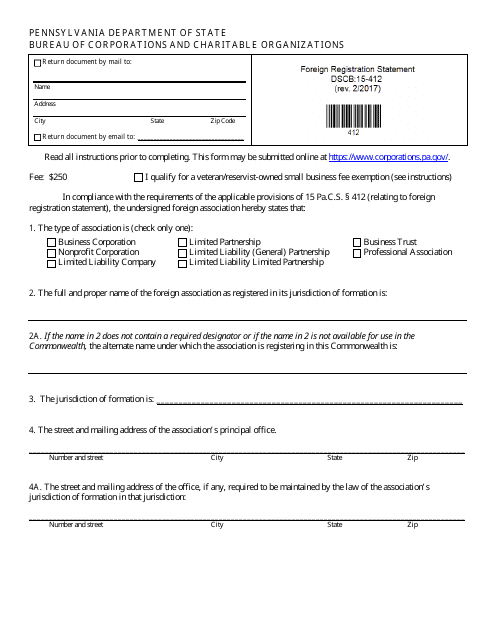

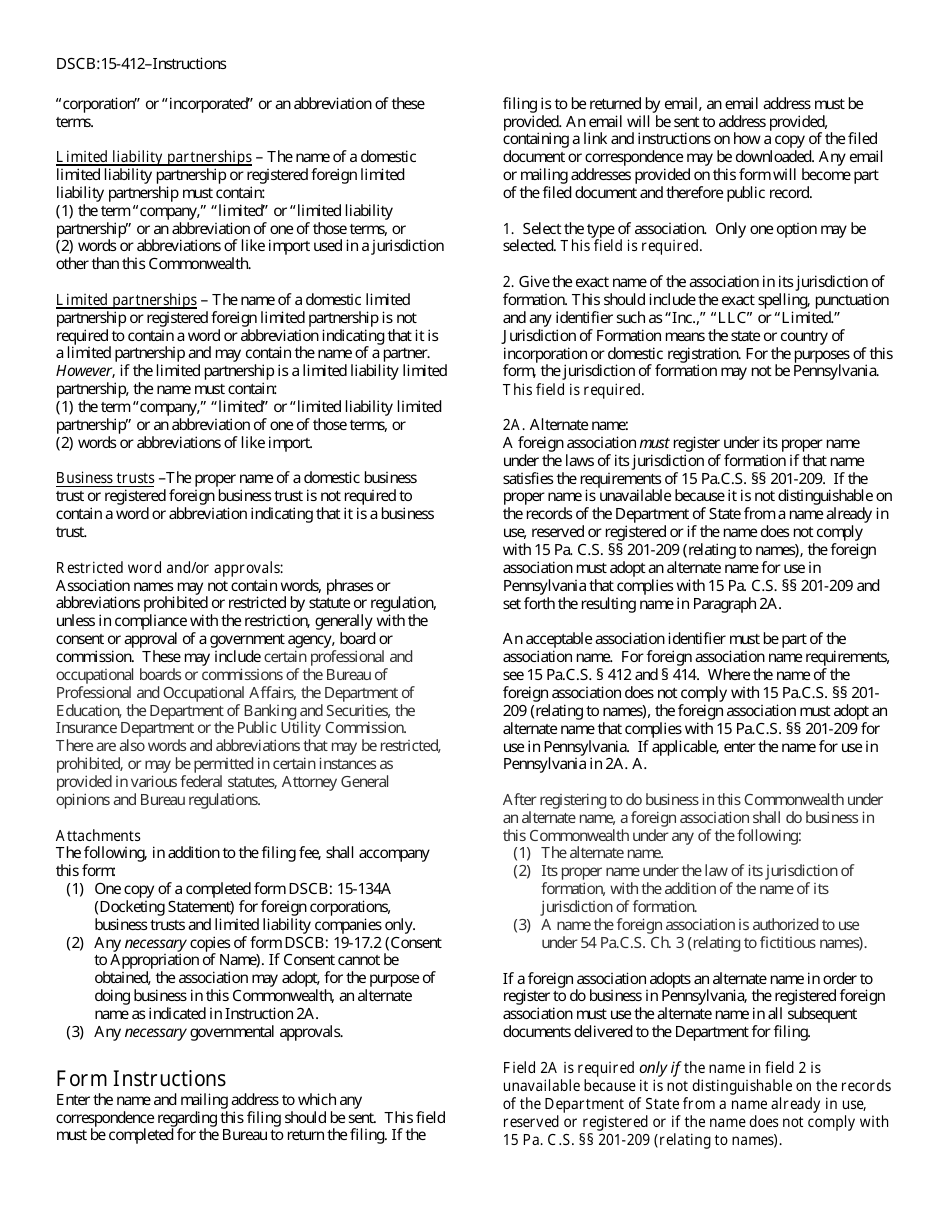

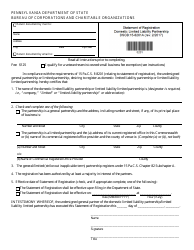

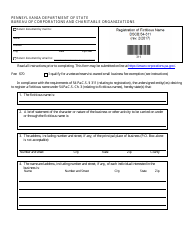

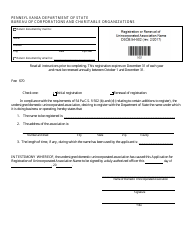

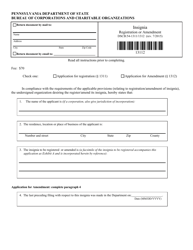

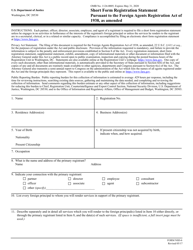

Form DSCB:15-412 Foreign Registration Statement - Pennsylvania

What Is Form DSCB:15-412?

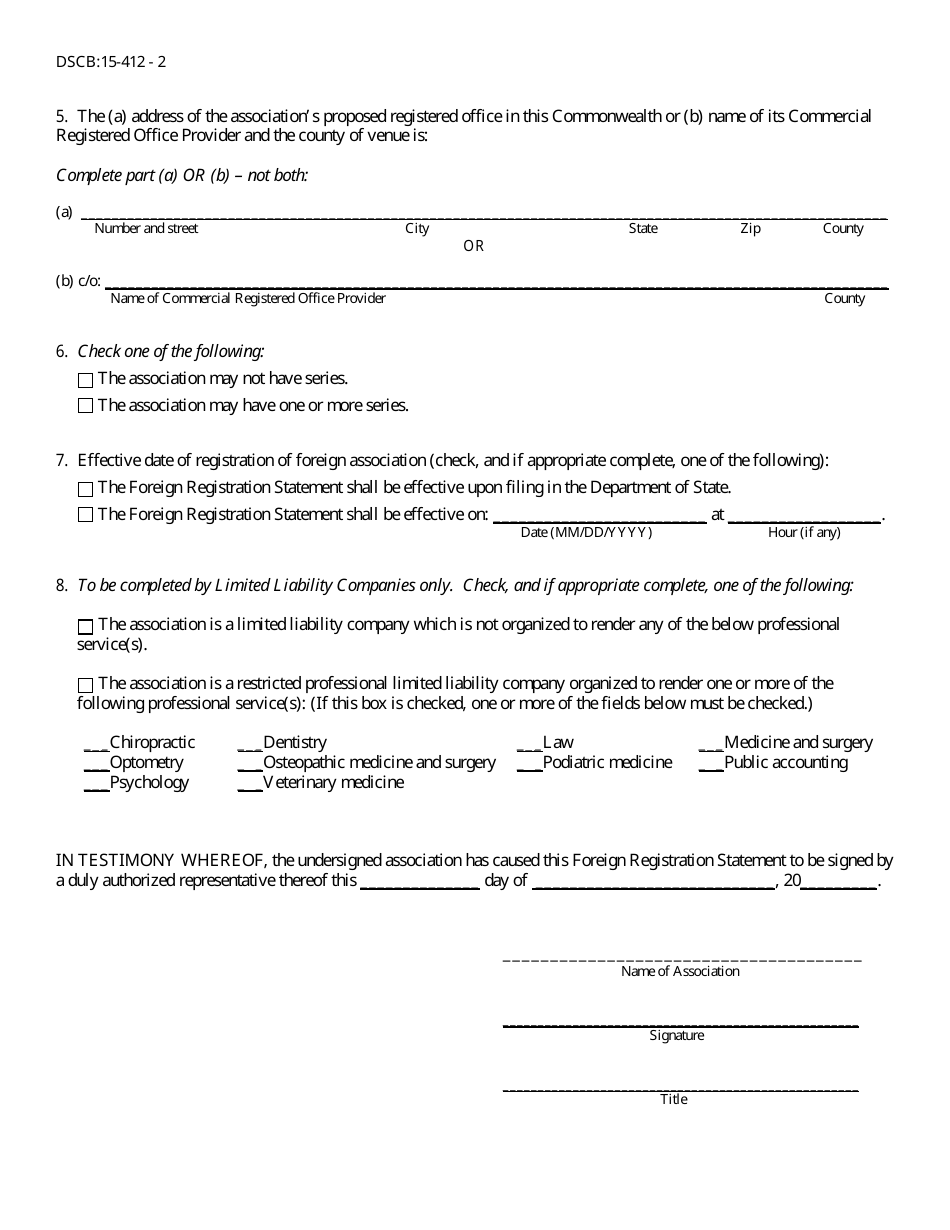

This is a legal form that was released by the Pennsylvania Department of State - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DSCB:15-412?

A: Form DSCB:15-412 is the Foreign Registration Statement for Pennsylvania.

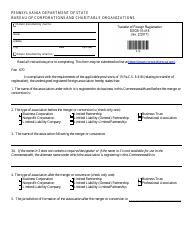

Q: Who needs to file Form DSCB:15-412?

A: Any foreign business entity that wants to do business in Pennsylvania needs to file Form DSCB:15-412.

Q: What is a foreign business entity?

A: A foreign business entity is a company or organization that is incorporated outside of Pennsylvania.

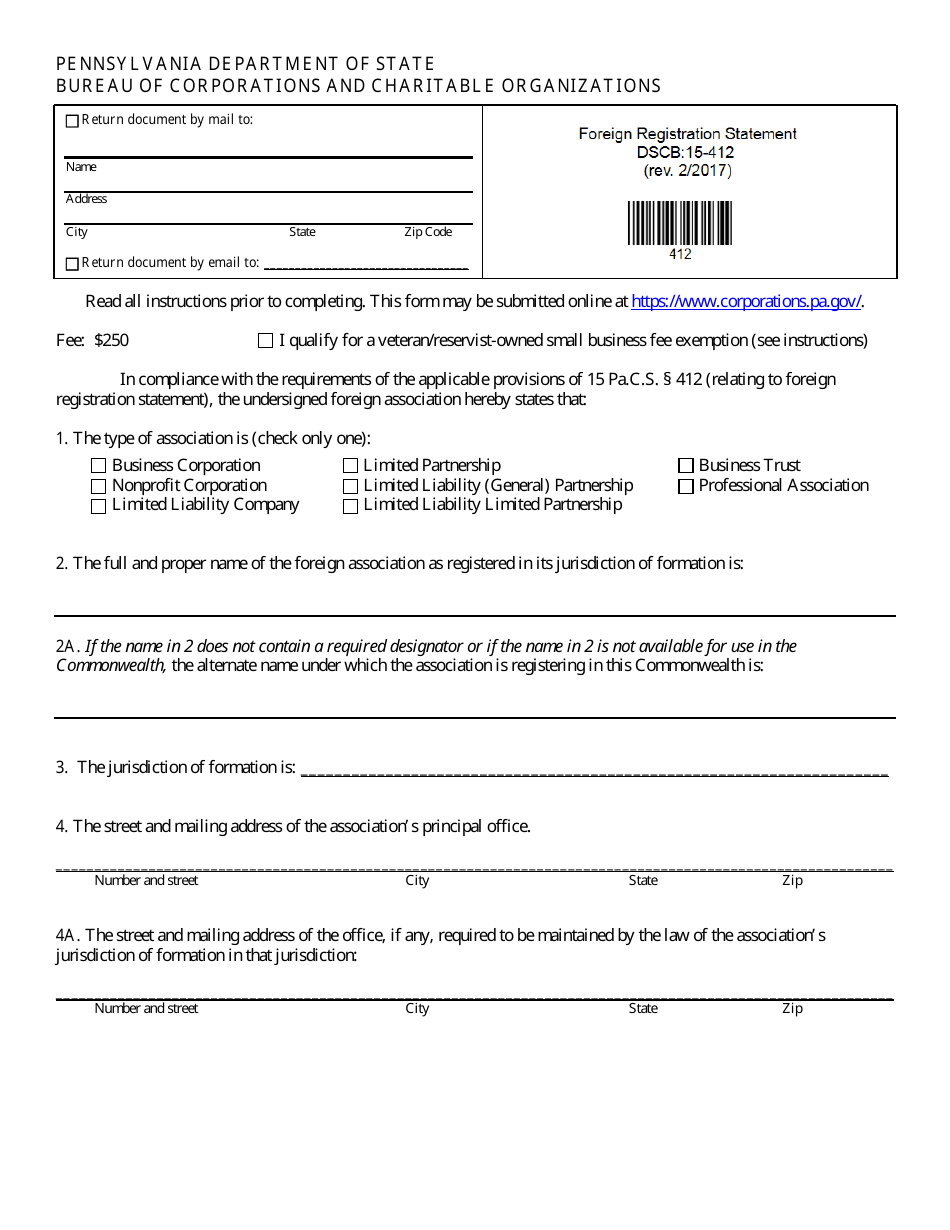

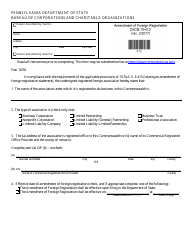

Q: What information is required on Form DSCB:15-412?

A: Form DSCB:15-412 requires information about the foreign business entity's name, address, directors, and registered agent.

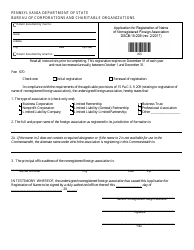

Q: Is Form DSCB:15-412 required every year?

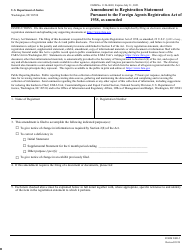

A: No, Form DSCB:15-412 is not required annually. It only needs to be filed when there are changes to the foreign business entity's information or when requested by the Pennsylvania Department of State.

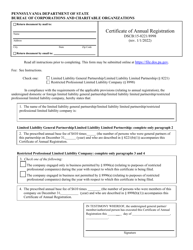

Q: What happens if I don't file Form DSCB:15-412?

A: Failure to file Form DSCB:15-412 may result in penalties and the loss of the foreign business entity's ability to do business in Pennsylvania.

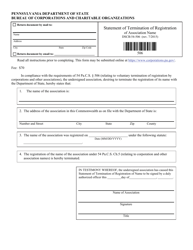

Q: Can I withdraw my foreign registration?

A: Yes, a foreign business entity can withdraw its registration in Pennsylvania by filing a Notice of Withdrawal form with the Pennsylvania Department of State.

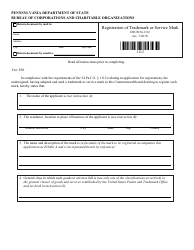

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Pennsylvania Department of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DSCB:15-412 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of State.