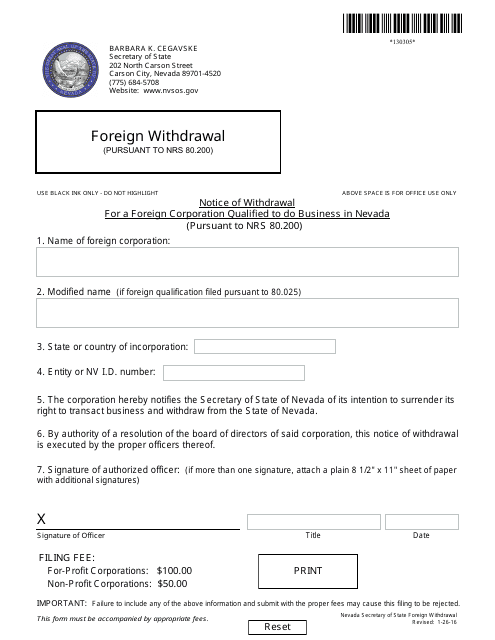

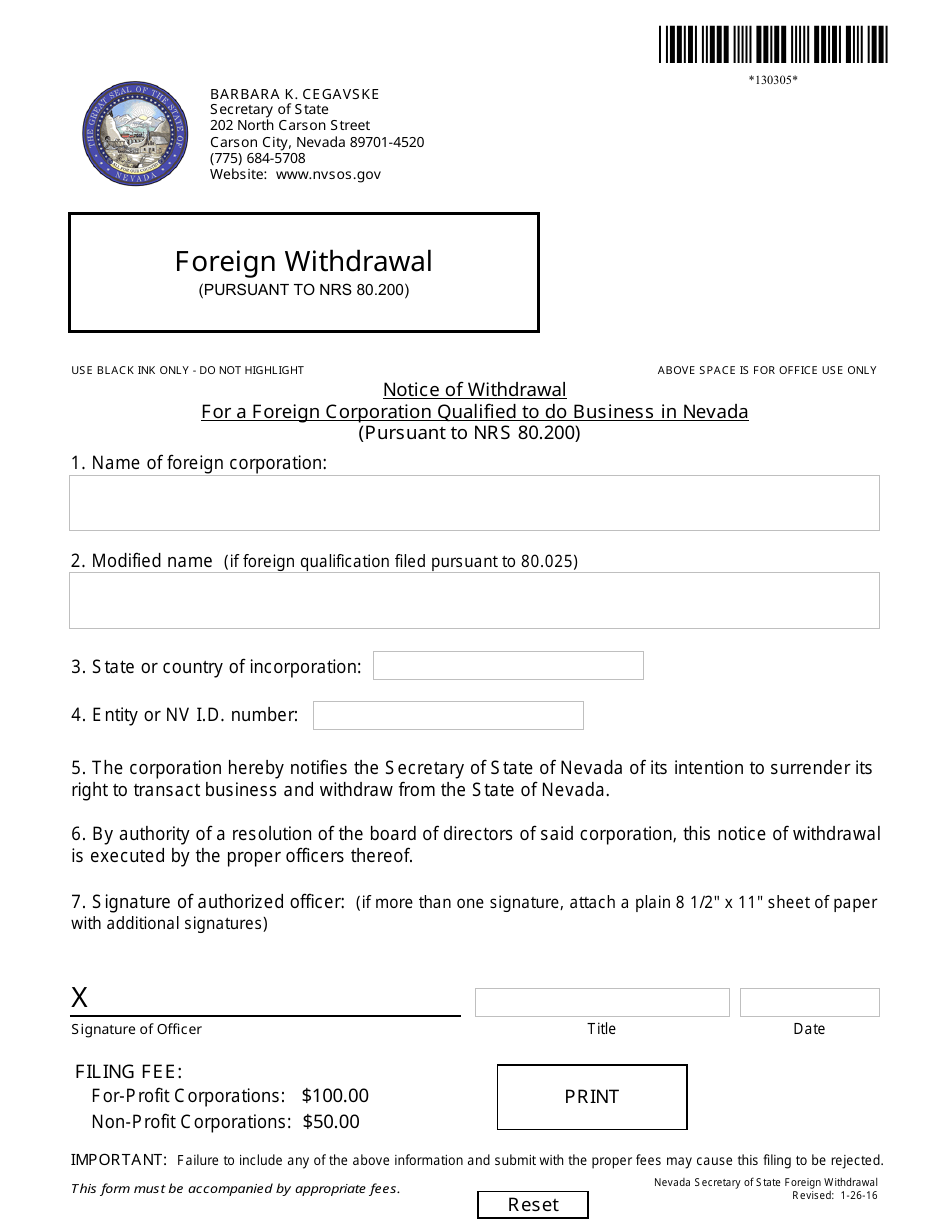

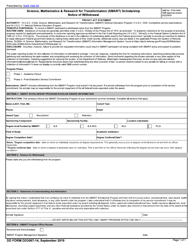

Form 130305 Notice of Withdrawal for a Foreign Corporation Qualified to Do Business in Nevada (Pursuant to Nrs 80.200) 0) - Nevada

What Is Form 130305?

This is a legal form that was released by the Nevada Secretary of State - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

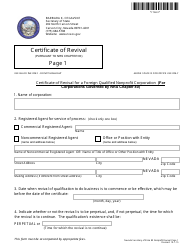

Q: What is Form 130305?

A: Form 130305 is the Notice of Withdrawal for a Foreign Corporation Qualified to Do Business in Nevada.

Q: What is a foreign corporation?

A: A foreign corporation is a corporation that is incorporated in a different state or country.

Q: What is NRS 80.200?

A: NRS 80.200 is a Nevada Revised Statute that pertains to the withdrawal of a foreign corporation.

Q: What does this form do?

A: This form is used to officially withdraw a foreign corporation that is qualified to do business in Nevada.

Q: Who can use this form?

A: Foreign corporations that are qualified to do business in Nevada can use this form to withdraw.

Q: Why would a foreign corporation need to withdraw?

A: A foreign corporation may need to withdraw if they no longer wish to do business in Nevada or if they are ceasing operations.

Q: What other documents are required for withdrawal?

A: Additional documents may be required depending on the specific circumstances of the foreign corporation's withdrawal.

Q: Is there a fee for filing this form?

A: Yes, there is a filing fee associated with filing Form 130305. The exact fee amount can be obtained from the Nevada Secretary of State's office.

Q: Are there any deadlines for filing this form?

A: There may be deadlines associated with the withdrawal of a foreign corporation, depending on the specific circumstances. It is best to consult with legal counsel or the Nevada Secretary of State's office for guidance.

Form Details:

- Released on January 26, 2016;

- The latest edition provided by the Nevada Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 130305 by clicking the link below or browse more documents and templates provided by the Nevada Secretary of State.