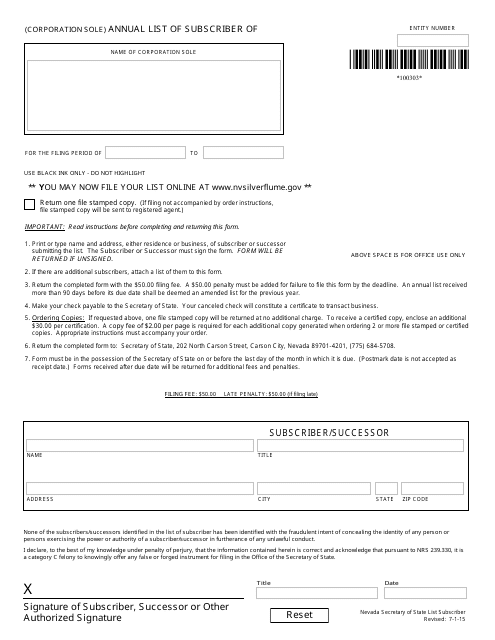

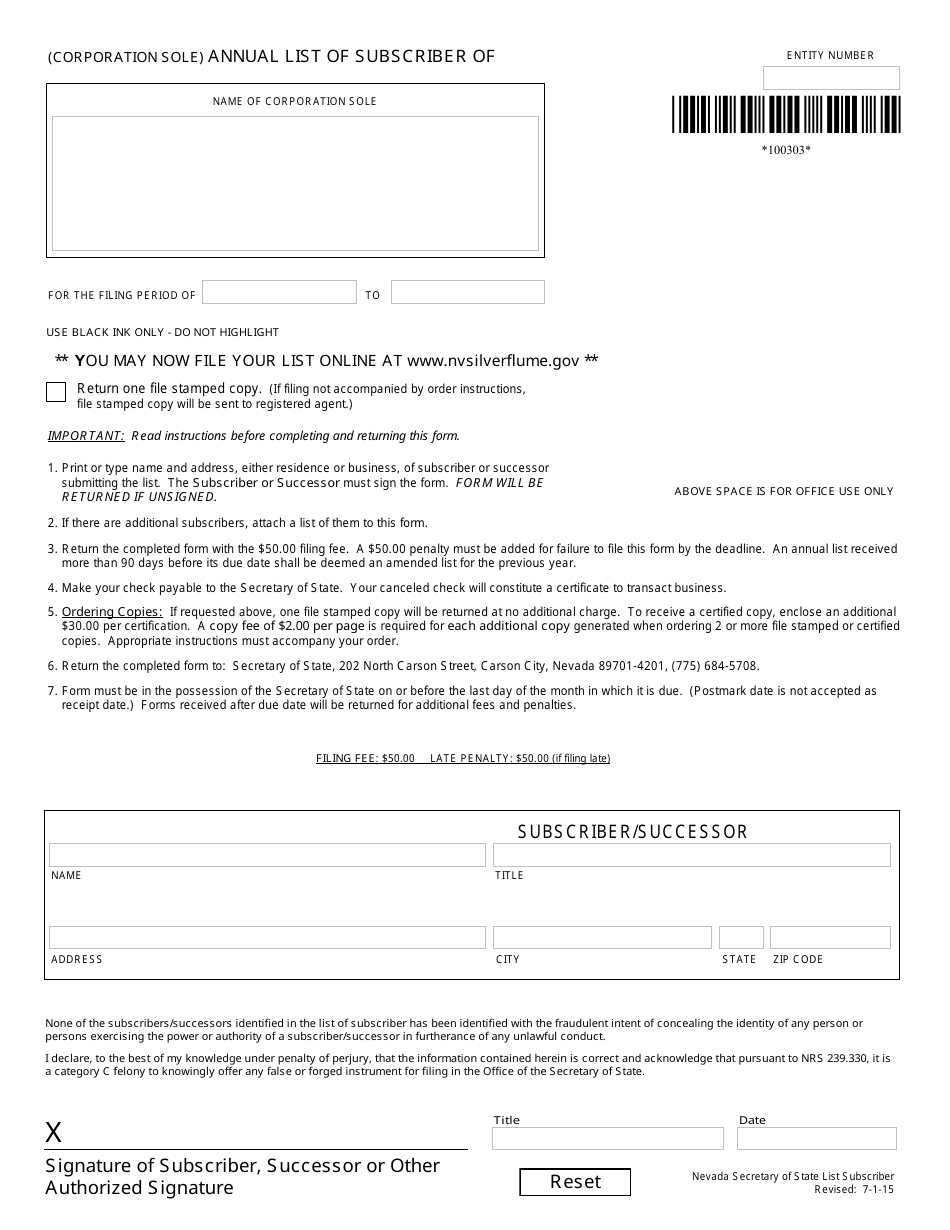

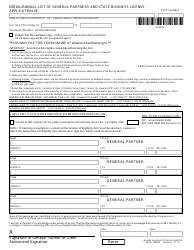

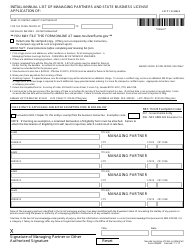

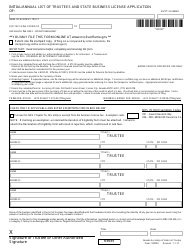

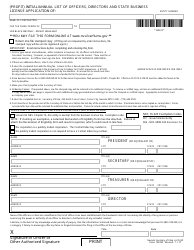

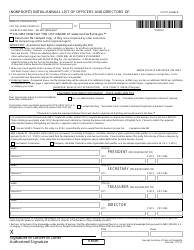

Form 100303 (Corporation Sole) Annual List of Subscriber (Nrs Chapter 84) - Nevada

What Is Form 100303?

This is a legal form that was released by the Nevada Secretary of State - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 100303?

A: Form 100303 is an Annual List of Subscriber form for Corporation Sole in the state of Nevada.

Q: Who needs to file Form 100303?

A: Corporation Sole entities in Nevada need to file Form 100303.

Q: What is the purpose of Form 100303?

A: The purpose of Form 100303 is to update and maintain accurate records of the subscribers of a Corporation Sole in Nevada.

Q: When is Form 100303 due?

A: Form 100303 is due on the last day of the anniversary month of the Corporation Sole's formation.

Q: Are there any fees associated with filing Form 100303?

A: Yes, there is a filing fee of $175 for Form 100303.

Q: Is it mandatory to file Form 100303?

A: Yes, it is mandatory for Corporation Sole entities in Nevada to file Form 100303.

Q: What happens if I don't file Form 100303?

A: Failure to file Form 100303 may result in penalties and the loss of good standing status for the Corporation Sole.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Nevada Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 100303 by clicking the link below or browse more documents and templates provided by the Nevada Secretary of State.