This version of the form is not currently in use and is provided for reference only. Download this version of

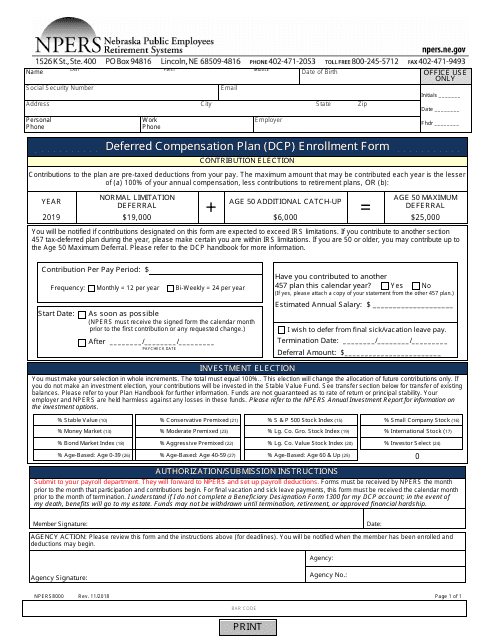

Form NPERS8000

for the current year.

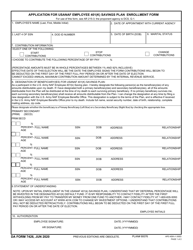

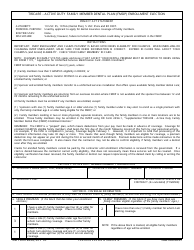

Form NPERS8000 Deferred Compensation Plan (Dcp) Enrollment Form - Nebraska

What Is Form NPERS8000?

This is a legal form that was released by the Nebraska Public Employees Retirement Systems - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

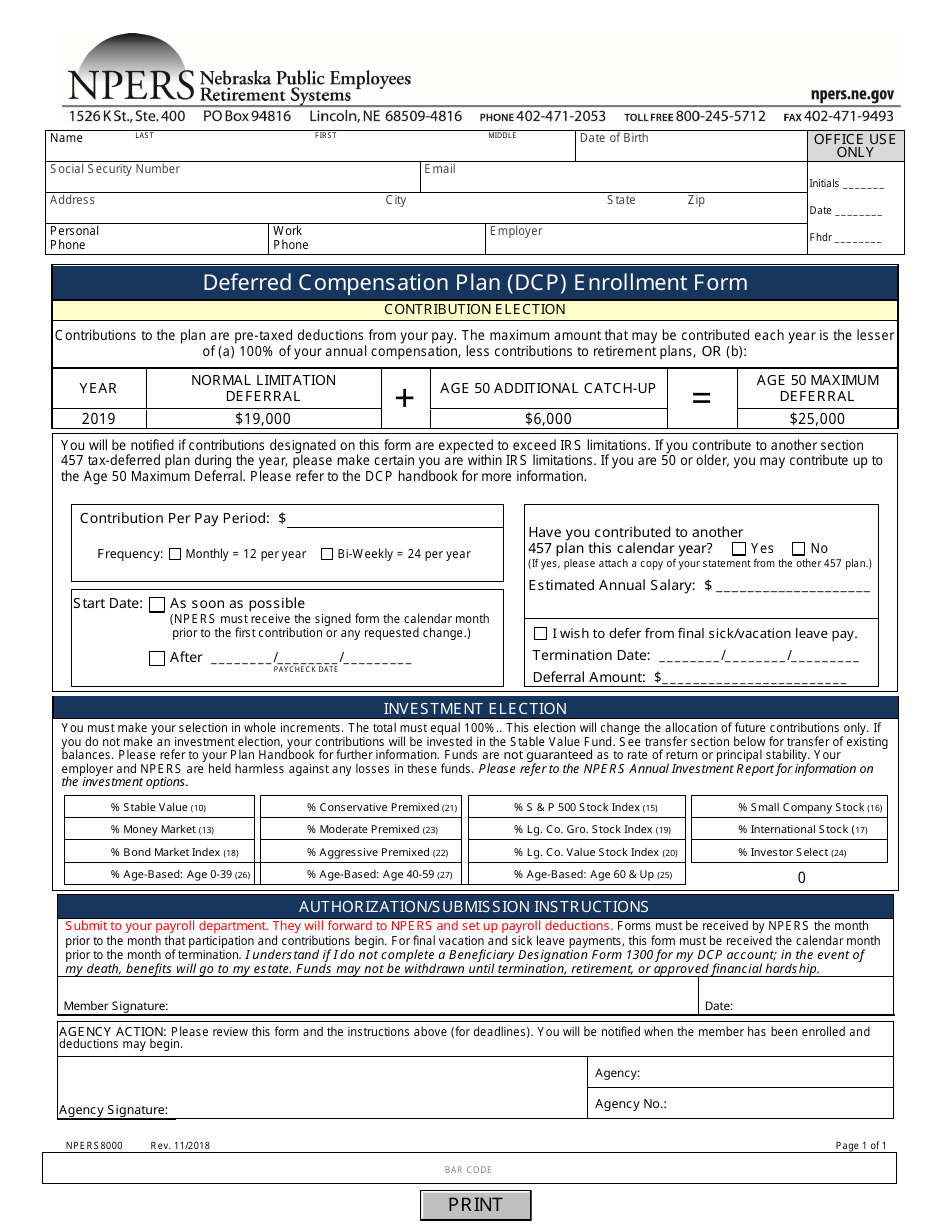

Q: What is the NPERS8000 Deferred Compensation Plan?

A: The NPERS8000 Deferred Compensation Plan (DCP) is a retirement savings plan available to employees in Nebraska.

Q: How do I enroll in the NPERS8000 DCP?

A: To enroll in the NPERS8000 DCP, you need to complete and submit the enrollment form, which is called the NPERS8000 Deferred Compensation Plan (DCP) Enrollment Form.

Q: Who can participate in the NPERS8000 DCP?

A: Employees in Nebraska are eligible to participate in the NPERS8000 DCP.

Q: Is the contribution to NPERS8000 DCP tax-deferred?

A: Yes, the contributions made to NPERS8000 DCP are tax-deferred, meaning they are not subject to federal income tax until they are withdrawn.

Q: What are the benefits of participating in NPERS8000 DCP?

A: Participating in NPERS8000 DCP allows you to save for retirement on a tax-deferred basis and potentially receive employer matching contributions.

Q: Can I change my contribution amount in NPERS8000 DCP?

A: Yes, you can change your contribution amount in NPERS8000 DCP by completing a new enrollment form.

Q: Are there any fees associated with NPERS8000 DCP?

A: Yes, there may be administrative fees or fund management fees associated with NPERS8000 DCP. It is important to review the plan's documentation for more information.

Q: What happens to my NPERS8000 DCP account if I leave my job?

A: If you leave your job, you may have options such as rolling over your NPERS8000 DCP account to another qualified retirement plan or leaving it with the plan administrator.

Q: How can I access the funds in my NPERS8000 DCP account?

A: You can typically access the funds in your NPERS8000 DCP account upon retirement or separation from service, subject to plan rules and regulations.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Nebraska Public Employees Retirement Systems;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NPERS8000 by clicking the link below or browse more documents and templates provided by the Nebraska Public Employees Retirement Systems.