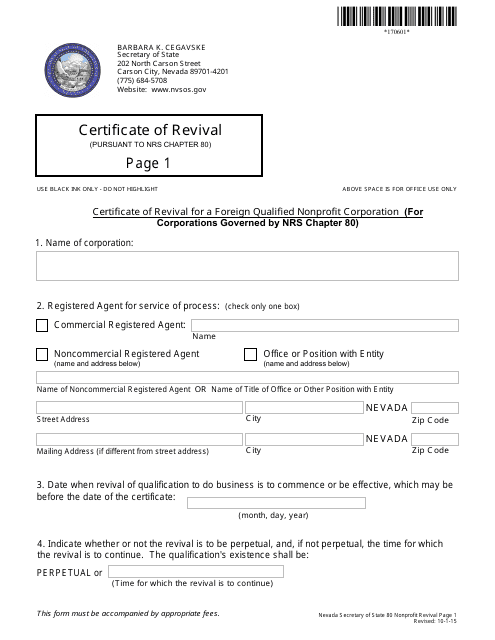

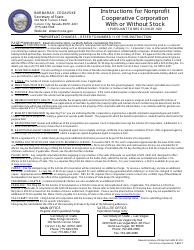

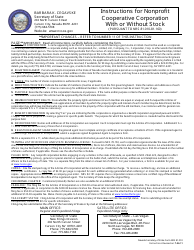

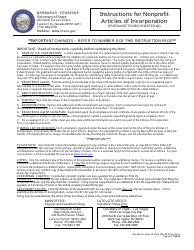

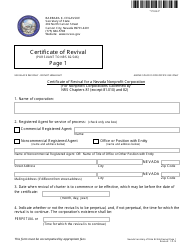

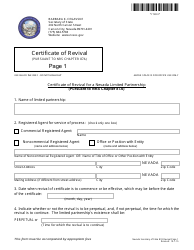

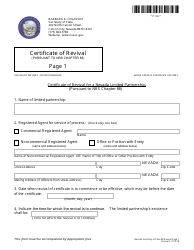

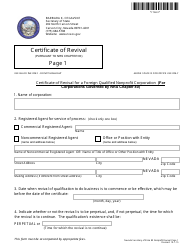

Revival for Nonprofit Corporation - Foreign (Nrs Chapter 80) - Complete Packet - Nevada

Revival for Nonprofit Corporation - Foreign (Nrs Chapter 80) - Complete Packet is a legal document that was released by the Nevada Secretary of State - a government authority operating within Nevada.

FAQ

Q: What is the Nrs Chapter 80?

A: Nrs Chapter 80 refers to the Nevada Revised Statutes Chapter 80, which contains laws related to nonprofit corporations.

Q: What is a nonprofit corporation?

A: A nonprofit corporation is a type of organization that is formed for purposes other than generating profits, such as charitable, educational, or religious purposes.

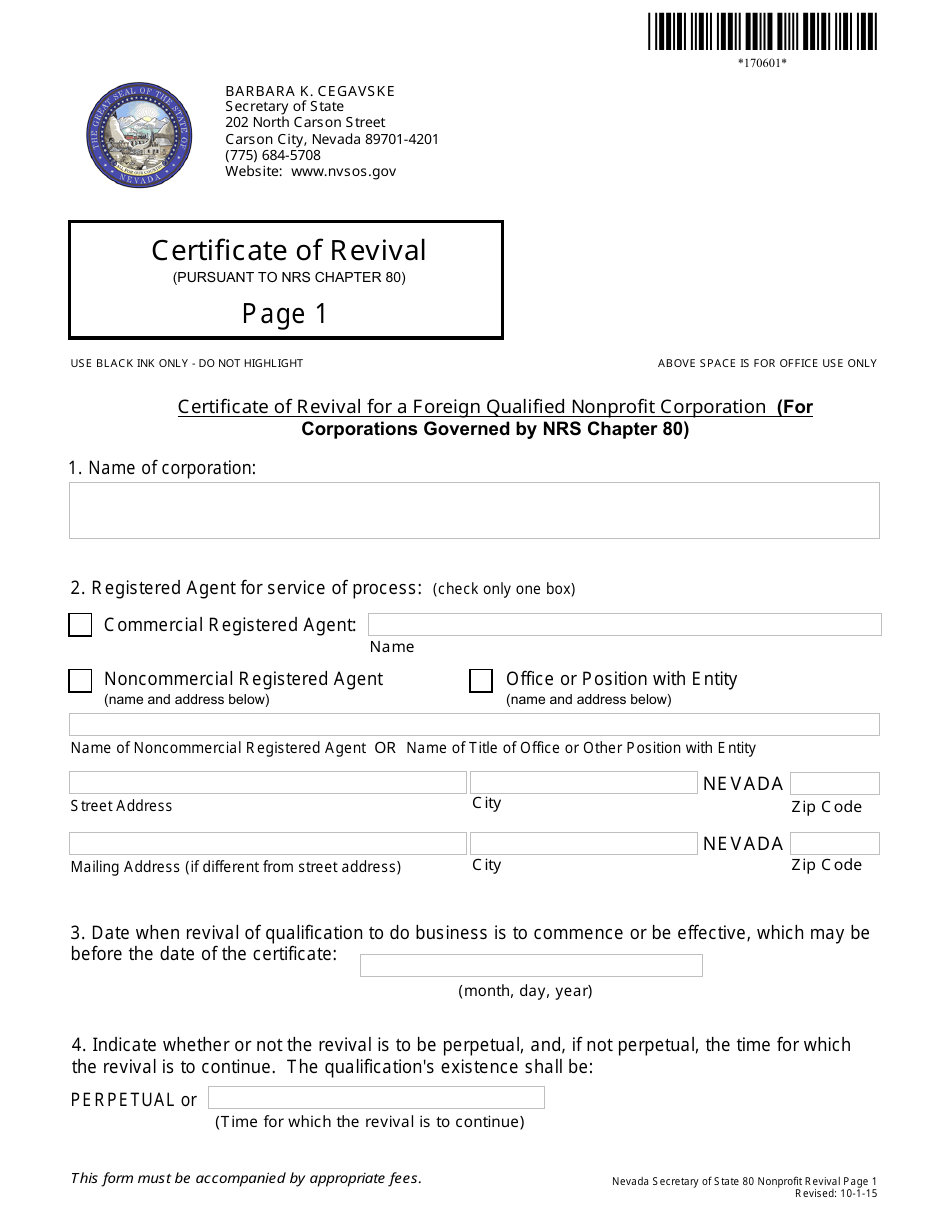

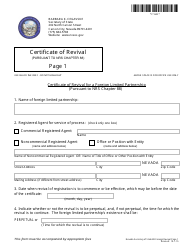

Q: What does 'Revival for Nonprofit Corporation - Foreign' mean?

A: Revival for Nonprofit Corporation - Foreign refers to the process of restoring the legal status of a foreign nonprofit corporation that had previously been revoked or dissolved.

Q: What is a foreign nonprofit corporation?

A: A foreign nonprofit corporation is a nonprofit corporation that was originally formed in a state other than Nevada.

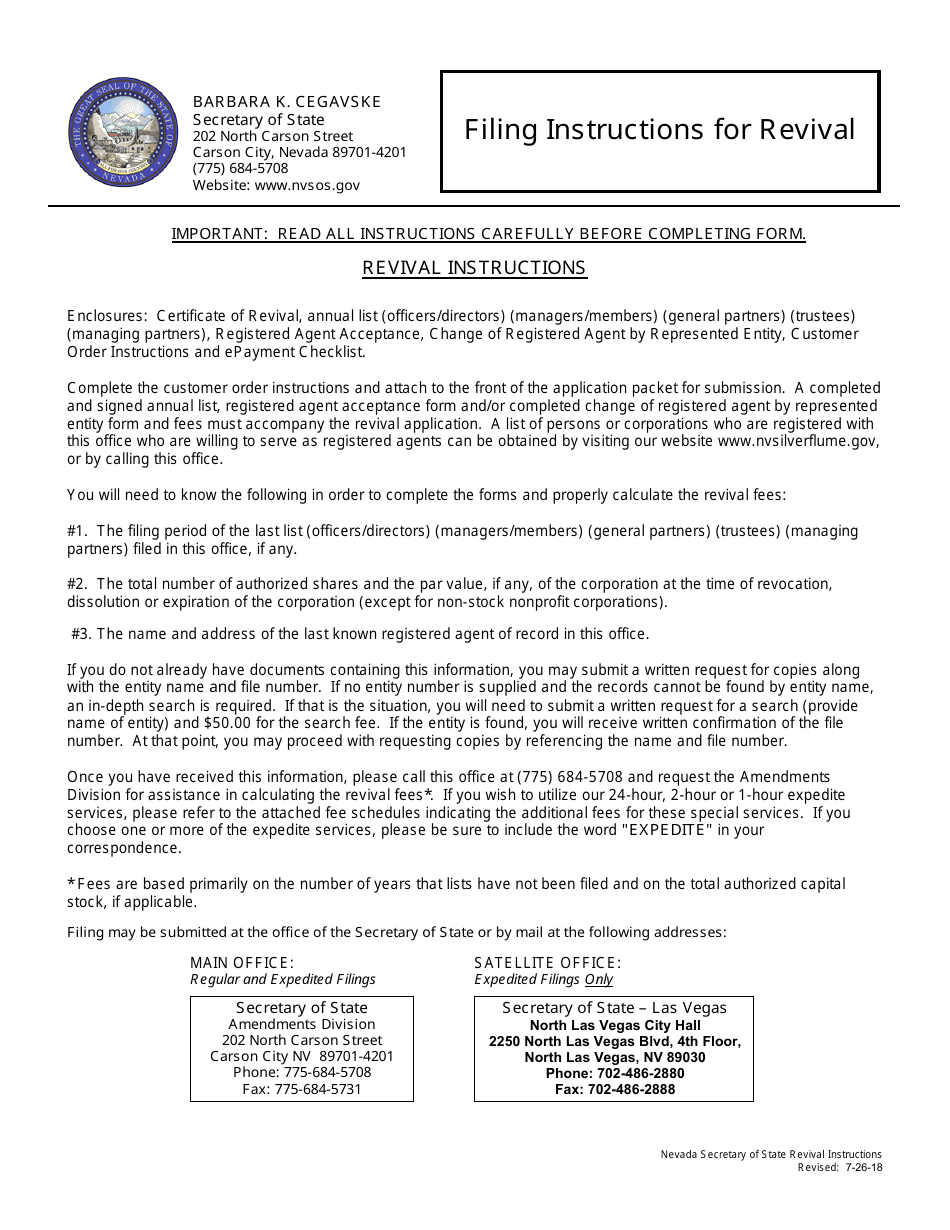

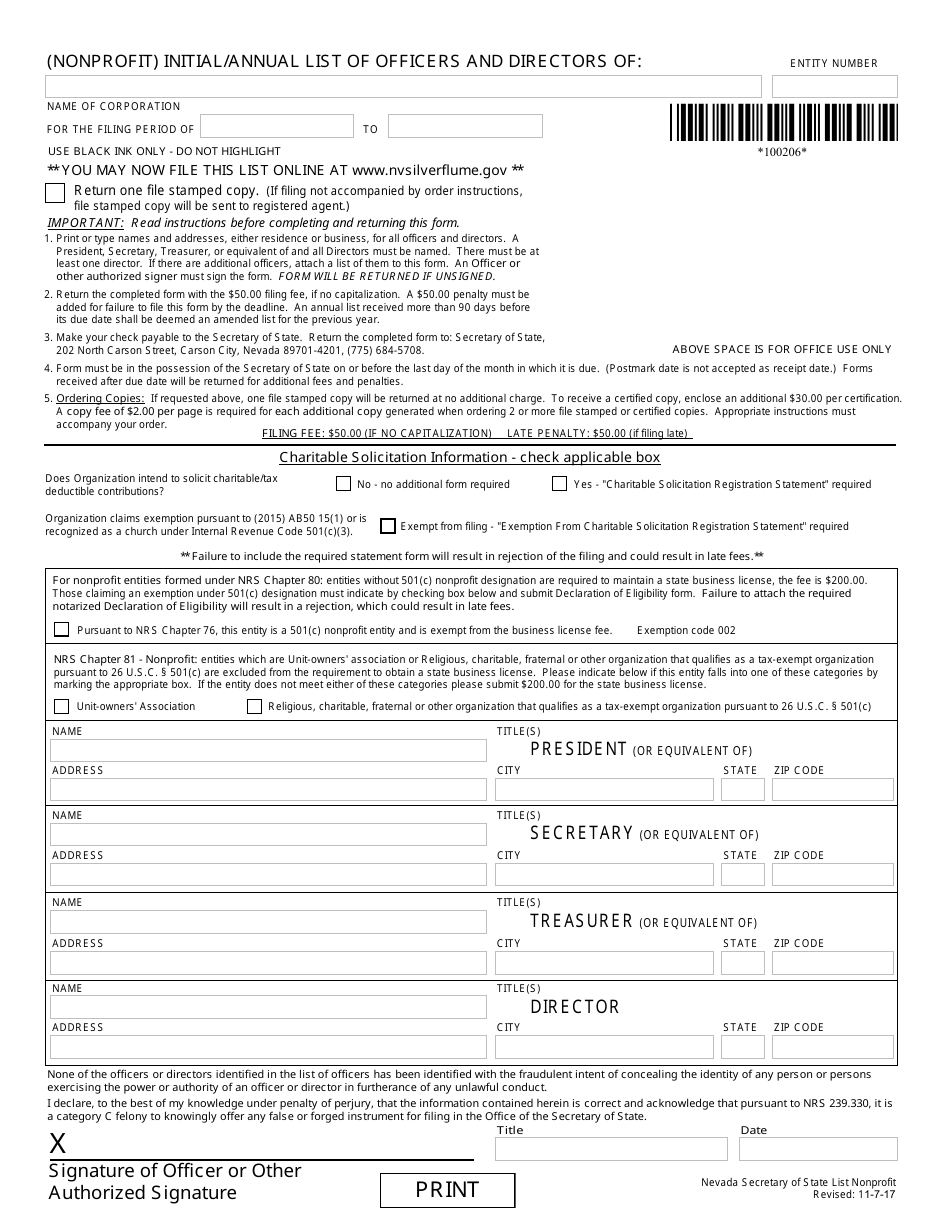

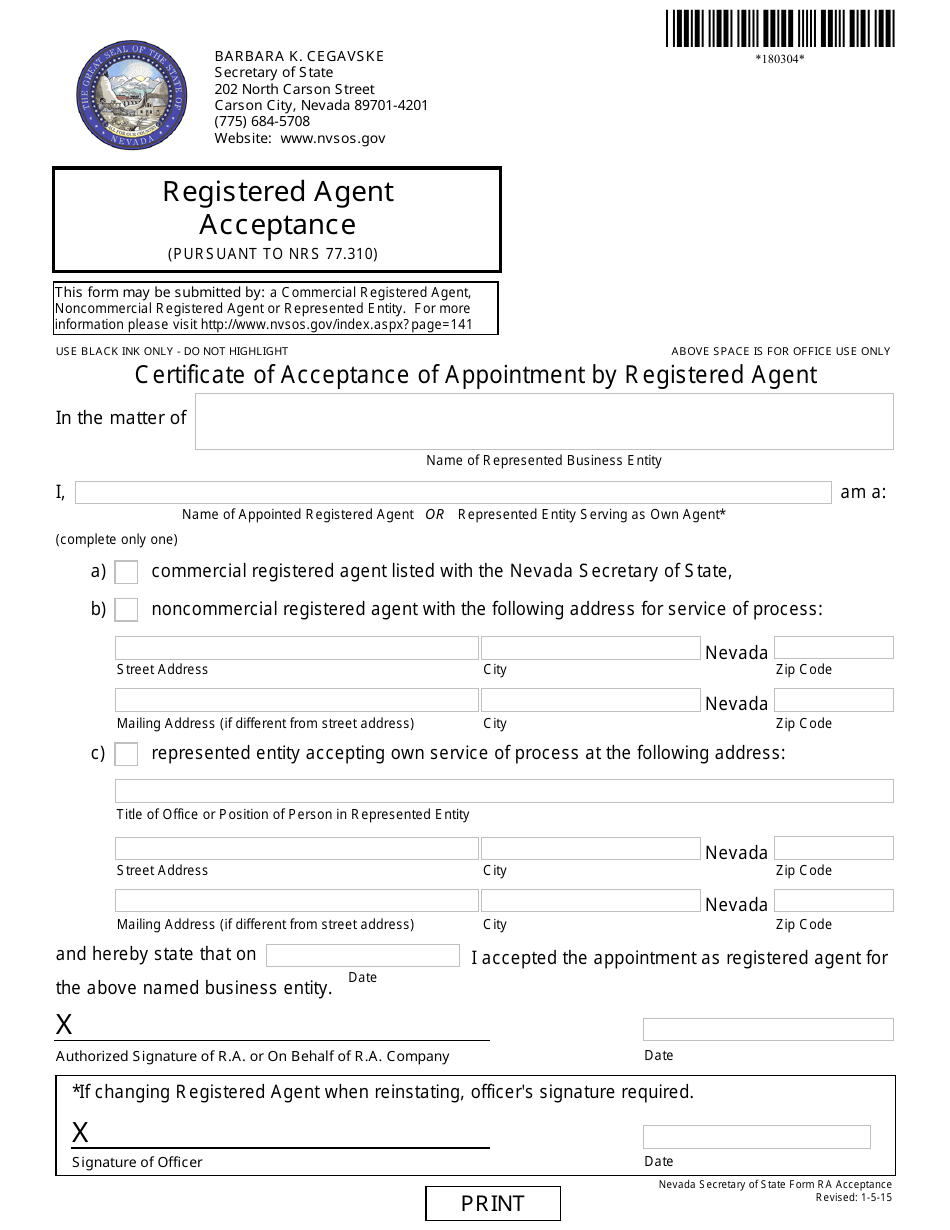

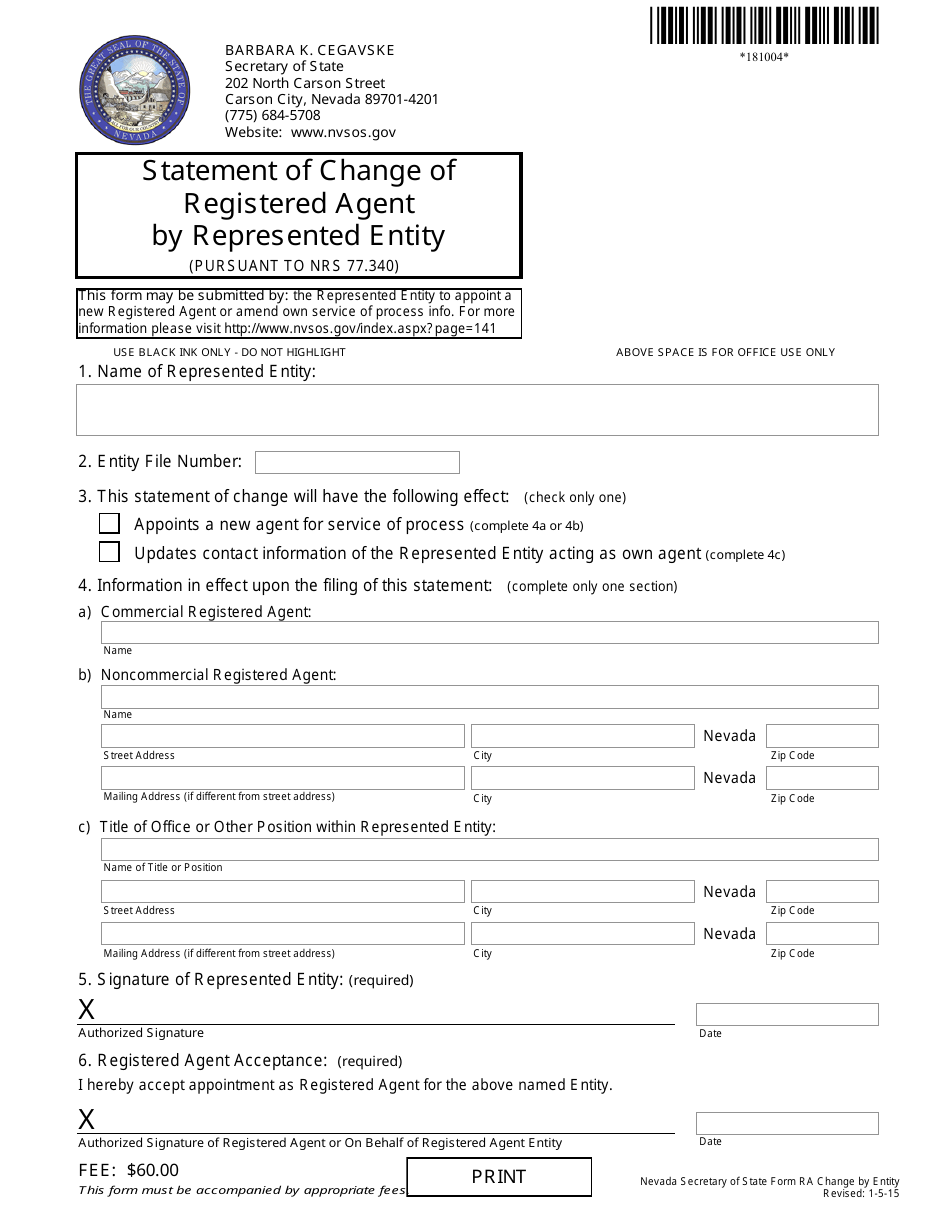

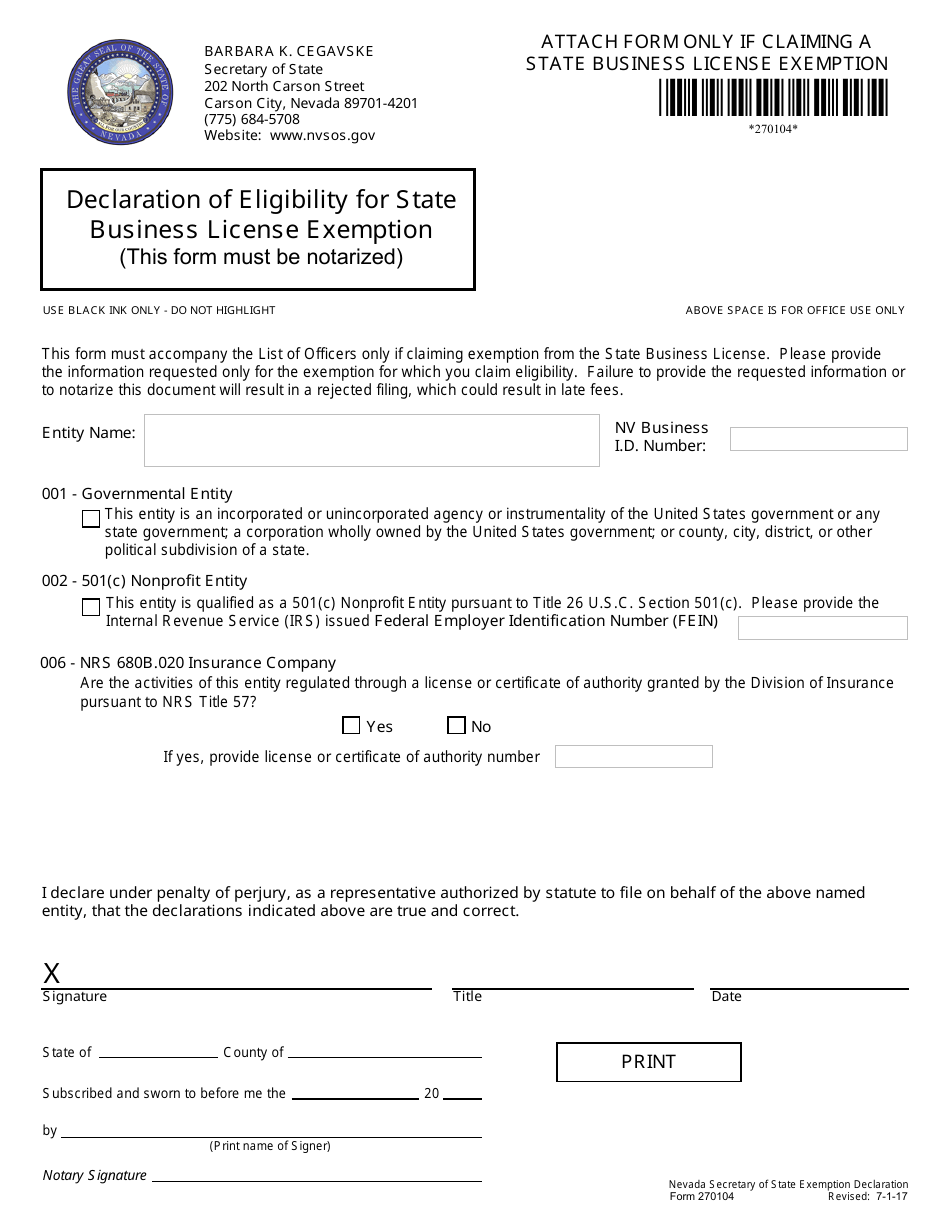

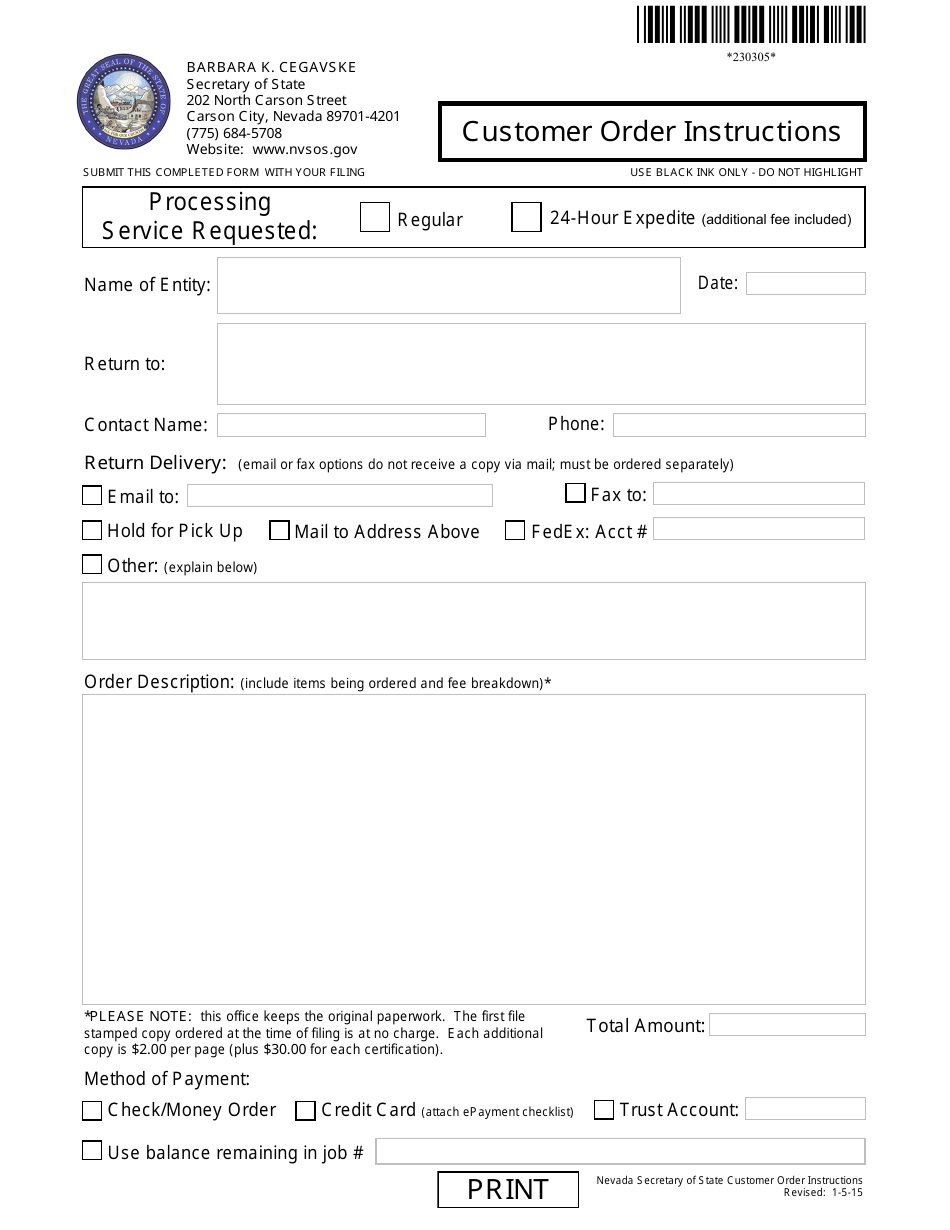

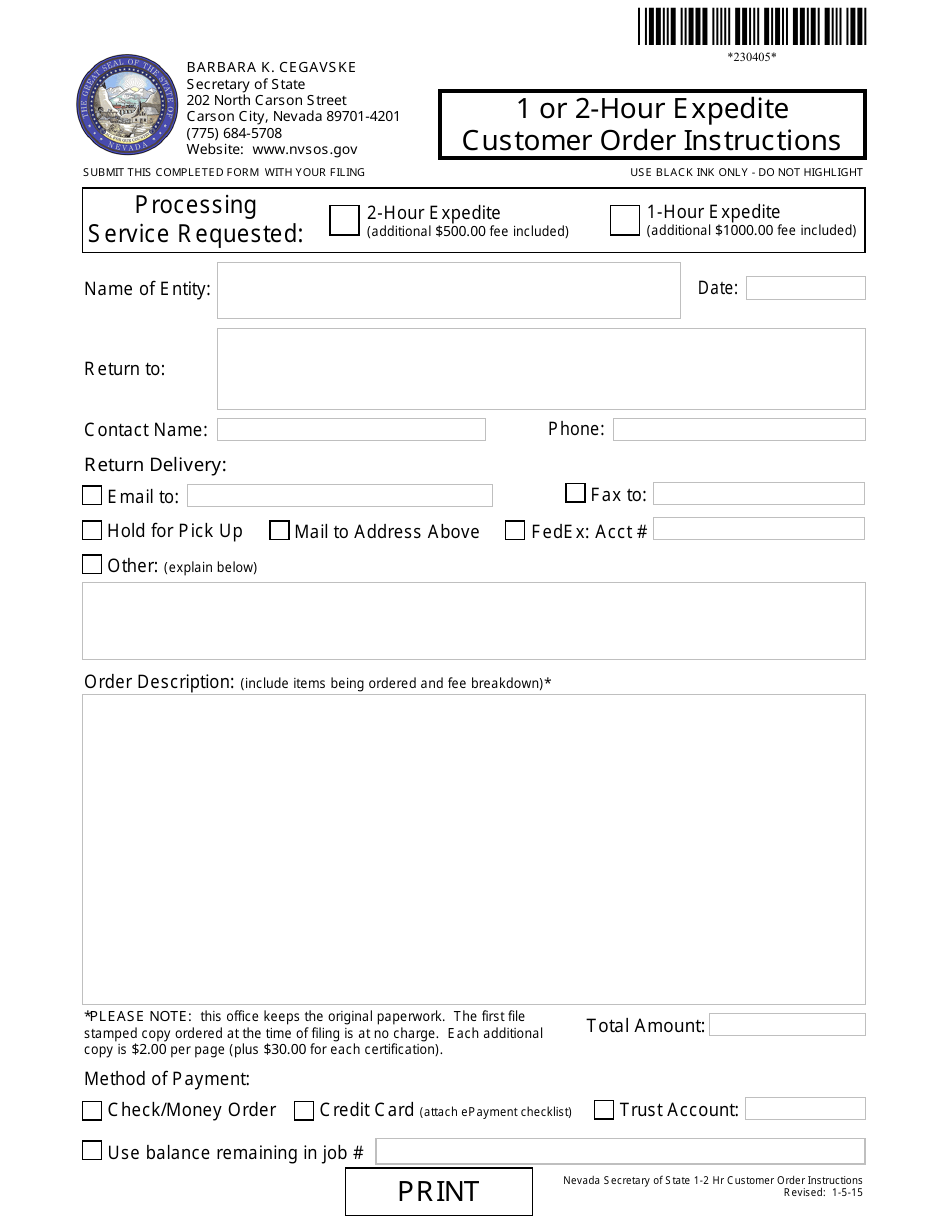

Q: What is the purpose of the 'Complete Packet'?

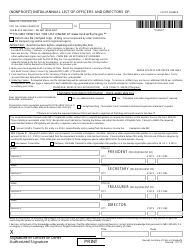

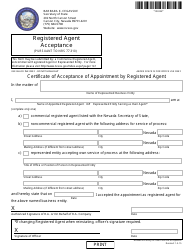

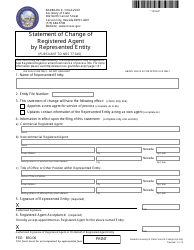

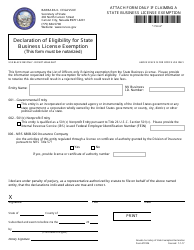

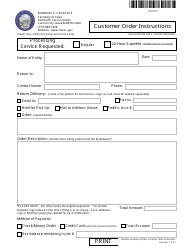

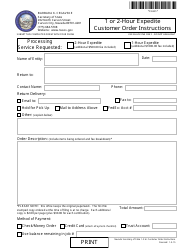

A: The Complete Packet provides all the necessary forms and instructions for filing the revival application for a foreign nonprofit corporation in Nevada.

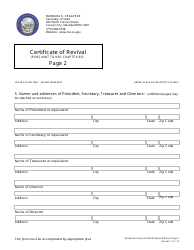

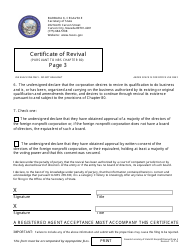

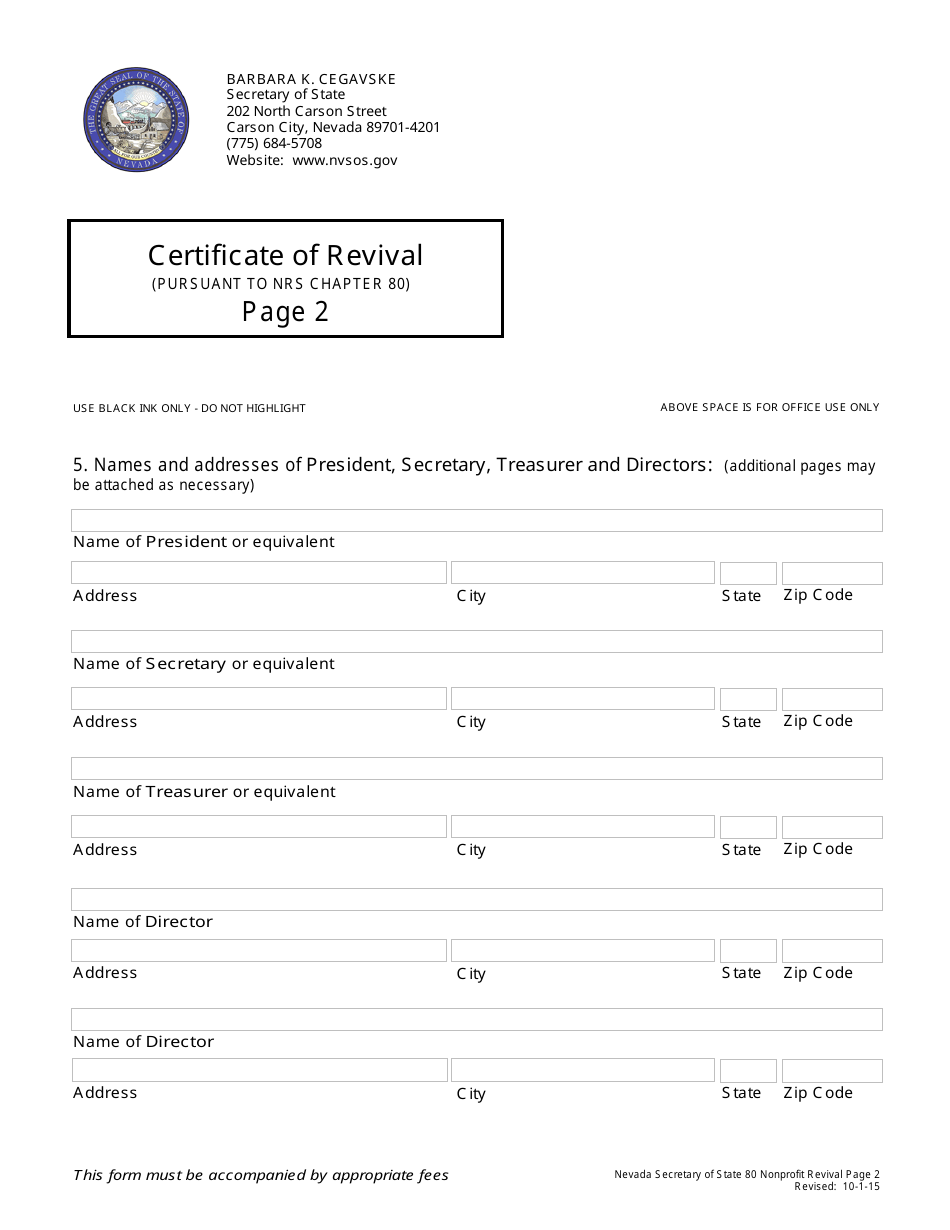

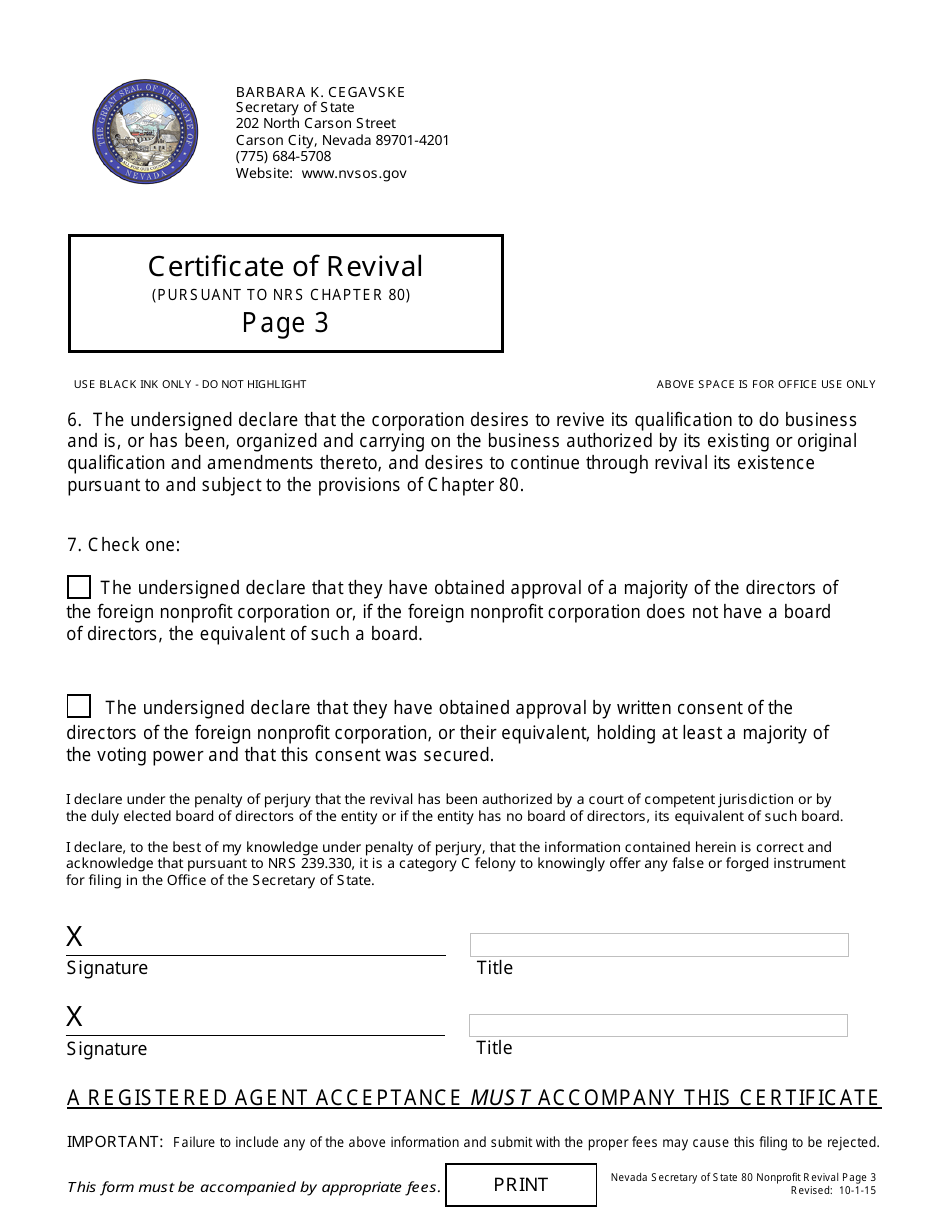

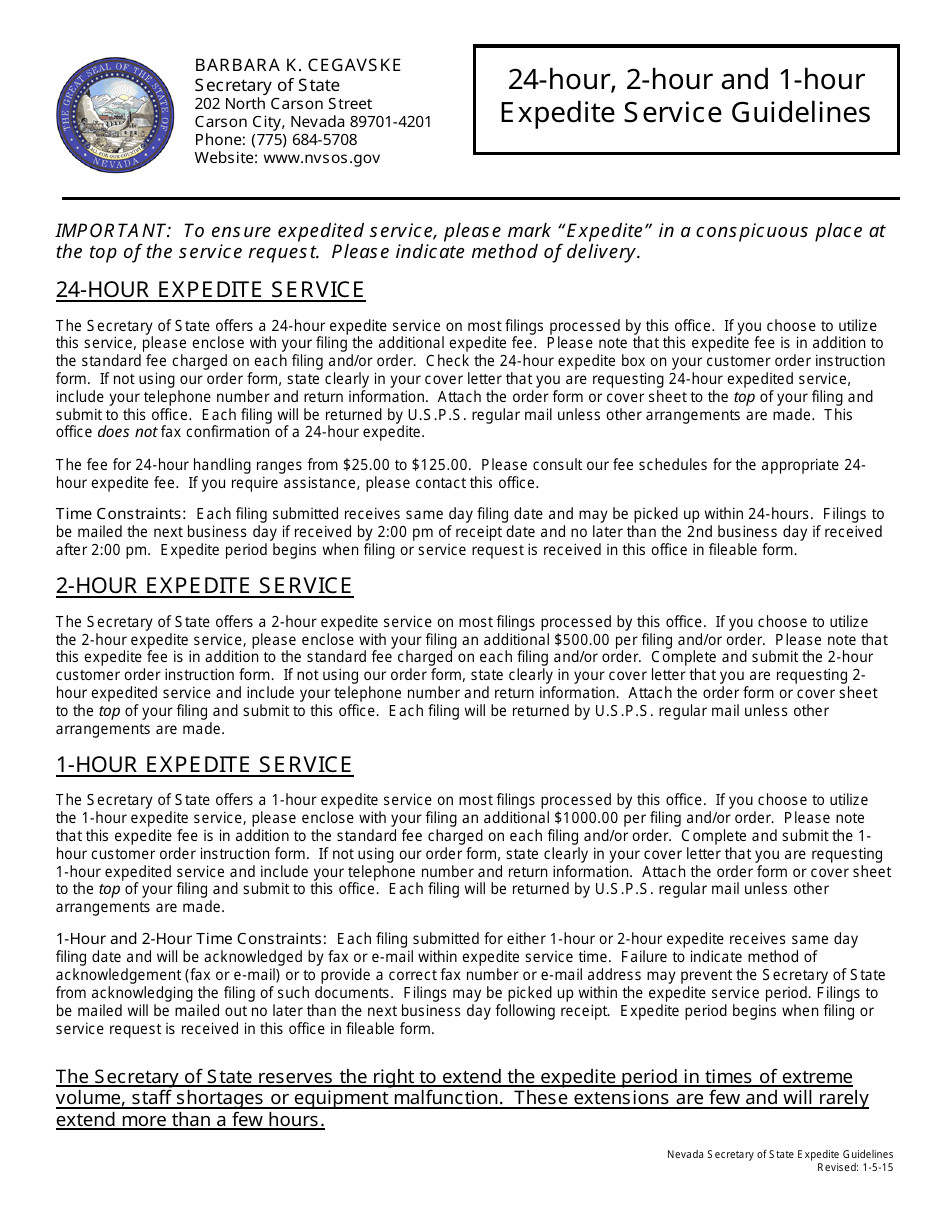

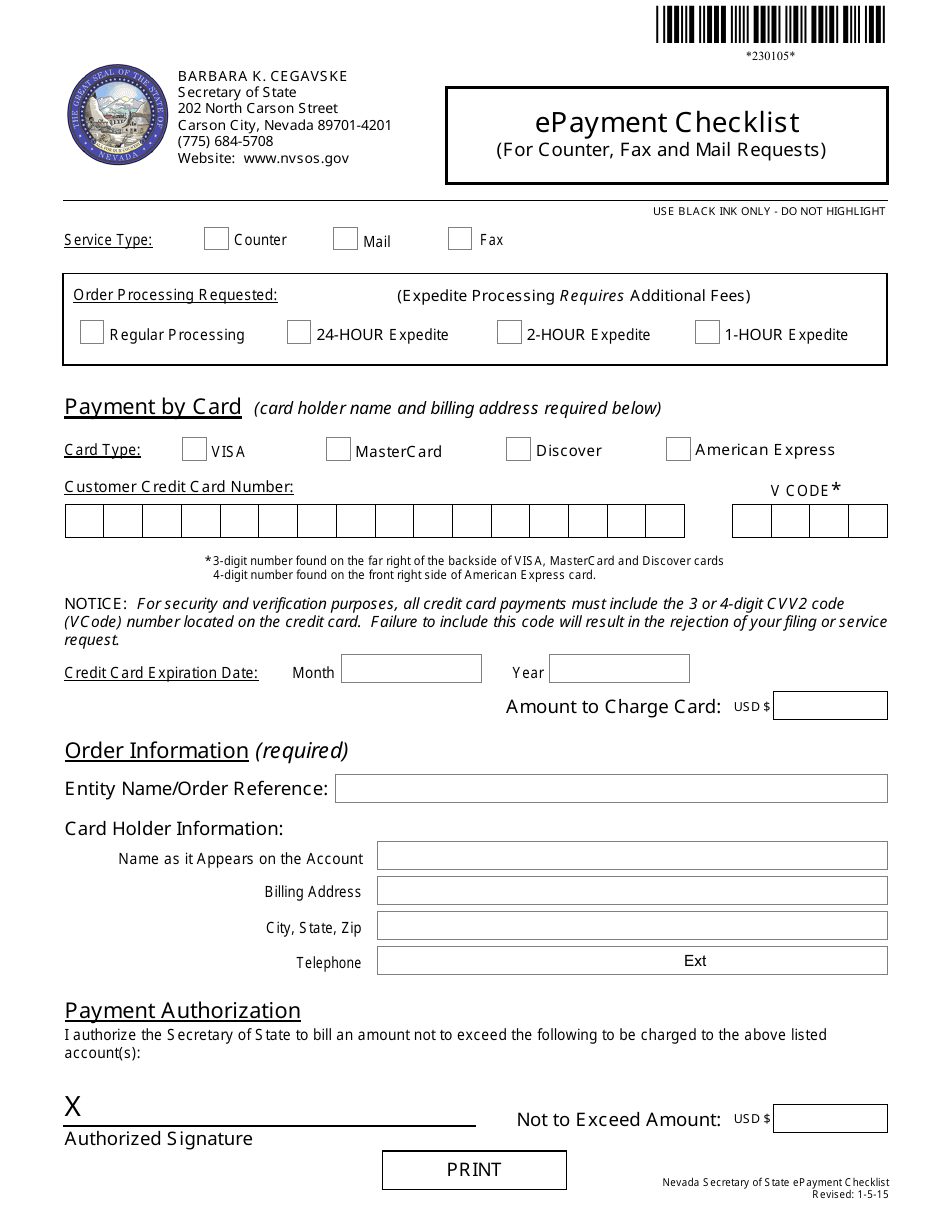

Q: What are the requirements for reviving a foreign nonprofit corporation in Nevada?

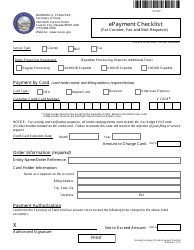

A: The requirements for reviving a foreign nonprofit corporation in Nevada include filing the revival application, paying the required fees, and submitting any additional documentation requested by the Secretary of State.

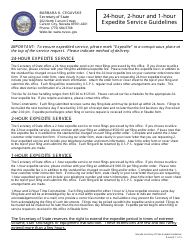

Q: How long does it take to complete the revival process for a foreign nonprofit corporation in Nevada?

A: The time required to complete the revival process for a foreign nonprofit corporation in Nevada can vary, but it typically takes several weeks to process the application.

Q: Can I still operate as a nonprofit corporation if my status has been revoked or dissolved?

A: No, if the status of your nonprofit corporation has been revoked or dissolved, you should not engage in any activities as a nonprofit until you have successfully revived your corporation.

Q: What are the consequences of operating as a nonprofit corporation without a valid status?

A: Operating as a nonprofit corporation without a valid status can result in legal and financial consequences, including potential liability for unpaid taxes and loss of certain benefits and protections afforded to nonprofit organizations.

Form Details:

- Released on October 1, 2015;

- The latest edition currently provided by the Nevada Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Secretary of State.