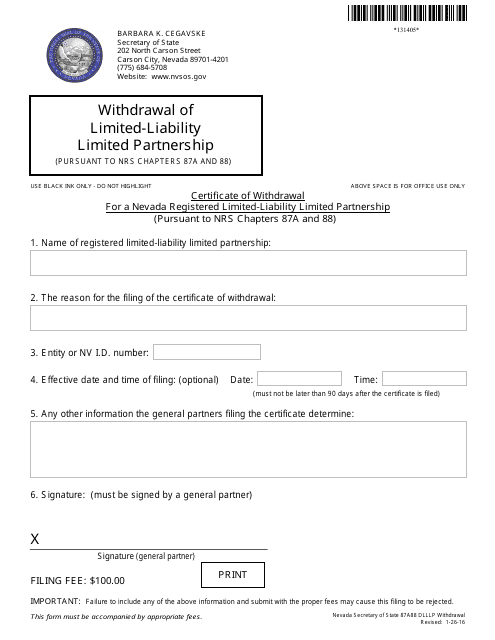

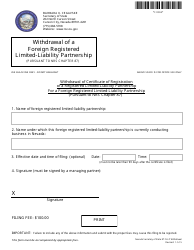

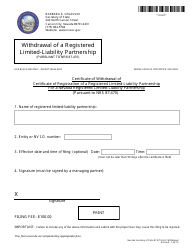

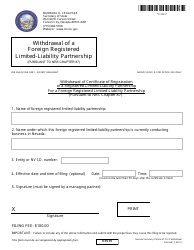

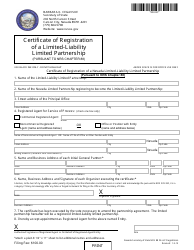

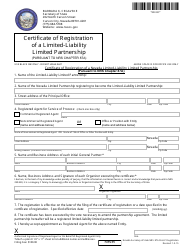

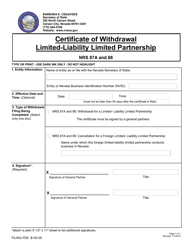

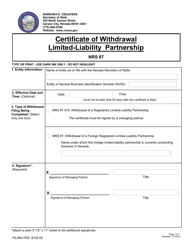

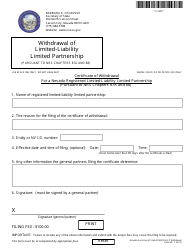

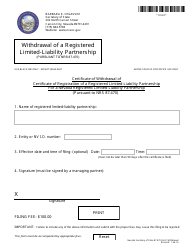

Withdrawal of Limited-Liability Limited Partnership (Pursuant to Nrs Chapters 87a and 88) - Complete Packet - Nevada

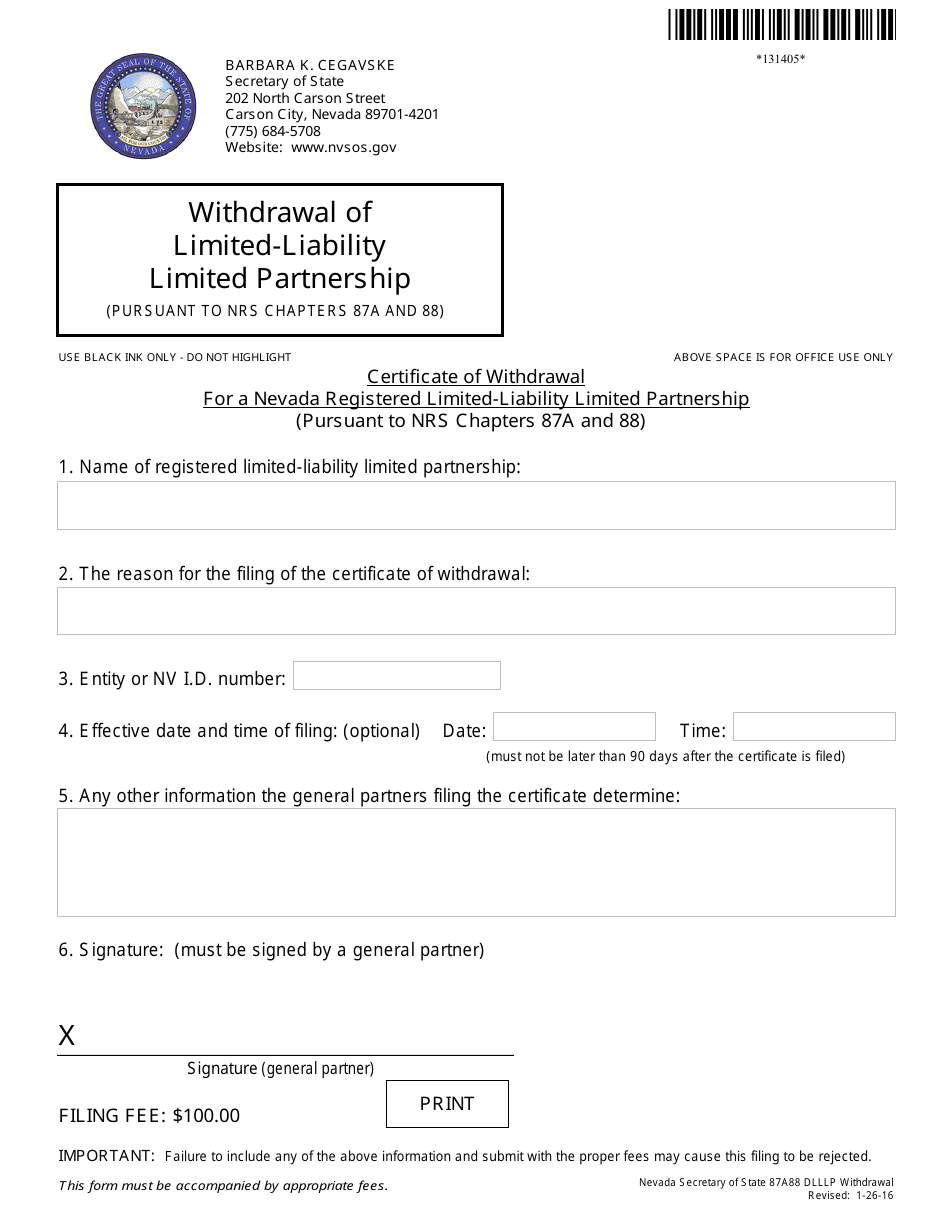

Withdrawal of Limited-Liability Limited Partnership (Pursuant to Nrs Chapters 87a and 88) - Complete Packet is a legal document that was released by the Nevada Secretary of State - a government authority operating within Nevada.

FAQ

Q: What is a limited-liability limited partnership?

A: A limited-liability limited partnership (LLLP) is a type of business entity that combines the features of a limited partnership (LP) with the liability protection of a limited liability company (LLC).

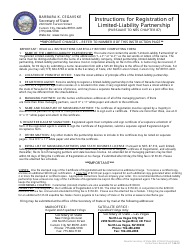

Q: How can I withdraw a limited-liability limited partnership in Nevada?

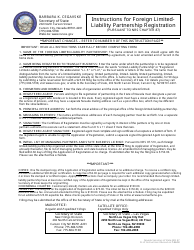

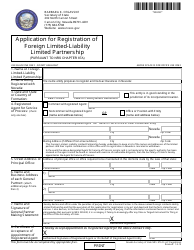

A: To withdraw a limited-liability limited partnership in Nevada, you must follow the procedures outlined in the Nevada Revised Statutes (NRS) Chapters 87A and 88.

Q: What is the process for withdrawing a limited-liability limited partnership?

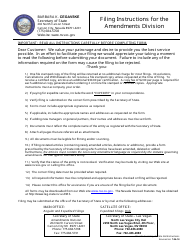

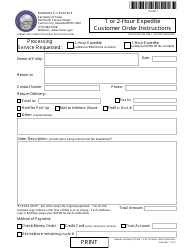

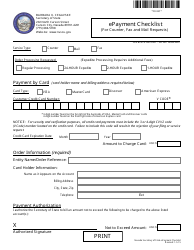

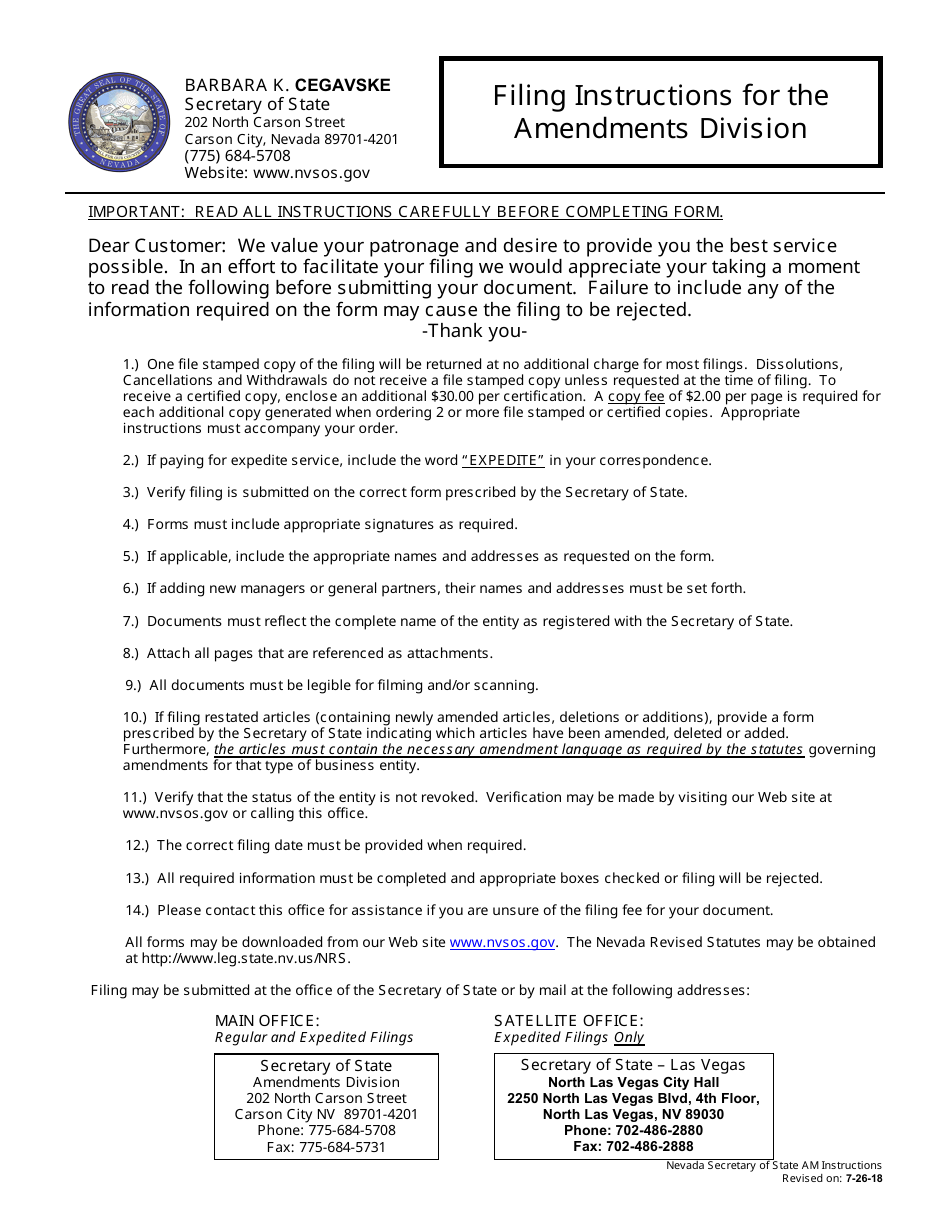

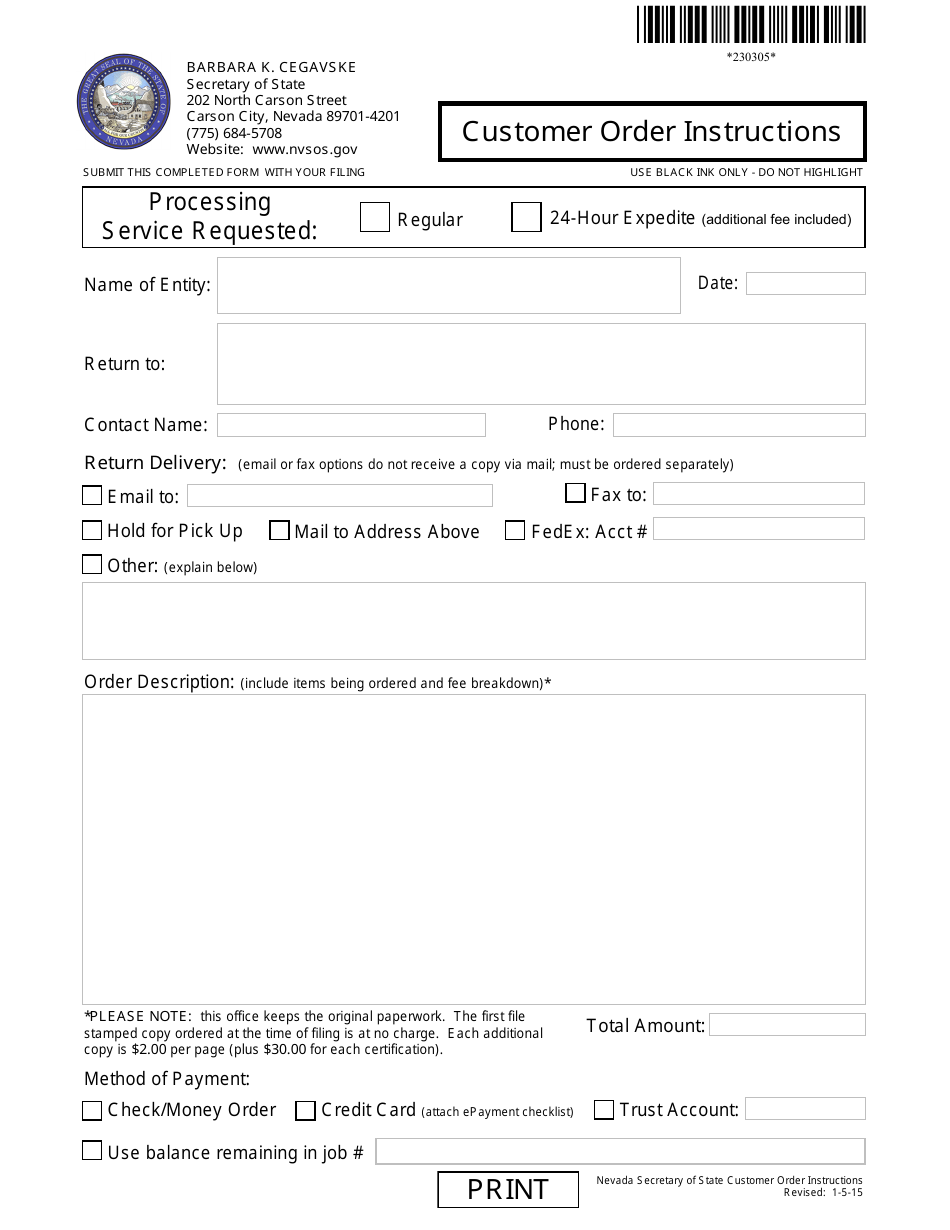

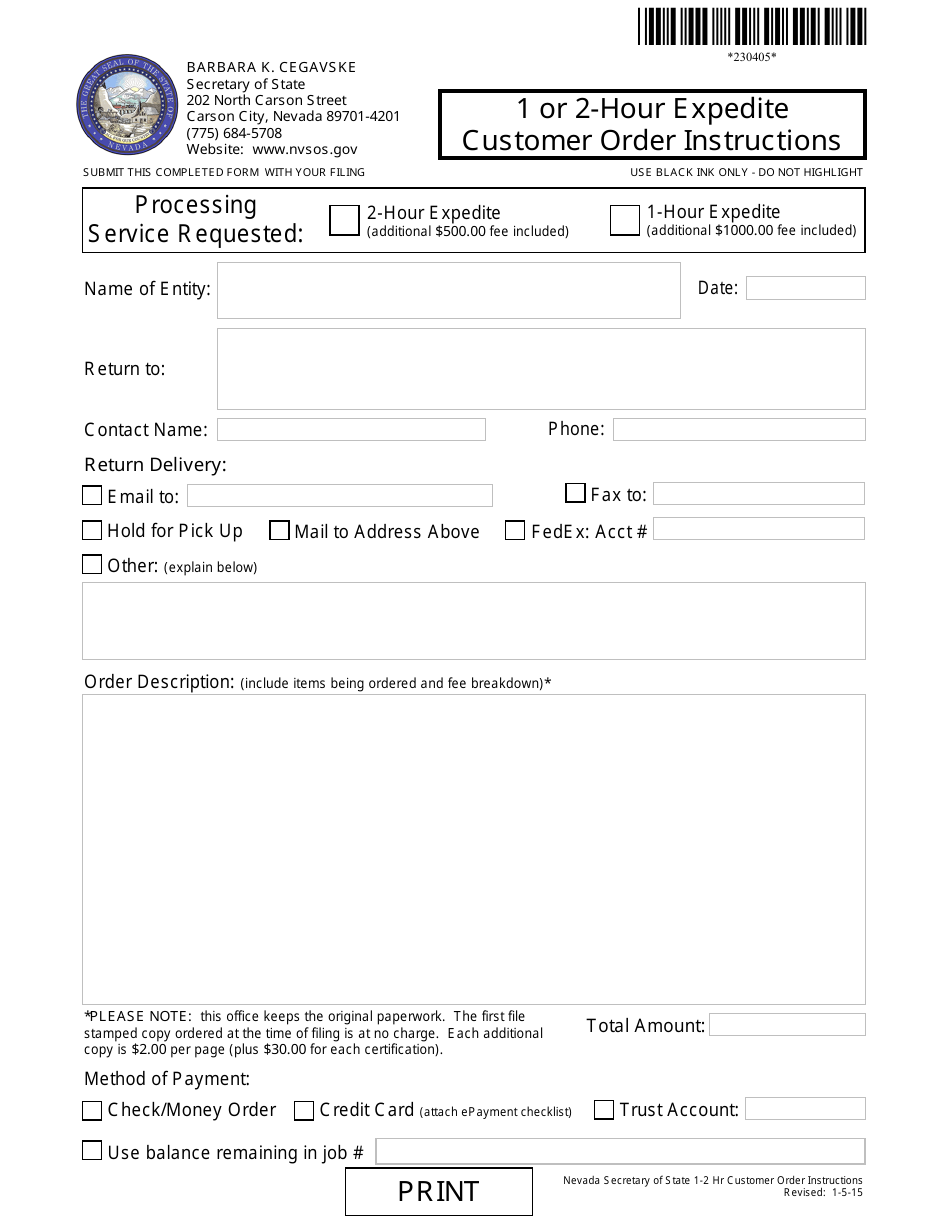

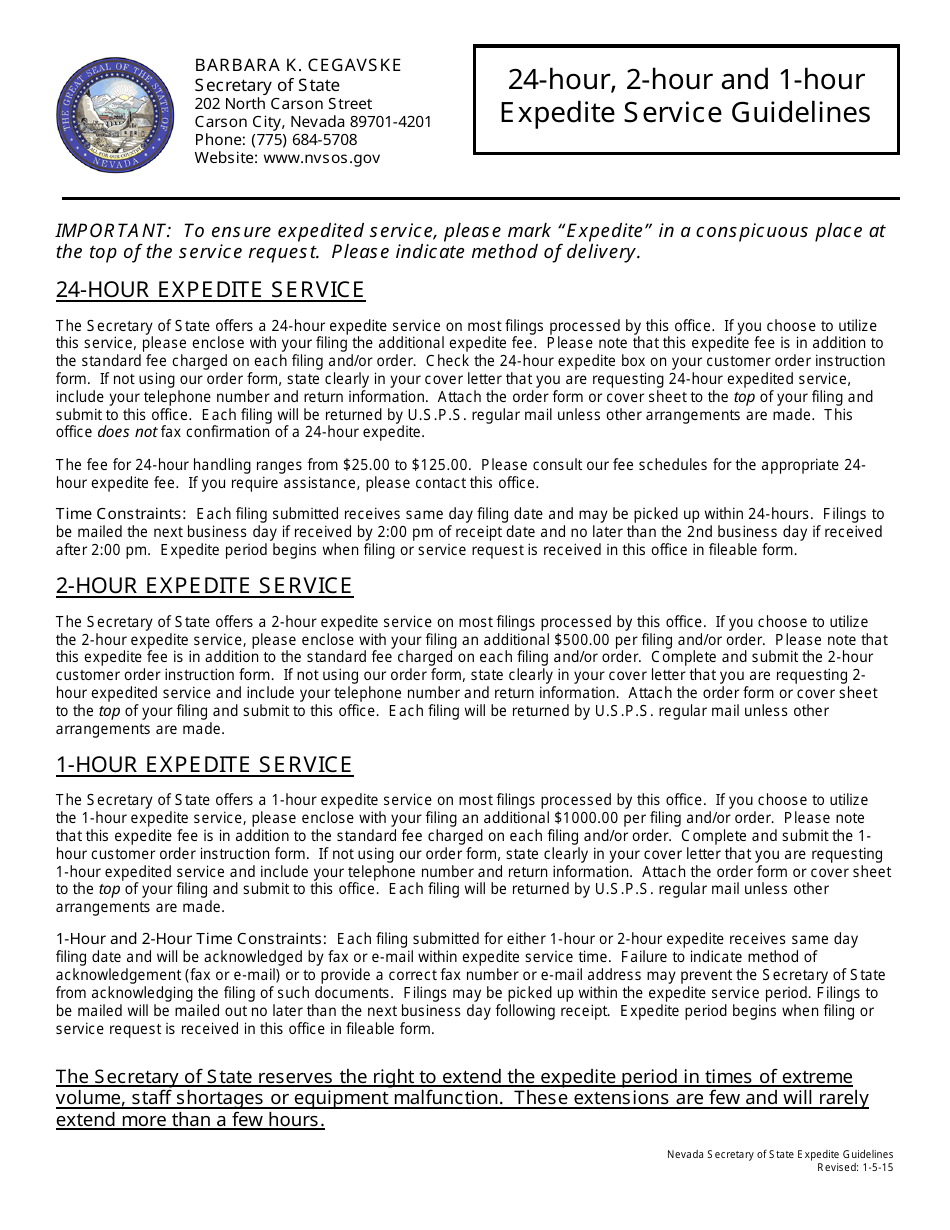

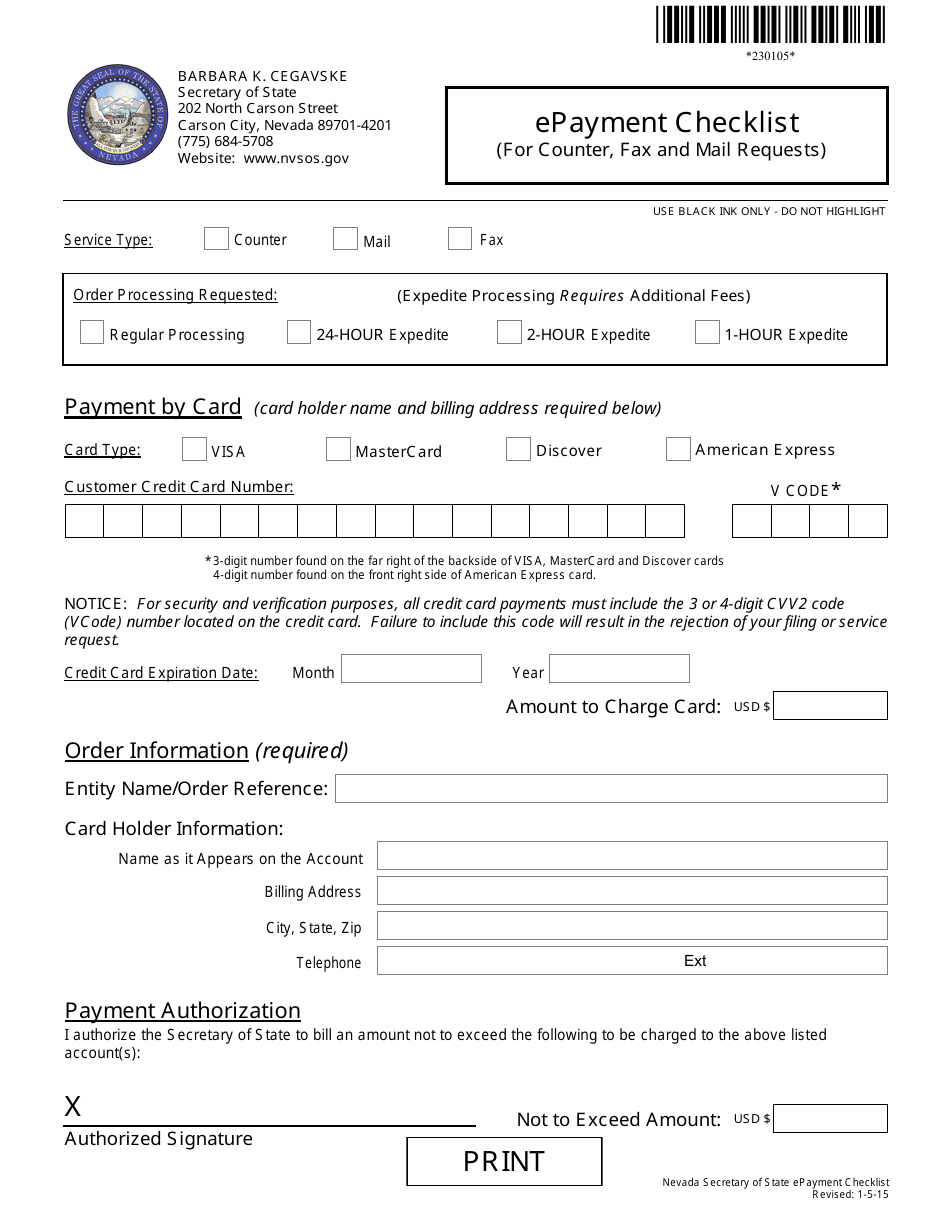

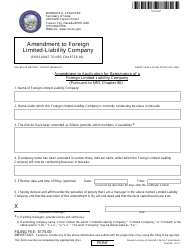

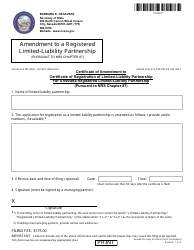

A: The process for withdrawing a limited-liability limited partnership involves filing the necessary paperwork with the Nevada Secretary of State and completing any other requirements stipulated by the NRS.

Q: What documents are required for withdrawal of a limited-liability limited partnership?

A: The documents required for the withdrawal of a limited-liability limited partnership in Nevada may include a Certificate of Cancellation, Statement of Dissolution, and any other applicable forms.

Q: Are there any fees associated with withdrawing a limited-liability limited partnership in Nevada?

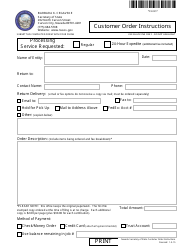

A: Yes, there are filing fees associated with withdrawing a limited-liability limited partnership in Nevada. The exact fees may vary, so it's best to check with the Nevada Secretary of State for the current fee schedule.

Q: Can I withdraw a limited-liability limited partnership on my own, or do I need legal assistance?

A: While it is possible to withdraw a limited-liability limited partnership on your own, legal assistance may be beneficial to ensure you meet all the necessary requirements and complete the process correctly.

Q: What are the consequences of not properly withdrawing a limited-liability limited partnership?

A: Not properly withdrawing a limited-liability limited partnership can result in continued liability for the partnership's debts and obligations, and may also lead to legal consequences.

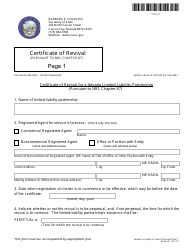

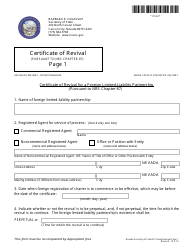

Q: Can I reinstate a limited-liability limited partnership after it has been withdrawn?

A: Yes, it may be possible to reinstate a limited-liability limited partnership after it has been withdrawn. The process for reinstatement may involve filing certain documents and paying any applicable fees.

Form Details:

- Released on January 26, 2016;

- The latest edition currently provided by the Nevada Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Secretary of State.