SBA Form 148 Unconditional Guarantee

What Is SBA Form 148

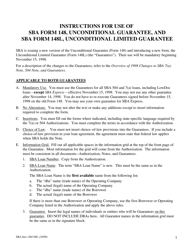

SBA Form 148, Unconditional Guarantee is a document used whenever the guarantor is liable for the repayment of the entire amount of the borrower's loan. It is applied when the authorization requires a full unsecured guarantee or a full secured guarantee.

The scope of the guarantor's liability is unlimited. Individuals with 20% or more of the applicant business have to provide unlimited personal guaranty. Guarantees must be used for all Small Business Administration (SBA) 504 and 7(a) loans, including LowDoc loans - except SBA Express - effective November 15, 1998. The SBA loan guarantee does not reduce any obligations of the small business borrower or its guarantors and protects lenders. The use of the guaranty on SBA Form 148 ensures nationwide consistency in court decisions interpreting the enforceability of the guarantee against guarantors of SBA loans.

The latest version of the form was released by the SBA on October 1, 1998 , with all previous editions obsolete. An up-to-date fillable version of this form is available for download below or can be found through the SBA website.

SBA Form 148L, Limited Guarantees is a document used whenever the lender intends to limit the scope of the guarantor's liability, such as limiting the amount or duration of the guarantee, or limiting the guarantor's obligation to the guarantor's interest in any property (real or personal) pledged to secure the repayment of the loan. The business can be expanded with loans guaranteed by the SBA that helps guarantors to find lenders.

SBA Form 148 Instructions

SBA Unconditional Guarantee form instructions are as follows:

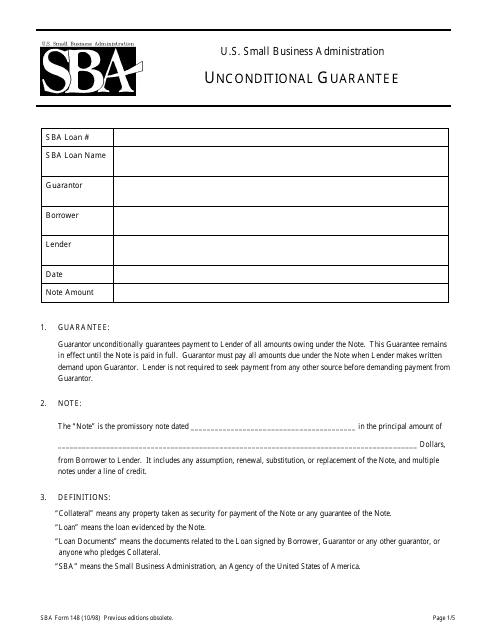

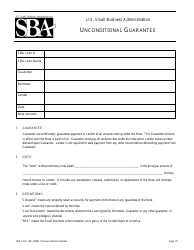

The guarantor is required to fill in all applicable spaces in the information grid - the SBA loan number and loan name, the guarantor (the legal names of individuals or entities), the borrower, the lender (for 7(a) loans - the name of the lender, for 504 loans - the name of the certified development company), the date, the note amount.

- Section 1. Guarantee. It states the main purpose of the guarantee and its designation;

- Section 2. Note. Write down the date and the amount of the promissory note;

- Section 3. Definitions. It contains the main terms used in the form;

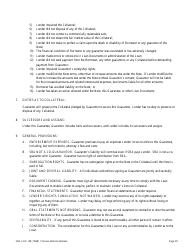

- Section 4. Lender's general powers. This part states what actions the lender may take without guarantor's consent;

- Section 5. Federal law. The note and the guarantee are interpreted and enforced under federal law;

- Section 6. Rights, notices, and defenses that guarantor waives. The guarantor waives them to the extent permitted by law;

- Section 7. Duties as to collateral. The guarantor preserves the collateral pledged to secure the guarantee;

- Section 8. Successors and assigns. The guarantor includes successors, the lender includes successors and assigns under the guarantee;

- Section 9. General provisions. It outlines the expenses, the subrogation rights, the financial statements, and the severability;

- Section 10. State-specific provisions. The applicant can add them if required;

- Section 11. Guarantor acknowledgment of terms. Acknowledge you have read and understood the significance of all terms;

- Section 12. Guarantor name and signature. Fill in the name and sign the form.