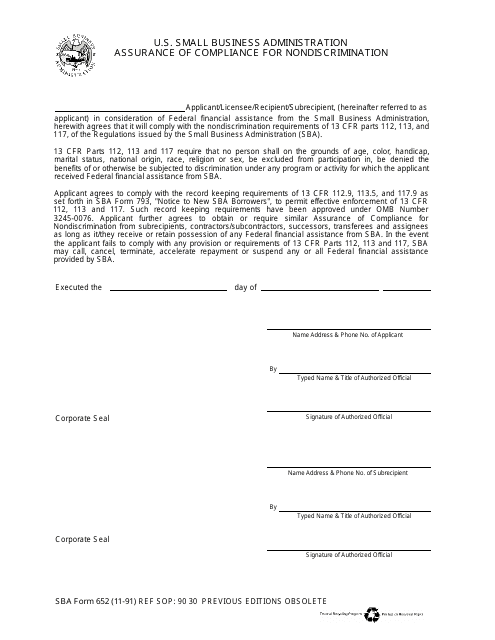

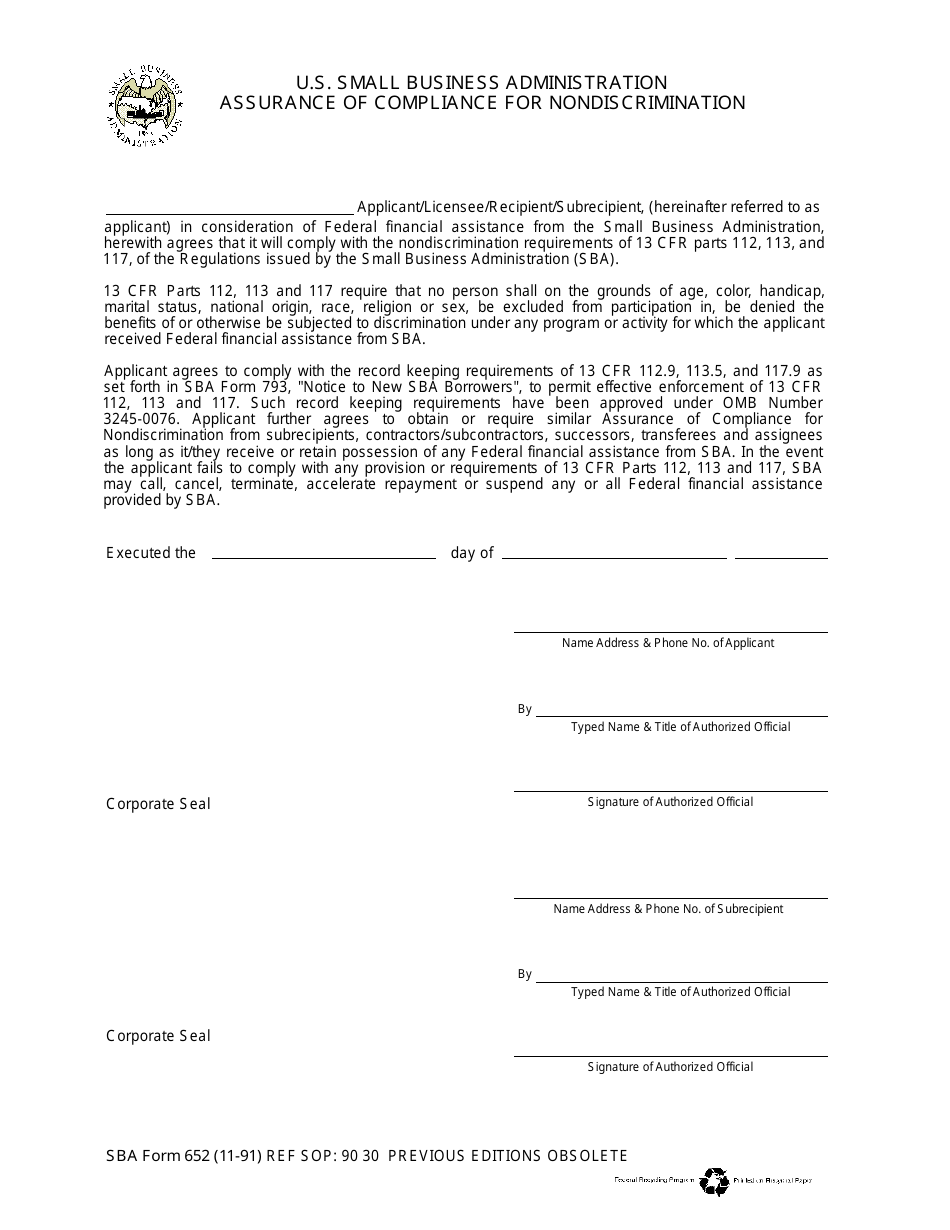

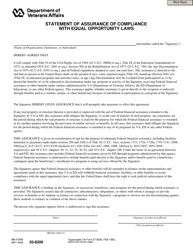

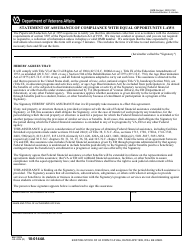

SBA Form 652 Assurance of Compliance for Nondiscrimination

What Is SBA Form 652?

SBA Form 652, Assurance of Compliance for Nondiscrimination is a form used to ensure that no participant of any business or activity that has received financial assistance from the Small Business Administration (SBA) will be discriminated on the grounds of age, handicap, marital status, national origin, race, gender or religion or sex nor be otherwise subjected to discrimination.

The form is filled out by a loan applicant, licensee, recipient, or sub-recipient. By signing the SBA Form 652 the applicant also agrees to obtain similar SBA 652 forms for all sub-recipients, contractors, subcontractors, successors, transferees, and assignees, if they receive any financial assistance from the SBA.

The SBA released the newest edition of the form on November 1, 1991 , with all previous editions obsolete. An up-to-date SBA Form 652 fillable version is available for digital filing and download below or can be found through the SBA website.

SBA Form 652 Instructions

- All recipients of SBA financial assistance must file the SBA Form 652.

- The form should be completed by the authorized representative of the loan applicant.

- Loan applicants must only use the SBA-issued form. Only the original form - with the form number and revision date clearly visible - can be submitted to the SBA. Copies will not be accepted.

- The form requires the authorized representative of the loan applicant to provide their own identifying and contact information, enter the name of the loan applicant, the date the form is completed and certify the form with their corporate seal.

- The same information must be provided by any sub-recipient signing the form.

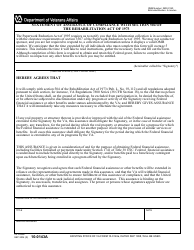

The SBA Form 652 is a part of the Small Business Investment Company (SBIC) Program application package. An SBIC is a privately owned and managed investment fund, regulated by the SBA that can give out loans of up to $10 million with interest rates of up to 16% to qualifying small businesses using its own capital and funds borrowed from the SBA.

The SBIC is allowed to control the business it lends money to for up to 7 years. That control varies in each situation.

Filing the form is mandatory if the SBIC is looking to receive SBA funding. If the SBIC fails to comply with SBA's non-discrimination requirements, the SBA may cancel, terminate or suspend any or all financial assistance provided to the company.