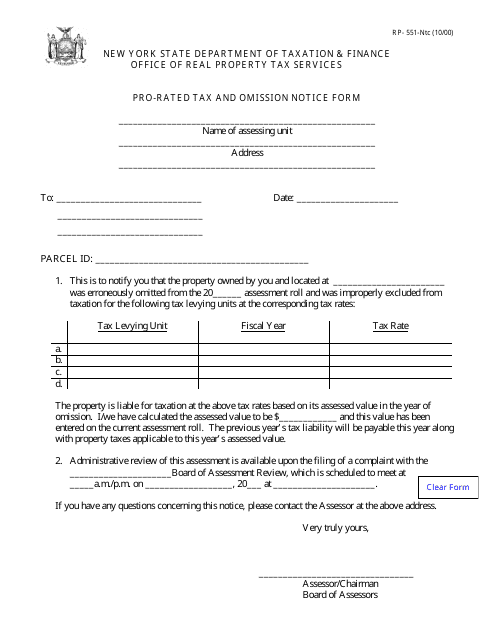

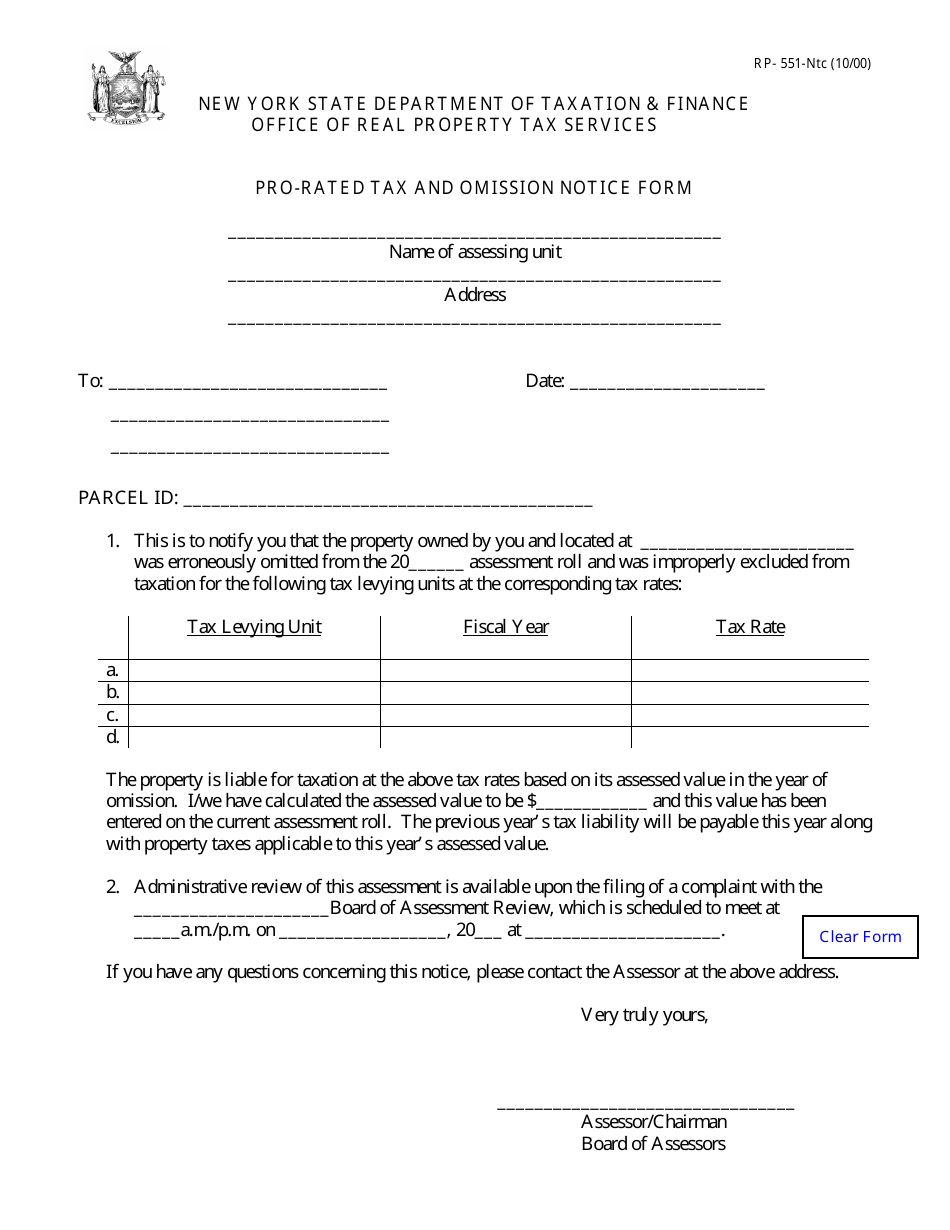

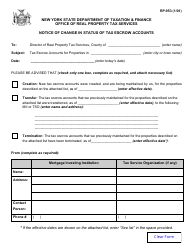

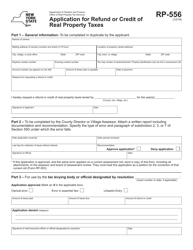

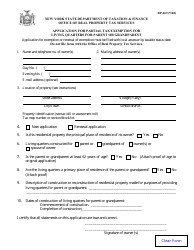

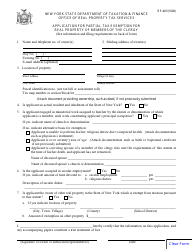

Form RP-551-NTC Pro-Rated Tax and Omission Notice Form - New York

What Is Form RP-551-NTC?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-551-NTC?

A: Form RP-551-NTC is the Pro-Rated Tax and Omission Notice Form in New York.

Q: What is the purpose of Form RP-551-NTC?

A: The purpose of Form RP-551-NTC is to report any pro-rated taxes or omissions in property taxes.

Q: Who needs to complete Form RP-551-NTC?

A: Property owners in New York who have pro-rated taxes or omissions in their property taxes need to complete Form RP-551-NTC.

Q: When is Form RP-551-NTC due?

A: The due date for Form RP-551-NTC varies and depends on the specific circumstances. It is important to check with the local tax authorities for the deadline.

Q: Is there a fee for filing Form RP-551-NTC?

A: There is no fee for filing Form RP-551-NTC in New York.

Q: Are there any penalties for late filing of Form RP-551-NTC?

A: Penalties may apply for late filing of Form RP-551-NTC. It is important to submit the form on time to avoid any penalties.

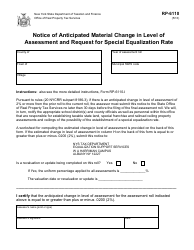

Form Details:

- Released on October 1, 2000;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-551-NTC by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.