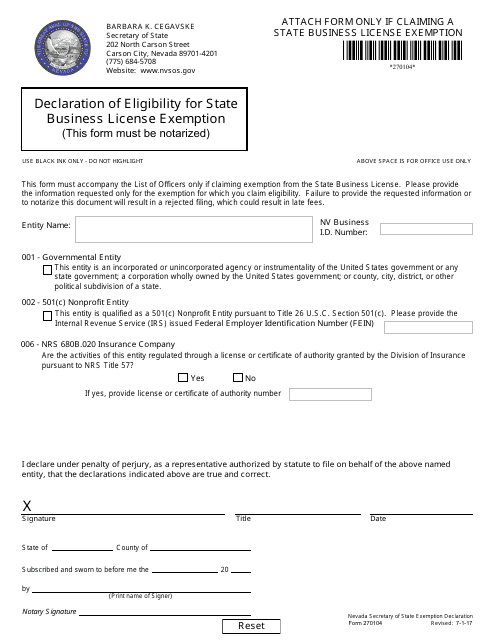

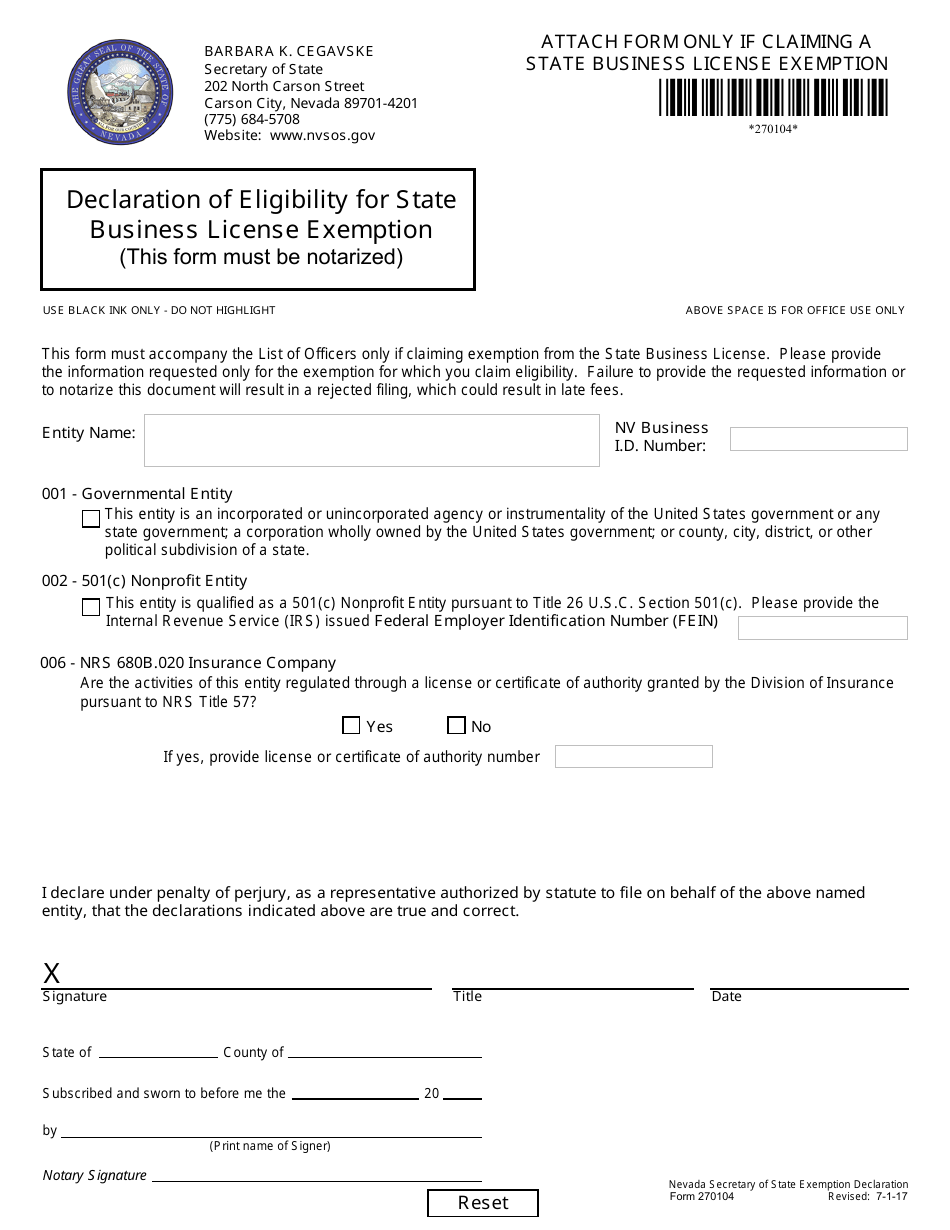

Form 270104 Declaration of Eligibility for State Business License Exemption - Nevada

What Is Form 270104?

This is a legal form that was released by the Nevada Secretary of State - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 270104?

A: Form 270104 is a declaration of eligibility for state business license exemption in Nevada.

Q: Who needs to file Form 270104?

A: Individuals or businesses who believe they are eligible for a state business license exemption in Nevada need to file Form 270104.

Q: What is the purpose of Form 270104?

A: The purpose of Form 270104 is to declare eligibility for a state business license exemption in Nevada.

Q: What information is required on Form 270104?

A: Form 270104 requires information such as the individual or business entity's name, address, Social Security or Tax ID number, and a statement of eligibility.

Q: Are there any fees associated with filing Form 270104?

A: No, there are no fees associated with filing Form 270104.

Q: What happens after filing Form 270104?

A: After filing Form 270104, the Nevada Secretary of State will review the declaration of eligibility and determine if the applicant is eligible for a state business license exemption.

Q: How long does it take to process Form 270104?

A: The processing time for Form 270104 can vary, but it generally takes a few weeks for the Nevada Secretary of State to review and process the form.

Q: Can I request an extension to file Form 270104?

A: Yes, you can request an extension to file Form 270104 by contacting the Nevada Secretary of State or their local business entity filing office.

Q: What should I do if I am not eligible for a state business license exemption?

A: If you are not eligible for a state business license exemption, you will need to obtain a business license in Nevada before conducting business operations.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Nevada Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 270104 by clicking the link below or browse more documents and templates provided by the Nevada Secretary of State.