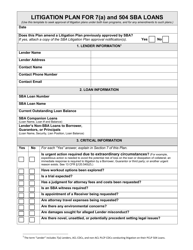

A: SBA Form 2233 is the Quarterly Loan Loss Reserve Report for the Premier Certified Lenders Program (PCLP).

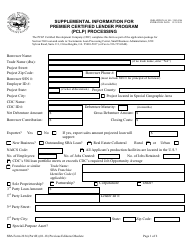

Q: What is the Premier Certified Lenders Program (PCLP)?

A: The Premier Certified Lenders Program (PCLP) is a program administered by the Small Business Administration (SBA) that allows certain lenders to have more autonomy in processing and servicing SBA loans.

Q: Who needs to file SBA Form 2233?

A: Lenders participating in the Premier Certified Lenders Program (PCLP) need to file SBA Form 2233.

Q: What is the purpose of SBA Form 2233?

A: The purpose of SBA Form 2233 is to report the loan loss reserve amounts for the Premier Certified Lenders Program (PCLP).

Q: How often is SBA Form 2233 filed?

A: SBA Form 2233 is filed quarterly.

Form Details:

- Released on September 1, 2016;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 2233 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.