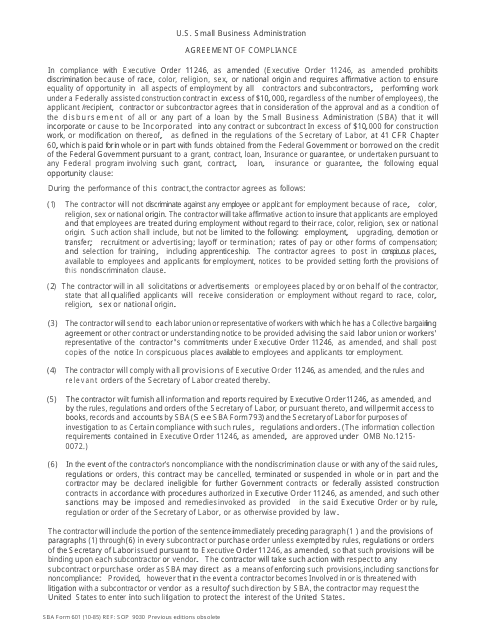

SBA Form 601 Agreement of Compliance

What Is SBA Form 601?

This is a legal form that was released by the U.S. Small Business Administration on October 1, 1985 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 601?

A: SBA Form 601 is the Agreement of Compliance form.

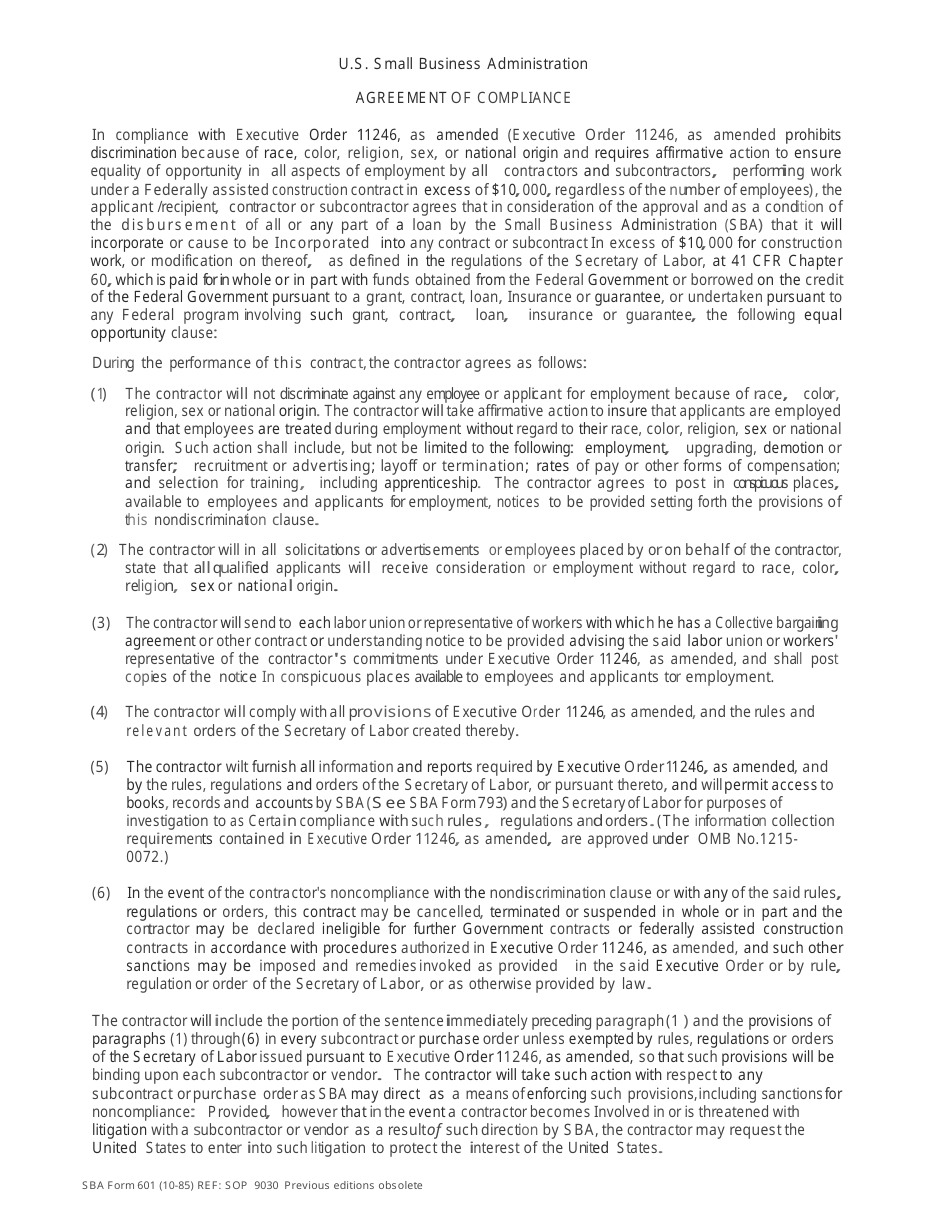

Q: What is the purpose of SBA Form 601?

A: The purpose of SBA Form 601 is to ensure compliance with Small Business Administration (SBA) regulations.

Q: Who needs to complete SBA Form 601?

A: Any business or individual applying for or receiving financial assistance from the SBA may need to complete SBA Form 601.

Q: What does SBA Form 601 require?

A: SBA Form 601 requires the applicant to agree to comply with various SBA regulations and provide supporting documentation.

Q: What happens after submitting SBA Form 601?

A: Once submitted, the SBA will review the form and supporting documentation to ensure compliance. They may request additional information or clarification if needed.

Q: Is there a deadline for submitting SBA Form 601?

A: The deadline for submitting SBA Form 601 will depend on the specific requirements of the SBA program or loan for which you are applying. Check the guidelines or contact the SBA office for the deadline.

Q: Are there any consequences for non-compliance with SBA regulations?

A: Non-compliance with SBA regulations can result in penalties, loss of financial assistance, or legal action. It is important to read and understand the regulations outlined in SBA Form 601.

Q: Can I make changes to SBA Form 601 after submitting?

A: It depends on the specific requirements of the SBA office. In some cases, you may be able to make changes or updates to the form if requested by the SBA.

Form Details:

- Released on October 1, 1985;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 601 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.