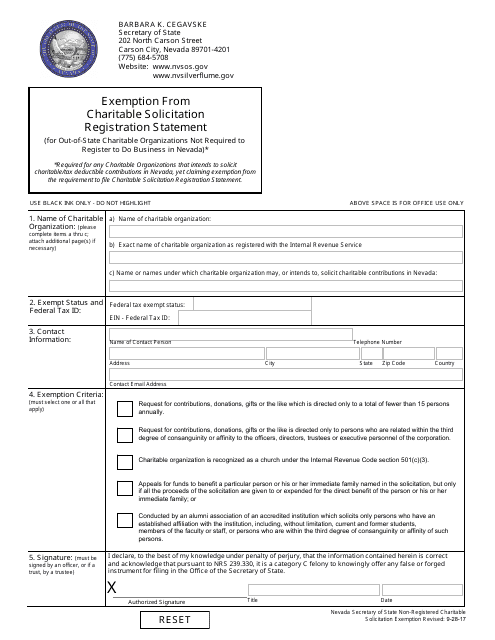

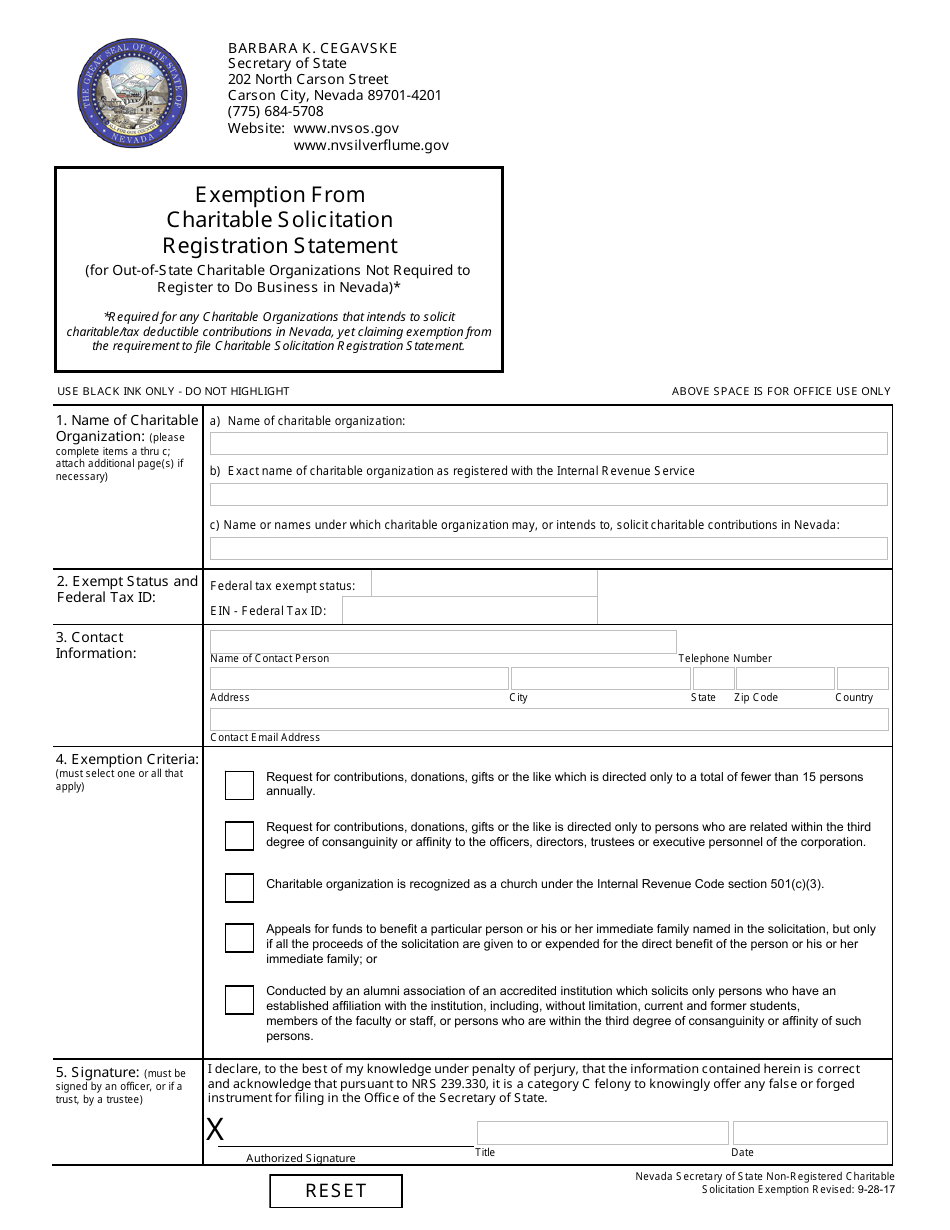

Exemption From Charitable Solicitation Registration Statement (For Out-of-State Charitable Organizations Not Required to Register to Do Business in Nevada) - Nevada

Exemption From Do Business in Nevada) is a legal document that was released by the Nevada Secretary of State - a government authority operating within Nevada.

FAQ

Q: Who needs to file a Charitable Solicitation Registration Statement in Nevada?

A: Out-of-state charitable organizations that are not required to register to do business in Nevada need to file a Charitable Solicitation Registration Statement.

Q: What is the purpose of the Exemption from Charitable Solicitation Registration Statement?

A: The purpose of this exemption is to allow out-of-state charitable organizations to engage in fundraising activities in Nevada without having to fully register to do business in the state.

Q: When is the Charitable Solicitation Registration Statement due?

A: The statement is due on or before the fifteenth day of the fifth month following the close of the organization's fiscal year.

Q: Are there any fees associated with filing the Charitable Solicitation Registration Statement?

A: Yes, there is a $50 filing fee for the statement.

Q: Do organizations have to renew their exemption annually?

A: Yes, organizations need to renew their exemption annually by filing a new Charitable Solicitation Registration Statement.

Form Details:

- Released on September 28, 2017;

- The latest edition currently provided by the Nevada Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Secretary of State.