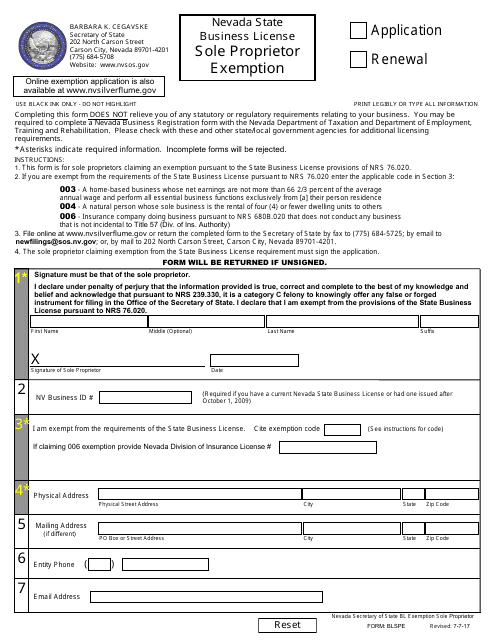

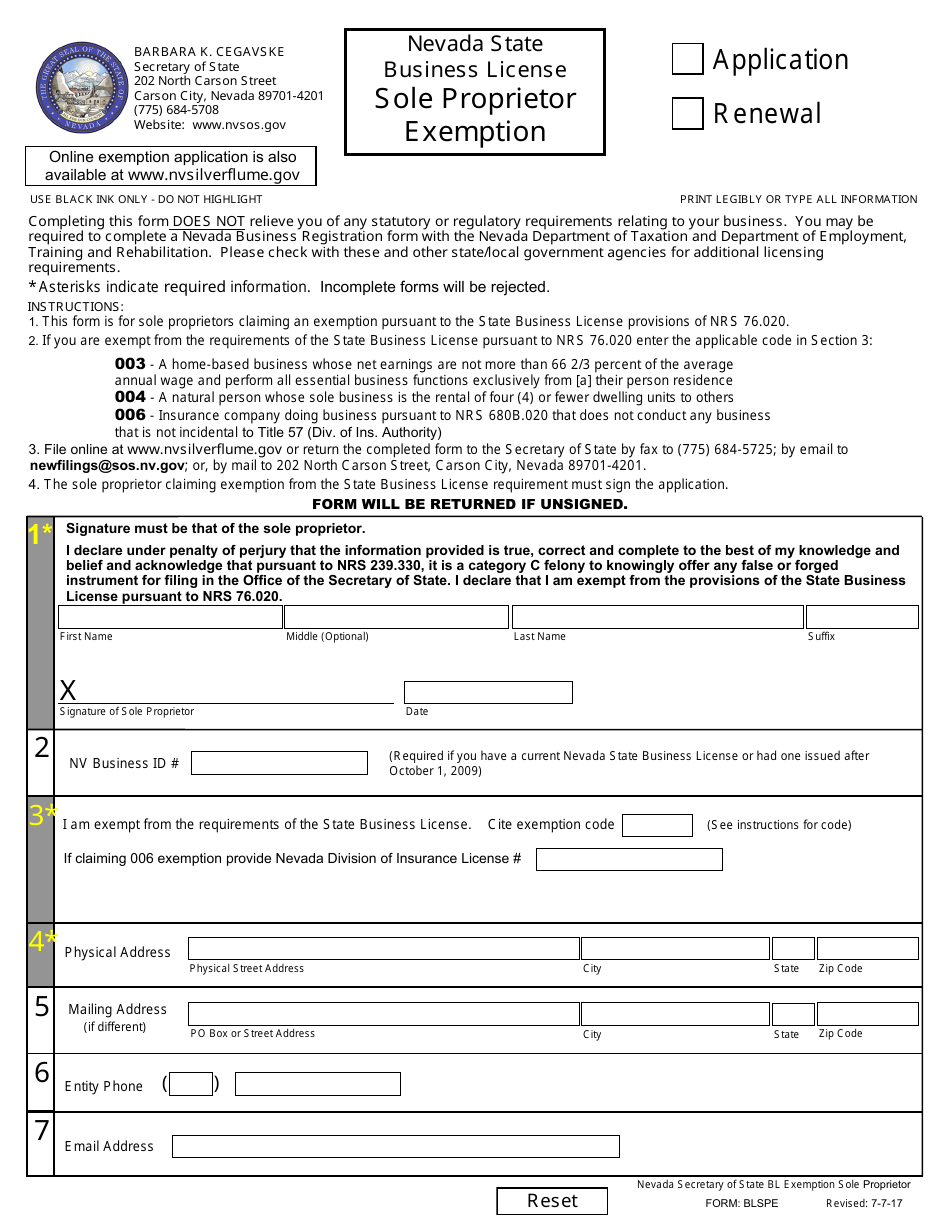

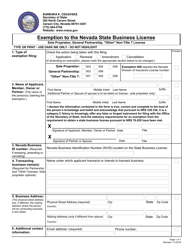

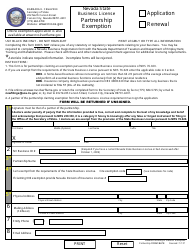

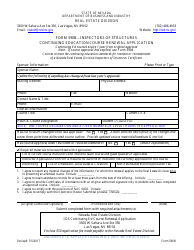

Form BLSPE Sole Proprietor Notice of Exemption - Application or Renewal (Nrs 76) - Nevada

What Is Form BLSPE?

This is a legal form that was released by the Nevada Secretary of State - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the BLSPE Sole Proprietor Notice of Exemption?

A: The BLSPE Sole Proprietor Notice of Exemption is an application or renewal form for sole proprietors in Nevada.

Q: Who needs to file the BLSPE Sole Proprietor Notice of Exemption?

A: Sole proprietorships in Nevada need to file the BLSPE Sole Proprietor Notice of Exemption.

Q: What is the purpose of filing the BLSPE Sole Proprietor Notice of Exemption?

A: The purpose of filing the BLSPE Sole Proprietor Notice of Exemption is to claim an exemption from the requirement to obtain a state business license.

Q: When should the BLSPE Sole Proprietor Notice of Exemption be filed?

A: The BLSPE Sole Proprietor Notice of Exemption should be filed annually, before the end of the current calendar year.

Q: Is there a fee for filing the BLSPE Sole Proprietor Notice of Exemption?

A: No, there is no fee for filing the BLSPE Sole Proprietor Notice of Exemption.

Q: What is the penalty for not filing the BLSPE Sole Proprietor Notice of Exemption?

A: Failure to file the BLSPE Sole Proprietor Notice of Exemption may result in the assessment of penalties and interest.

Q: What information is required to complete the BLSPE Sole Proprietor Notice of Exemption?

A: The BLSPE Sole Proprietor Notice of Exemption requires information such as the sole proprietor's name, address, social security number, and the nature of the business.

Form Details:

- Released on July 7, 2017;

- The latest edition provided by the Nevada Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BLSPE by clicking the link below or browse more documents and templates provided by the Nevada Secretary of State.