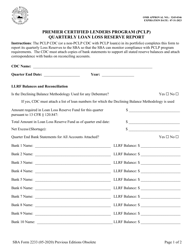

SBA Form 2230 Deposit Fund Control Agreement - Loan Loss Reserve Fund

What Is SBA Form 2230?

This is a legal form that was released by the U.S. Small Business Administration on April 1, 2003 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 2230?

A: SBA Form 2230 is the Deposit Fund Control Agreement - Loan Loss Reserve Fund.

Q: What is a Deposit Fund Control Agreement?

A: A Deposit Fund Control Agreement is a document that outlines how funds will be handled, deposited, and withdrawn.

Q: What is a Loan Loss Reserve Fund?

A: A Loan Loss Reserve Fund is a fund set aside by the Small Business Administration (SBA) to cover potential losses on loans.

Q: Why is SBA Form 2230 important?

A: SBA Form 2230 is important because it establishes the terms and conditions for managing and using the Loan Loss Reserve Fund.

Q: Who needs to fill out SBA Form 2230?

A: Banks or other lenders who are participating in SBA loan programs may need to fill out SBA Form 2230.

Q: Are there any fees associated with SBA Form 2230?

A: There may be administrative fees associated with the establishment and maintenance of the Loan Loss Reserve Fund.

Q: Can I modify the terms of the Deposit Fund Control Agreement?

A: Modifications to the terms of the Deposit Fund Control Agreement may be possible, subject to approval from the SBA.

Q: What happens if I don't comply with SBA Form 2230?

A: Failure to comply with the terms of SBA Form 2230 may result in penalties or loss of participation in SBA loan programs.

Q: Is SBA Form 2230 specific to the United States or Canada?

A: SBA Form 2230 is specific to the United States and is not applicable in Canada.

Form Details:

- Released on April 1, 2003;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 2230 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.