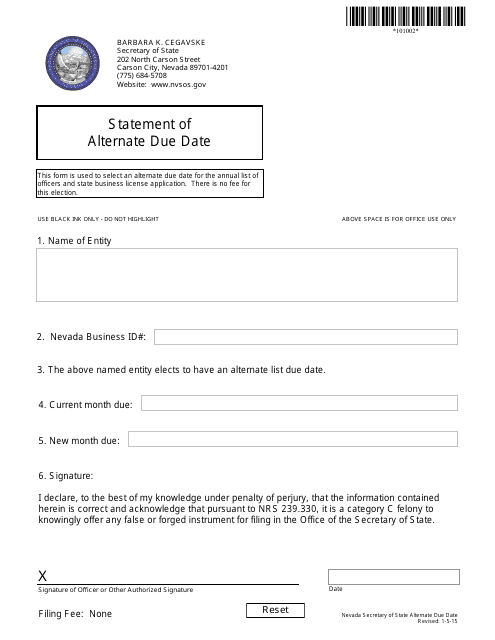

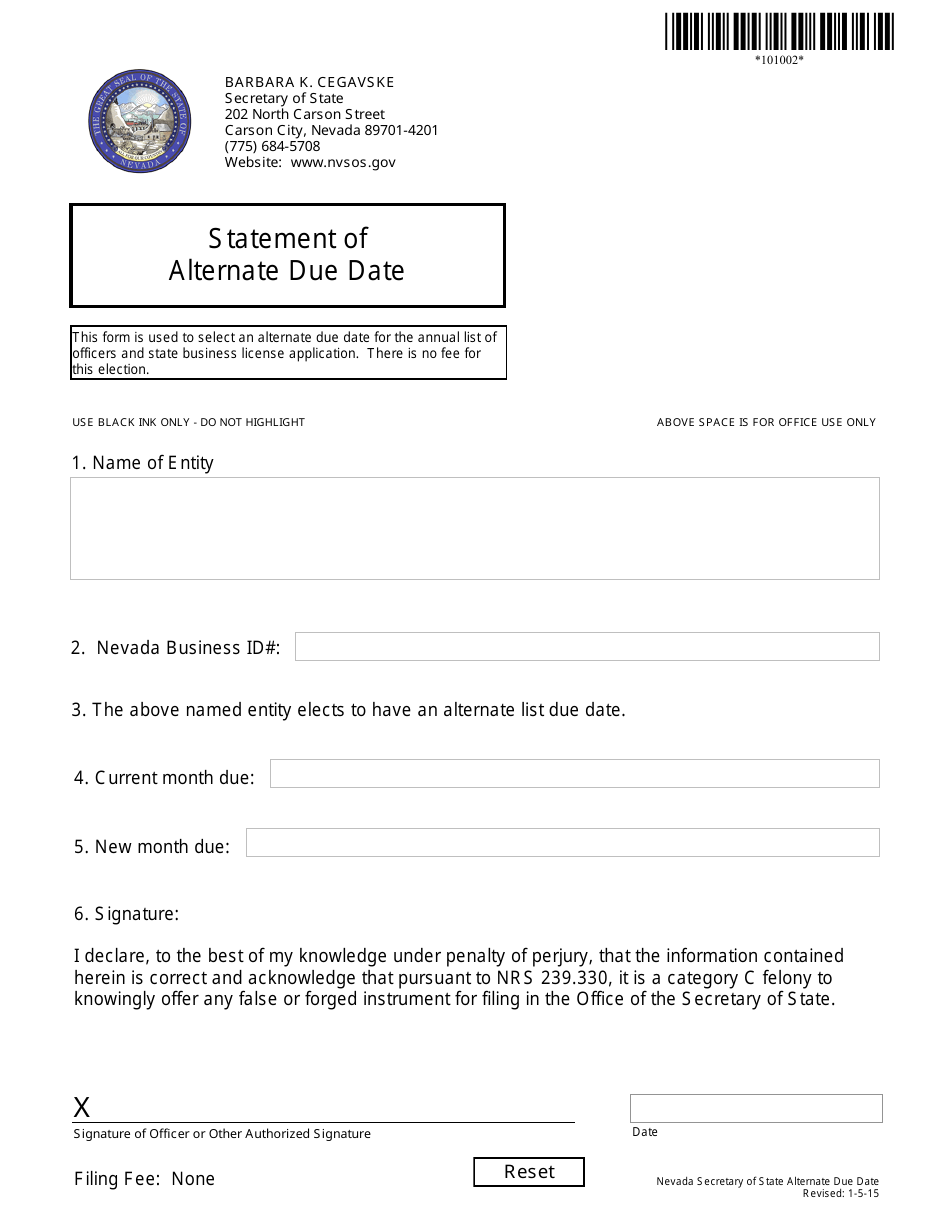

Form 101002 Statement of Alternate Due Date - Nevada

What Is Form 101002?

This is a legal form that was released by the Nevada Secretary of State - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 101002?

A: Form 101002 is the Statement of Alternate Due Date for businesses in Nevada.

Q: Who is required to file Form 101002?

A: Businesses in Nevada that want to request an alternate due date for filing their business tax returns.

Q: What is an alternate due date?

A: An alternate due date is a different date on which businesses can file their tax returns.

Q: Why would a business request an alternate due date?

A: Businesses may request an alternate due date if their regular due date conflicts with other important business deadlines or if they need additional time to prepare their tax returns.

Q: How can a business request an alternate due date?

A: Businesses can request an alternate due date by submitting Form 101002 to the Nevada Department of Taxation.

Q: Is there a fee for requesting an alternate due date?

A: No, there is no fee for requesting an alternate due date.

Q: What is the deadline for filing Form 101002?

A: Form 101002 must be filed at least 30 days before the regular due date of the business tax return.

Q: What happens if a business does not file Form 101002?

A: If a business does not file Form 101002, the regular due date for their tax return will apply.

Q: Can a business change their alternate due date?

A: Yes, a business can request to change their alternate due date by submitting a new Form 101002 to the Nevada Department of Taxation.

Form Details:

- Released on January 5, 2015;

- The latest edition provided by the Nevada Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 101002 by clicking the link below or browse more documents and templates provided by the Nevada Secretary of State.