This version of the form is not currently in use and is provided for reference only. Download this version of

SBA Form 1149

for the current year.

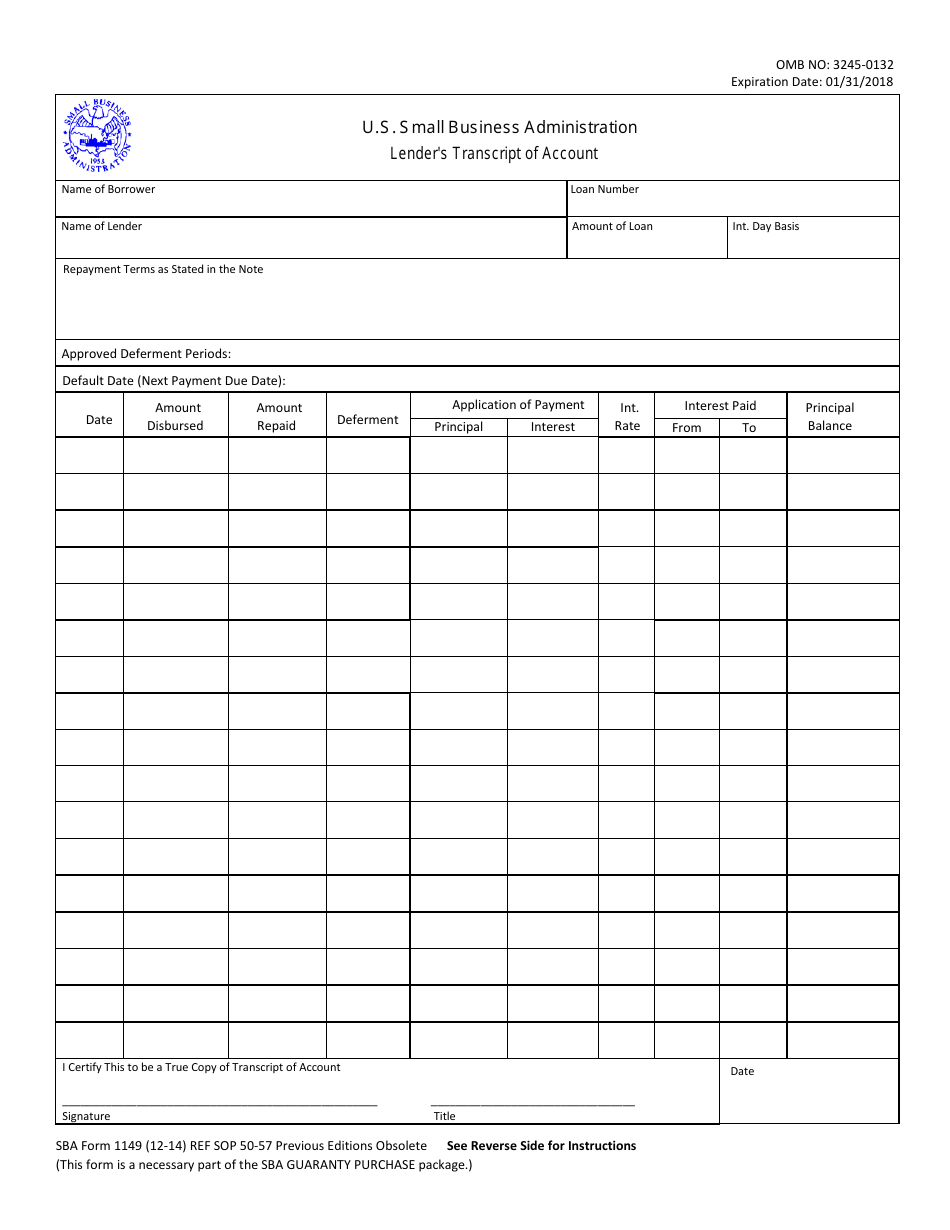

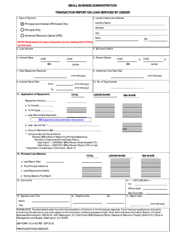

SBA Form 1149 Lender's Transcript of Account

What Is SBA Form 1149?

SBA Form 1149, Lender's Transcript of Account is a document that accounts for the disbursement of 7(a) Loan proceeds and the applications of payments. The Small Business Administration (SBA) uses this information to determine the date the loan went into default and to assess how much interest is payable to the lender. The information is also used to determine whether the loan was properly disbursed and serviced.

The form - also known as the SBA Transcript of Account form - was released by the SBA on December 1, 2014 . An SBA Form 1149 fillable version is available for download and digital filing below.

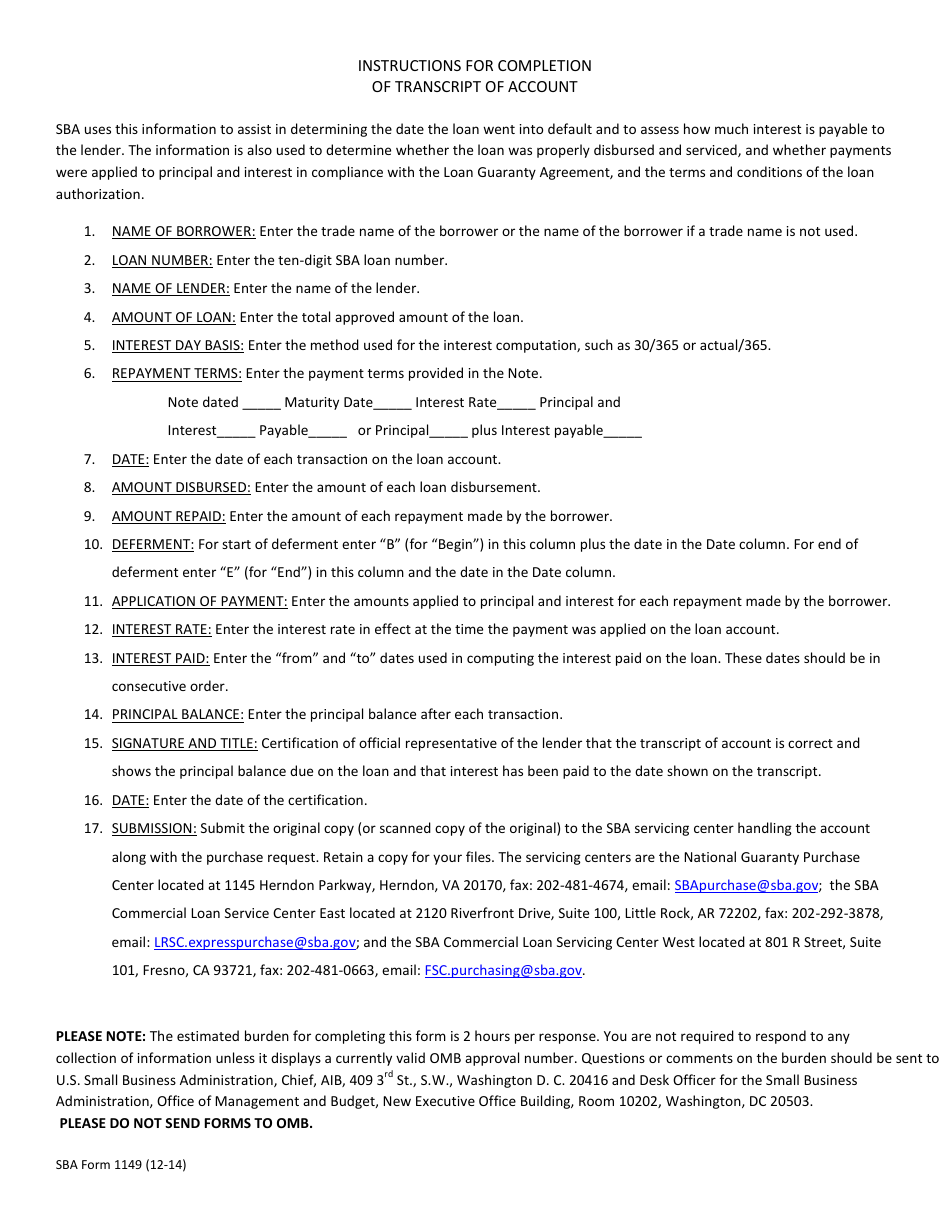

SBA Form 1149 Instructions

The SBA 1149 is the SBA's preferred Transcript of Account Form. Submit the original copy of the completed form to the SBA along with the purchase request for the default loan. Filing instructions are as follows:

- Name of Borrower. Enter the trade name or the actual name of the Borrower of the Loan.

- Loan Number. Specify the ten-digit SBA loan number in the provided space.

- Name of Lender. Provide the name of the Lender.

- Amount of Loan. Enter the total amount of the loan.

- Interest Day Basis. Enter the method that was used to compute interest.

- Repayment Terms. Provide the repayment terms specified in the note for the loan.

- Date. Specify the date of every transaction on the loan account.

- Amount Disbursed. Specify the amounts for every disbursement.

- Amount Repaid. Account for every repayment made by the Borrower.

- Application of Payment. For each repayment made by the Borrower, the amounts applied to principal and interest must be specified.

- Interest Rate. Enter the interest rate that was effective during the time the payments were made.

- Interest Paid. Determine the time period used for calculating the total interest paid on the loan.

- Principal Balance. Provide the principal balance after each payment.

- Signature and Title. Have the form signed by an official representative of the Lender. Their signature certifies that the transcript of account is correct and that interest has been paid to the date shown on the form.

- Date. The representative must enter the date of their certification.