Form DSCB:15-134A Docketing Statement - New Entity - Pennsylvania

Fill PDF Online

Fill out online for free

without registration or credit card

What Is Form DSCB:15-134A?

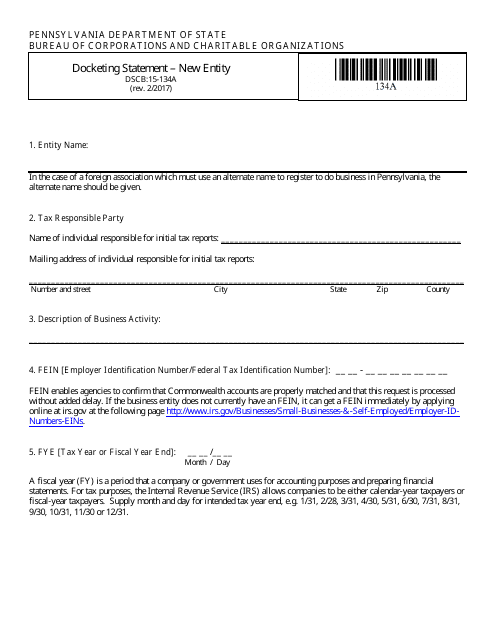

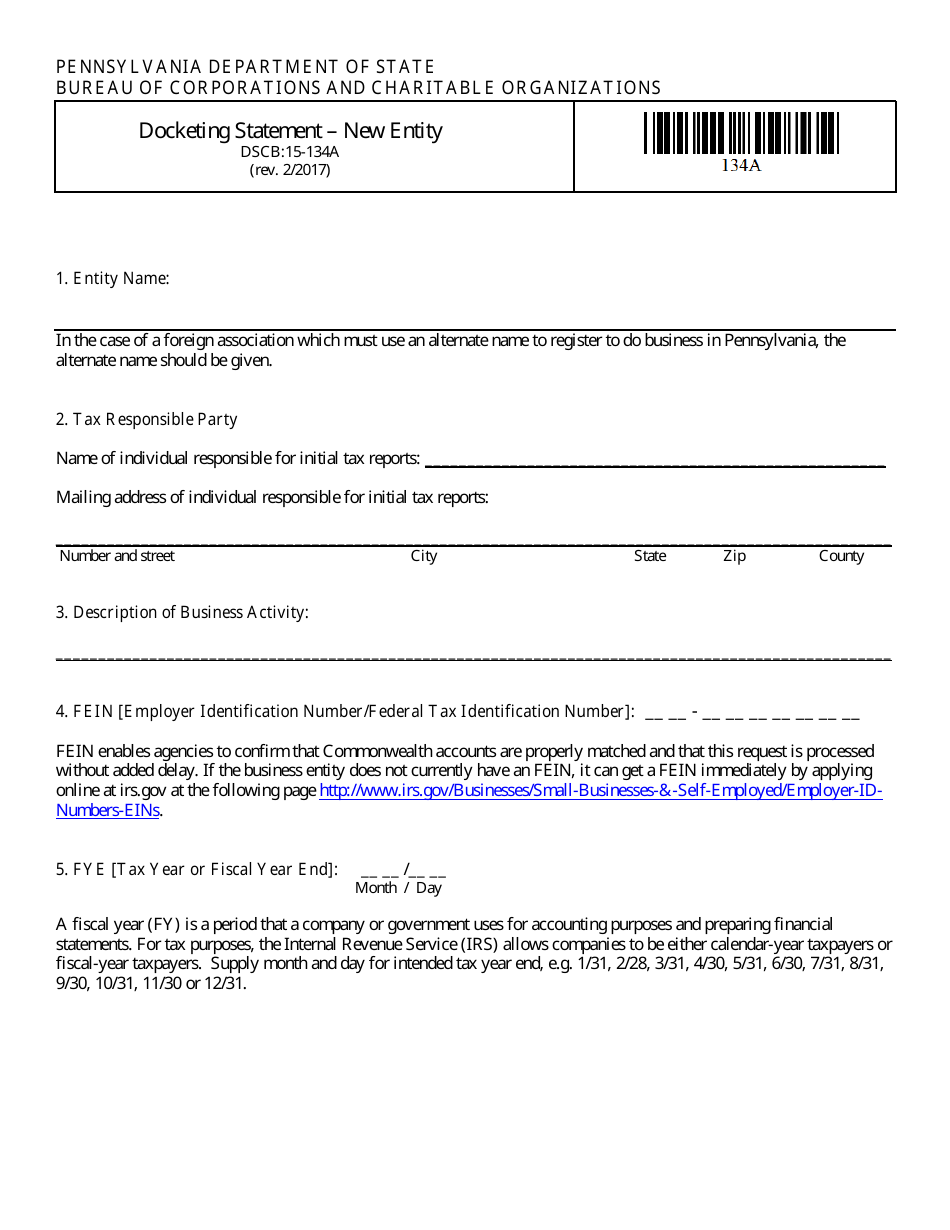

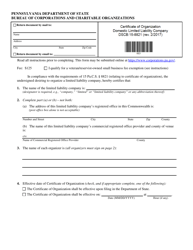

Form DSCB:15-134A, Docketing Statement - New Entity , is a one-page form to register your new Pennsylvania LLC for tax purposes. This PA Docketing Statement is submitted to the Pennsylvania Department of Revenue for the purpose of assigning your LLC a Pennsylvania Tax ID number. This form must be submitted in conjunction with the Form DSCB:15-8821, Certificate of Organization. These are the two documents needed to officially form an LLC in Pennsylvania.

This DSCB:15-134A Form, is issued by the Pennsylvania Department of State and the latest revision took place on February 1, 2017 . A DSCB:15-134A Form is available for download below.

How to Fill Out Form DSCB:15-134A?

Follow the DSCB:15-134A instructions below to complete the form.

- For Entity Name, enter the name of your LLC, exactly as it is on your Certificate of Organization. Before choosing an LLC name for both of these documents, make sure the LLC name is available by checking the PA State government website;

- For Tax Responsible Party, enter the name, street, city, state, zip, and county of the "primary member's" name. The only people who can be members of an LLC is the owner of the LLC and any others who agree to go into business with the owner. This will be your name and address for most filers. All states allow single-member LLCs.;

- For Description of Business Activity, enter at least a few words or sentences to describe what the business will do. It does not have to be very specific or technical. If the business will conduct multiple activities, enter the primary activity. This section is just for initial information for the Department of Revenue. Do not enter any general LLC purpose statement, otherwise, the document will be rejected;

- Regarding the FEIN (Employer Identification Number/Federal Tax Identification Number), one can apply online. It is recommended however to leave this section blank and apply for your Federal Tax ID Number after your LLC is approved. If this number is left blank, the state will still accept the document;

- For the FYE (Tax Year or Fiscal Year End) enter 12/31 if your business calendar year is January 1 to December 31. If your business reporting cycle does not end on 12/31, enter your business fiscal year-end date;

- This form does not require a signature. Once these steps are completed it is ready to submit along with the completed Certificate of Organization Form DSCB: 15-8821.