This version of the form is not currently in use and is provided for reference only. Download this version of

VA Form 21P-8416

for the current year.

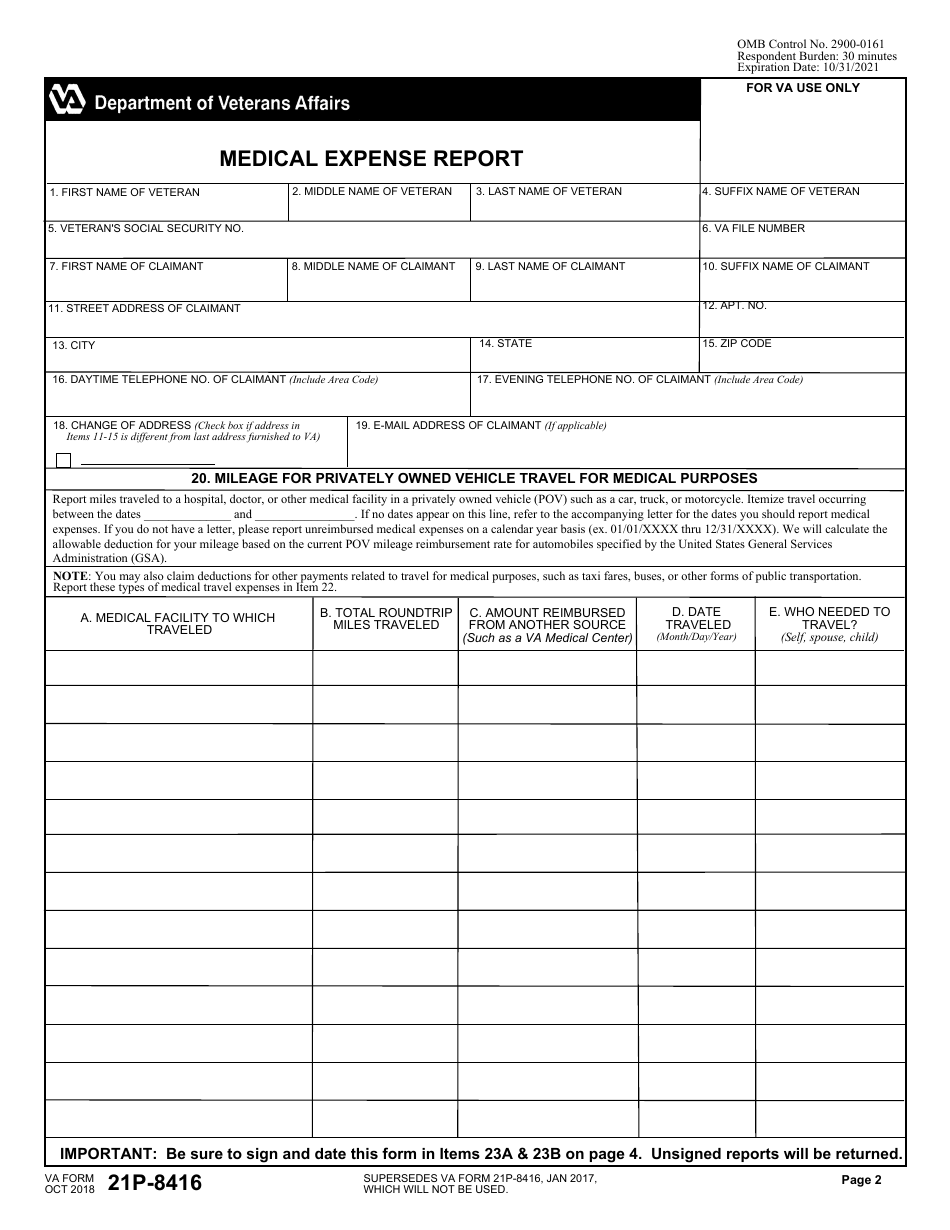

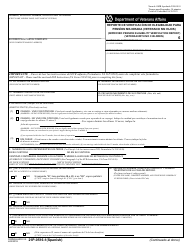

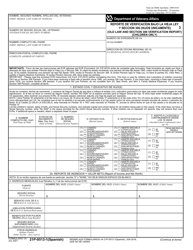

VA Form 21P-8416 Medical Expense Report

What Is VA Form 21P-8416?

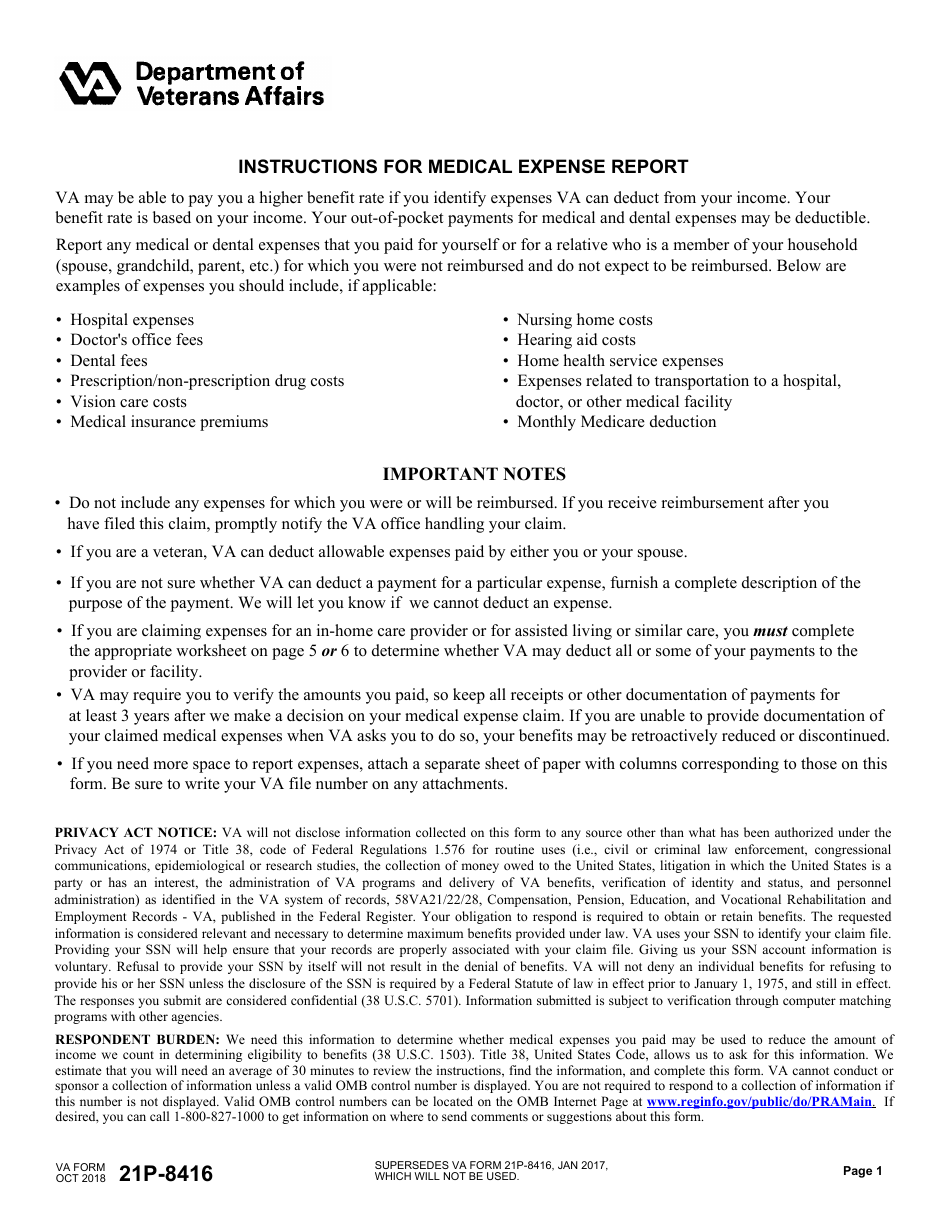

VA Form 21P-8416, Medical Expense Report, is a document used to report expenses paid for medical or dental treatment of the veteran or their family member. This form is used for reporting only expenses that are not or will not be reimbursed.

The latest version of the form was released by the U.S. Department of Veterans Affairs (VA) on October 1, 2018 , with all previous editions obsolete. A VA Form 21P-8416 fillable version is available for download below.

This form is related to the now-obsolete VA Form 21P-8146B, Report of Medical, Legal, and Other Expenses Incident to Recovery for Injury or Death. VA Form 21P-8416B was used by the VA to obtain the information necessary for a determination of eligibility for income-based benefits and the payable rate.

How to Fill Out VA Form 21P-8416?

Expenses that can be reported on the form include:

- Hospital expenses;

- Doctor's office fees;

- Dental fees;

- Prescription or non-prescription drug costs;

- Vision care costs;

- Medical insurance premiums;

- Nursing home costs;

- Hearing aid costs;

- Home health service expenses;

- Expenses related to transportation to a hospital, doctor, or another medical facility;

- Monthly Medicare deduction.

Step-by-step VA Form 21P-8416 instructions are as follows:

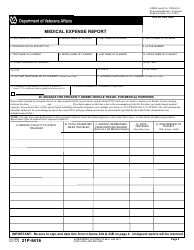

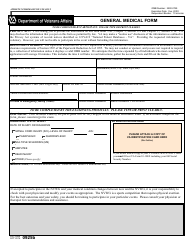

- The veteran's full name is provided in Items 1-4. Item 5 is for the social security number. The VA file number is entered in Item 6. The full name of the claimant is provided in Items 7-10. Items 11-15 require the claimant's mailing address. Items 16 and 17 are for providing the daytime and the evening phone numbers of the claimant. If the claimant's mailing address is different from the last furnished to VA, this should be indicated in Item 18. Item 19 is for the claimant's email address.

- Item 20 is for reporting miles traveled to a medical facility in a privately owned vehicle. The claimant has to indicate the timeframe of travel. This item should also include information about travels done in public transportation, taxi, etc.

- Column A is for entering the name of the medical facility the claimant has traveled to. Column B requires the total miles traveled. The amount of reimbursement from another source is given in Column C. The date of each travel is given in Column D. Column E is for entering the person, the travel was done for.

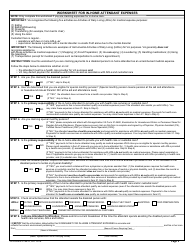

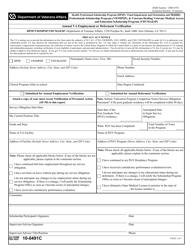

- Item 21 is used for reporting the in-home attendant expenses. If such expenses are claimed, the claimant has to complete page 5 of the form ("In-Home Attendant Worksheet"). This item requires the timeframe when expenses were paid.

- The name of the provider is given in Column A. Column B is for the number of hours and hourly rate. Amount paid is given on Column C. The date of payment is provided in Column D. Column E is for entering the person-receiver of the expenses.

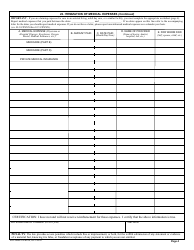

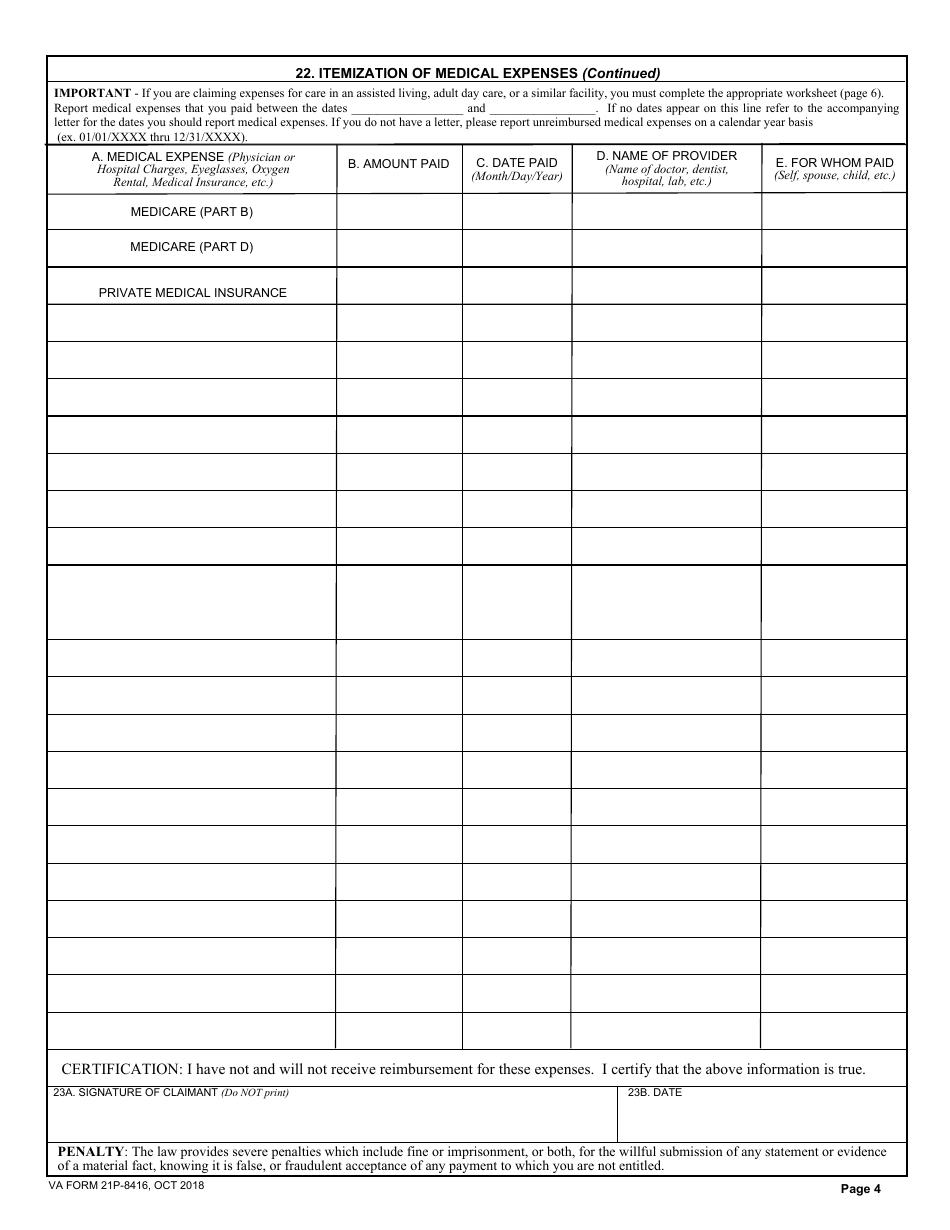

- Item 22 is for the itemization of medical expenses. It requires the period when expenses were paid and completing the chart. Column A is for naming the medical expense. The amount of the expense is given in Column B. The date the expense was paid is provided in Column C. Column D is for the name of the provider. The person-receiver of the expenses is named in Column E.

- When the report is completed, the form must be signed and dated by the claimant in Items 23A and 23B.

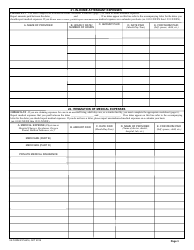

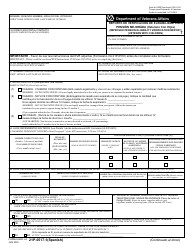

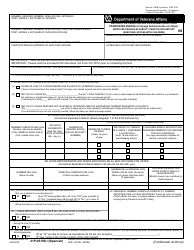

- If in-home attendant expenses are claimed, the claimant must complete the worksheet on page 5. This is a questionnaire that requires information about the attendant assistance and the claimant's condition. The worksheet must be signed and dated by the attendant.

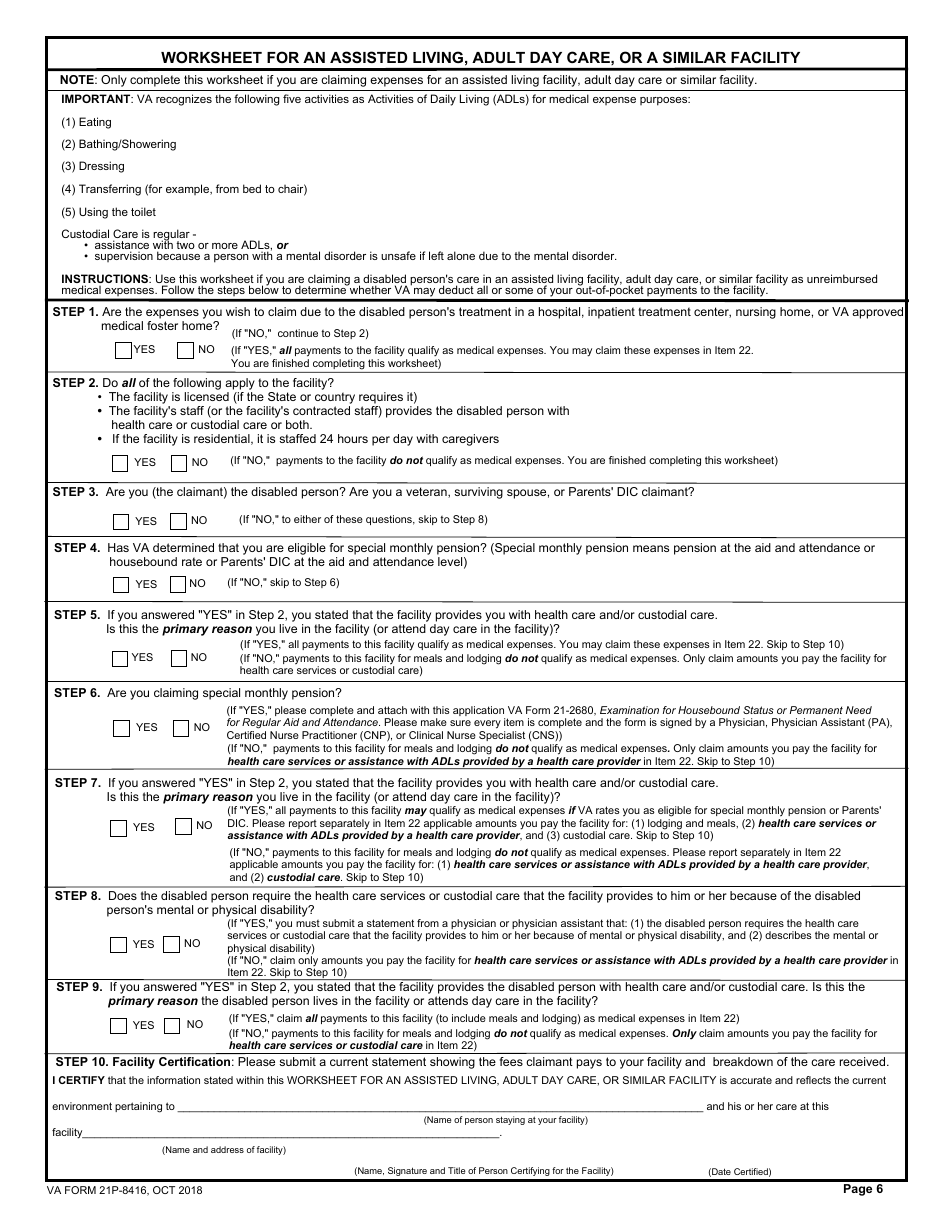

- If the claimant reports expenses for assisted living, adult daycare, or similar facility, they should complete the worksheet on page 6. The worksheet is made up of several yes/no - questions and requires information about the received assistance and the claimant's condition. The completed worksheet must be signed and dated by the representative of the facility.

Where Do I Send VA Form 21P-8416?

The form may be presented in person or mailed to the local VA benefits office. The mailing address for VA Form 21P-8416 can be obtained through the VA website. The form can be also filed using the VA website. Submitting the claim through the VONAPP is no longer possible.