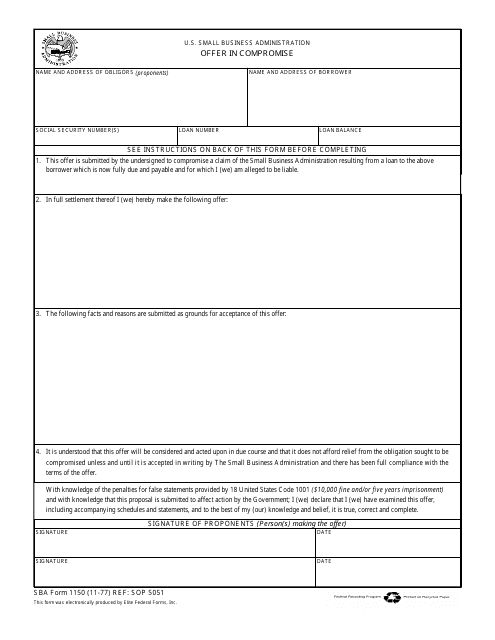

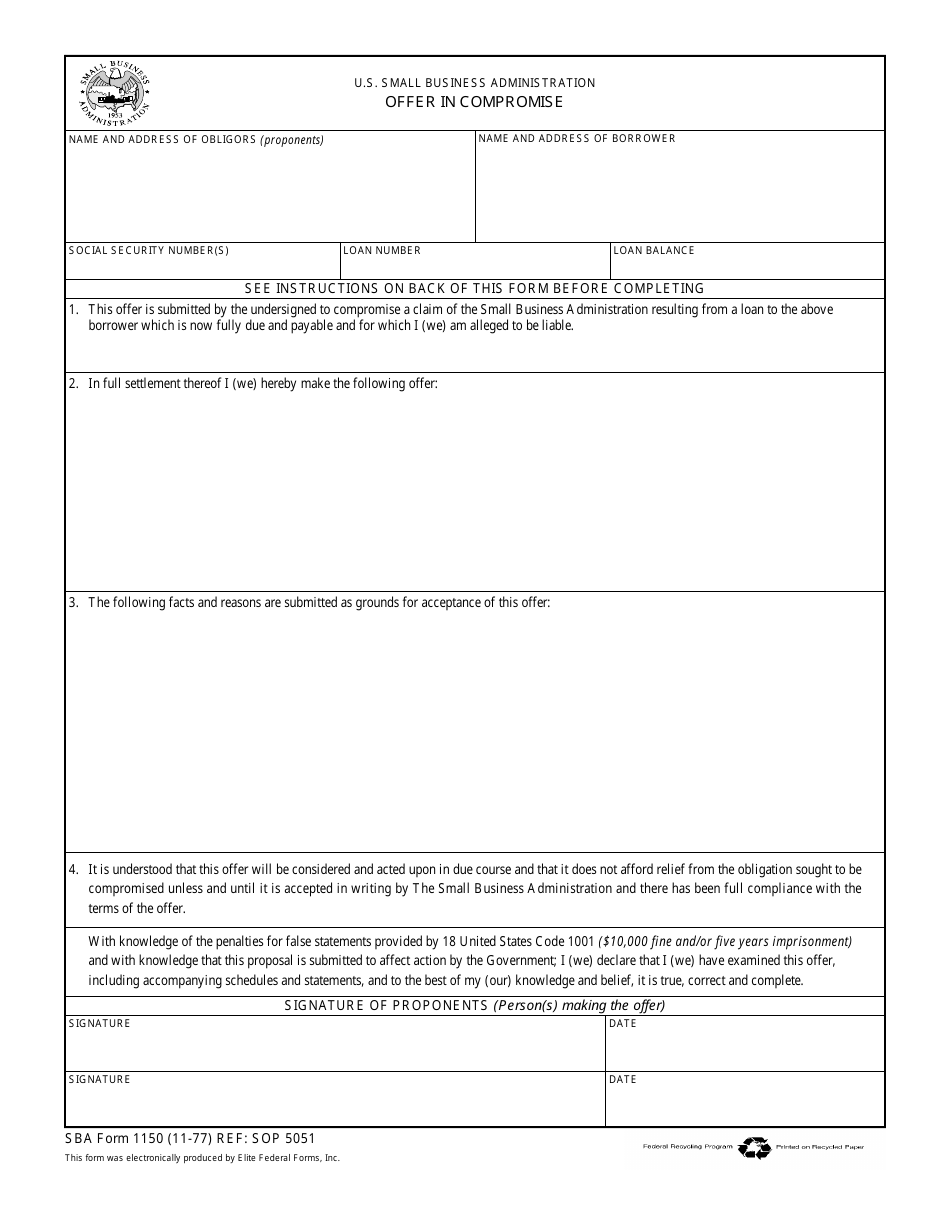

SBA Form 1150 Offer in Compromise

What Is SBA Form 1150?

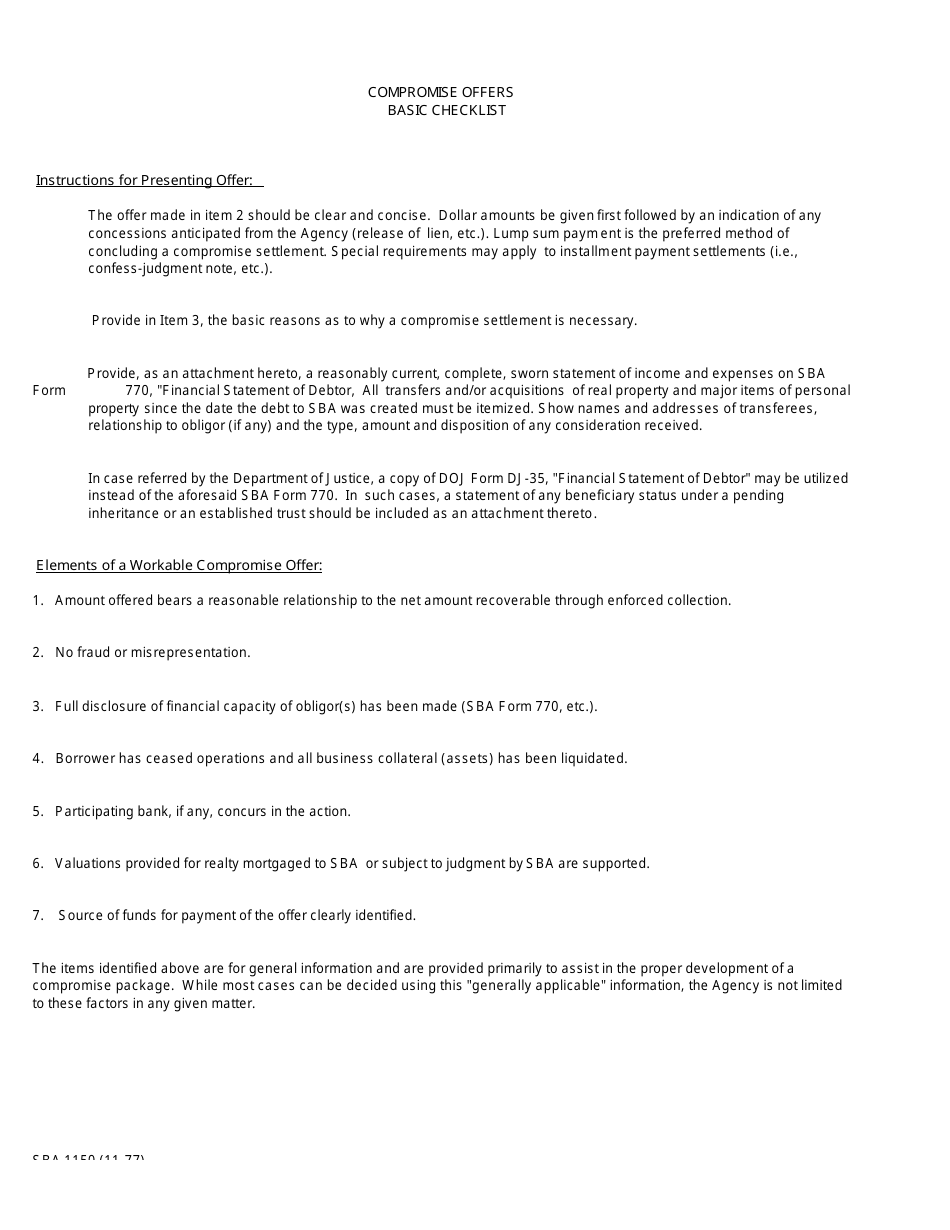

SBA Form 1150, Offer in Compromise is a form filed by a Borrower of a Small Business Administration (SBA) loan in order to make a compromise offer to the Lender if the Borrower is unable to repay their loan after liquidation. The Borrower can use the form to propose to pay a reduced amount of debt.

The latest version of the form was released by the SBA on November 1, 1977 , with all previous editions obsolete. An SBA Form 1150 fillable version is available for download and digital filing below.

SBA Form 770 and 1150

The SBA Offer in Compromise is presented to the Lender with the SBA Form 770, Personal Financial Statement - not to be confused with the other SBA Personal Financial Statement - the SBA Form 413 (used when applying for 7(a)/504 Loans and Surety Bonds).

The SBA Form 770 is the Borrower's current financial statement. It compiles the information necessary to evaluate the Borrower's financial capacity to repay the debt owed to the Lender and to determine the steps the SBA may take to compromise the debt, maximize recovery, and protect the interests of the Agency. Completed forms are submitted to the Lender.

SBA Form 770 Instructions

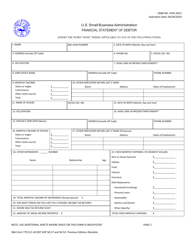

- The Borrower's name and their SBA loan number are entered in Box 1.

- Boxes 2 through 5 require the Borrower's date of birth, full address, phone number, and Social Security Number.

- Box 6 requires a description of the Borrower's current occupation. The duration of their current employment is provided in Box 7. Box 8 requires information about their current employer.

- Box 9 is for specifying the Borrower's monthly income. The names and addresses of any other employers the Borrower worked for during the past three years are entered in Box 10 along with the periods of employment.

- Box 11 requires the name of the Borrower's spouse. Boxes 12 to 17 require the spouse's date of birth, information about their current occupation and employer, their monthly income and other employment within the past three years.

- The dependents, if any, are listed in the table in Box 18. Their total monthly income is specified in Box 19.

- The period of the last income tax return is specified in Box 20. The place where the tax return was filed is specified in Box 21. The amount of gross income reported is entered in Box 22.

- Box 23 is for listing any fixed monthly expenses the Borrower may have. Boxes 24 through 27 require listing all assets, liabilities, payable loans, owned real estate and mortgages.

- Life insurance policies are entered in Box 28. All real and personal property owned by the spouse and dependents is listed in Box 29. Any transfers of property that took place within the last three years are listed in Box 30.

- Box 31 is filled out if the Borrower is a co-maker, a guarantor or a party in any pending lawsuit, this should be specified in. Box 32 is filled out if the Borrower is a trustee, administrator or executor. Box 33 is for specifying whether the Borrower is a beneficiary under a pending, possible or established inheritance or trust.

- Box 34 required specifying the date the Borrower believes they will be able to start making payments on their SBA debt. The amount of money the Borrower is able to pay on a monthly or periodic basis is given in Box 35.