This version of the form is not currently in use and is provided for reference only. Download this version of

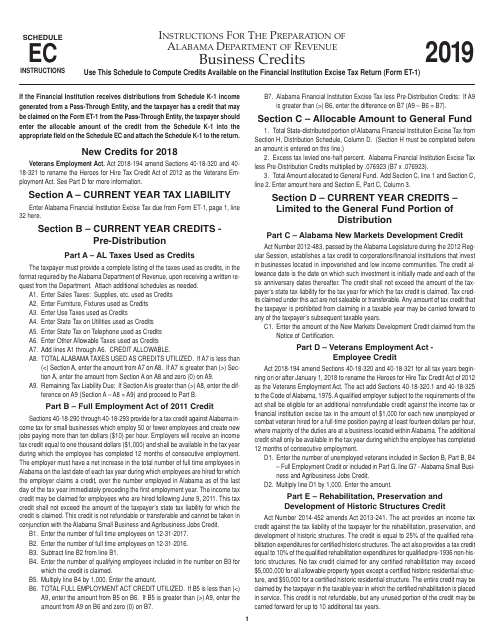

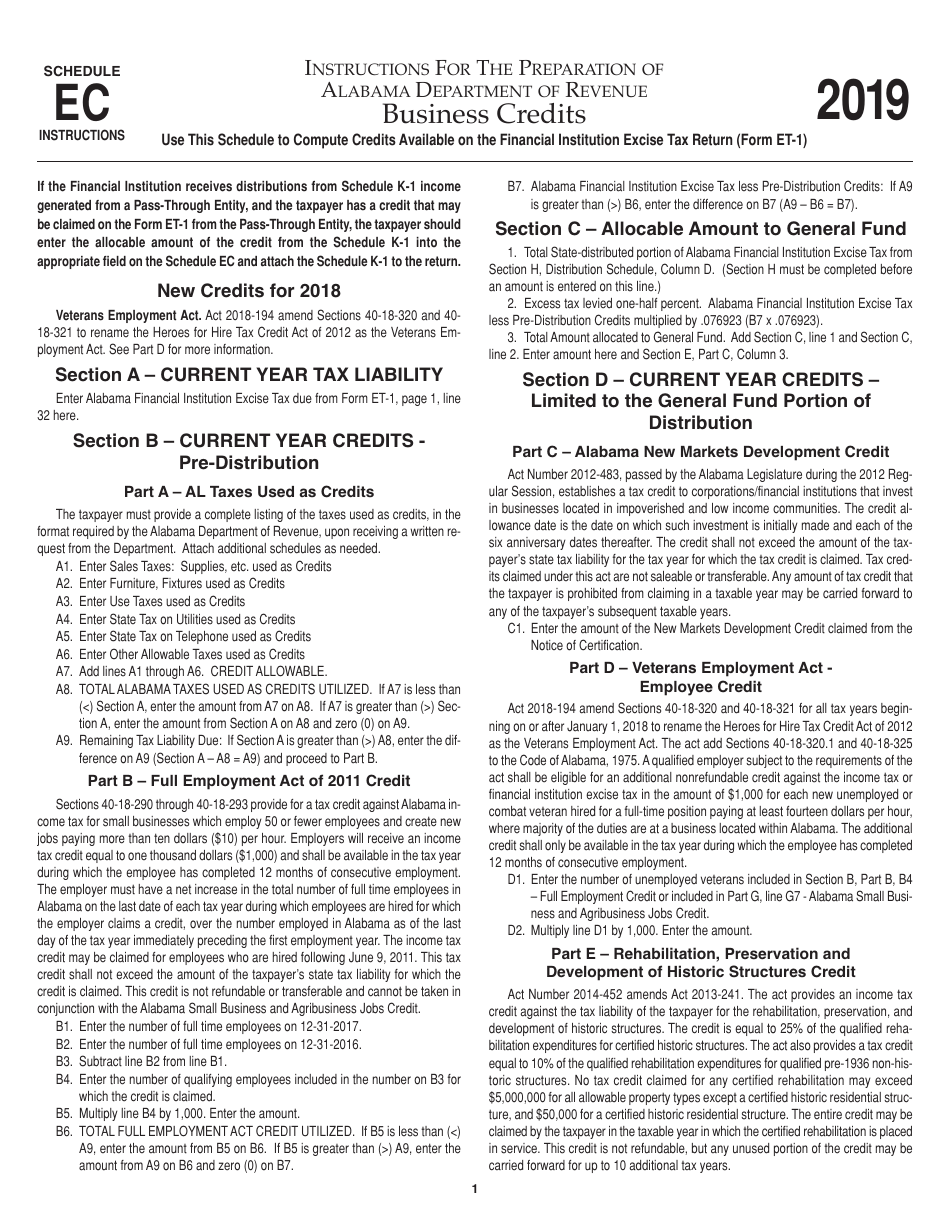

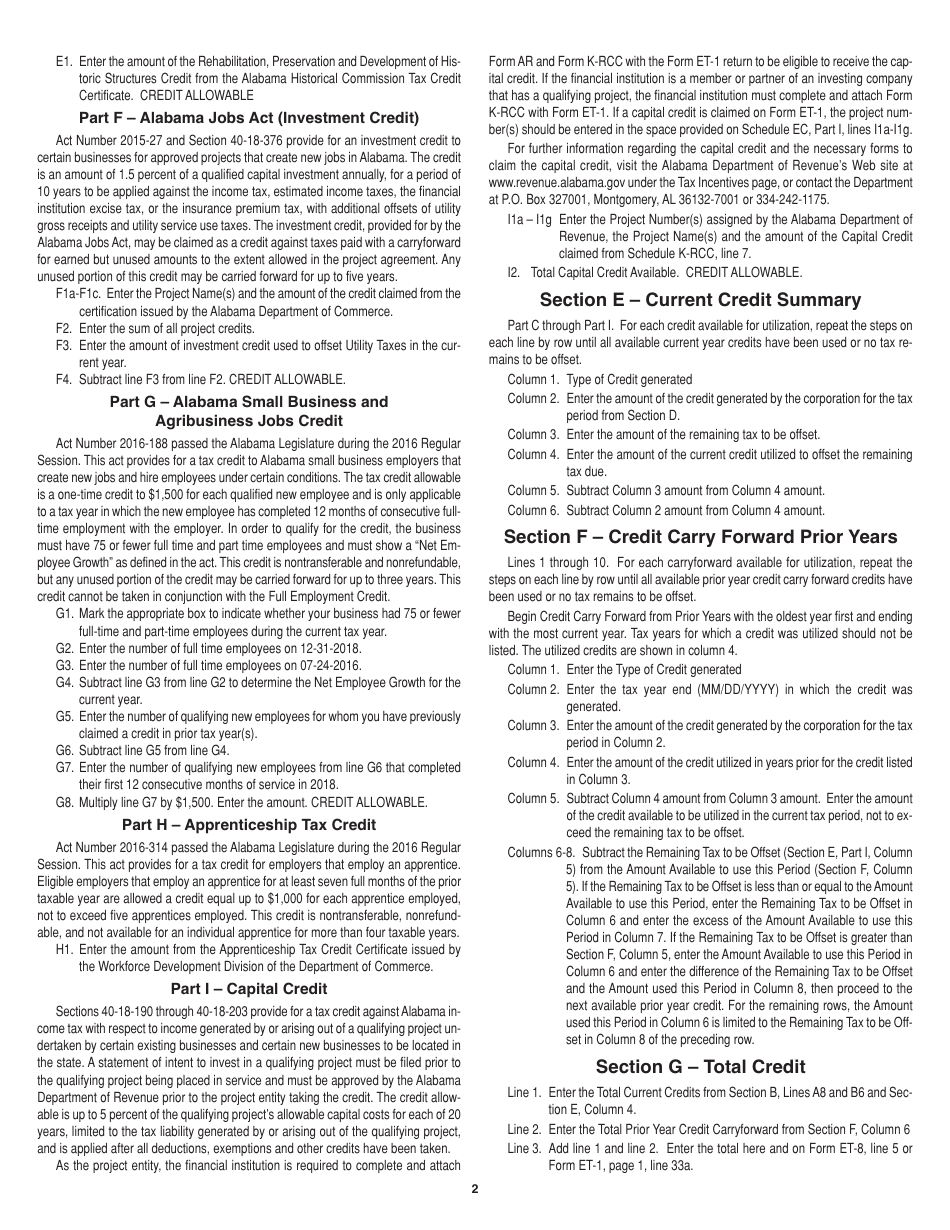

Instructions for Form ET-1 Schedule EC

for the current year.

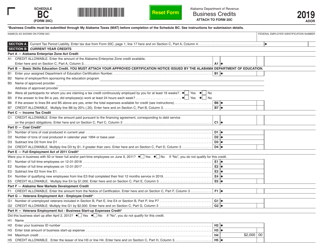

Instructions for Form ET-1 Schedule EC Business Credits - Alabama

This document contains official instructions for Form ET-1 Schedule EC, Business Credits - a form released and collected by the Alabama Department of Revenue.

FAQ

Q: What is Form ET-1 Schedule EC?

A: Form ET-1 Schedule EC is a form used in Alabama to claim business credits.

Q: What are business credits?

A: Business credits are tax incentives provided by the government to encourage certain business activities.

Q: Who should file Form ET-1 Schedule EC?

A: Businesses in Alabama that are eligible for business credits should file Form ET-1 Schedule EC.

Q: What information is required on Form ET-1 Schedule EC?

A: Form ET-1 Schedule EC requires information about the business and details of the business credits being claimed.

Q: When is the deadline to file Form ET-1 Schedule EC?

A: The deadline to file Form ET-1 Schedule EC is the same as the deadline for filing the Alabama business privilege tax return.

Q: Are there any penalties for late filing of Form ET-1 Schedule EC?

A: Yes, there may be penalties for late filing of Form ET-1 Schedule EC. It is important to file the form on time to avoid any penalties.

Q: Can I claim multiple business credits on Form ET-1 Schedule EC?

A: Yes, you can claim multiple business credits on Form ET-1 Schedule EC if you are eligible for them.

Q: Should I include any supporting documentation with Form ET-1 Schedule EC?

A: Yes, it is recommended to include supporting documentation with Form ET-1 Schedule EC to substantiate the business credits being claimed.

Q: Who can I contact for help with Form ET-1 Schedule EC?

A: You can contact the Alabama Department of Revenue or seek assistance from a tax professional for help with Form ET-1 Schedule EC.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.