SBA Form 147 Note - 7(A) Loans

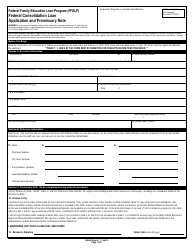

What Is SBA Form 147?

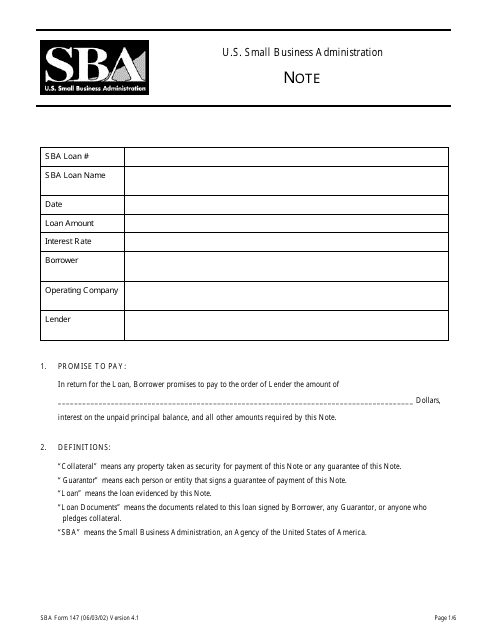

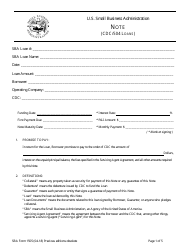

SBA Form 147, Note - 7(a) Loans - also known as the SBA Note Form 147 - is a document used as a promise by the borrower to pay to the order of the lender a certain amount, interest on the unpaid principal balance, and all other amounts required. 7(a) Loans are a part of the most basic and most popular Small Business Administration (SBA) loan programs. It takes its name from section 7(a) of the Small Business Act, which authorizes the agency to provide business loans to American small businesses.

SBA 7(a) loans can be up to $2 million, and the SBA loan guarantee amounts to no more than $1.5 million. The interest rates are based on the prime rate, the size of the loan, and the maturity of the loan.

The latest version of the form was released by the SBA on June 3, 2002 , with all previous editions obsolete. An up-to-date SBA Form 147 fillable version is available for download below or can be found through the SBA Forms website.

SBA Form 147 Instructions

The borrower is required to fill in all spaces in the information grid - the SBA loan number and loan name, the date, the loan amount, the interest rate, the name of the borrower, the operating company, and the name of the lender.

- Section 1. Promise to pay. State the amount to be paid by the borrower to the order of the lender, the interest on the unpaid principal balance, and all other amounts required by the note;

- Section 2. Definitions. It defines the main terms used in the form - "collateral", "guarantor", "loan", "loan documents", and "SBA";

- Section 3. Payment terms. The borrower must make all payments at the place the lender designates. State the payment terms;

- Section 4. Default. It states all the circumstances that put the borrower in default under the note;

- Section 5. Lender's rights, if there is a default. A lender may require immediate payment of all amounts owing under this note, collect all amounts owing from any borrower or guarantor, file suit and obtain a judgment, take possession of any collateral, or sell, lease, or otherwise dispose of, any collateral at public or private sale, with or without advertisement;

- Section 6. Lender's general powers. The form establishes what the lender may do without borrower's consent;

- Section 7. The note is interpreted and enforced under federal law;

- Section 8. Successors and assigns. The borrower and the operating company include the successors of each, and the lender includes its successors and assigns under the guarantee;

- Section 9. General provisions. The form outlines the liability, the waiver of suretyship defenses, the demands and notices, the exercising and enforcing of lender's rights, the use of the oral statement of the lender or the SBA by the borrower;

- Section 10. State-specific provisions. The loan applicant can add extra provisions if required;

- Section 11. Borrower's name and signature. An individual or entity becomes obligated under the note as a borrower.