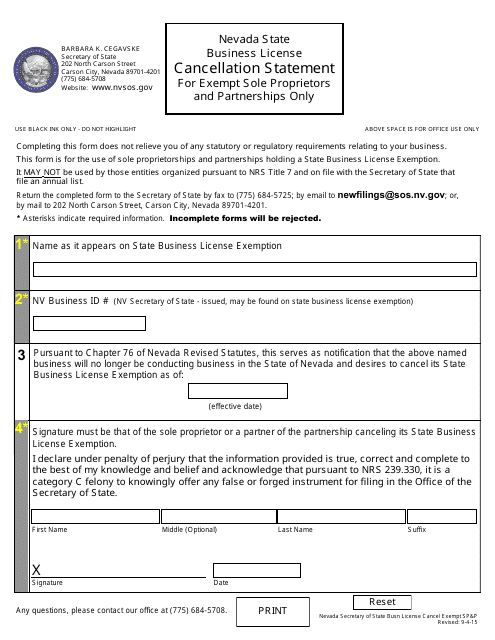

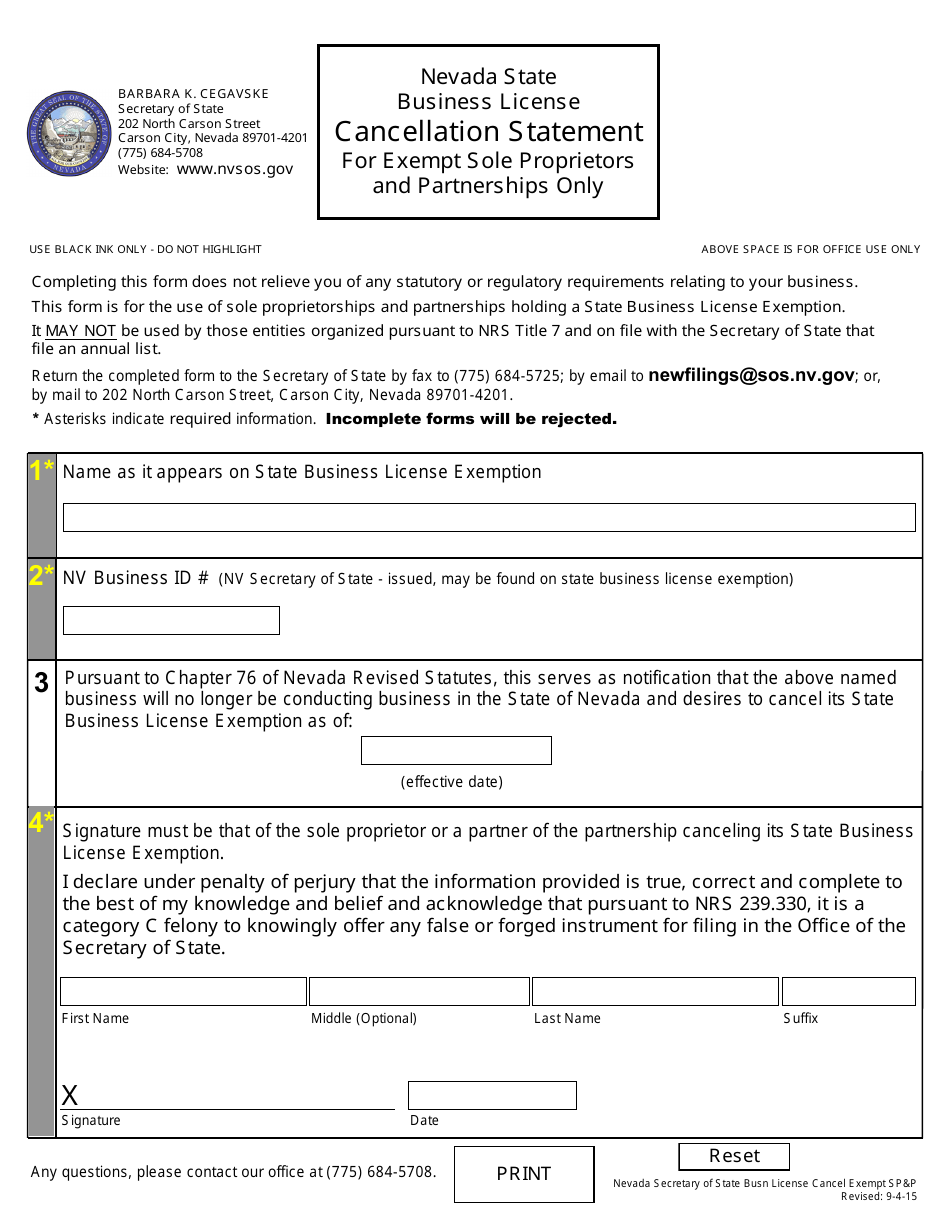

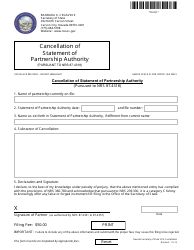

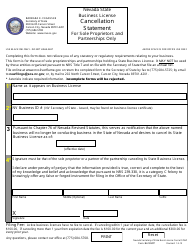

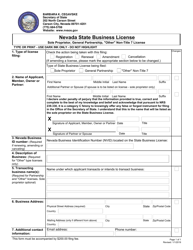

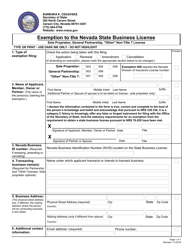

Exempt Sole Proprietor or General Partnership Cancellation Statement (Nrs 76) - Nevada

Exempt Sole Proprietor or General Partnership Cancellation Statement (Nrs 76) is a legal document that was released by the Nevada Secretary of State - a government authority operating within Nevada.

FAQ

Q: What is an Exempt Sole Proprietor or General Partnership Cancellation Statement?

A: It is a form used in Nevada to cancel the registration of a sole proprietorship or general partnership.

Q: Who needs to file an Exempt Sole Proprietor or General Partnership Cancellation Statement?

A: Anyone who wants to cancel the registration of their sole proprietorship or general partnership in Nevada.

Q: What information is required on the form?

A: You will need to provide the business name, filing number, and the reason for cancellation.

Q: Is there a fee to file the Exempt Sole Proprietor or General Partnership Cancellation Statement?

A: Yes, there is a $100 fee to file the form.

Q: What happens after I file the form?

A: Once the form is approved, your sole proprietorship or general partnership will be officially canceled and removed from the Nevada Secretary of State's records.

Form Details:

- Released on September 4, 2015;

- The latest edition currently provided by the Nevada Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Secretary of State.