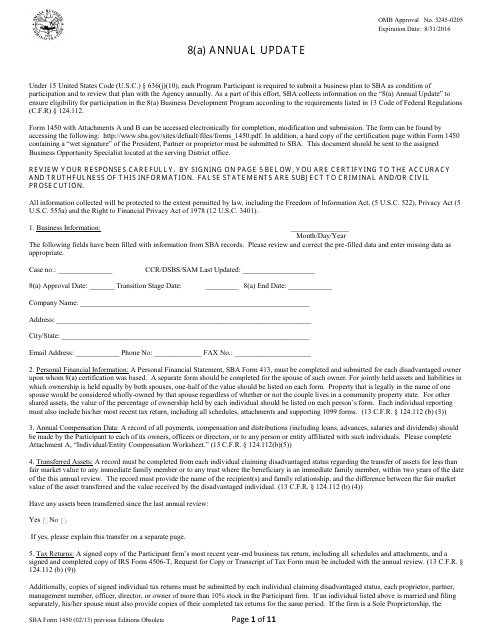

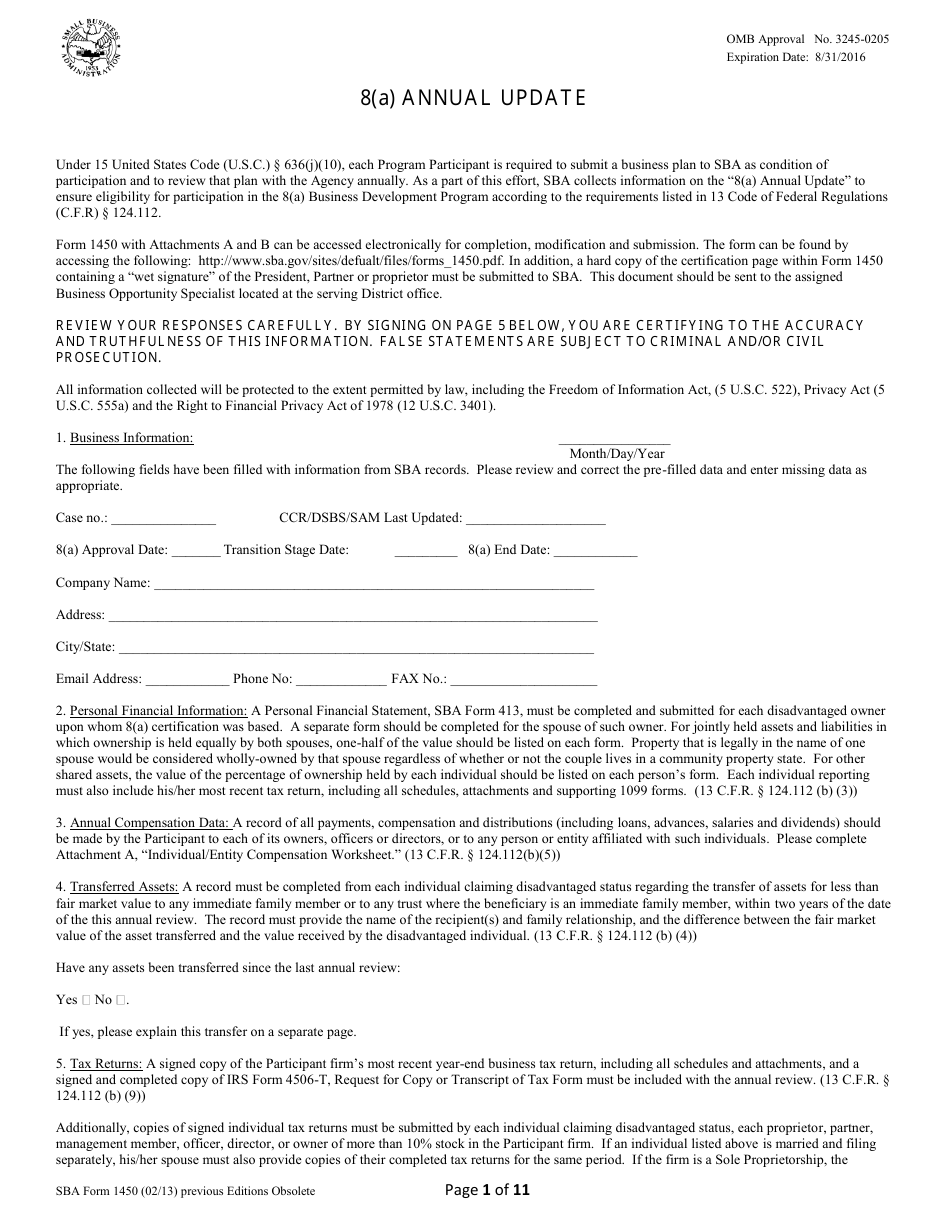

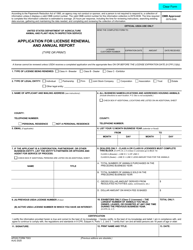

SBA Form 1450 8(A) Annual Update

What Is SBA Form 1450?

SBA Form 1450, 8(a) Annual Update is a form used by the participants of the Small Business Administration (SBA) 8(a) programs to show that they continue to meet the program's eligibility requirements.

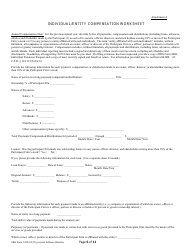

The latest version of the form was released by the SBA on February 1, 2013 , with all previous editions obsolete. An SBA Form 1450 fillable version is available for download below.

The SBA 1450 Form is a part of the SBA 8(a) program, which is designed as a support for small businesses owned by y socially and economically disadvantaged people. The 8(a) Business Development Program assists small businesses in competing in the federal marketplace. To qualify for the program, the business has to meet SBA small size standards and be unconditionally owned and controlled by one or more socially- and economically disadvantaged individuals who are of good character. The business must maintain its eligibility throughout the course of its participation.

SBA Form 1450 Instructions

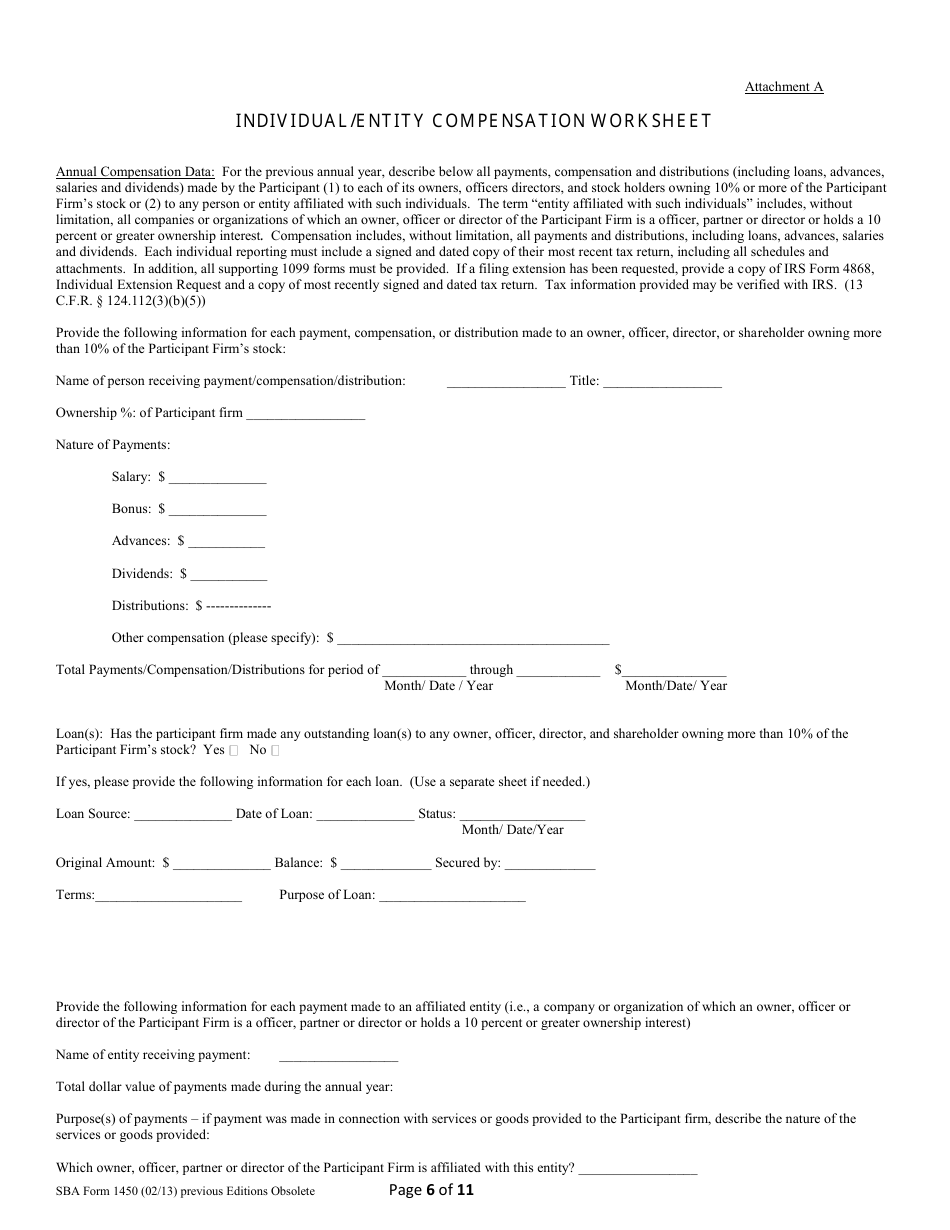

- Block 1 is for providing business information. The fields should be filled with the information from SBA records. This includes the case number, any recent updates, the date of the 8(a) approval, the transition stage date, and the 8(a) end date. This part also requires the name of the participant's company, its physical address, its e-mail address, phone, and fax numbers.

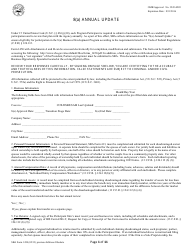

- If any assets were transferred from the participant claiming disadvantaged status to any family member for a for less than fair market value, this should be recorded in Block 4 with an explanation required to be attached to the form.

- Block 6 requires information on any changes in the structure of the participant's business.

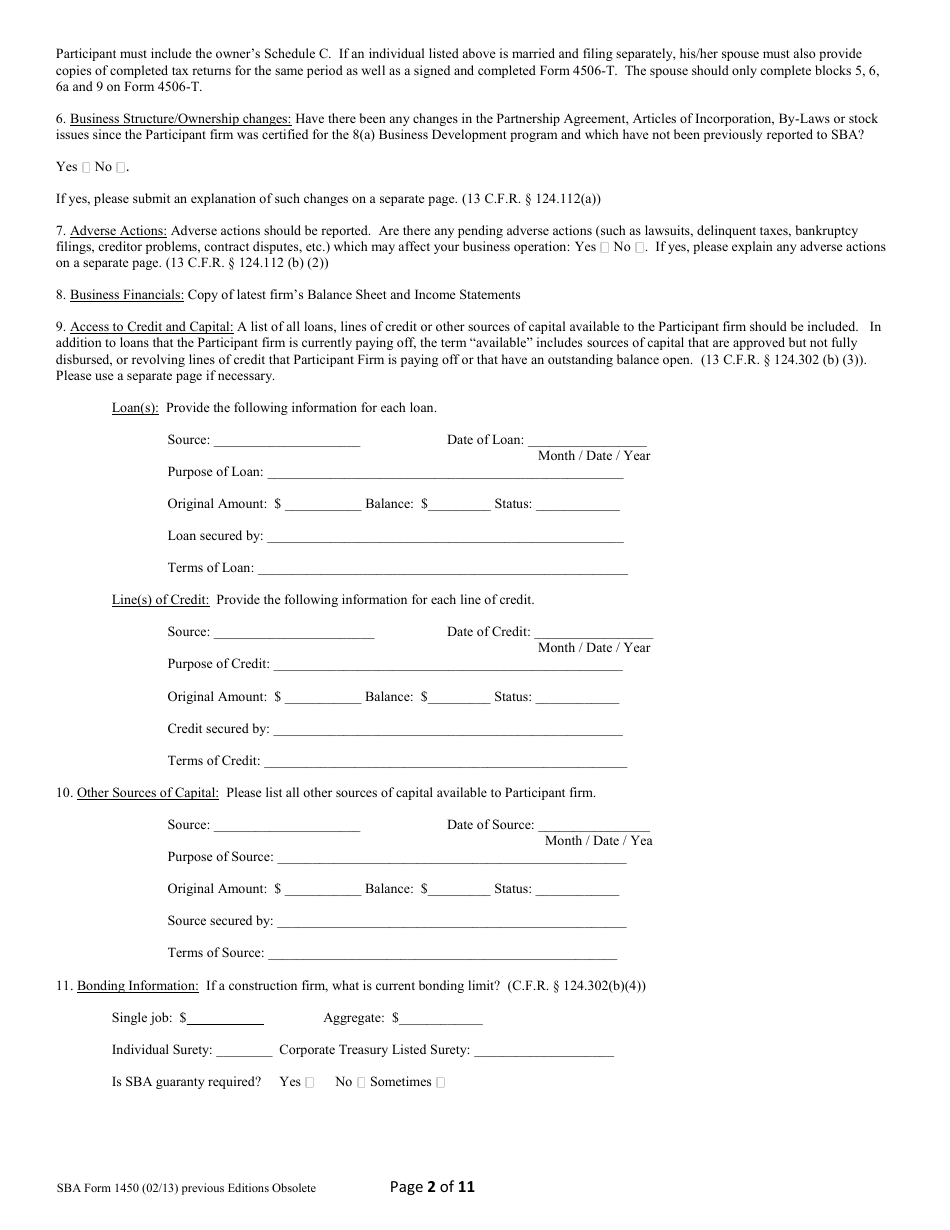

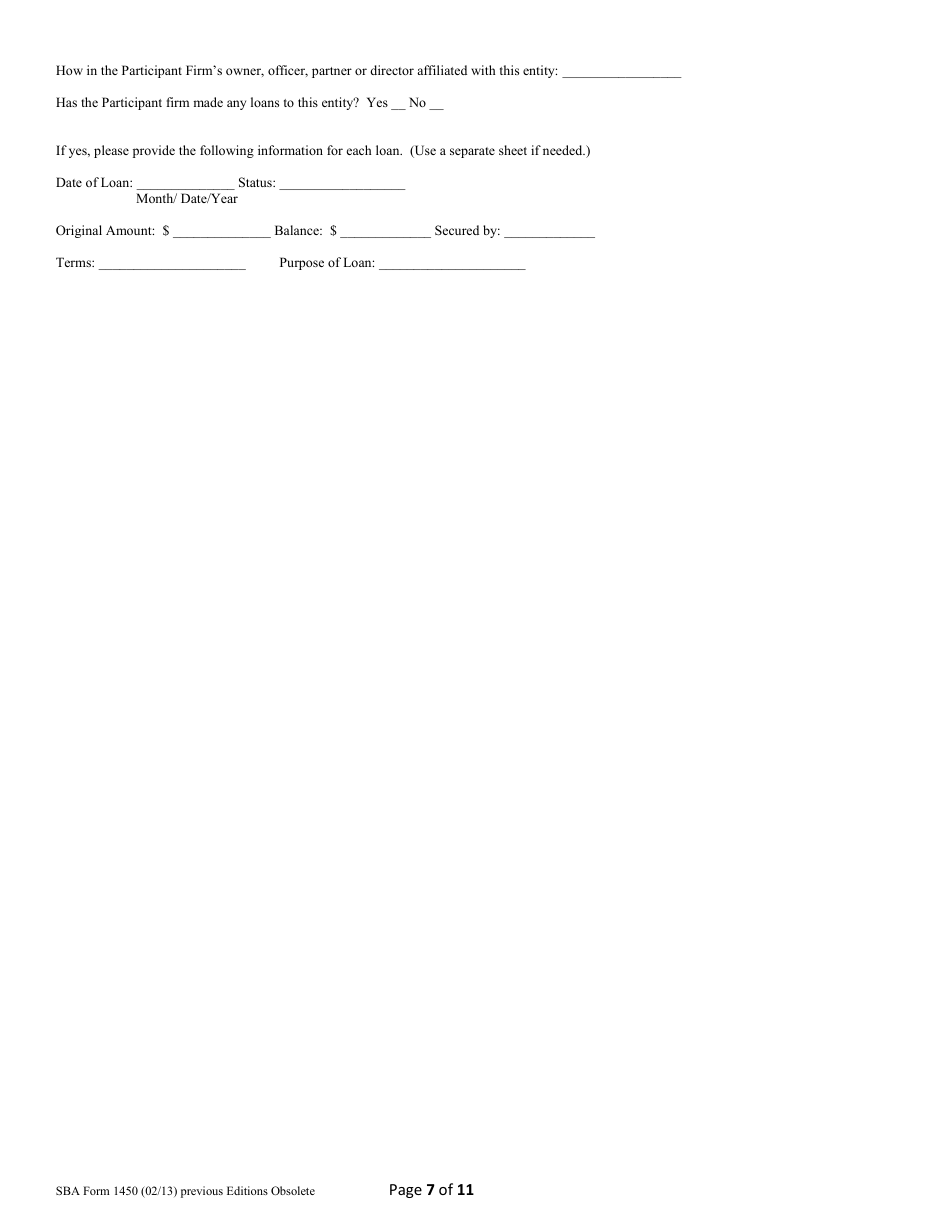

- All loans or credits available to the participant should be listed in Block 9. The source of the loan, the date, its purpose, original amount, balance, status, security, and terms should be specified in the corresponding lines.

- Block 10 is for listing any other sources of capital. The name of each source and the original amount, purpose, and terms of any received capital must be disclosed.

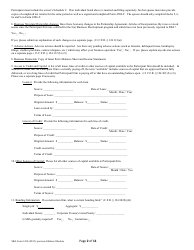

- Block 11 is completed if the business is a construction firm.

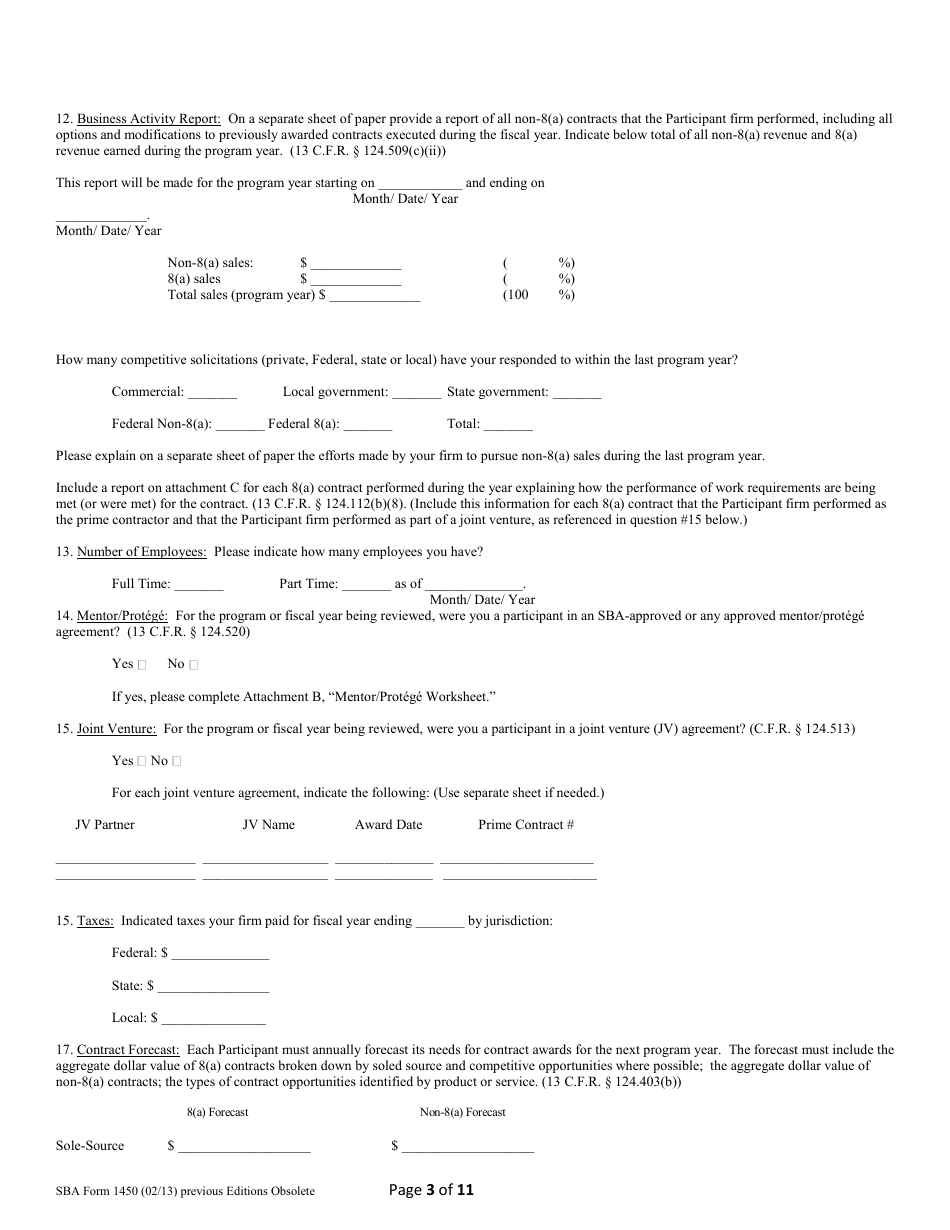

- To complete Block 12, the participant has to prepare a report of all non-8(a) contracts performed during the previous year on a separate sheet.

- The number of employees working for the participant's business is given in Block 13.

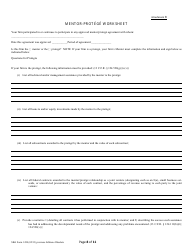

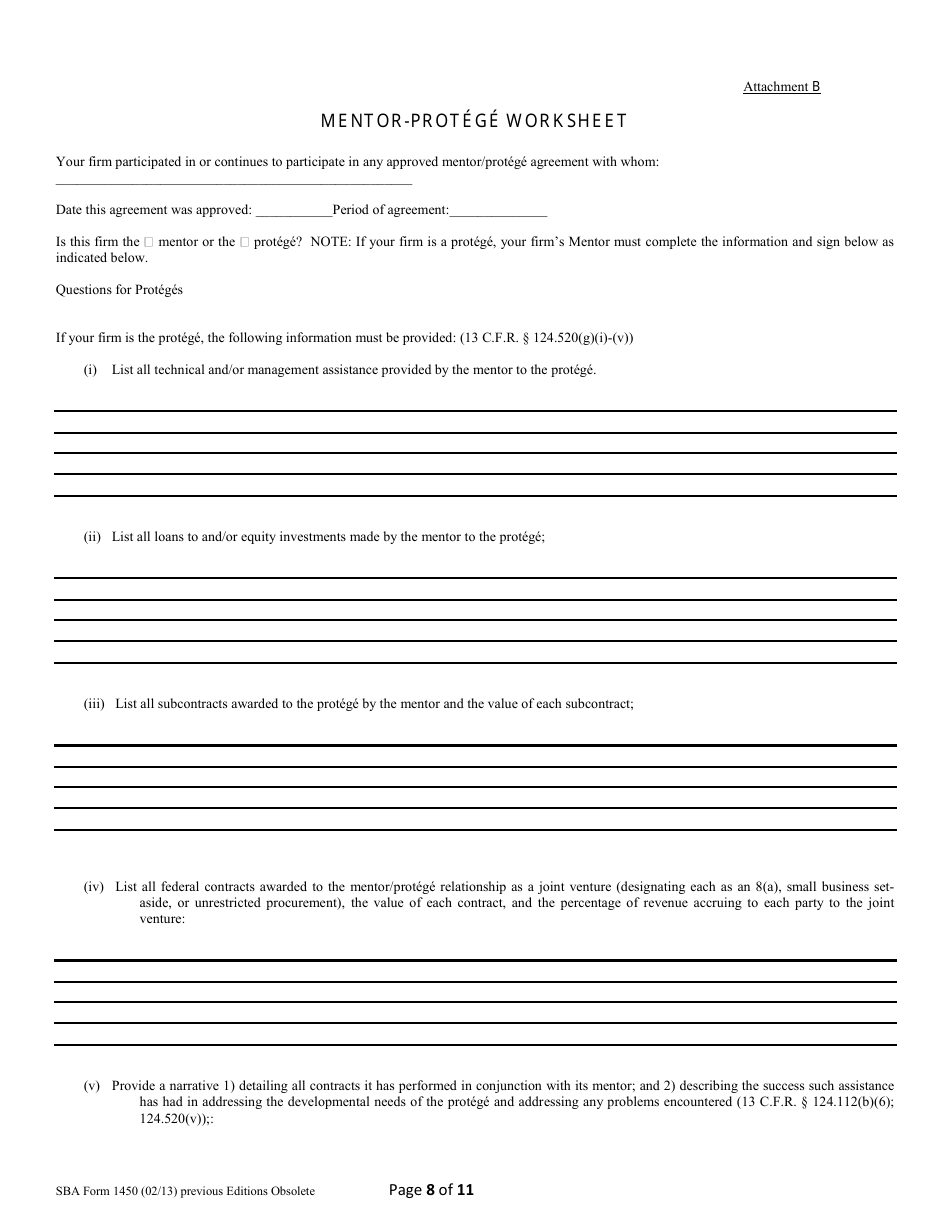

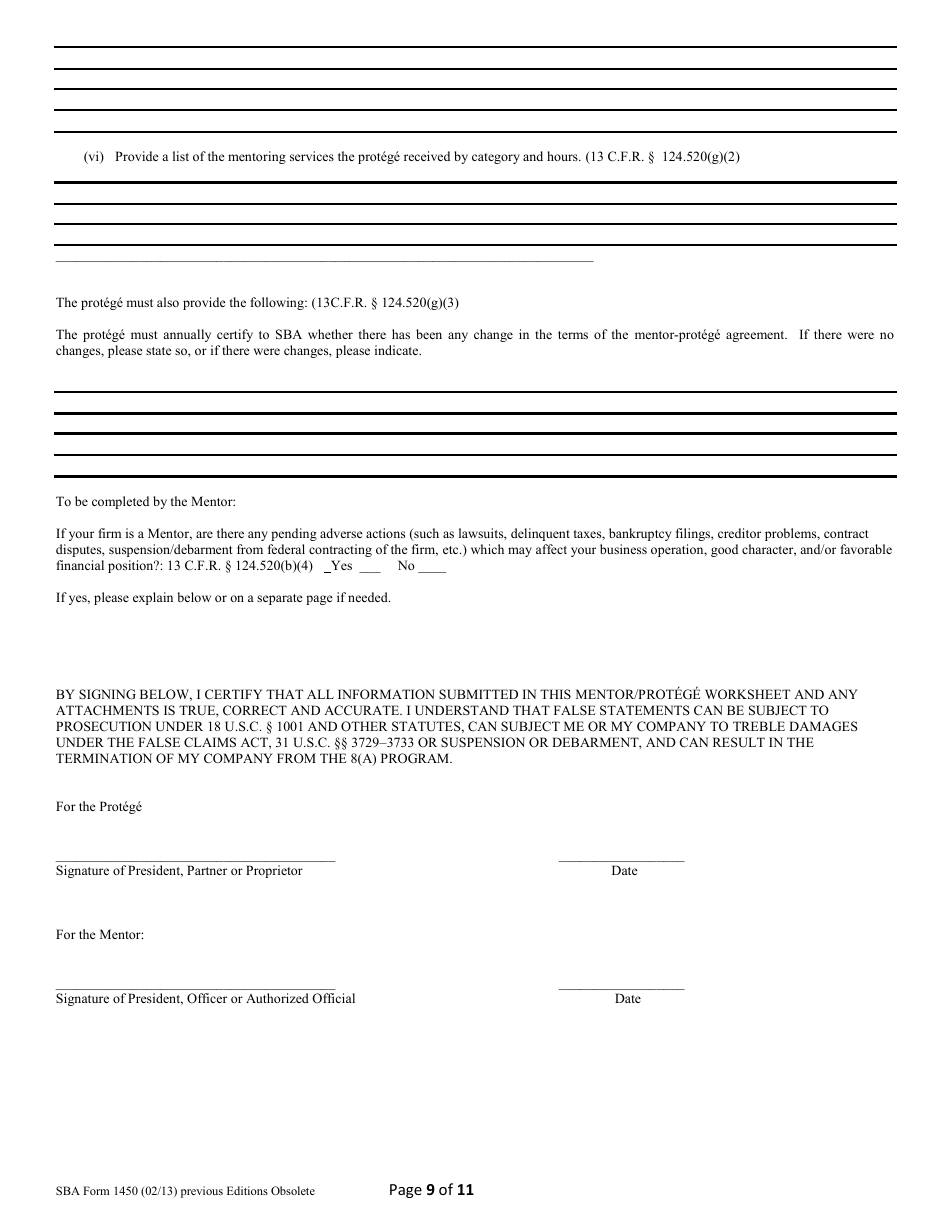

- The participant must complete Block 14 and Attachment B if they took part in an approved mentor or protégé agreement.

- The participant must complete Block 15 is their business was a participant of a joint venture agreement.

- The amount of taxes paid is disclosed in Block 16.

- Block 17 requires a forecast of contract awards needs for the next year.

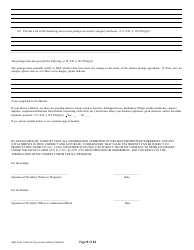

The SBA Form 1450 should be signed and dated by the president, partner or proprietor of the business

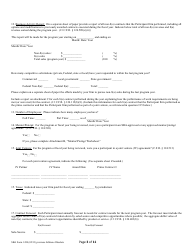

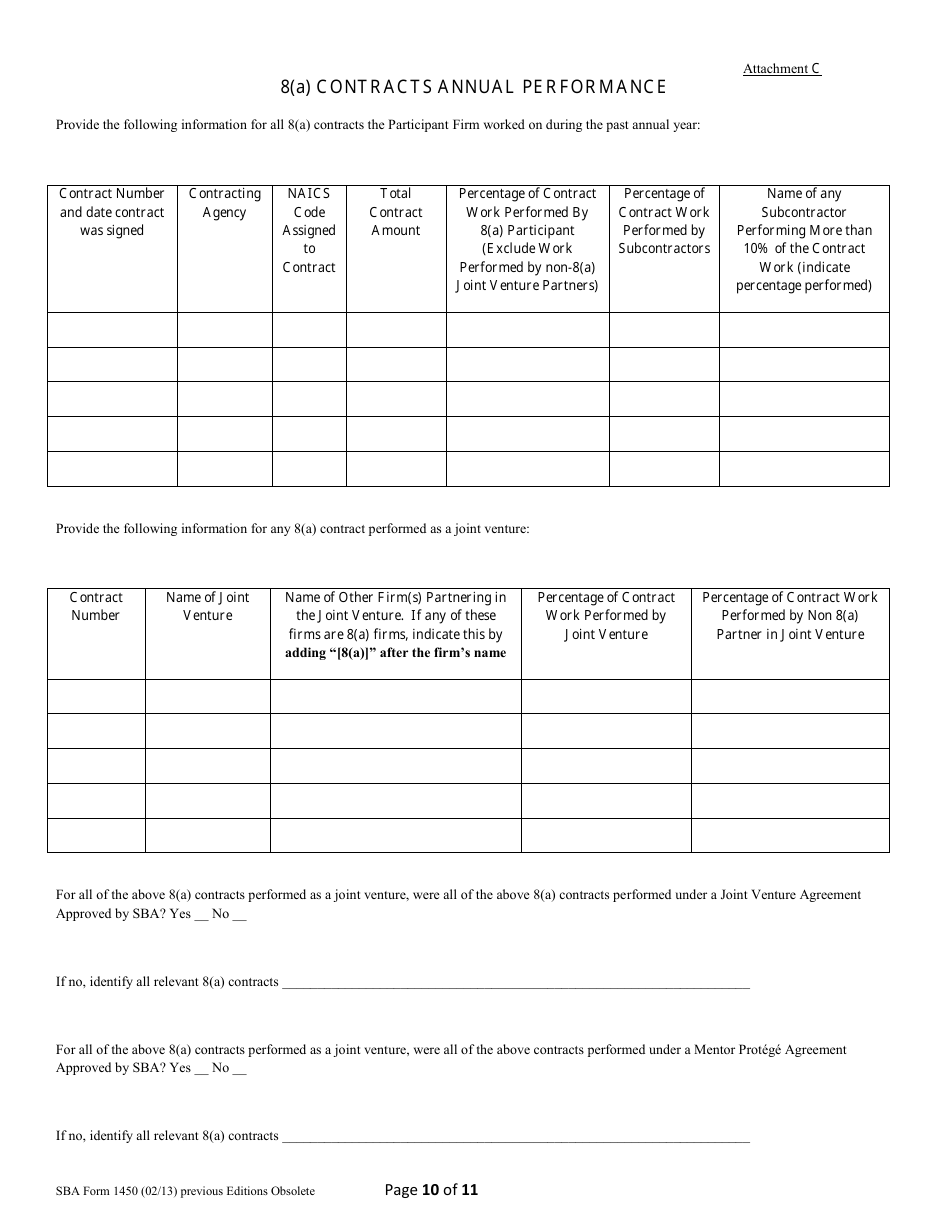

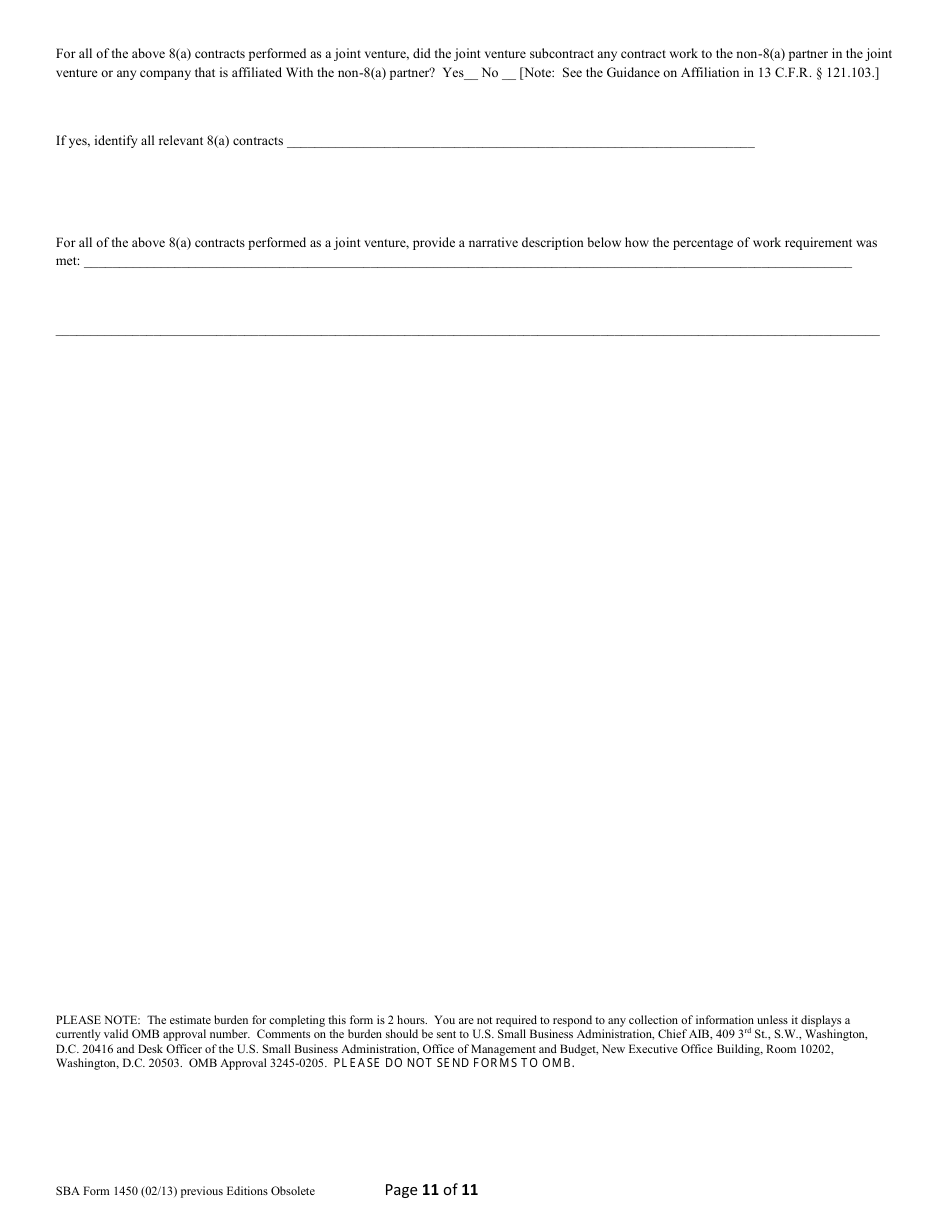

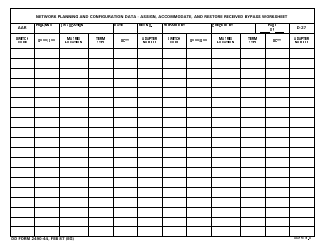

SBA Form 1450 Attachment C Instructions

Attachment C, 8(a) Contracts Annual Performance is an attachment to the SBA 1450 Form used for listing all 8(a) contracts the participant's business engaged with during the previous year.

The first part of the attachment is a table for information on each contract. It requires the number of the contract, the date the contract was signed, the contracting agency, and the assigned North American Industry Classification System (NAICS) code. The table should also contain the percentage of work performed by the participant and the percentage performed by any subcontractors. A subcontractor performing more than 10% of the work should be named and the percentage they performed should be indicated.

The participant has to fill out the second table of Attachment C if any 8(a) contract was performed as a joint venture. It should contain the numbers of each contract, the names of the joint ventures, the names of any other firms participating in the venture, the percentage of work performed by the venture, and the percentage of work performed by non-8(a) partners in the venture.

The attachment also requires the following additional information:

- Whether all of the contracts under a joint venture listed above were performed under an SBA-approved joint venture agreement.

- Whether these contracts were performed under an SBA-approved mentor-protégé agreement.

- Whether the joint venture subcontracts any contract worked to the non-8(a) partner in the venture or any company affiliated with the non-8(a) partner.s.

The participant should provide a narrative description of how the percentage of work requirement was met for all contracts performed under a joint venture.