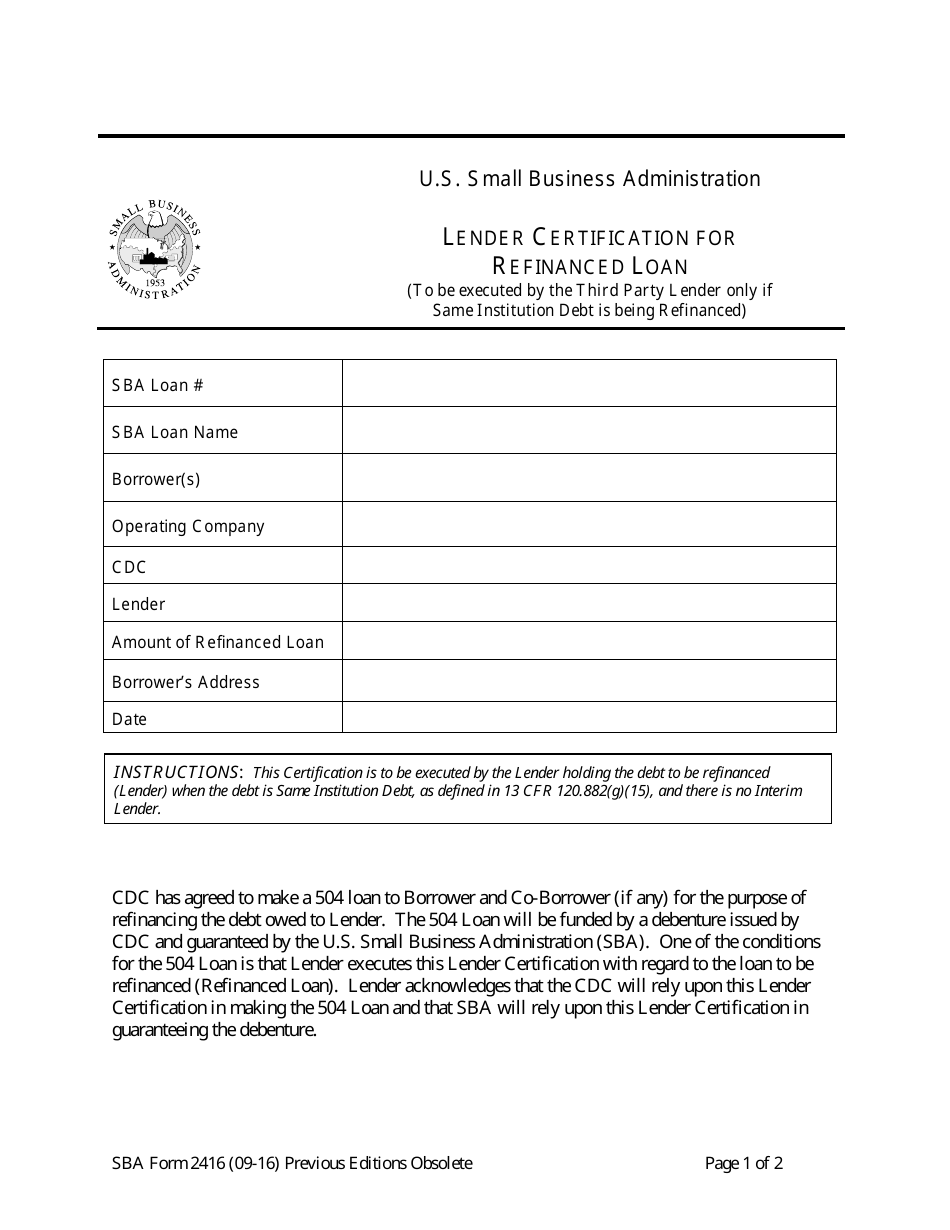

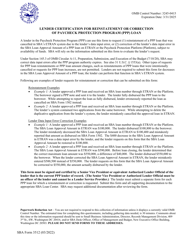

SBA Form 2416 Lender Certification for Refinanced Loan

What Is SBA Form 2416?

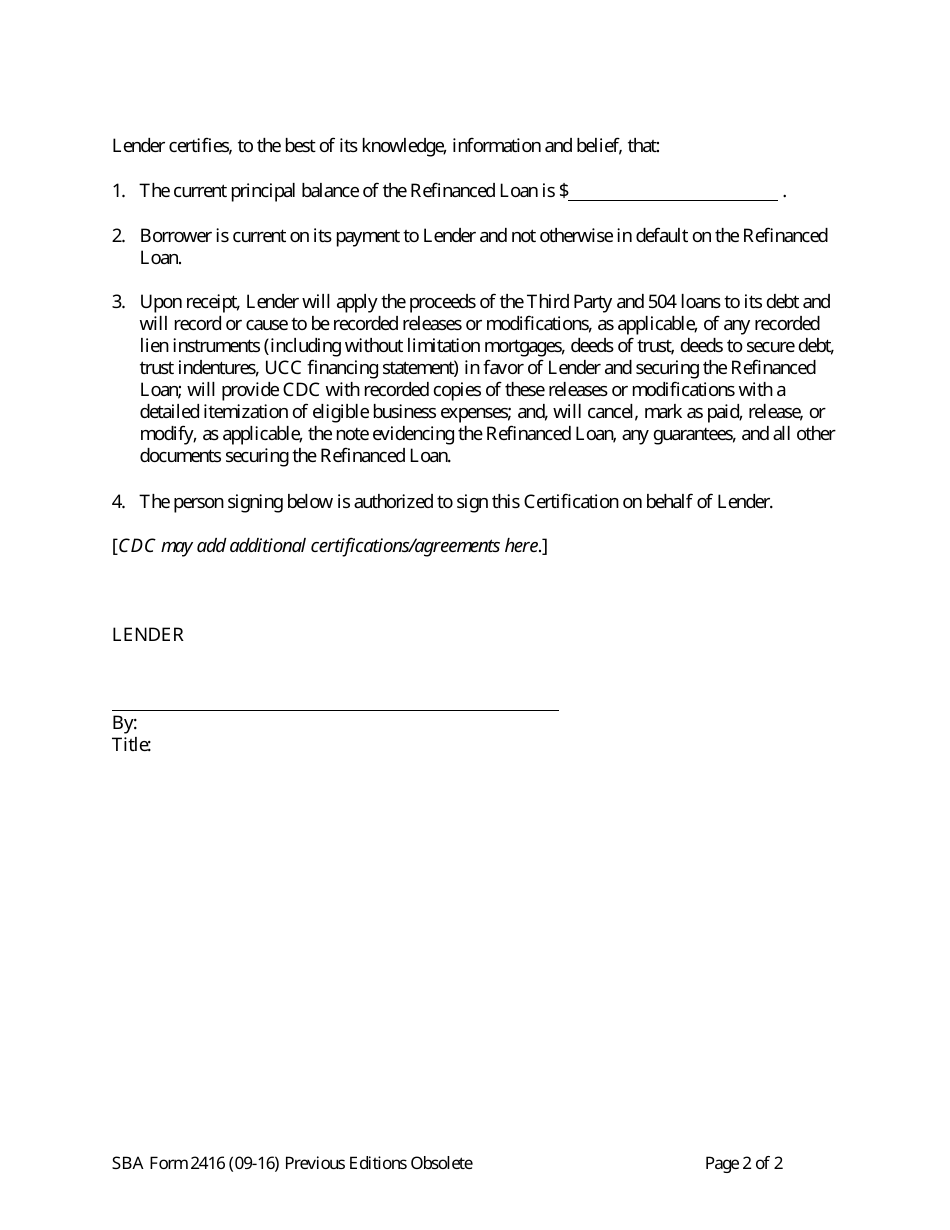

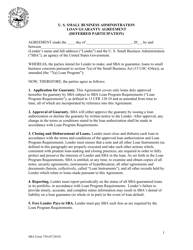

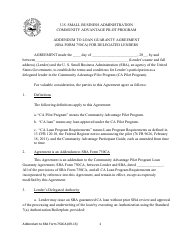

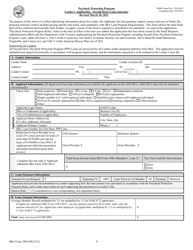

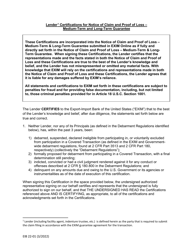

SBA Form 2416, Lender Certification for Refinanced Loan is a form completed by the Third Party Lender (who, in this case, is also the Lender of the debt being refinanced) if the loan being refinanced is Same Institution Debt. The Lender must execute the Lender Certification for Refinanced Loan and submit the form to the Certified Development Company (CDC) at the time of closing.

The latest version of the form was released by the Small Business Administration (SBA) on September 1, 2016 , with all previous editions obsolete. An up-to-date SBA Form 2416 fillable version is available for digital filing and download below.

SBA Form 2416 Instructions

SBA Form 2416 is used in connection with the SBA 504 Refinance Program that became a permanent loan option in December 2015. This loan can be used for refinancing up to 90% of the value of commercial property to pay off existing debts. One or multiple loans can be refinanced, except for any existing government-guaranteed loans. The refinancing can include cash-out to cover eligible business operating expenses including salaries, rent, and inventory costs. In these cases, the maximum loan-to-value is lowered to 75 percent.

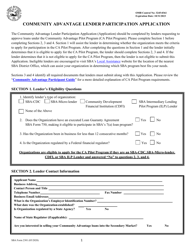

To qualify for the SBA 504 Debt Refinancing, the business has to operate for at least two years under the same ownership before the date of the application. Changes of ownership within the two-year period will immediately disqualify the application. The business also has to meet the SBA 504/CDC loan eligibility criteria.

The SBA Form 2416 may only be used if no Interim Lenders participate in the refinancing.

SBA Form 2416 Related Publications:

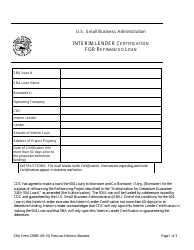

- SBA Form 2288, Interim Lender Certification, is a form filled out by Interim Lenders taking part in the SBA 504 loan program;

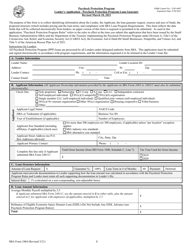

- SBA Form 2288R, Interim Lender Certification for Refinanced Loan, is a form completed by Interim Lenders taking part in the SBA 504 Debt Refinance Loan Program.