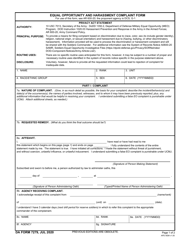

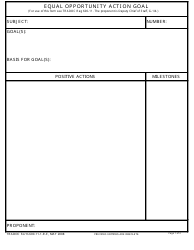

SBA Form 722 Equal Employment Opportunity Statement

What Is SBA Form 722?

This is a legal form that was released by the U.S. Small Business Administration on October 1, 2002 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 722?

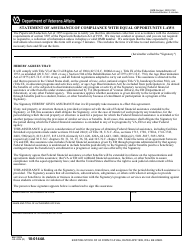

A: SBA Form 722 is a form used by the Small Business Administration (SBA) for collecting Equal Employment Opportunity (EEO) data.

Q: Why is Equal Employment Opportunity important?

A: Equal Employment Opportunity is important because it promotes fair treatment and prevents discrimination in the workplace based on factors such as race, color, religion, sex, national origin, disability, and age.

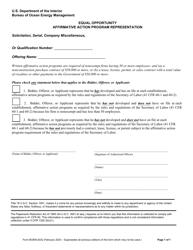

Q: Who is required to fill out SBA Form 722?

A: All federal contractors and subcontractors who have 50 or more employees and a contract of $50,000 or more with the federal government are required to fill out SBA Form 722.

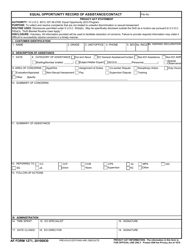

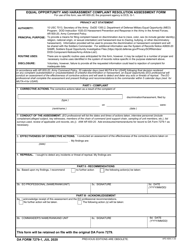

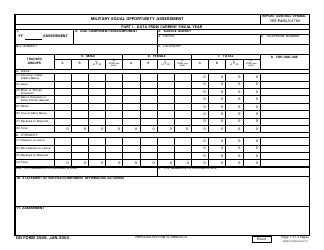

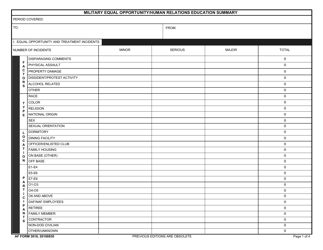

Q: What information is collected on SBA Form 722?

A: SBA Form 722 collects information about the number of employees in different job categories, as well as the demographics of employees in terms of race, gender, and ethnicity.

Q: How often do companies need to fill out SBA Form 722?

A: Federal contractors and subcontractors are required to fill out SBA Form 722 annually.

Form Details:

- Released on October 1, 2002;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of SBA Form 722 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.